Recession Double Dippers In The Ascendancy

Stock-Markets / Stock Markets 2010 Aug 25, 2010 - 10:26 AM GMTBy: PaddyPowerTrader

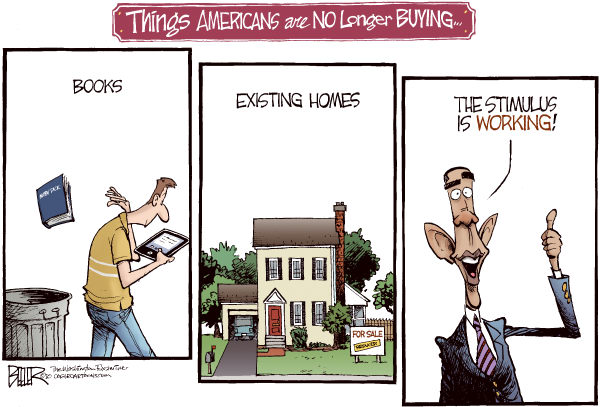

US stocks declined Tuesday, sending the S&P 500 Index to a seven-week low, as a record plunge in home sales cast further doubt on the viability of the economic recovery as the battle between “moderators” and “double dippers” is currently being won hands down by the latter. Existing US home sales where a real horror show – resales dropped a record 27.2 percent–nearly twice as much as analysts had expected–to an annual rate of $3.83 m in July, the National Association of Realtors said Tuesday. Meanwhile, inventories rose to 12.5 months from 8.9 months in June, pressuring already depressed home prices. Inventories are at their highest level in more than a decade.

US stocks declined Tuesday, sending the S&P 500 Index to a seven-week low, as a record plunge in home sales cast further doubt on the viability of the economic recovery as the battle between “moderators” and “double dippers” is currently being won hands down by the latter. Existing US home sales where a real horror show – resales dropped a record 27.2 percent–nearly twice as much as analysts had expected–to an annual rate of $3.83 m in July, the National Association of Realtors said Tuesday. Meanwhile, inventories rose to 12.5 months from 8.9 months in June, pressuring already depressed home prices. Inventories are at their highest level in more than a decade.

Treasury yields hit new lows, European PIIGS peripheral bond yields blew out and the Swiss Franc hit a record level against the Euro, while the Yen rose to a 15 year high versus the USD – all “risk off indicators” clearly. Nevertheless, equity markets here in Europe managed to rebound off the 2590 level on the Eurostoxx to finish the day still down quite considerably, but at least not on the lows.

Today in Europe stocks catch the eye include BP which is off fell 2.1 percent on news that the US Bureau of Ocean Energy Management said offshore drillers will have to provide third-party verification that safety equipment such as blowout preventers work. The blowout preventer at BP’s Macondo Well failed leading to the world’s largest accidental oil spill. President Obama stopped drilling in waters deeper than 500 feet after the Deepwater Horizon oil rig sank on April 20. Third-party safety checks may push back the resumption of deepwater drilling in the gulf until the middle of 2011, said Michael McKenna, president of MWR Strategies, an oil industry consulting firm in Washington on Bloomberg TV

Staying with oil stocks, Tullow is down 6.6 percent today after the oil explorer said the Ugandan government had withheld approval of its $1.5 bn acquisition of Heritage’s interest in two blocks in the Lake Albert basin. Tullow hopes to pump more than 200,000 barrels of oil a day from the blocks by 2014 or 2015. The tax dispute could delay work “in the very short term,” Tullow said in a statement. The company also reported first-half net income that more than doubled to $81.7 mn.

SNS Reaal Groep plunged 8.4 percent after the Dutch life insurer and bank reported first-half profit adjusted for one-off items of €87 mn. That missed the €92 mn average estimate of five analysts surveyed by Bloomberg.

CEO Ronald Latenstein said at a press briefing that the insurer currently isn’t in talks about repaying the rest of the aid it received from the Dutch State and Stichting Beheer SNS Reaal.

But better tidings from Ageas which rallied 3.6 percent after the Belgian insurer formerly known as Fortis reported first-half profit from its insurance operations of €180.5 mn, beating analysts’ estimates. The company also said the sovereign-debt crisis hardly affected its book value. And Admiral has climbed 3.8 percent today. The UK’s best-performing insurance stock this year reported a 21 percent gain in pretax first-half profit to £126.9 mn as customer numbers increased to a record high.

