How Investors Can Earn 18% Without Buying a Single Stock

Housing-Market / Investing 2010 Aug 24, 2010 - 09:35 AM GMTBy: Jared_Levy

I recently put one of my townhomes on the housing market to sell. It has been completely remodeled and is in a great location at a price that is the lowest in the area and by far the cheapest when compared to similar units in square footage, location and finish out. (No, I'm not trying to sell you my home.)

I recently put one of my townhomes on the housing market to sell. It has been completely remodeled and is in a great location at a price that is the lowest in the area and by far the cheapest when compared to similar units in square footage, location and finish out. (No, I'm not trying to sell you my home.)

I have marketed my home on every real estate website out there and even lowered the price of my unit to the cheapest in my building. The home is located in one of the densest and most desirable areas of Dallas, Texas. Even after all that and 40 days on the market, I have had one showing. I'm not looking for pity at all; in fact, taking this frustration in stride I realized there are some real deals to be had out there.

You see, I am also looking to buy another property and boy, do I have a selection, including penthouse condos in the nicest part of town that were once selling for $300,000 and up are now priced below $120,000 in some cases. The plethora of inventory and the current weak state of the American consumer and would-be homebuyer have created an enormous opportunity for those who have a little faith, knowledge, patience and willingness to look for value in the housing market.

The real value may not be from the sellers like me who are looking to unload their homes and move on, but mostly from struggling homeowners and the banks, lenders and Fannie Mae, who currently have a glut of properties on their books that they need to unload (known as real estate owned or REO). You see, banks and even Fannie Mae are not in the business of buying and selling homes. Their job is simply to lend money or insure those notes for the borrowers who have now jumped ship and offered their deeds in exchange for the monies owed.

Many of the banks we know have already taken enormous write-downs on these bad loans and the next step is to move them off the books and get whatever cash they can. This means exceptional deals for you, and what's even better is that you can buy these homes not only at a relatively cheap price, but you get to leverage your money at a very low cost (interest rates are at a 40-year low) and collect dividends through rent, which can actually pay for your ownership while you wait for values to rise. If values don't rise, remember that you can still reduce your cost every month through rent and take legal tax deductions on the money borrowed as well as any repairs you need to do.

REOs, Foreclosures and Short-Sales

While some realtors may steer you away from these types of sales because of the extra work sometimes needed to execute a contract, as well as the possibility of reduced commissions, you shouldn't ignore the values they offer. REOs and foreclosures are generally the most attractive because the banks have either already taken full control of the property or they are in the process of doing so and want to get that asset off their books. A short-sale is when the owner of the property is negotiating with the bank to sell the home and will satisfy the note for an amount lower than what they owe. Those are sometimes a bit tougher to complete, but may also offer great profit opportunities.

Lower Volatility

The equity markets can be quite volatile and have the ability to fluctuate plus or minus 2-3% daily. That can create a ton of headaches, not to mention spook you into exiting a position because you don't want to see your investment lose more value. The real estate market is much less volatile than the Dow Jones Industrial Average. That doesn't mean we didn't have a bubble in the real estate market, the likes of which had not been seen in decades. However, bubbles tend to occur less frequently in the overall real estate market and this recent bubble has corrected itself.

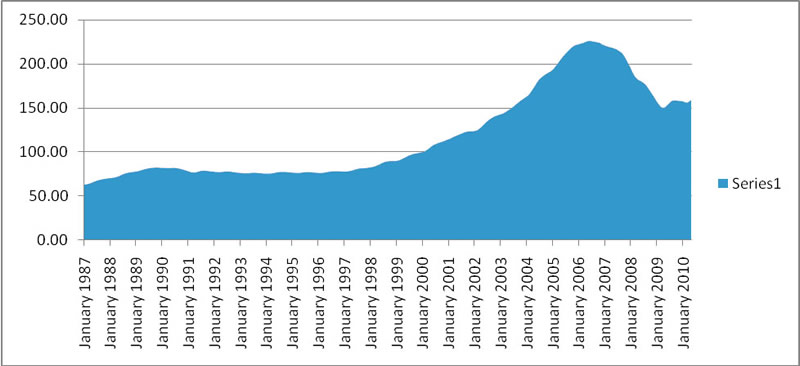

Case-Shiller 10-City Price Index 1987-Today

Dow Jones Industrial Average 2000-Today

How Do You Go About It?

