Stocks, Housing and Economy, Mass Delusion American Style

Stock-Markets / Liquidity Bubble Aug 14, 2010 - 01:04 PM GMTBy: James_Quinn

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one." - Charles Mackay- Extraordinary Popular Delusions and the Madness of Crowds

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one." - Charles Mackay- Extraordinary Popular Delusions and the Madness of Crowds

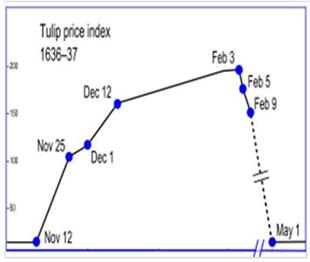

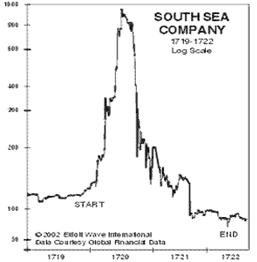

The American public thinks they are rugged individualists, who come to conclusions based upon sound reason and a rational thought process. The truth is that the vast majority of Americans act like a herd of cattle or a horde of lemmings. Throughout history there have been many instances of mass delusion. They include the South Sea Company bubble, Mississippi Company bubble, Dutch Tulip bubble, and Salem witch trials. It appears that mass delusion has replaced baseball as the national past-time in America. In the space of the last 15 years the American public have fallen for the three whopper delusions:

Buy stocks for the long run

Buy stocks for the long run - Homes are always a great investment

- Globalization will benefit all Americans

Bill Bonner and Lila Rajiva ponder why people have always acted in a herd like manner in their outstanding book Mobs, Messiahs and Markets:

"Of course, we doubt if many public prescriptions are really intended to solve problems. People certainly believe they are when they propose them. But, like so much of what goes on in a public spectacle, its favorite slogans, too, are delusional - more in the nature of placebos than propositions. People repeat them like Hail Marys because it makes them feel better. Most of our beliefs about the economy - and everything else - are of this nature. They are forms of self medication, superstitious lip service we pay to the powers of the dark, like touching wood....or throwing salt over your shoulder. "Stocks for the long run," "Globalization is good." We repeat slogans to ourselves, because everyone else does. It is not so much bad luck we want to avoid as being on our own. Why it is that losing your life savings should be less painful if you have lost it in the company of one million other losers, we don't know. But mankind is first of all a herd animal and fears nothing more than not being part of the herd."