Mining stocks with Aussie exposure are again coming under pressure today on press reports that 3 out of 4 independent and Green MPs who hold the balance of power and whom are set to determine the next Australian government, said they supported a profits-based tax on mining

Datawise we’ve just had US Durable goods orders for July which increased only 0.3 percent trailing consensus expectations for a 3.0 percent rise. And Ex-transport orders slumped 3.8 percent in July, after +0.2 percent in June. Non-defence capital goods orders ex aircraft – a proxy for investment spending – crashed 8.0 percent. Of course, this is also a very volatile data series. -8 percent in July, +3.6 percent in June, +4.7 percent in May, -2.8 percent in April and +6.7 percent in March. So, one should not read too much into a single month’s worth of data. However, it is abundantly clear that the economy is in for a double dip if July’s weakness should continue in the next few months.

Today’s Market Moving Stories

- The big news event for Europe is that S&P has downgraded Ireland by one notch to AA- from AA and has also left its outlook at negative (the news came at 21.50pm London time, so Europe closed and the US in the ghost hour before Asia started to come back in). S&P said that the projected cost to the Irish government of supporting the country’s financial sector had increased significantly from prior estimates. It said a further downgrade was possible if those costs rise more or that economic conditions weaken the governments ability to meet its objectives. S&P said that rather than falling, it expected Ireland’s government debt to reach 113 percent of GDP in 2012, more than one-and-a-half times the Eurozone average. The cost of supporting the Irish banking sector was increased from €80 bln to €90 bln (so from 50 percent of GDP to 58 percent). Ireland’s NTMA hit back, commenting that the S&P action was based on an extreme estimate of bank recapitalisation costs, that the assumptions put no value at all the bad bank current assets and that all told S&P’s methodology is flawed, which it is. Given 25 percent of NAMA’s real estate assets are in the UK and inside the M25 corridor what S&P are saying is that NONE of this portfolio is worth anything So the Savoy hotel is worth zero, as is the Dorchester according to their “methodology”. As if ratings agencies hadn’t discredited themselves enough.

- Fed members continue to provide justifications for the August 10th decision to reinvest maturing MBS proceeds back into the US Treasury market. Fisher commented late Tuesday that the Fed wanted to avoid an inadvertent tightening of conditions. Fed member Evans, meanwhile warned that the changes the US dropped back into recession again had increased (in fact he sounded very much like new kid on the block Weale of the BoE – not the central scenario, but certainly there is a risk of it occurring). Reuters reports that its discussions with Fed officials suggest that even given the need to maintain loose conditions, the Fed is not considering reducing the rate of interest it pays on reserves. It said officials believed it was very much a last resort policy that they would rather keep back for more dire conditions.

An the upcoming economic data from the other side of the pond, especially next week’s much-awaited jobs report, is unlikely to change the gloomy economic picture. However, an increase in the unemployment rate which sparks a stock market slump might persuade the doubters at the Fed to give Mr Bernanke free rein to print more money. The worry is that such policies (while averting a Depression and financial system collapse) have not delivered much in the way of a sustainable economic recovery. Maybe this is the ‘New Normal’ and that the reality is that the credit excesses of the recent past have to be resolved through further deleveraging and balance sheet adjustment. In this scenario, you can expect sub-par growth, high unemployment rates, low inflation and low interest rates for some time to come.

An the upcoming economic data from the other side of the pond, especially next week’s much-awaited jobs report, is unlikely to change the gloomy economic picture. However, an increase in the unemployment rate which sparks a stock market slump might persuade the doubters at the Fed to give Mr Bernanke free rein to print more money. The worry is that such policies (while averting a Depression and financial system collapse) have not delivered much in the way of a sustainable economic recovery. Maybe this is the ‘New Normal’ and that the reality is that the credit excesses of the recent past have to be resolved through further deleveraging and balance sheet adjustment. In this scenario, you can expect sub-par growth, high unemployment rates, low inflation and low interest rates for some time to come. - In the currency world, it is worth noting that the most traded currency pair, the EURUSD, has actually traded in a 1.18-1.33 trading range since the start of June. Now, the euro is in the middle of that range. Germany needs a weaker euro to keep its export engine alive. If the euro ever went back above 1.33, don’t be surprised to hear screams of pain from German industry. Exports are the only thing keeping the German economy going as consumer spending is pretty sluggish. Some commentators like Martin Wolf at the FT have (rightly) highlighted this consumption/savings imbalance in the eurozone, which is to the detriment of the trade deficit countries who are forced to become increasingly ‘competitive’, i.e., more pay cuts and unemployment, just to stay in the race with Germany. Ultimately, this will only cause deeper economic problems in the eurozone and a resurgence of the debt crisis.

