Gold BIG Move Is Still To Come!

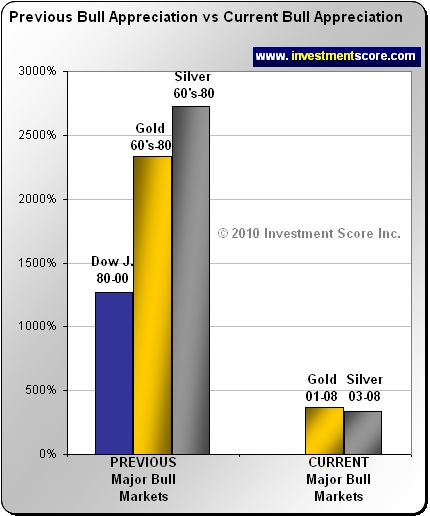

Commodities / Gold and Silver 2010 Aug 27, 2010 - 01:57 AM GMT In the big picture we think the gold and silver bull market has just started to warm up. It is not that we believe the ten year bull market has not been underway for a significant amount of time, but rather we believe the majority of the price appreciation is ahead and not behind us.

In the big picture we think the gold and silver bull market has just started to warm up. It is not that we believe the ten year bull market has not been underway for a significant amount of time, but rather we believe the majority of the price appreciation is ahead and not behind us.

