Recession Batters State Budgets Which Could Slow Economic Recovery

Economics / US Economy Aug 17, 2010 - 06:09 AM GMTBy: John_Mauldin

There were a lot of questions last week when I wrote about public pensions. So for this week’s Outside the Box, I offer you some more information about how bad the state deficit situation is, and for your specific state. States are having to cut more than 1% of national GDP in fiscal 2011, as federal stimulus money is slowly drying up. And that is just states. Local municipalities and schools have a similar problem. And then add on the possibility of the Bush tax cuts going away and that is a very serious situation. It is why I am so concerned and vocal about the need for the Bush tax cuts to be extended for at least one year until the economy is growing above stall speed. The headwinds from cities and states are severe, as you can see.

There were a lot of questions last week when I wrote about public pensions. So for this week’s Outside the Box, I offer you some more information about how bad the state deficit situation is, and for your specific state. States are having to cut more than 1% of national GDP in fiscal 2011, as federal stimulus money is slowly drying up. And that is just states. Local municipalities and schools have a similar problem. And then add on the possibility of the Bush tax cuts going away and that is a very serious situation. It is why I am so concerned and vocal about the need for the Bush tax cuts to be extended for at least one year until the economy is growing above stall speed. The headwinds from cities and states are severe, as you can see.

Basically, the states were profligate going into the downturn, and they have enormous costs going forward, so even for 2011 and 2012 they are going to have massive budget deficits. Some, like Illinois and Nevada have shortfalls of 40-50%. That is simply not sustainable.

The research is from the Center on Budget and Policy Priorities at http://www.cbpp.org/cms/index.cfm?fa=view&id=711. for those in the US, I think you will find it interesting to see how your state is doing. For those outside, look and see how much the problem is in terms of GDP and realize what impact that is going to have on the overall US economy.

I am at the airport in Omaha with Trey on a trip looking at schools, and on to Illinois tonight. It is a lot cooler here than in Dallas, at least.

Your data watching analyst,

John Mauldin, Editor

Outside the Box

Recession Continues to Batter State Budgets; State Responses Could Slow Recovery

By Elizabeth McNichol, Phil Oliff and Nicholas Johnson

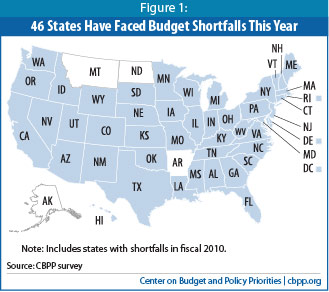

The worst recession since the 1930s has caused the steepest decline in state tax receipts on record. As a result, even after making very deep spending cuts over the last two years, states continue to face large budget gaps. At least 46 states struggled to close shortfalls when adopting budgets for the current fiscal year (FY 2011, which began July 1 in most states). These came on top of the large shortfalls that 48 states faced in fiscal years 2009 and 2010. States will continue to struggle to find the revenue needed to support critical public services for a number of years, threatening hundreds of thousands of jobs. States face:

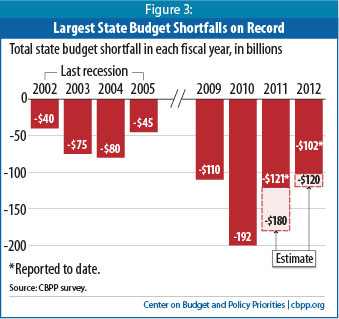

- Budget problems in 2011. Fiscal year 2011 gaps — addressed with spending cuts and revenue increases by most states — totaled $121 billion, or 19 percent of budgets in 46 states.[1] This total is likely to grow over the course of the fiscal year, which started July 1 in most states. It may well exceed $140 billion and would be higher still without federal assistance. The fact that the gaps have been filled and budgets are balanced does not end the story. Families hit hard by the recession will experience the loss of vital services throughout the year, and the negative impact on the economy will continue.

- Uncertainty for the future. States’ fiscal problems will continue in the current fiscal year and likely beyond. Already 39 states have projected gaps that total $102 billion for the following year (fiscal year 2012). Once all states have prepared estimates these are likely to grow to some $120 billion.

