Gold Close to New Record Highs, Investors On Sidelines Ahead of Bernanke Speech

Commodities / Gold and Silver 2010 Aug 27, 2010 - 06:20 AM GMTBy: GoldCore

Markets participants are cautious ahead of Ben Bernanke’s speech which is expected to focus on the uncertain outlook for the US economy. Asian stock markets were mixed overnight and European indices are under pressure today. Investors continue to pile into government bonds and German Bund futures rose 14 ticks. The Yen and the British pound are slightly weaker today in tentative trading.

Markets participants are cautious ahead of Ben Bernanke’s speech which is expected to focus on the uncertain outlook for the US economy. Asian stock markets were mixed overnight and European indices are under pressure today. Investors continue to pile into government bonds and German Bund futures rose 14 ticks. The Yen and the British pound are slightly weaker today in tentative trading.

GOLD

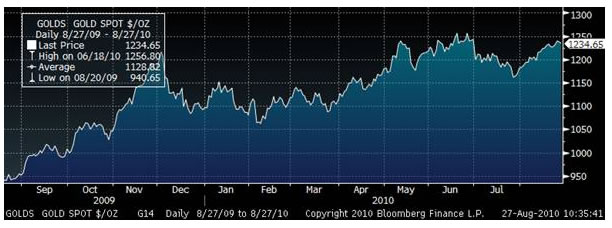

Gold has traded sideways in Asian and early European trading after yesterday’s small fall on option expiry day. Gold closed slightly in backwardation yesterday (August contract closed at $1235.4 while September closed at $1234.2) which has rarely happened on the COMEX and suggests that there is increasing tightness in the physical gold market. This would not be surprising considering the small size of the physical market versus the size of the overall financial markets and considering the high demand coming from investors and central banks and from India and China in particular. Gold is currently trading at $1,236/oz and in Euro, GBP, CHF, and JPY terms, gold is trading at €972/oz, £797/oz, CHF 1,264/oz, JPY 104,580/oz respectively.

The recent run of poor economic data is leading to concerns about the GDP figures to be released later today. Bernanke may hint at a further round of quantitative easing or QE2 and this would likely lead to a bid coming into equity markets and the gold market. QE2 which is printing money to buy assets (including government bonds) on a large scale in a near zero interest rate environment will lead to increased concerns of inflation and thus to increased allocations to assets that are a hedge against inflation.

Bloomberg reports that gold demand is set to soar in Vietnam due to economic uncertainty, a stock market slump and a currency devaluation. Governments around the world are seeing weaker currencies in order to try and boost exports and trade their way out of recessions. This is seen in increasing talk of Japanese intervention to weaken the yen. Competitive currency devaluations could be an important factor in leading to higher gold prices in the coming months.

SILVER

Silver is currently trading at $18.95/oz, €14.90/oz and £12.20/oz.

Silver is looking even stronger than gold in the recent price rises. Silver has outperformed gold since Aug. 23, gaining 6 percent compared with gold’s 1.4 percent gain, as investors bought “poor man’s gold” because of its relative cheapness to gold. The gold silver ratio is at 65 which still very favourable to silver and leading to increased buying of silver in India and internationally. Silver remains well below its recent high of nearly $21/oz ($20.77) reached on March 17th, 2008. And less than half of its price in 1980 when it reached $50 per ounce.

PGM’s

Platinum is trading at $1,535/oz and palladium is currently trading at $503/oz. While rhodium is at $2,125/oz.

Today’s News and Commentary

Reuters: Analysis: Financial storm clouds set gold on course for history

Bloomberg: Gold Demand to Soar in Vietnam as `Shelter' From Devaluations, Stock Slump

AFP: Global gold demand powered this year by China, India: WGC

Bloomberg: Iran Imports 23 Tons of Gold in 4 Months, 22 Tons in the Previous Year

Reuters: Gold steady; market quiet as Bernanke speech eyed

Bloomberg: Gold Weakens for Second Day After Advance to Two-Month High Spurs Selling

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.