Stocks for the Long Run

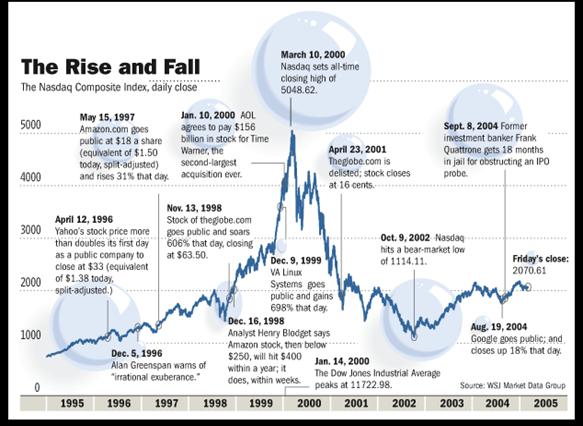

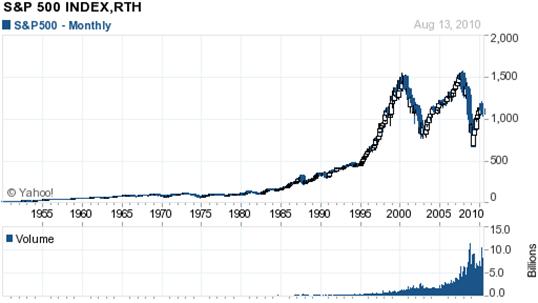

The book Stocks for the Long Run was written by Jeremy Siegel in the mid-1990's. The premise is that if you just buy and hold stocks over a 20 to 30 year period, you will always make money. This was exactly what the Wall Street witch doctors ordered. They pounded this message into the brains of every American incessantly in their advertising campaigns, literature and propaganda. It became an unquestioned truth. Just one problem. It isn't the truth. Valuations matter. The Dow Jones was at the same level in 1982 as it was in 1966. On an inflation adjusted basis, the Dow did not get back to the 1966 level until 1990. That is 24 years of no return in the stock market. The American public ignored the true facts and piled into equities during the late 1990s. The result was one of the greatest examples of mass delusion in history. The internet bubble drove the NASDAQ market to a peak of 5,048 in March 2000. Today it sits at 2,180. Ten years after the bubble burst, the NASDAQ is still down 57% from its peak.

Delusional Americans all over the country believed in the new internet paradigm. Fools thought "bricks and mortar" retailers were dead. Morons quit their jobs so they could get rich day trading. Wall Street hucksters took advantage of this hysteria by attaching .COM to every ridiculous IPO they shilled to the American public. Wall Street knew these companies were pieces of crap, but they churned out the IPOs as quickly as possible while the getting was good. The Wall Street oligarchs made billions and the delusional American public got screwed. You would think that average Americans would have learned their lesson after this experience. They did not. They continued to buy into the Wall Street lies about stocks being a sure path to riches. The fact is that the S&P 500 is currently at the same level it was in March 1998. On an inflation adjusted basis, it is 25% below the level of 1998. You don't hear this information on CNBC because the oligarchs that control the media need the delusion to continue in order to harvest more riches from the ignorant masses.

Home Sweet Home

“The continuing shortages of housing inventory are driving the price gains. There is no evidence of bubbles popping.” - David Lereah - Chief Economist for National Association of Realtors - 2005

“We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.” - Ben Bernanke - 2005

“House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals.” - Ben Bernanke - 2005

Why was it that two supposedly brilliant, highly trained economists, with countless degrees and high paying positions could be so very wrong? Were they just mistaken or were they purposefully encouraging a national delusion? With the bursting of the internet bubble in 2000 - 2002, Americans immediately proceeded to the next bubble. Alan Greenspan was an almost God like figure in the early 2000s. He had "saved" the economy countless times during his 15 year reign of terror at the Federal Reserve. When he spoke, the American people listened. After the internet bubble and 9/11, he proceeded to reduce interest rates to 1% for an extended period of time. He then gave the all clear sign to Americans to take out adjustable rate mortgages. Lastly, Mr. Free Markets decided that banks and mortgage brokers could police themselves. The result was the greatest housing bubble in US history and a near collapse of the worldwide financial system.

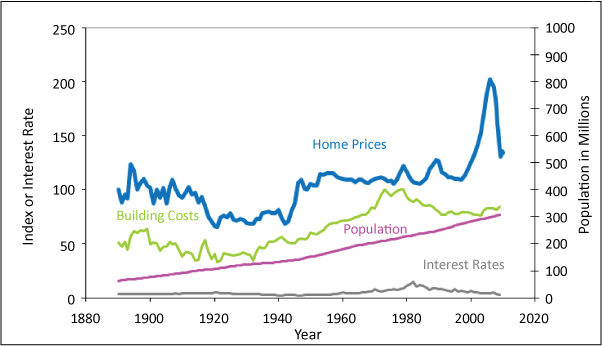

Sane economists like Robert Shiller saw it for what it was. He calmly pointed out that home prices had pretty much tracked inflation for over 100 years. A 100% increase in home prices over the course of 3 years was irrationally exuberant. He was scorned and ridiculed by the delusion propagators at the NAR, the cheerleaders on CNBC, the Wall Street money changers, the Federal Reserve stuffed suits, and the corrupt politicians in Washington DC. The usual drivel about positive demographics, low interest rates, strong income growth, and limited land to develop were spewed out by the corporate media complex. The beneficiaries of this mass delusion were the Wall Street banks that created mortgage products and derivatives faster than Obama spreads our wealth around.

