Stock Markets Rise On Higher Than Expected U.S. GDP Q2 Growth

Stock-Markets / Stock Markets 2010 Aug 27, 2010 - 09:51 AM GMTBy: PaddyPowerTrader

Stocks Rise On Higher Than Expected US GDPUS stocks were up Friday, sending the Dow Jones back above the 10000 level after numbers for US GDP Q2 economic growth were slightly above analysts expectations. The Dow climbed 44 points, or 0.4 percent, to 10030 on the news. The Dow closed below the psychologically important 10000 mark on Thursday for the first time since early July, due in part to jitters ahead of Friday morning’s report on gross domestic product.

Stocks Rise On Higher Than Expected US GDPUS stocks were up Friday, sending the Dow Jones back above the 10000 level after numbers for US GDP Q2 economic growth were slightly above analysts expectations. The Dow climbed 44 points, or 0.4 percent, to 10030 on the news. The Dow closed below the psychologically important 10000 mark on Thursday for the first time since early July, due in part to jitters ahead of Friday morning’s report on gross domestic product.

The Nasdaq climbed 0.6 percent to 2132 on the same data. The Standard & Poor’s 500 index added 0.6 percent to 1053, with its materials sector leading the broad advance. The gains follow a Commerce Department report showing gross domestic product, the value of all goods and services produced, rose at an annualized seasonally adjusted rate of 1.6 percent in April to June. The growth rate is down from the previous estimate of 2.4 percent, but above economists’ expectations for 1.3 percent growth. (Market Watch).

Market Moving Stories

•Britain’s economy grew at its fastest pace for nine years in the second quarter, an unexpected revision to official data showed on Friday, but economists said a sharp slowdown was still on the cards.

•Germany’s economy continues to set the pace in the euro zone and bank lending in the bloc shows signs of reviving too, data showed on Thursday, but Spain and Italy face a harder road to recovery. German consumer morale increased for the third month running, hitting its highest level since last October as shoppers responded to an improving labour market, following an unexpected rise in business sentiment reported on Wednesday.

That healthy picture contrasted with a sharp drop in morale in Italy, the euro zone’s third-largest economy, where consumers turned much more downbeat over their personal finances and the overall confidence index hit a 17-month low.

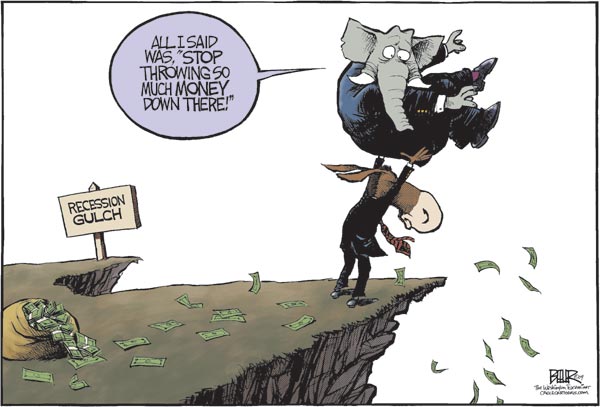

GDP blues in the USA.

US economic growth was revised down to a sluggish 1.6 percent annual rate in the second quarter, dampened by the largest increase in imports in 26 years, the government said on Friday. Gross domestic product growth previously was estimated at 2.4 percent and analysts had feared it would be pushed down even more sharply, but business investment was robust enough to partially cushion the blow from imports. Analysts polled by Reuters had forecast GDP, which measures total goods and services output within U.S. borders, would be revised to a 1.4 percent growth rate. The economy grew at a 3.7 percent pace in the first three months of the year. “The instant reaction is that it isn’t good but we thought it might be worse, so there might be a bit of relief,” said Nigel Gault, chief US economist at IHS Global Insight in Lexington, Massachusetts. U.S. stock index futures added to gains after the report, while Treasury debt prices extended losses. The U.S. dollar rose against the yen. (Reuters)

Company News

•Luxury jewelry retailer Tiffany & Co. said Friday that its fiscal second-quarter net profit rose a better-than-expected 19 percent, driven by strong demand in most markets from the U.S. to China. The company lifted its outlook for the year but said higher marketing spending will limit profit growth in the third quarter.

•Facebook is now worth as much as $33.7bn based on secondary market transactions, giving the privately held company an implied valuation greater than the market capitalisations of publicly traded internet stalwarts such as Ebay and Yahoo, the Financial Times Reports. Common stock in Facebook is trading as high as $76 a share as investors scramble to get a piece of the company before it files for an initial public offering, which analysts say could be the biggest technology IPO since Google’s $1.67bn flotation in 2004.

( New York Times)

•How high can the bidding war between Dell and Hewlett-Packard for 3Par, an 11-year-old storage company, go? The New York Times tells us that the ante has now been raised five times since Dell opened the public bidding on Aug. 13. On Friday, the bids came fast and furious. First, Dell raised its bid by 10 percent, to $27 a share, matching Hewlett’s offer of Thursday. Several hours later, Hewlett-Packard decided to scrap the game of bidding up by pennies and went big: an offer of $30 a share, or an 11 percent increase from the last bids. Will Dell match? The price for 3Par is now more than eight times its annual revenue of $240 million, a company, which Bloomberg News notes, has “lost money every year since going public in 2007.” That seems very rich for a stock that had been trading around $10 for most of the year.

•The world’s largest fertiliser producer, Potash Corporation, has urged its shareholders to reject a hostile takeover bid from BHP Billiton. Mining giant BHP last week launched a $40bn (£25.8bn) hostile bid for Canada’s Potash Corp after having had an initial offer rejected. Potash reiterated that the bid was “wholly inadequate”, as demand for its products is expected to rise. It also said it had held talks with other potential bidders. “There are a number of people who have contacted us… all sorts of different players. People would be surprised at what we’re seeing,” the group’s chief executive Bill Doyle said. Potash said it expected “superior offers” or other alternatives to emerge from these discussions. Media reports have suggested that Chinese fertiliser firm Sinochem may be interested in bidding.

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.