- Today EUR/USD gave up most of its post US Existing Homes Sales gains overnight after Ireland was downgraded one notch to AA- by Standard & Poor’s, but made a strong recovery following the better than expected IFO number. EUR/USD posted a 1.2727 high after the data, but crucially, failed to break the 1.2730 level again and has been drifting lower ever since.

- Staying with FX and news on the super strong JPY overnight: Japan’s Finance Minister Yoshihiko Noda told reporters that, ‘when necessary we must respond appropriately” to address JPY strength. An article in the Nikkei newspaper comments that the Ministry would consider intervening unilaterally if its currency rose at a pace of several JPY against the USD in a single day. The Jiji news agency claims that Prime Minister Naoto Kan has said he feels a ‘sense of crisis’ over the strong JPY and wants to show a firm response soon. After a meeting with Kan and Chief Cabinet Secretary Yoshito Sengoku, Noda said “Our talks today were not about specific [steps versus the JPY], but were centred on things like economic analysis”.

- The key German Ifo index in August gains another 0.5pts to 106.7 counter to expectations of a slight drop. This was on back of the assessment component jumping to 108.2 (from 106.8), while expectations slightly dropped 0.3pts to 105.2. The rise in the assessment of the current situation increases the chance that third quarter GDP might also surprise to the upside. The decline in expectations, however, supports the view that growth rates will moderate in this quarter and the following – while still remaining above average.

- According to HM Revenue & Customs, on a seasonally adjusted basis, UK housing transactions with a value of £40,000 and over were 81,000 in July, 4 percent higher than July last year. Transactions in July were also 6,000 above June and the highest so far this year.

- The Telegraph reports that Spain is putting all its eggs into one basket, and if it carries on like this, we may start to see a lot of Basques and Catalans crowding into one exit. The state pension fund – the €64bn Fondo de Reserva, known as the ‘hucha de las pensiones‘ – is buying Spanish sovereign debt at a vertiginous pace. The financial daily Cinco Dias reports that the share of the Fondo’s total portfolio invested in Spanish government bonds rose from below 50 percent in 2007 to 76 percent in 2009. The Social Security minister Octavio Granado said it will rise to 90 percent by the end of this year. It is clear from an analysis of the data that the Fondo is not just investing fresh revenues in Spanish bonds, but also rotating out of Dutch, French, and German bonds into Spanish debt. The Spanish government is also funnelling 90 percent of its sickness fund into state bonds. This helps explain why Spanish bonds trade far tighter than say Ireland’s to Germany in terms of yield spread as there is NO domestic support for the Irish government bond market locally.

- Staying with matters Iberian, s Banco Santander analyst and an accomplice illegally reaped almost $1.1 mn with insider trades before BHP Billiton Ltd.’s $39 bn dollar takeover bid for Potash Corp. of Saskatchewan.

regulators said. Juan Jose Fernandez Garcia, 35, and Luis Martin Caro Sanchez, 36, used accounts at the same US brokerage to buy more than $61,000 in Potash stock options days before BHP’s offer became public Aug. 17, the Securities and Exchange Commission said in documents filed Aug. 20 to federal court in Illinois. Fernandez Garcia heads the bank’s European equity derivatives research, according to the agency’s complaint.

Company / Equity News

- Tullow Oil have provided a disappointing H1 update to the market this morning. The explorer has failed to provide an update on the sidetrack operations at its recent discovery in Ghana and also announced that the farm out of the Ugandan assets which it purchased from Heritage Oil is being delayed by a tax dispute between the sovereign and Heritage Oil. Tullow Oil’s operating figures were better than expected however these figures are almost immaterial as Tullow Oil’s value is derived from the assets in its exploration portfolio. The company did announce a small discovery in Uganda which now brings the total resources discovered in the country to 1 billion barrels of oil.

- Glanbia released interim results this morning with turnover up 9.7 percent yoy and operating profit increasing to €66.3mn from €47.8mn a year ago. The operating margin increased by 130bps to 6.4 percent. EPS for the half year was 18.62c and the interim dividend has been increased to 3.03c. The strong performance was helped by the return to profitability in Irish Dairy Ingredients with a continued strong performance by Global Nutritionals. Management have also upped guidance with adjusted EPS to increase by 20 percent this year of 36.6c compared to consensus of 35c. The recovery in Diary markets along with the potential for the group to revisit the Co-Op deal makes the stock attractive.

