OECD Oil Consumption, Transportation, Emissions, Biofuels and Whiskey

Commodities / Crude Oil Aug 21, 2010 - 06:03 AM GMTBy: Dian_L_Chu

A new report released by the Carbon Disclosure Project notes that globally, 98% of transportation runs on fuel made from oil. The transportation sector is responsible for almost 60% of oil consumption in OECD countries.

A new report released by the Carbon Disclosure Project notes that globally, 98% of transportation runs on fuel made from oil. The transportation sector is responsible for almost 60% of oil consumption in OECD countries.

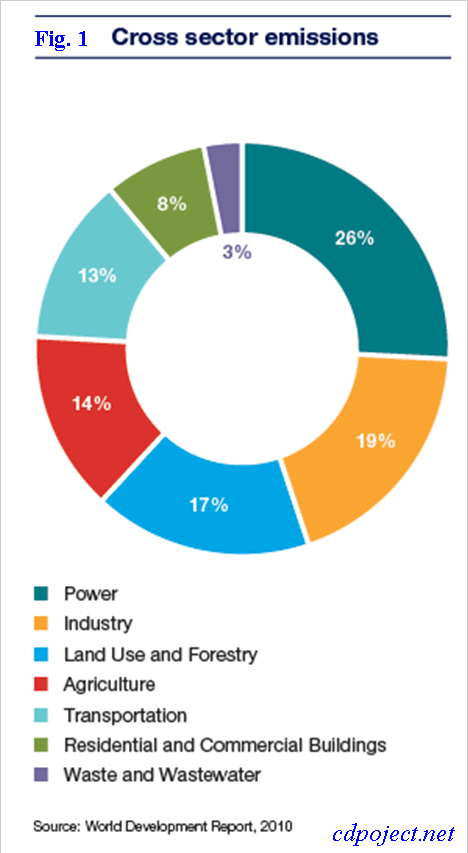

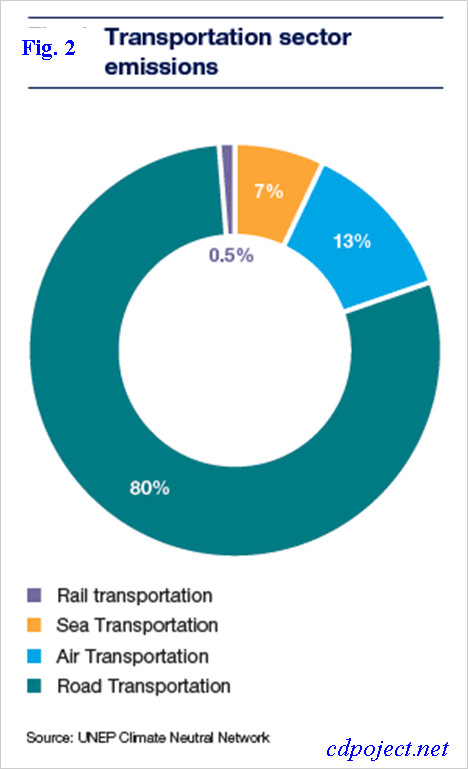

This heavy dependence on oil has resulted in the transportation sector generating 13% of total global emissions, compared to 26% from the power sector and 14% from agriculture (Fig. 1). And out of all the modes of transportation, road vehicles generate the lion's share of the transportation sector’s total contribution to CO2 emissions --approximately 80% (Fig. 2).