- The effects of gaps in 2010 budgets. These new shortfalls are in addition to the gaps states closed in their fiscal year 2010 budgets. Counting both initial and mid-year shortfalls, 48 states addressed such shortfalls in their budgets for fiscal year 2010, totaling $192 billion or 29 percent of state budgets — the largest gaps on record.

Declining federal assistance. Federal aid to states provided in the American Recovery and Reinvestment Act has lessened state cuts in services and tax increases. But the aid is now mostly gone; only about $40 billion remains to help with 2011 fiscal problems. The federal government could avert deep additional budget cuts that would further harm the economy by extending assistance over the period during which state fiscal distress is expected to continue rather than cutting it off before states have recovered.

Declining federal assistance. Federal aid to states provided in the American Recovery and Reinvestment Act has lessened state cuts in services and tax increases. But the aid is now mostly gone; only about $40 billion remains to help with 2011 fiscal problems. The federal government could avert deep additional budget cuts that would further harm the economy by extending assistance over the period during which state fiscal distress is expected to continue rather than cutting it off before states have recovered.

- Combined gaps of $260 billion for 2011 and 2012. These numbers suggest that states are dealing with total budget shortfalls of some $260 billion for 2011 and 2012. When all is said and done, states will have closed shortfalls of more than $500 billion since the start of the recession.

State Budget Shortfalls in 2010, 2011, and 2012

States already have faced and addressed extraordinarily large shortfalls as they developed and implemented spending plans for fiscal years 2009, 2010, and 2011 (which have now ended in most states). Shortfalls are the extent to which states’ revenues, hit hard by the recession, fall short of the cost of providing services. Every state save Vermont has some sort of balanced-budget law. So the shortfalls for 2009 and 2010 and most of the shortfalls for 2011 have already been closed through a combination of spending cuts, withdrawals from reserves, revenue increases, and use of federal stimulus dollars.

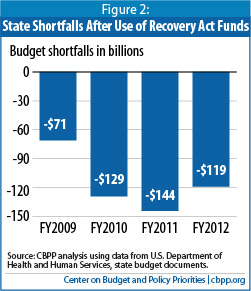

States’ fiscal conditions remain extremely weak this year – fiscal year 2011 – even as the economy appears to be moving in the direction of recovery. Indeed, historical experience and current economic projections suggest 2011 will be worse than 2010 by the time the year ends due to declining federal assistance. Taking all these factors into account, it is reasonable to expect that for 2011, shortfalls are likely to exceed $140 billion after taking into account approximately $40 billion in federal Recovery Act dollars that are likely to remain available for fiscal year 2011.[2] Once employment is growing again, state budget problems will diminish but it is likely that states will face shortfalls of at least $120 billion in fiscal 2012. This means that states will close shortfalls of some $260 billion for fiscal years 2011 and 2012 combined. Figure 2 shows the budget shortfalls that states faced and will face after taking into account the federal recovery act dollars.

States’ fiscal conditions remain extremely weak this year – fiscal year 2011 – even as the economy appears to be moving in the direction of recovery. Indeed, historical experience and current economic projections suggest 2011 will be worse than 2010 by the time the year ends due to declining federal assistance. Taking all these factors into account, it is reasonable to expect that for 2011, shortfalls are likely to exceed $140 billion after taking into account approximately $40 billion in federal Recovery Act dollars that are likely to remain available for fiscal year 2011.[2] Once employment is growing again, state budget problems will diminish but it is likely that states will face shortfalls of at least $120 billion in fiscal 2012. This means that states will close shortfalls of some $260 billion for fiscal years 2011 and 2012 combined. Figure 2 shows the budget shortfalls that states faced and will face after taking into account the federal recovery act dollars.

The recession caused a state fiscal crisis of unprecedented severity. Figure 3 compares the size and duration of the shortfalls that occurred in the recession of the first part of this decade to shortfalls reported to date this time. In the early 2000s, as in the early 1990s and early 1980s, state fiscal problems lasted for several years after the recession ended. The same will undoubtedly be the case this time, since the current recession is more severe — deeper and longer — than the last one, and state fiscal problems have proven to be worse and are likely to remain so.

