Bernanke Expands Permanent Open Market Operations to Buy Stocks

Stock-Markets / Stock Markets 2010 Aug 19, 2010 - 01:14 PM GMTBy: PhilStockWorld

Today we get another round of Permanent Open Market Operations.

Today we get another round of Permanent Open Market Operations.

POMOs are the Fed's way of creating additional bank reserves to finance asset purchases and loans for its Primary Dealers (the Gang of 12 or, as David Fry calls them, Da Boyz). GS and Co. then turn around and use this money to fuel their bots to buy equities and we believe we saw a little test run of those programs a couple of times this week as we had very irrational, sharp rallies for no particular reason and I had commented to Members, during chat, that it looked like some Bot testing.

Note that in David's picture, Bernanke is still playing the role of the generous bartender he played in the hit video "Hayek vs. Keynes - An Economic Smackdown." Note this all ends badly for Keynes but WHAT A PARTY!

We made 3 aggressive upside spreads looking for a big finish for the week in yesterday morning's Alert to Members on SSO, QLD and DDM. Fortunately our timing was good as my call to look for a run once we got past the 10:30 oil inventory report was on the money but then we were very disappointed by the size of the sell-off in the afternoon - even though we were short at that point (we can root for the bulls while betting against them). It's all about jobs this morning and we need to see less the 450,000 pink slips handed out in the past week to get a little more aggressive.

My prediction in the morning was: "We should get our bottoms with the crude inventories at 10:30 so no hurry on bullish plays, most likely. Selling XOM $60 puts for $1 or more (now .47) on a dip today is a nice play into expirations as you can always roll them along." The XOM puts topped out at .63, so no luck there, but the action (see Davids chart) was right on the money for us:

We took a long play on USO at the bottom that did well (and we took money and ran) and we flipped back to bearish at 1:41 with put plays on IWM and DIA that did nicely into the close. As I had said in the morning post - blissful agnosticism!

8:30 Update: 500,000 jobs lost last week! Ouch!!! Looks like we should have held onto those puts because this is going to suck. We get Leading Economic Indicators and the Philly Fed at 10 but it will be hard to get things in gear after that report.

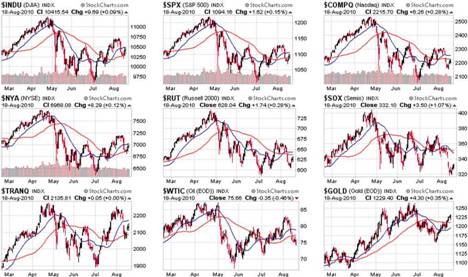

On the bright side, poor jobs numbers mean MORE FREE MONEY and we'll see if we can hold our floors once again, despite the bad news at: Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635 - with the Russell, for good reason, continuing to be our canary in the coal mine that gave us a great bearish signal yesterday as they topped out at 633 at 1:15, leading to my bearish call 30 minutes later.

500K is an ugly number but it's "just" 12,000 more jobs than we lost last week so hardly a reason to crash the market. Last Thursday we lost 484,000 jobs (revised to 488,000) and we opened down about 100 but finished the day near flat at 10,320 - probably about the line we'll be testing at the open. We're still stuck in the middle on most of our indexes with the Russell (the smaller businesses that are doing most of the laying off) having moved from leader to laggard so it's the Nasdaq we'll be looking to take us higher but they aren't going to do it without their SOX, which has been a total drag all month.

Merger mania continues with INTC paying a 70% premium for MFE ($7.7Bn) in a friendly takeover (you'd be friendly too if someone were paying you more than your all-time high in cash in this market!). What's telling in these deals is how much the acquiring company goes down and, in Intel's case, the pre-market answer is "not too much." So INTC is a $109Bn company buying a company that traded at $4.5Bn yesterday for $7.7Bn so a $3.3Bn premium could hit INTC by about 3% if people think that's what they overpaid. If INTC goes down half of that, then we can assume that there is a general consensus that MFE was, indeed undervalued and we can infer the SOX in general are undervalued and my way to play that would be (and Members already have this play):

USD Sept $27 calls at $1.88, selling the Sept $30 calls for .75 is net $1.13 on the $3 spread. You can enhance the potential returns by risking an assignment of this ultra-ETF by selling the $25 puts for $1.15, which puts you in the play for free with SDS currently at $27.25 and your worst case is that SDS is assigned to you at net $24.98, which is 8.3% lower than it's trading for now. This should be a great trade at the open as the puts are likely to be higher in price (so we are selling into the initial excitement) and the bull call spread should be cheaper - Bottom fishing 101 for non-members and we'll check in on this trade over the next month to see how it does.

USD Sept $27 calls at $1.88, selling the Sept $30 calls for .75 is net $1.13 on the $3 spread. You can enhance the potential returns by risking an assignment of this ultra-ETF by selling the $25 puts for $1.15, which puts you in the play for free with SDS currently at $27.25 and your worst case is that SDS is assigned to you at net $24.98, which is 8.3% lower than it's trading for now. This should be a great trade at the open as the puts are likely to be higher in price (so we are selling into the initial excitement) and the bull call spread should be cheaper - Bottom fishing 101 for non-members and we'll check in on this trade over the next month to see how it does.

Asia had a nice morning with the Hang Seng up 0.24% and the Shanghai up 0.81% and the BSE up 1.1% and the Nikkei up 1.3% but the Hang Seng plunged over 200 points into the close, presumably on the news that the BOJ will manipulate the Dollar/Yen trade by expanding credit programs to weaken their own currency. The RUMOR is that the BOJ will increase the credit facility for lenders to 30 trillion Yen ($351 billion) from 20 trillion Yen so about $120Bn extra tossed into the mix.

Since the Yuan is still manipulated pegged to the dollar, Hong Kong exporters were not thrilled with the news but, thankfully, Bernanke's POMO trumps Japan's money dump any day of the week and our 3am trade was saved as the Yen flew back from 85.9 to the Dollar, all the way back to 85.2, making yet another Bazillion Dollars for the currency traders in the World's easiest trade! It's funny because I've been pointing this trade out for over a year and it still works much more often than not. You would think someone would get tired of propping up the Dollar every night but noooooooo.

Europe, of course, is all freaked out about our jobs report and are down about 0.3% ahead of our open. The Euro is weak against the Dollar on concerns the recovery there is slowing too and tensions are rising in Greece as austerity measures shrink every aspect of the economy.

Meanwhile, in stronger countries, 130,000 pre-orders for IPhones crashed Korea Telcom servers yesterday. Our online shop server was jammed instantly as too many clients placed orders simultaneously,” KT spokesman Jin Byung-Kwon told AFP. “We didn’t expect so many people to pre-order the iPhone 4 in such a short time.” But then, no one ever does. Right, AT&T? Incidentally, first-day pre-orders for the iPhone 4 easily broke the local record held by the iPhone 3G, which received 65,000 pre-orders over five days.

It's a global economy folks, don't get too fixated on your local troubles when considering the prospects of our multi-national corporations.

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.