Silver Price Trend Update

Commodities / Gold and Silver 2010 Aug 18, 2010 - 04:37 AM GMTBy: Bob_Kirtley

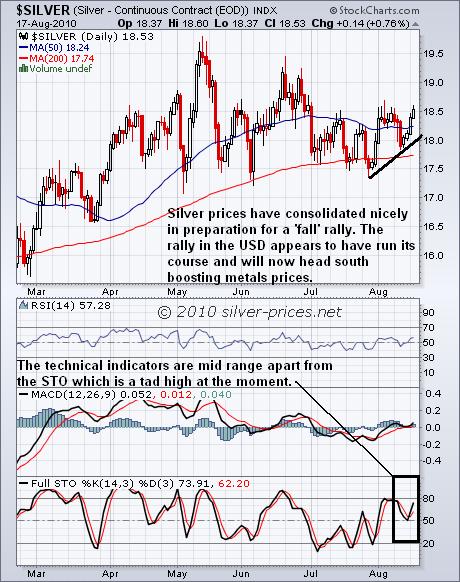

We kick off with a light hearted review of silver taking a quick look at the chart for silver prices where we can see that they have been consolidating nicely over the last three months or so. The technical indicators are more or less in the middle of their respective ranges and as so have room to move higher. As we see it this current set up bodes well for silver to make some real progress from now through until January 2011.

We kick off with a light hearted review of silver taking a quick look at the chart for silver prices where we can see that they have been consolidating nicely over the last three months or so. The technical indicators are more or less in the middle of their respective ranges and as so have room to move higher. As we see it this current set up bodes well for silver to make some real progress from now through until January 2011.

The economic landscape, in general terms, does not appear to be too healthy as the trillion dollar stimulus packages already unleashed by various governments across the globe have done very little to boost the economies any country. So we now have a follow up jab to make sure that the patient doesn’t die in the operating theater in the form of the QE2 LITE. Whats the QE2 LITE you ask? Is it a new lite beer to try and dampen the fervor of rambunctious ice hockey fans? No its not. Is it a smaller version of that wonderful ship that is regarded as a master piece of marine engineering? No, wrong again. Its the printing presses going full tilt and producing dollars out of thin air once again. The Federal Reserve are pursuing the only answer they know with the creation of cash from nowhere which will eventually lead to a massive dose of inflation. But you knew that as the decade long rise in gold prices has been telling us so.

What to do now is to get into position in order to take advantage of the upcoming surge in silver prices by whatever vehicle best fits with your own objectives and investment criteria.

Now, if we take a quick peek at the chart for the USD we can see that its demise came to a sudden halt as the broader markets rocked a little and stocks were sold off resulting in a small boost for the dollar. This short rally appears to have run its course and we now expect it to re-test the 200dma average once again. The technical indicators are mid range apart from the STO which is a tad high at the moment and is about to curl over and head down.

Most of the northern summer is now behind us and Labour Day is just a few short weeks away so for you people who inhabit such wet places as Vancouver, you can look forward to the excitement in this tiny sector coming to a screen near you, it will occupy your mind while you scrape the ice off your windscreen in the early hours of the morning. Mean while down here in the Bay of Plenty, spring is upon us, green lipped mussels, a glass of Chardonnay or two……

Stay on your toes these are treacherous waters so take care.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

On Friday 7th May our premium options trading service OPTIONTRADER opened a speculative short term trade on GLD Puts, signalling to short sell the $105 May-10 Puts series at $0.09.

On Tuesday the 11th May we bought back the puts for just $0.05, making a 44.44% profit in just 4 days.

Silver-prices.net have been rather fortunate to close both the $15.00 and the $16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

Got a comment then please add it to this article, all opinions are welcome and appreciated.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.