Mass delusion is always encouraged by those who benefit most from the mass delusion. David Lereah has admitted that he lied about the housing bubble because he was employed by realtors. Realtors made millions in commissions. Appraisers made millions in fees by inflating appraisals. Mortgage brokers made millions by encouraging people to lie on mortgage applications. Wall Street whores made billions by creating toxic packages of mortgages and selling them to Irish nuns, old ladies and clueless municipal administrators. The ratings agencies made hundreds of millions in fees for slapping AAA ratings on toxic derivatives. Politicians got rich from political "contributions" from Fannie Mae, Freddie Mac, Wall Street, and the NAR. Any reasonable human being could look at the chart above and see that this would end badly, but Americans wanted to be deluded. They choose to believe. The housing market has now been falling for five years, with another five years to go. Ben Bernanke has reduced interest rates to zero. I wonder how that will work out.

Who Benefited from Globalization?

“It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.” - Mark Twain

From the time that Bill Clinton signed the NAFTA agreement in 1994, globalization has been touted by those in power as beneficial to all Americans. How could free markets and free trade be a bad thing? Corporate America, Wall Street, and the mainstream corporate media have blared the propaganda of globalization benefits from their loudspeakers. In theory, globalization appears to be a positive concept. It describes a process by which regional economies, societies, and cultures have become integrated through a global network of communication, transportation, and trade. The truth is that globalization is not inherently good or inherently bad. The idea is that each country has its own strengths and weaknesses. Each country will take advantage of their strengths and rely on other countries to help mitigate their weaknesses. This will result in increased trade, a larger world market, and economic progress for all. One small problem. Trade is not really free. Every country on earth protects various industries. Every country on earth manipulates their currency in order to get an edge. Every country on earth invokes tariffs to protect their national interests.

Bill Bonner and Lila Rajiva address the difficulties of globalization and "free trade" in Mobs, Messiahs and Markets:

"Unfair trade is yet another of the dodgy slogans festooning the spectacle of globalization like tinsel slithering around a pole dancer. How can different regulations and practices in different countries constitute unfairness? Isn't the essence of trade that different countries have different things to offer - whether cheap labor, or better technology, or more bountiful natural resources, or more welcoming business environments? If all countries had exactly the same things to offer each other, there would be no reason to trade at all. But what "fair" trade advocates are really advocating, of course, is unfair trade! They want to make sure their foreign competitors divest themselves of the very advantages that they bring to trading."

"We notice, for instance, that when Americans in Detroit lose jobs to other Americans in California, they might grumble a bit. But, by and large, they accept it as part of the nature of things. They move, or retrain, or change jobs. But when they lose their jobs to Japanese in Osaka or Indians in Bangalore, then a cry goes up. Unfair trade, howl the trade unions; race to the bottom, scold the social activists; yellow - or brown - peril, shriek the xenophobes and racists."

It seems the American middle class was sold a false bill of goods. They bought the Big Lie that globalization would benefit them. They bought into the delusion that even though their high paying manufacturing jobs sailed away to China and India, they could maintain their lifestyle through brain work, easy credit, cheap goods made in China by the people who took their jobs, and the ever increasing value of their homes. Noam Chomsky notes the fallacy of this delusion:

"The dominant propaganda systems have appropriated the term "globalization" to refer to the specific version of international economic integration that they favor, which privileges the rights of investors and lenders, those of people being incidental."

