At Least Be Aware Of The Current Risk In Treasury Bonds!

Interest-Rates / US Bonds Aug 25, 2010 - 03:15 AM GMTBy: Sy_Harding

Money continues to pour into bonds at a ferocious pace, with investors confident they are a safe and conservative holding in the midst of all the economic and stock market uncertainty.

Money continues to pour into bonds at a ferocious pace, with investors confident they are a safe and conservative holding in the midst of all the economic and stock market uncertainty.

With last week’s further rally, the 30-year Treasury bond had its biggest weekly gain in price since May, pushing their yield down to just 3.66%. The yield on 10-year Treasury notes was pushed down to 2.61%, while the yield on two-year notes fell to 0.496%.

The newly found confidence in bonds is in several ways reminiscent of the tech stock bubble in 1999, and the ease with which new issues of tech stocks were being eagerly swept up by investors convinced they could only go higher, finding all kinds of reasons not to believe warnings that they were in a bubble.

Corporations are currently scrambling to issue new supplies of bonds as fast as tech companies brought new stock IPO’s to market in 1999.

IBM recently had no trouble raising $1.5 billion by issuing three-year bonds that pay a record low 1% interest. That is, the bonds sold at 100 times their yield. It’s worth noting that IBM has an impressive record, going back to at least 1979, of timing its bond sales, most often selling at very low yields when investors were piling into them, and just before yields began to rise. Jack Albin, chief investment officer at Harris Private Bank says, “I don’t know how they’ve done it over the years, but it’s remarkable.”

With bond investors scrambling for most any issue the market tosses in front of them, Wall Street is now even considering the possibility of some companies being able to successfully issue 100-year bonds, bonds that would mature in 2110, long after the buyers have passed away. It’s been done a few times in the past, by IBM, Disney, Coca-Cola, Ford Motors, Federal Express, and a few others.

Imagine the temptation of being able to borrow large amounts of capital from investors at very low interest rates, with the loan not coming due for 100 years. It takes a buyer with a special need, or lacking in understanding of why they’re being offered a yield higher than on 30-year bonds, and unusual conditions in the bond market. Obviously, Wall Street believes the unusual conditions are present.

Fueling the bond frenzy is not just the determination to find a safe haven that at least pays something more than the 0% of money markets, but the popular opinion that bonds will continue to rally as a safe haven as long as the economy appears to be softening, and as long as the stock market correction continues.

Be aware that is not a given, or even evidenced by recent history.

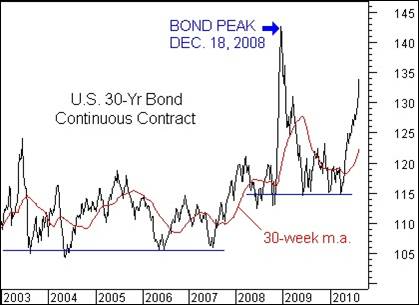

As the following charts show, the big spike-up in bonds at the end of 2008, which was also fueled by economic worries and a declining stock market, ended on December 18, 2008, even as worries about the economy worsened further, and almost three months before the stock market ended its severe 2007-2009 bear market (on March 10, 2009).

And are bonds conservative and safe? As the top chart shows bonds are often as volatile as stocks. Holding through their declines can often be as painful as holding through a stock market decline.

So the bubble rally in bonds may continue, but investors still piling into them need to be more aware of the risks than they appear to be, and aware that timing the bond market is almost as important as timing the stock market.

Sy Harding is president of Asset Management Research Corp, publishers of the financial website www.StreetSmartReport.com, and the free daily market blog, www.SyHardingblog.com.

© 2010 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.