Gold Marginally Lower in USD and Flat in EUR and CHF

Commodities / Gold and Silver 2010 Aug 23, 2010 - 07:05 AM GMTBy: GoldCore

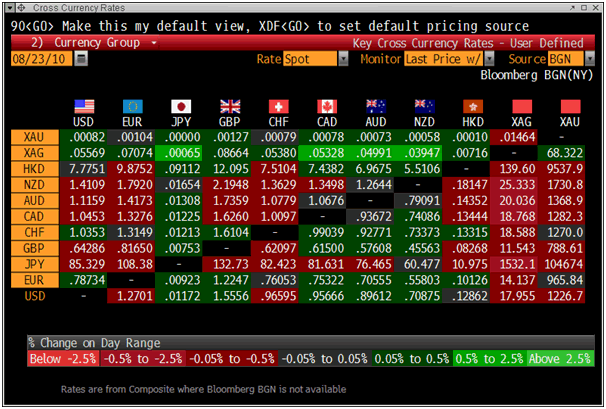

Gold traded sideways in Asian trade, hovering near last week's close at $1,228/oz. There was a brief spike to $1,231.35/oz in early European trade prior to sharp and determined selling. Gold remained marginally higher until the London AM fix whereupon there was a further wave of selling which took prices down to $1,225.30/oz. Gold is lower in most currencies except the euro and the Swiss franc which are slightly weaker this morning (see Cross Currency Rates).

Gold traded sideways in Asian trade, hovering near last week's close at $1,228/oz. There was a brief spike to $1,231.35/oz in early European trade prior to sharp and determined selling. Gold remained marginally higher until the London AM fix whereupon there was a further wave of selling which took prices down to $1,225.30/oz. Gold is lower in most currencies except the euro and the Swiss franc which are slightly weaker this morning (see Cross Currency Rates).

Gold is currently trading at $1,225.72/oz, €964.91/oz, £788.30/oz.

Cross Currency Rates at 1200

Asian equity markets were mixed overnight while European markets have eked out meager gains possibly due to merger and acquisition activity. Spreads between Bunds and European peripheral debt were tighter, indicating some return of risk tolerance in government debt markets. With prices at all time historical record highs and yields at record lows, concerns about bubbles in many government debt markets are growing.

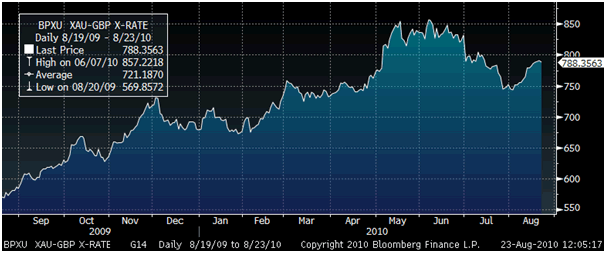

Gold in GBP - 1 Year (Daily)

Gold's higher weekly close last week, while marginal, is important technically and confirms the recent trend change from negative to positive. August looks set to see higher gold prices which will set the market up nicely technically as we enter the stronger autumn months and the Diwali and the Indian buying season. This month's options expiration could see another round of selling as is common on options expiration and savvy buyers will again use this as a buying opportunity.

Gold in EUR - 1 Year (Daily)

Gold appears to have bottomed out in late July (in all major currencies) and higher prices can be expected in euros and British pounds in the coming months while the eurozone and the UK continue to deal with their significant fiscal challenges.

Silver

Silver is currently trading at $17.92/oz, €14.10/oz and £11.52/oz.

Platinum Group Metals

Platinum is trading at $1,504.00/oz, palladium is at $475/oz and rhodium is at $2,050/oz.

News

(PTI) -- Bullion: Gold continued to glitter at the bullion market and regained its 1-1/2 month high during the week under review on sustained buying by stockists and jewellers as well as good local demand amid firming trend in global markets. "The uptrend in yellow metal was also aided by increased demand from retailers and jewellers ahead of the ensuing festival season," traders said.

(Bloomberg) -- Hedge-fund managers and other large speculators increased their net-long position in New York gold futures in the week ended Aug. 17, according to U.S. Commodity Futures Trading Commission data. Speculative long positions, or bets prices will rise, outnumbered short positions by 204,228 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 13,541 contracts, or 7 percent, from a week earlier.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.