Gold Falls on Positive Jobs Number

Commodities / Gold and Silver 2010 Aug 26, 2010 - 08:22 AM GMTBy: GoldCore

Gold is slightly lower while silver has risen again today after they rose 1% and 3% respectively yesterday as investors moved into the safety of AAA rated government bonds and the precious metals. Both gold and silver have remained firm in Asian and early European trading despite an increase in risk appetite as seen in the bounce in Asian and European equity markets. The fall in jobless claims has added to risk appetite and seen gold come under pressure, while silver remains firm. Some calm has returned to European sovereign debt markets after the successful Portuguese and Irish debt auctions. Government bonds have fallen in value after their recent rise and the increasing spreads between peripheral European economies and Germany have eased.

Gold is slightly lower while silver has risen again today after they rose 1% and 3% respectively yesterday as investors moved into the safety of AAA rated government bonds and the precious metals. Both gold and silver have remained firm in Asian and early European trading despite an increase in risk appetite as seen in the bounce in Asian and European equity markets. The fall in jobless claims has added to risk appetite and seen gold come under pressure, while silver remains firm. Some calm has returned to European sovereign debt markets after the successful Portuguese and Irish debt auctions. Government bonds have fallen in value after their recent rise and the increasing spreads between peripheral European economies and Germany have eased.

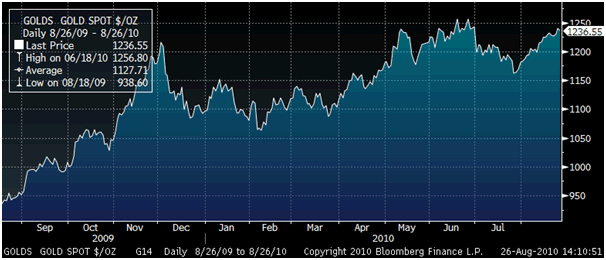

Gold is currently trading at $1,238.30/oz, €973.51/oz, £796.54/oz.

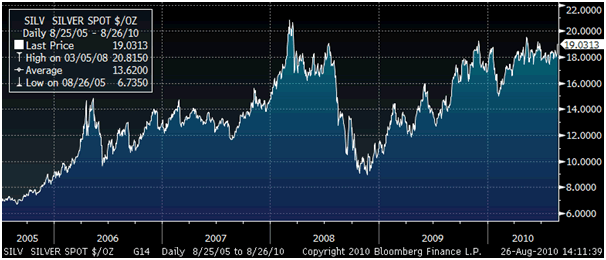

Gold's, and particularly silver's, move up is unusual and is bullish as in recent years, the day before options expiration which is today, would normally see sharp selling and liquidations prior to an equally sharp rebound. The precious metals rise yesterday and firmness today suggest that there are eager and determined buyers at these levels who are willing to take on the determined sellers in the pits. Technically both gold and silver look very good and gold's record highs of $1,264/oz (nominal) look likely to be breached sooner rather than later. There is no technical resistance above the $1,264/oz level and gold would likely then target the psychological round figure of $1,300/oz.

There is speculation of central bank buying in recent days pushing the price to near new record (nominal) high prices. This seems more than possible as we know the Chinese, Indian and Russian central banks have been buying gold. Only last week, Russia's central bank said that it added 500,000 ounces of gold last month, increasing its stockpile to 23.3 million ounces. That followed last year's purchases by India, Mauritius and Sri Lanka. The World Gold Council reported yesterday how central banks were net buyers of gold for the 5th straight quarter and central banks, who declared their purchases, bought 7.7 metric tons during the quarter. Indeed, it is likely that some larger central banks are not declaring their purchases in an effort to secure better prices and not cause a price hike. Indeed, this is how the Chinese increased their reserves between 2003 and 2009. SAFE, part of the central bank, the People's Bank of China, last year revealed its gold reserves had grown to 1,054 tonnes from 600 tonnes in 2003, mainly the result of buying up local production. These purchases were not declared at the time.

Silver

Silver is currently trading at $19.11/oz, €15.03/oz and £12.29/oz.

Platinum Group Metals

Platinum is trading at $1,526.25/oz, palladium is at $503/oz and rhodium is at $2,050/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.