Marc Faber and Peter Schiff on the U.S. Treasury Bond Bubble

Interest-Rates / US Bonds Aug 26, 2010 - 07:57 AM GMTBy: Dian_L_Chu

As I've been saying for some time that the bond market is screaming for an imminent burst, now Dr. Marc Faber and Mr. Peter Schiff also spoke with CNBC on Aug. 23 warning of a bond bubble trouble.

As I've been saying for some time that the bond market is screaming for an imminent burst, now Dr. Marc Faber and Mr. Peter Schiff also spoke with CNBC on Aug. 23 warning of a bond bubble trouble.

Faber - Stay Away from a 19-year Rally

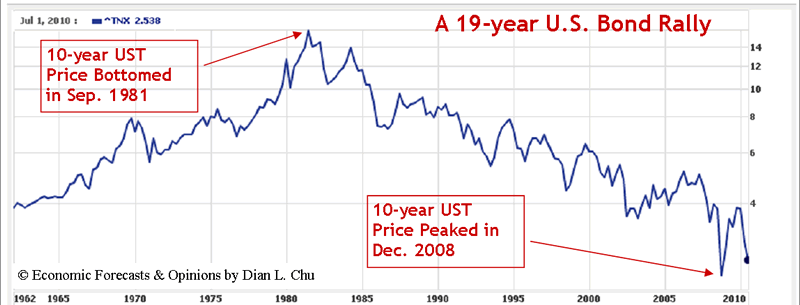

Faber advises investors "stay away from Treasurys as they’ve been rallying since 1981--equivalent to a 19-year bull run,"--when the 10-year bottomed out on Sep. 21, 1981. Faber says Dec. 18, 2008 was the peak of the bond bubble with yield of 2.08% and 2.53% on 10-year and 30-year respectively. (See 10-year chart)

“I think that there isn’t much upside potential in Treasurys unless it’s for the short term. Even the short term is uncertain. But if I look 10 years ahead, where do I want to have my money, then certainly not in US Treasuries.”Faber's biggest concern is that because of a weak economy, the U.S. budget deficit will likely remain high, and continue to go up under the Obama administration, which could make interest payments on government debt unbearable.

He also warned against the misguided confidence arising from still strong foreign demand for U.S. Treasurys:

“In 1999 and 2000, foreigners (bought) the NASDAQ and what happened afterwards was a major collapse. I would not look at foreign buying as a very intelligent leading indicator.”

Faber says a better place for investor's money now is farm land, agricultural commodities and gold should also be a part of investor's portfolio.

Schiff - The Mother of All Bubbles

Schiff basically declares the bond market the mother of all bubbles, and noted that when the bubble bursts, the loss will dwarf the combined losses of the bubbles of stock market and the real estate. Eventually, the government will either inflate or default. Either way will ultimately make bond investors go bust.

For risk-averse investors, Schiff believes gold and foreign bonds such as Switzerland where government debt level is not as high, would be better options than U.S. treasuries.

My Thoughts

Dismal economic data has spooked investors flocking to Treasuries driving down yields. Traditionally, bonds are considered to be safer and less volatile than equities and commodity. However, the financial markets have evolved in such a way that the same players are active in all sectors, employing the same trading technique. This, in part, has made bonds behave almost like stocks with similar volatility. (See comparison chart)

So, investors should start looking at bond the same way as equities, and commodities, and now is the time to move out of bond and into either equities (dividend-paying blue chips as noted in my previous post), or commodity such as gold.

And for the highly risk-averse, parking in cash for the short term would still be better off than staying in "the mother of all bubbles."

(Recommended Reading: Self Fulfilling Prophecy: The Bond Trade, Yield, Dow 30 vs. 10-year U.S. Treasury, and Bonds & Equities: Expect a Major Shift)

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.