Hyperinflation is a Fiscal, not Monetary Phenomenon

Economics / HyperInflation Aug 23, 2010 - 02:29 PM GMTBy: Jordan_Roy_Byrne

Months ago we wrote about the true causes of hyperinflation. We proceed to expand upon our views as we disagree with the views put forth by John Mauldin, Mike Shedlock and now Jim Rickards who all focus on velocity and/or bank lending as important causes of hyperinflation.

Months ago we wrote about the true causes of hyperinflation. We proceed to expand upon our views as we disagree with the views put forth by John Mauldin, Mike Shedlock and now Jim Rickards who all focus on velocity and/or bank lending as important causes of hyperinflation.

The reality is that hyperinflation is first and foremost set in motion and driven by a deteriorating fiscal situation. In fact, significant economic weakness and deflation is a precursor to hyperinflation. Too many analysts believe that there has to be some economic demand or some consumption to stimulate inflation or hyperinflation. Printing money to try and stimulate your economy or excessive credit growth is what leads to inflation. Printing money because you are broke and can’t service your debts is what leads to hyperinflation.

Recently Jim Rickards wrote about how a change in velocity can trigger hyperinflation.

At Mises.org, Henry Hazlitt educates us on velocity:

For example, it is frequently said that the value of the dollar depends not merely on the quantity of dollars but on their "velocity of circulation." Increased "velocity of circulation," however, is not a cause of a further fall in the value of the dollar; it is itself one of the consequences of the fear that the value of the dollar is going to fall (or, to put it the other way round, of the belief that the price of goods is going to rise). It is this belief that makes people more eager to exchange dollars for goods. The emphasis by some writers on "velocity of circulation" is just another example of the error of substituting dubious mechanical for real psychological reasons.

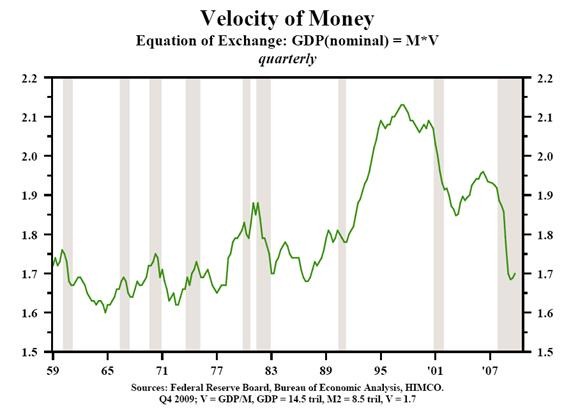

Indeed! The focus on velocity may have led you astray over the past 10 or 15 years. Take a look at this chart of velocity from Dr. Lacy Hunt of Hoisington Investment Management.

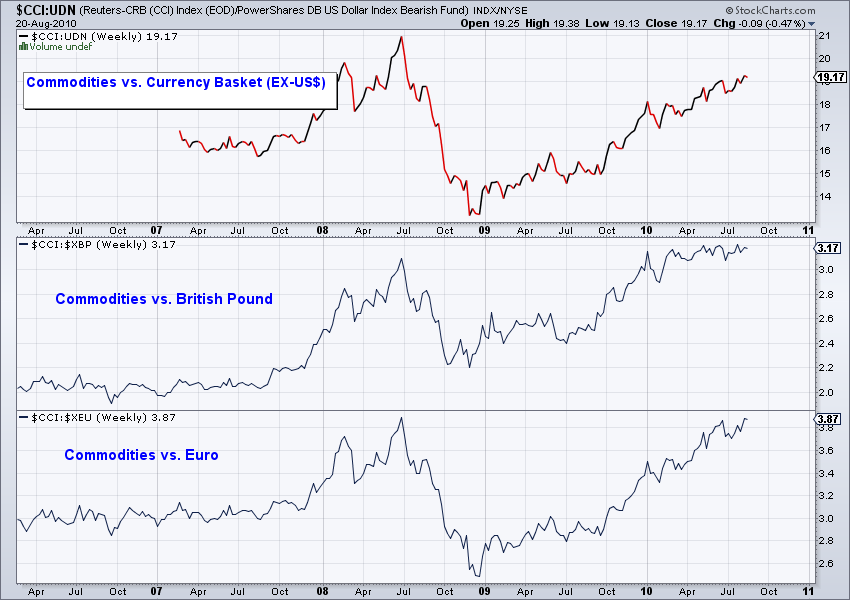

As you can see, velocity actually increased during a time of disinflation and has been muted throughout most of the bull market in commodities. Moreover, despite in recent years, the sharp drop in credit growth and bank lending in the West, Gold and Commodities have powered higher. We know that Gold has made all time highs against every currency. Yet, take a look at this chart.

Priced in Euros and Pounds, Commodities have rallied back to their 2008 high! Priced against a basket of currencies (ex US$), Commodities are 9% below their 2008 peak. Not bad considering the crash in 2008 and ensuing deflationary environment.

Why are Gold and Commodities performing so well if we are in a deflationary environment? The greater the deflation and the worse the economy gets, the greater the worry about sovereign bankruptcy, which will come via default or hyperinflation. Certain government bonds are rallying because they are safe-havens relative to other government bonds.

The point is, precious metals are outperforming and commodities to a lesser extent even without a rise in bank lending, a rise in credit growth and a rise in velocity. As we already explained, deflationary forces and a weak economy ultimately exacerbate the ability of various governments to service their ongoing and growing debt burdens.

Hyperinflation is a fiscal phenomenon borne out of a bankrupt state that can’t service its debts. Monetization is a trigger while a rise in consumption and velocity is a psychological effect as Hazlitt notes. After all, if massive inflation is coming, what is the first thing you want to do? You’ll position yourself in hard assets well ahead of thinking that “I need to spend now because this money will be worthless later.”

In our premium service, we have paid little attention to inflation-deflation or money supply or velocity. Instead, we correctly focus on the fiscal health of various governments. As that deteriorates, it brings us closer and closer to the eventual end game, which is a new currency regime. For what it is worth, I do believe we will see severe inflation but note that hyperinflation of the Zimbabwe or German kind is out of the question due to the deep and liquid bond markets that we, Europe and the UK have. If you’d be interested in more clear analysis and how you can reap big profits while protecting yourself, consider a free 14-day trial to our premium service.

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.