- According to reports in Poland, AIB is set to pick a buyer of its 70 percent stake in Poland’s Bank Zachodni WBK within seven days. The bidders for AIB’s stake include Banco Santander, BNP Paribas and Poland’s largest bank PKO Bank Polski. All three banks have offered to buy only 66 percent of Bank Zachodni, as a 70 percent bid would trigger a mandatory takeover bid under Polish law.

Apple is in advanced talks with News Corp. to let iTunes users rent TV shows for 99 cents and is in discussions with other media companies about similar deals, said three people familiar with the plan. Viewers would be able to rent programs from News Corp.’s Fox for 48 hours, said the people, who declined to be identified because the discussions aren’t public. CBS Corp., NBC Universal and Walt Disney Co. — where Apple Chief Executive Officer Steve Jobs is a board member and the largest shareholder — also are in talks about joining the effort, the people say.

Apple is in advanced talks with News Corp. to let iTunes users rent TV shows for 99 cents and is in discussions with other media companies about similar deals, said three people familiar with the plan. Viewers would be able to rent programs from News Corp.’s Fox for 48 hours, said the people, who declined to be identified because the discussions aren’t public. CBS Corp., NBC Universal and Walt Disney Co. — where Apple Chief Executive Officer Steve Jobs is a board member and the largest shareholder — also are in talks about joining the effort, the people say.- Mining giant BHP Billiton said Wednesday its net profit for the 2010 fiscal year totalled $12.72 bn, more than double the year-earlier figure of $5.88 bn, bolstered by record sales volumes of iron ore, metallurgical coal and petroleum. Revenue for the year ended in June was $52.8 bn, a 5.2 percent rise from the previous year’s $50.21 bn. BHP said it “remains cautious on the short-term outlook for the global economy,” citing policy tightening in China and uncertainty over fiscal policies around the world. The board also declared a final dividend of 45 US cents, bringing the dividend payout for the full year to 87 U.S. cents, a 6.1 percent rise from a year ago.

- A McAfee. investor sued to block Intel’s proposed $7.68 bn takeover of the maker of security software. Directors of McAfee, the second-biggest maker of security software, have a duty to get the best price for shareholders, Natalie Gordon said Aug. 20 in a Delaware Chancery Court complaint in Wilmington. “Both the value to McAfee shareholders contemplated in the merger and the process by which defendants propose to consummate the merger are fundamentally unfair” to shareholders, Gordon said in the complaint, asking to pursue the case on behalf of all McAfee shareholders. Intel’s $48-a-share cash offer, announced Aug. 19, represents a 60 percent premium over McAfee’s closing price the day before.

- Heineken, the world’s second-largest brewer by sales after Anheuser-Busch InBev , Wednesday reported a better than expected rise in first-half net profit, boosted by lower interest charges and positive exceptional items, while organic volume growth was pressured by declining volumes in Europe, and said it expects a low double digit increase in net profit in 2010. “Trading conditions remained challenging in Europe and the US, but we realised volume growth in Africa and Asia,” Heineken Chief Executive Officer Jean-Francois van Boxmeer said. Heineken remains cautious on the development of beer consumption in Europe and the US, but expects volumes in Latin America, Africa and Asia to continue to grow. Heineken refrained from giving a full year outlook earlier, but now said it expects an increase of its net profit before exceptional items and amortization of brands, or BEIA, to be at least in low double digits. Net profit BEIA rose 29 percent to €621 million in the six months ended June 30, from €483 million last year, boosted by €104 million in cost savings and beating analysts’ expectations of a net profit BEIA of €584 million.

- Amadeus IT Holding SA, Essar Energy Plc and Victrex Plc were among seven companies added to the benchmark Stoxx Europe 600 Index, while Allied Irish Banks Plc and Yell Group Plc were among those deleted, Stoxx Ltd. said. Electrocomponents Plc, National Express Group and Hikma Pharmaceuticals of the UK were also added to the benchmark gauge, as was Georg Fischer AG of Switzerland, the index provider said in an emailed statement. The other deletions include Bellway Plc of the UK, Maurel et Prom of France, Marfin Investment Group SA of Greece, Atrium European Real Estate Ltd of Austria and ProSafe of Cyprus. The changes will be effective at the open of European markets on Sept. 20, Stoxx Ltd. said.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.