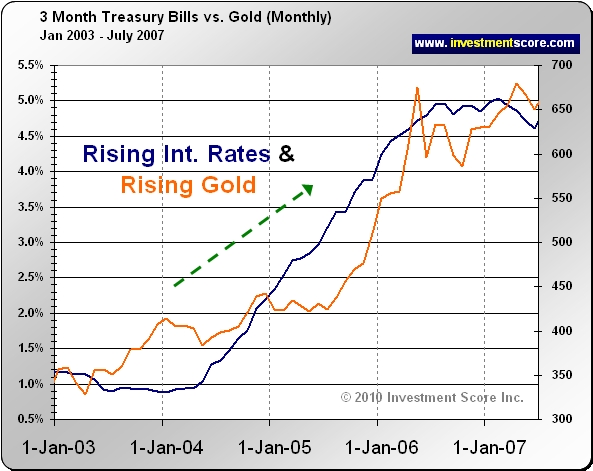

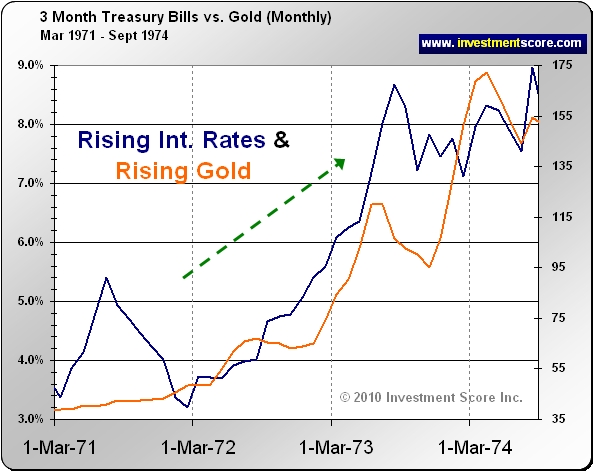

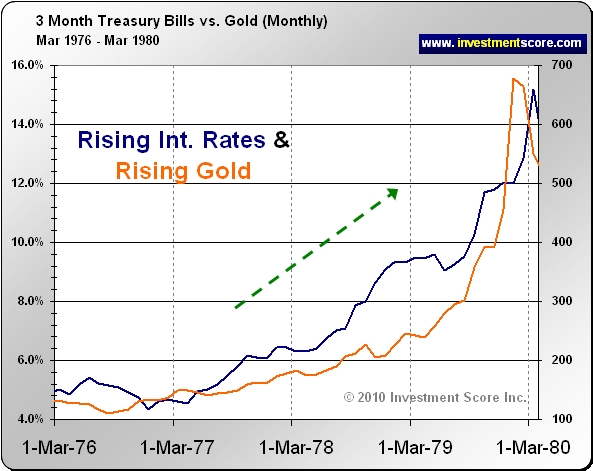

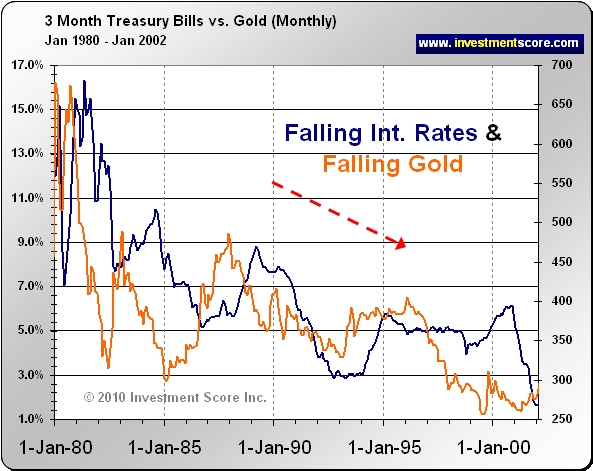

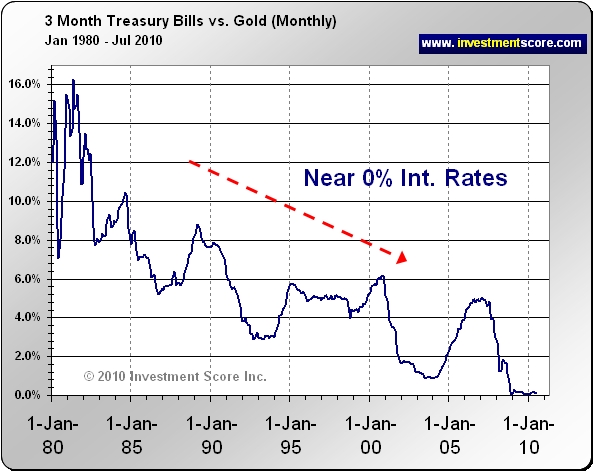

There is a common belief that rising interest rates are negative for the price of gold. Where do these crazy ideas come from? If that is the case then gold investors should fear that the bull market is nearly over as interest rates are near zero and when they eventually do rise the bull market will be threatened. Contrary to this popular opinion we think that rising interest rates are a great sign for gold! With rates near record lows it means that there is a lot of “fuel” for the gold price when interest rates do eventually rise. Currently there is a nice big, fat bond market loaded with capital ready to pour out of bonds and into the commodities market. To prove our point, consider the following historical examples:

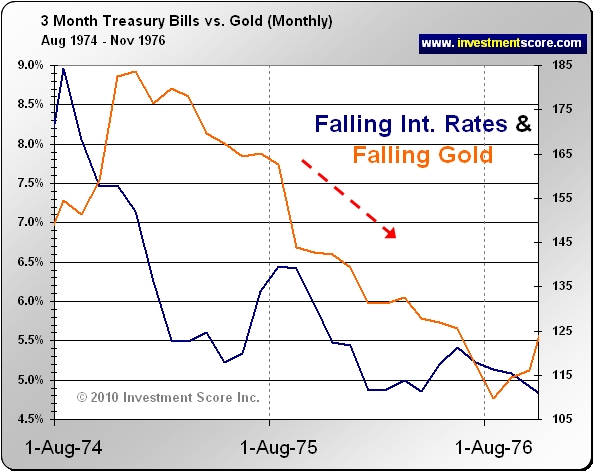

In the above charts notice the following:

- Interest rates and gold generally move in the same direction. We believe that rising interest rates are a Bullish and NOT a Bearish sign for Gold.

- In many instances, interest rates tended to “peak” after gold has already peaked. This would not support the theory that rising rates end gold advances. If rising interest rates were ending the gold advances then one would expect interest rates to peak first and then cause gold to peak second.

We have found the following argument is used to support the idea that rising interest rates are negative for gold: ‘In the 1970’s Fed Chairman Paul Volker raised interest rates ending the gold bull market.’ This appears to be the only argument that has created the apparent myth that rising interest rates are bad for the price of gold. Instead we would argue that when interest rates are rising, bond prices are falling as capital flows out of bonds and into gold. We would argue that around the early 1980’s was the end of the bear market in bonds which was around the same time the bull market was ending in commodities. To support our theory, we have provided the above historical examples.

With interest rates at near all time lows we think that there is a lot of capital in the bond markets that is ready to pour into the commodity markets when rates rise again.

The following chart compares the price appreciation of the price of gold compared to historical price advances.

Like all bull markets the majority of the price appreciation will come towards the end of the advance when the ‘manic / parabolic’ phase hits. We feel this explosive ending is a long way off from today and there will be a lot of ups and downs along the way. We are expecting there will be more great buying opportunities and we plan to add to positions at lower risk opportunities.

At investmentscore.com we have created long term Custom made signals to help us monitor the long term “mega trending bull markets”. We also monitor the intermediate term moves to help us to decide when to add to or lighten up on positions. To learn more visit www.investmentscore.com and be sure to sign up for our free newsletter.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.