Unemployment, which peaked after the last recession at 6.3 percent, has already hit 10 percent, and many economists expect it to remain at high levels throughout 2010 and beyond. Continued high unemployment will keep state income tax receipts at low levels and increase demand for Medicaid and other essential services that states provide. High unemployment and economic uncertainty, combined with households’ diminished wealth due to fallen property values, will continue to depress consumption, thus sales tax receipts also will remain low. These factors suggest that state budget gaps will continue to be significantly larger than in the last recession, and last longer.

Estimates from the states, although incomplete, are consistent with this outlook. Table 1 lists the shortfalls that states dealt with when adopting budgets for 2011. A total of 46 states addressed shortfalls for fiscal year 2011. This total includes at least 34 of the states that prepare budgets annually and recently addressed deficits for fiscal year 2011. In addition, 11 states that operate on a two-year budget cycle (known as a biennial budget) adopted budgets a year ago that addressed shortfalls for 2011 totaling at least $25 billion. In total, fiscal year 2011 gaps — which have been addressed in most states — total $121 billion or 19 percent of budgets. In addition, at least 39 states have looked ahead to fiscal year 2012 and anticipate shortfalls totaling $102 billion. (See Table 2.) It is reasonable to expect that it will grow during the course of the fiscal year if revenues again come in under expectations or spending reductions yield less savings than anticipated.

These current year shortfalls are in addition to the gaps states closed when adopting their fiscal year 2010 budgets and the mid-year gaps that developed after these budgets were adopted. Table 3 combines the mid-year gaps with the gaps that were addressed when states wrote their 2010 budgets. In total, 48 states have addressed shortfalls in their budgets for fiscal year 2010, totaling $192 billion or 29 percent of state budgets — the largest gaps on record. (Table 4 of this paper shows the 2009 budget gaps that were addressed, and Table 5 lists the sources of these shortfall estimates for each state.)

Of course, a faster-than-expected recovery could reduce the size of future shortfalls. But several factors could make it particularly difficult for states to recover from the current fiscal situation. Housing markets might be slow to fully recover; their decline already has depressed consumption and sales tax revenue as people refrain from buying furniture, appliances, construction materials, and the like. This also would depress property tax revenues, increasing the likelihood that local governments will look to states to help address the squeeze on local and education budgets. And as the employment situation continues to be weak, income tax revenues will continue to lag and there will be further downward pressure on sales tax revenues as consumers are reluctant or unable to spend.

Of course, a faster-than-expected recovery could reduce the size of future shortfalls. But several factors could make it particularly difficult for states to recover from the current fiscal situation. Housing markets might be slow to fully recover; their decline already has depressed consumption and sales tax revenue as people refrain from buying furniture, appliances, construction materials, and the like. This also would depress property tax revenues, increasing the likelihood that local governments will look to states to help address the squeeze on local and education budgets. And as the employment situation continues to be weak, income tax revenues will continue to lag and there will be further downward pressure on sales tax revenues as consumers are reluctant or unable to spend.

Some states have not been affected by the economic downturn, but the number is dwindling. Mineral-rich states — such as New Mexico, Alaska, and Montana — saw revenue growth in the beginning of the recession as a result of high oil prices. More recently, however, the decline in oil prices has affected revenues in these states. The economies of a handful of other states have so far been less affected by the national economic problems. Only two states, Montana and North Dakota, have not reported budget shortfalls, but the recession has dampened those states’ surpluses, which were largely mineral-driven as well. Two other states – Alaska and Arkansas – faced shortfalls in fiscal year 2010 but are not now projecting gaps for fiscal year 2011.

The Consequences of Shortfalls

In states facing budget gaps, the consequences are severe in many cases — for residents as well as the economy. To date, budget difficulties have led at least 45 states to reduce services to their residents, including some of their most vulnerable families and individuals.[3] Over 30 states have raised taxes to at least some degree, in some cases quite significantly.