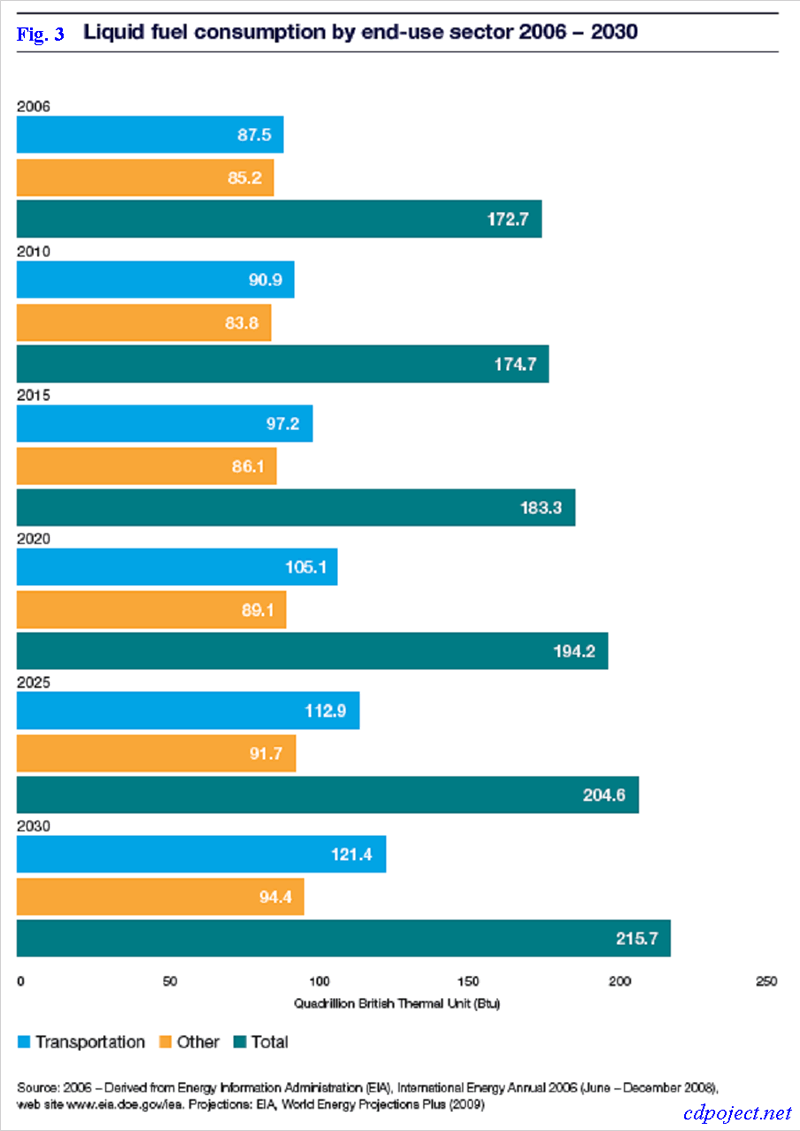

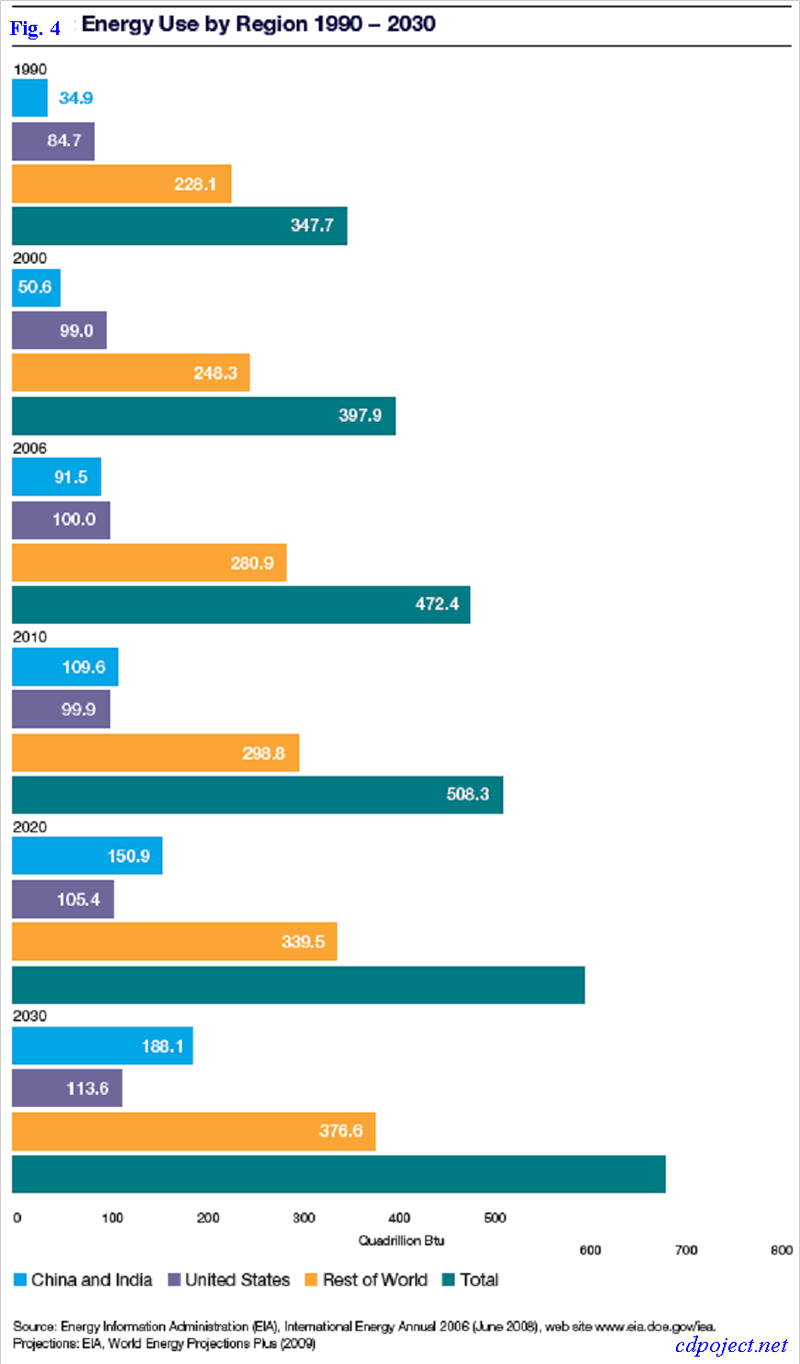

The study further finds demand is projected to grow for both transportation and energy, and about 93% of the increase in energy demand is expected to come from non OECD countries, largely China and India. (Fig. 3 & 4) Demand for commercial transportation is also projected to grow in all regions and the fastest developing nations will have overtaken the OECD as the largest source of commercial transportation demand by 2030. Increased demand on the sector leads to heightened risk of increased greenhouse gas emissions.

While there are ongoing debates about the link between greenhouse emissions and climate change, it is a logical and evolutional process to broaden our energy sources. Biofuels is one of the reasonable, although not complete, solutions for our heavy dependence on petroleum based fuel. However, the food versus fuel debate already has many worried about diverting crops for biofuels would pose a great risk to global food supply and skyrocket food and feedstock prices.

One of the latest biofuel developments is using whiskey by-products. Some Scottish scientists at Edinburgh Napier University figured out a way to turn whiskey waste--pot ale and draff-- into butanol, reports the Guardian. Butanol is a new kind of biofuel that researchers have found to yield 30% more power output than ethanol, and can be used in conventional vehicles without engine modifications. The research team also said it could be used to fuel planes and as the basis for chemicals such as acetone, an important solvent.

When it comes to recycling beer waste, America is ahead of the curve on this. Currently in the US, ethanol is primarily made from corn with 10% blending ratio in gasoline. Coors Brewing Company has been turning its beer waste into ethanol since 2008. CBS also reported beer manufacturer Sierra Nevada Brewing is already in a partnership with E-Fuel to test the use of beer by-products as feedstock for ethanol fuel.

The need to reduce carbon emissions has now become a legal requirement in many parts of the world. The Guardian says this novel whiskey biofuel could be available at pumps in a few years. It seems more environmentally sustainable than using corns or other crops, but it is unclear if a mass commercial application would be economical or feasible.

While we normally prefer whiskey served in a glass, putting whisky biofuel into gas tank could be a welcoming step to the right direction to diversify our energy sources.

(The entire Carbon Capture Project Transport Report is available at cdproject.net.)

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.