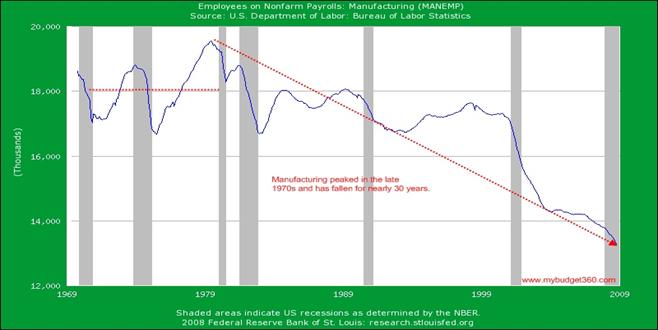

Again, one must seek out who benefits from the delusion of globalization. The crony capitalists, Wall Street oligarchs, and corporate fascists who control the puppet strings in this country have benefited greatly from the Big Lie. Over 5 million manufacturing jobs have been off-shored since 2000. These good paying jobs are never coming back. Millions of service sector jobs continue to be shipped overseas. The global conglomerates like GE, HP, Oracle, IBM, and Boeing continue to rake in billions of profits, distributing millions to its high paid executives, while gutting middle class America. The ruling oligarchs convinced Americans to take advantage of cheap goods and easy credit, to buy electronics, cars, appliances, new kitchens, and take the vacations of their dreams. This Big Lie has left the American consumer with $2.5 trillion of non-mortgage debt and the lowest level of home equity in history. Retailers like Wal-Mart, Target, Home Depot, and Best Buy reaped billions in profits as Americans whipped out one of their 10 credit cards to buy HDTV's, economy bags of tube socks, iPads, iPods, stainless steel refrigerators, and Dell computers. Small town America’s mom and pop economy was gutted by Big Box retailers selling the globalization delusion. The biggest beneficiaries of the globalization delusion were the Wall Street banks. They control 80% of credit card market and have reaped billions in interest at rates exceeding 20%, while sucking $20 billion per year in late fees from the clueless public. Wall Street bankers have rewarded themselves for their brilliance in destroying the middle class by reaping multi-million dollar bonus packages.

Vincible Ignorance

“Most ignorance is vincible ignorance. We don't know because we don't want to know.” - Aldous Huxley

Based on all available evidence, it seems the American public wants to be misled. They have chosen ignorance over knowledge and understanding. They want to believe their corrupt leaders. They want to believe that things always work out in the long run. They want to believe that the economy is about to get better. They don't want to think about unsustainable debt, unfunded liabilities, saving for retirement, or Simon Cowell leaving American Idol. Americans desperately want to be deluded into another bubble, but there are no evident bubbles left to blow. The existing American delusion is that the current fiscal path will not lead to the utter destruction of our once great Republic.

America resembles a 40 year old aging baseball icon with two bad knees, a pot belly, receding hairline and delusions that he is still the ball player he was at 24. He doesn't realize that his skills are shot, as he flails at curveballs in the dirt thrown by 21 year old kids. The rest of the league knows he is washed up, but he refuses to accept reality. America isn't even running on fumes at this point. It is running on delusions. Politicians think they have saved the country from a Depression by adding $3 trillion to the National Debt and allowing Wall Street banks to pretend they are solvent. Americans have been deluded by the ruling oligarchs that a $700 billion bank bailout, an $800 billion pork filled stimulus plan, the Federal Reserve buying $1.2 trillion of toxic mortgages, and the Treasury forcing taxpayers to pick up a $400 billion tab for Fannie Mae and Freddie Mac’s bad loans has actually solved a problem created by too much debt.

The American herd has gone mad. A few people have regained their senses, but the vast majority still exhibits the behavior of sheep being led to slaughter. The ruling oligarchs have utter contempt for the average American, but they fear the masses. In order to retain their power and wealth, they gladly hand out two years of unemployment payments, food stamps, and welfare payments to keep the masses sedated. The working middle class foots the bill. Corruption abounds and is sustained by the passage of more laws and regulations. The sociopathic powers that control the levers of power in this country need to be brought to justice if this country has any chance at survival. The den of vipers and thieves have trampled on the Constitution, speculated with the country's funds, risked blowing up the financial system, committed fraud on a massive scale, and continue to rape and pillage the American citizens. Vincible ignorance by the American people is no longer a legitimate excuse. The criminals on Wall Street and Washington DC must be routed out and Americans must awaken from their delusional state before it is too late. I weep for the liberty of my country.

And you run and you run to catch up with the sun, but it's sinking

Racing around to come up behind you again

The sun is the same in a relative way, but you're older

Shorter of breath and one day closer to death

Pink Floyd - Time

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2010 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.