If revenue declines persist as expected in many states, additional spending and service cuts are likely. Budget cuts often are more severe later in a state fiscal crisis, after largely depleted reserves are no longer an option for closing deficits.

Spending cuts are problematic policies during an economic downturn because they reduce overall demand and can make the downturn deeper. When states cut spending, they lay off employees, cancel contracts with vendors, eliminate or lower payments to businesses and nonprofit organizations that provide direct services, and cut benefit payments to individuals. In all of these circumstances, the companies and organizations that would have received government payments have less money to spend on salaries and supplies, and individuals who would have received salaries or benefits have less money for consumption. This directly removes demand from the economy.

Tax increases also remove demand from the economy by reducing the amount of money people have to spend — though to the extent these increases are on upper-income residents, that effect is minimized because much of the money comes from savings and so does not diminish economic activity. At the state level, a balanced approach to closing deficits — raising taxes along with enacting budget cuts — is needed to close state budget gaps in order to maintain important services while minimizing harmful effects on the economy.

The Role of Federal Assistance

Federal assistance is lessening the extent to which states need to take pro-cyclical actions that further harm the economy. The American Recovery and Reinvestment Act enacted in February 2009 includes substantial assistance for states. The amount in ARRA to help states maintain current activities is about $135 billion to $140 billion over a roughly 2 ½-year period — or between 30 percent and 40 percent of projected state shortfalls. Most of this money is in the form of increased Medicaid funding and a “State Fiscal Stabilization Fund.” (There are also other streams of funding in the economic recovery act flowing through states to local governments or individuals, but these will not address state budget shortfalls.) This money has reduced the extent of state spending cuts and state tax and fee increases.

But it now appears likely the federal assistance will end before state budget gaps have abated. The Medicaid funds are scheduled to expire in December 2010, which is just halfway through the 2011 fiscal year in most states.[4] States will have drawn down most of their State Fiscal Stabilization Fund allocations by then as well. So even though the 2011 budget gaps may well be larger than those for 2010, there will be less federal money available to close them. States are likely to respond with spending cuts and tax increases even larger than those that have already been enacted.

Such measures in most states will take effect with the 2011 fiscal year — that is, in July 2010, thereby reducing aggregate demand and weakening the economy at a critical moment in its recovery. If states get no further federal assistance, the steps they will have to take to eliminate deficits will likely take a full percentage point off the Gross Domestic Product. That, in turn, could cost the economy 900,000 jobs next year. [5]

A possibility would be for the federal government to reduce state budget gaps — and hence avert some spending cuts and/or tax increases — by extending the Medicaid funds over the period during which state fiscal conditions are expected to still be problematic, rather than cutting them off in December 2010. The federal government could also provide additional assistance to states for education through the State Fiscal Stabilization Fund. Ideally, such action would occur very soon, so that it can be factored into states’ budget decisions for fiscal year 2011. (Most states are balancing their budgets on the assumption that the Medicaid funding will be extended, but are not assuming additional education funds. If the federal government fails to extend this aid, many states will be forced to reopen their 2011 budgets to make even deeper spending cuts and more tax increases than previously planned.)

End Notes:

[1] Only three states have not yet adopted fiscal year 2011 budgets – Michigan (with a fiscal year that begins October 1) and California and New York.

[2] In general, the projected budget shortfalls reflect state fiscal conditions before deficit-closing actions are taken. States are using a combination of actions to close the deficits including use of federal stimulus funds, budget cuts, tax increases, and reserves. (For FY2011, however, some states projected the size of the deficit after use of federal stimulus funds. This would be reflected in the $121 billion in shortfalls reported to date for FY2011. The estimated total of $180 billion reflects the projected deficit before use of federal stimulus funds.)

[3] For more detailed information, see “An Update on State Budget Cuts.”

[4] Most states operate on a July-June fiscal year; the exceptions are New York (April-May), Texas (September-August), and Alabama and Michigan (October-September).

[5] For more information on this analysis see: Iris J. Lav, Nicholas Johnson and Elizabeth McNichol, “ Additional Federal Fiscal Relief Needed to Help States Address Recession’s Impact,” Center on Budget and Policy Priorities .

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.