Just because real estate is cheap doesn't mean you need spend $300,000 on a fancy new condo! Think small -- remember that the more affordable it is to you, the more affordable it will be to the masses. I suggest keeping your investments under $150k (preferably $100k) and in dense, desirable areas where you can find renters and lots of potential buyers.

In the major cities across the U.S., renters are in vogue and if you can pick yourself up a clean unit or fixer-upper in a nice neighborhood, you may discover a gem. Fannie Mae properties also offer financing called Homepath loans, which are flexible in terms, cheaper to complete and have lower rates even for people with less-than-perfect credit. They even offer repair financing if you want to incorporate that into your loan. Check out homes and programs here: http://www.homepath.com/.

If you can live in the home, then of course you can spend a bit more, but look to save on what you are currently spending if at all possible and either pay down the principal on the new mortgage or buy some other investments with your extra cash.

But let's assume you are looking for a pure investment property -- don't forget to check with the township or realtor to find out what the home has sold for in the past to ensure you're getting a good deal.

So Here Is What Your Investment Might Look Like:

Let's say you find a home for $100,000.

You put 10% down, which is a $10,000 investment, similar to what many of us may put into the stock market. (You can put more or less down, if you are doing conventional financing through the FHA. With Homepath, you can put as little as 3% down, although you may be required to pay PMI if you put down less than 20%.)

That means you are financing $90,000. Let's assume you finance it at a 4.5% rate (current 30-year rate). This will cost you $456 per month.

Taxes will vary; in Dallas, for example, you can expect to pay around $200 per month.

You may or may not have to pay a condo fee, but let's assume it's $100 per month.

Your total monthly cost in this property would be around $756.

Of course you should do this math beforehand when figuring out if this is a good deal, and whether you can rent the property for $900 per month. Remember, you can also deduct mortgage interest and some repairs, upgrades and depreciation, but check with your accountant on those!

In this case you are making about $1,800 per year on your $10,000 investment. That's 18% annually you could receive to pay down your debt on an asset that you now own, which should begin to appreciate in value moving forward.

Of course, there are no guarantees and you have repairs to make, but if you keep a renter in the home, eventually you will own the home free and clear and whatever you sell the home for would be pure profit!

That 18% is more than you could make in the stock market. In fact, if you bought the Dow Jones in August 2000, you'd have lost 9%, not to mention the money you spent on Maalox. This is one reason why diversifying your portfolio makes perfect sense.

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source : http://www.taipanpublishinggroup.com/tpg/smart-investing-daily/smart-investing-082310.html

By Jared Levy

http://www.taipanpublishinggroup.com/

Jared Levy is Co-Editor of Smart Investing Daily, a free e-letter dedicated to guiding investors through the world of finance in order to make smart investing decisions. His passion is teaching the public how to successfully trade and invest while keeping risk low.

Jared has spent the past 15 years of his career in the finance and options industry, working as a retail money manager, a floor specialist for Fortune 1000 companies, and most recently a senior derivatives strategist. He was one of the Philadelphia Stock Exchange's youngest-ever members to become a market maker on three major U.S. exchanges.

He has been featured in several industry publications and won an Emmy for his daily video "Trader Cast." Jared serves as a CNBC Fast Money contributor and has appeared on Bloomberg, Fox Business, CNN Radio, Wall Street Journal radio and is regularly quoted by Reuters, The Wall Street Journal and Yahoo! Finance, among other publications.

Copyright © 2010, Taipan Publishing Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.