Stock Market Underlying Support Fades

Stock-Markets / Stock Markets 2010 Aug 25, 2010 - 03:38 AM GMTBy: Donald_W_Dony

Following the August 18 Market Minute titled "S&P participation remains weak", underlying support for the S&P 500 has deteriorated during the last few days. On August 18, the percentage number of advancing stocks within the broad-based index had fallen to 50%. In contrast, at the peak of the bull advance in April, that percentage number was over 75%.

Market conditions have continued to change to the negative side. Currently, only 34% of the stocks in the index are trading over their 200-day moving average. This means that 66% are trending down (Chart 1). When the majority of an index's securities are declining, a downward trend develops. Similar conditions occurred in late 2007 and throughout 2008.

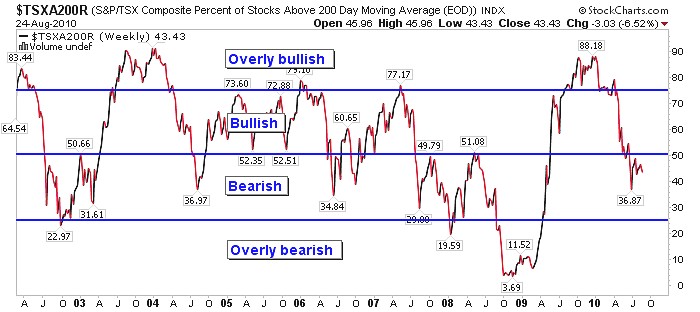

The TSX is in a near identical situation. Since April, the percentage number of advancing stocks has slowly slipped from a high of 70% to below 50% in mid-August. This means the balance of support for the index is steadily moving more to the negative side. Presently, only 43% of the holdings in the TSX are trending up and 57% are falling (Chart 2).

Bottom line: Market support has shifted faster than expected to the negative side. Advancing markets require a clear majority (60%-90%) of their underlying stocks to move higher if an index is going to trend up. When the percentage falls below 50%, markets start to decline.

Investment approach: Models indicate that most indexes trade on an approximate 4-month cycle. As the last trough was in late May to early June, the next probable low can be anticipated in late September to mid-October. With the underlying support for both the S&P 500 and TSX quickly eroding, increasing downward pressure can be expected over the next 4-6 weeks.

Investors may wish to take a very defensive stance this month by increasing cash percentages and raising stops. Good value opportunities are anticipated after this correction in Q4.

More information, including targets and key support levels, will be in the upcoming September newsletter.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2010 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.