Commodites Soar as US Dollar Plunges to New Lows Due to Record National Debt

Commodities / Gold & Silver Sep 20, 2007 - 04:57 PM GMTBy: Gold_Investments

Gold

Gold

Spot gold rose more than one percent to hit a 27-year high at $730.20 an ounce this morning on safe-haven buying and a slide in the dollar to record lows against the euro.

Gold was quoted at $728.00/728.50 an ounce, compared with $721.10/721.90 in New York late on Wednesday.

Gold has risen more than 15 percent so far this year. In January 1980, gold reached its all-time non inflation adjusted high price of $850. If one was to adjust for the considerable inflation of the last 27 years, the inflation adjusted high would be some $2,400. Most commodities are now at inflation adjusted all time record highs and given increasing uncertainty regarding the health of the U.S. economy and the USD it seems extremely likely that gold will challenge the inflation adjusted high of $2,400 in the next 5 years.

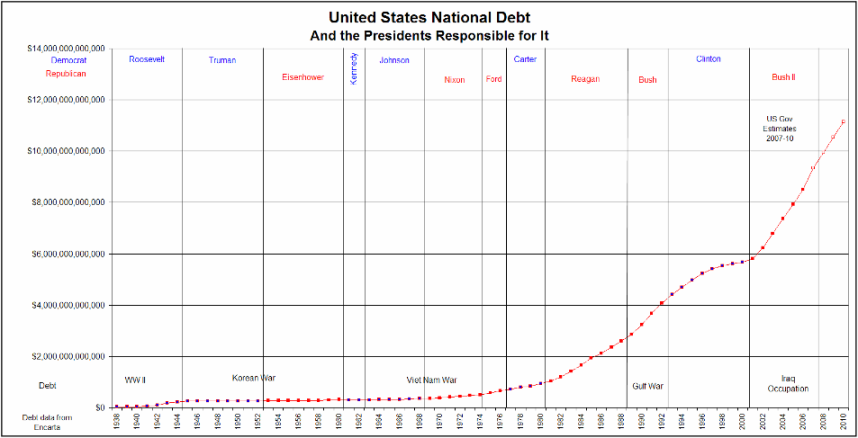

News that the U.S. debt limit is to be increased to $9.815 trillion will put further pressure on the USD. The U.S. national debt has now increased by more than 90% since George Bush came to power 7 years ago (more in Forex and Gold below).

Forex and Gold

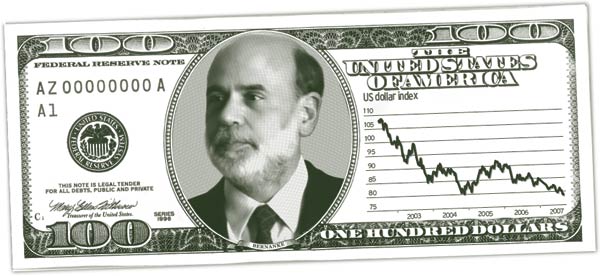

The USD hit a new all time low against the euro at 1.4064.

The USD has fallen to a new all time low mark on the US Dollar Index at 78.791.

A number of factors were cited for the USD further sell off. Bloomberg reported that Bernanke will tell a congressional hearing that the U.S. housing slump threatens to slow economic growth. This is not new news and the currency markets had likely already priced this in.

Of more importance was the breaking news regarding the likelihood that the Saudis may break their USD peg as they are refusing to cut interest rates in unison with the Fed for the first time (http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2007/09/19/bcnsaudi119.xml). This may result in the huge petrodollar reserves of the region staying in the region or being diversified internationally and not recycled in the USD Treasuries and USD denominated assets.

Ben Bernanke has placed the dollar in a dangerous situation, say analysts

Also of importance is the news that Treasury Secretary Paulson expects the federal government to reach its $8.965 trillion statutory debt limit on October 1. Paulson, in a letter to congressional leaders, urged quick Senate approval of a bill that would increase U.S. borrowing authority by $850 billion and reduce chances that uncertainty over federal funding could exacerbate financial market turmoil. "The full faith and credit of the United States, to which we all remain committed, is a national asset and a cornerstone of the global financial system," Paulson wrote. "In light of current developments in financial markets, which would be exacerbated by uncertainty in the Treasuries market, I urge the Senate to pass the legislation reported by the (Senate) Finance Committee to increase the debt limit as soon as possible," he wrote. The finance panel last week approved an increase in the federal debt limit to $9.815 trillion.

Greenspan recently chastised George Bush's fiscal policies. He said that Bush has engaged in "profligate spending" and has abandoned "fiscal restraint".

It is not surprising that Greenspan has questioned Bush's fiscal policy. The national debt limit has gone from $5.12 Trillion to be soon over $9.815 Trillion in less than 7 years. This means the national debt has increased by more than 90% in just 7 years. Fiscal conservatives have said that Bush has engaged in drunken sailor spending on par with Latin American banana republics. Some have even suggested that his pork barrel "guns and butter" spending (more guns than butter) could push the U.S. close to bankruptcy - http://www.cato.org/research/articles/cpr28n1-050101.html. The Emperor is not wearing any clothes and their international creditors in China, Japan and the Middle East are getting extremely nervous which could lead to a wholesale dumping of and a run on the USD.

Silver

Spot silver is trading at $13.10/13.11 (1200 GMT).

PGMs

Platinum was trading at $1311/1316 (1200 GMT).

Spot palladium was trading at $334/338 an ounce (1215 GMT).

Oil

Oil prices closed Wednesday at a record high near 82USD a barrel in New York following news that U.S. crude reserves tumbled last week. They remain near record highs but are off somewhat on profit taking.

With the USD down some 30% against a basket of currencies in recent years, $80 a barrel today is not what it was in 2001. Oil producers seeing their dollar revenues continuingly depreciating are likely to seek higher USD prices.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.