Front Running the Fed Treasury Bond Purchase Announcement - Who Knew?

Interest-Rates / US Bonds Aug 11, 2010 - 12:50 PM GMTBy: Mike_Shedlock

Curve Watchers Anonymous is paying close attention to the following snip from the Bloomberg article Pimco Calls Fed Rate Policies ‘Good for Risk Assets’

Curve Watchers Anonymous is paying close attention to the following snip from the Bloomberg article Pimco Calls Fed Rate Policies ‘Good for Risk Assets’

The central bank said in a separate statement that it will announce a purchasing schedule today and that its buying will be concentrated “in the two- to 10-year sector” of the maturity spectrum, though it will also buy other maturities as well as Treasury Inflation Protected Securities.

Clearly no one could have possibly known that in advance. Or could they?

On August 6 in Two Year Treasury Yields Drop Below .5% First Time Ever; 30Yr/10Yr Spread Widens Again I commented...

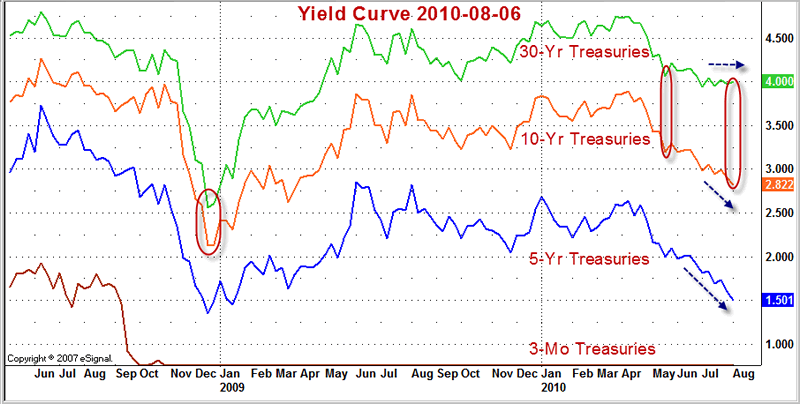

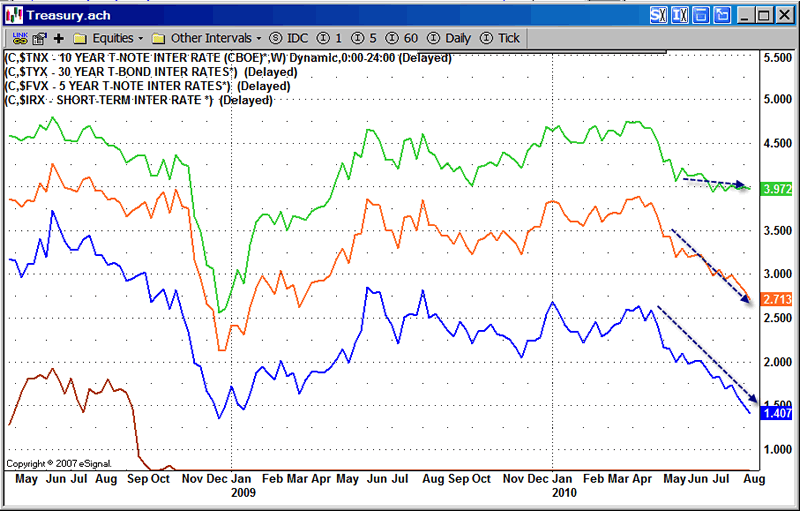

The following chart shows the yield curve over time.

The chart depicts weekly closes. 10-year yields did slightly exceed 4% in April but those highs do not show in the above chart. Thus, the decrease in yields is even more dramatic than shown.

Note the huge rally on 5 and 10 year treasuries as compared to the 30-year long bond. It appears as if someone is putting on a long-10 short-30 spread.

Shortly after the FOMC meeting but before I saw details of what the Fed would be buying I commented on Quantitative Nothingness and the Yield Curve's Reaction

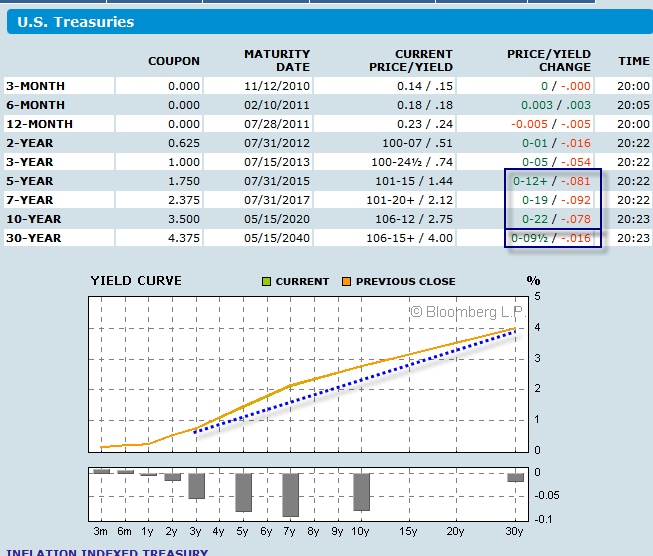

Yield Curve as of 2010-08-10

7-year Sweet Spot

Once again the yield curve flattened with the "sweet spot" this time being the 7-year treasury. The 30-year long bond barely budged.

Normally, the further out one goes the bigger the rally (or loss) in response to economic news. It will be interesting to see if the 30-year long-bond can catch up.

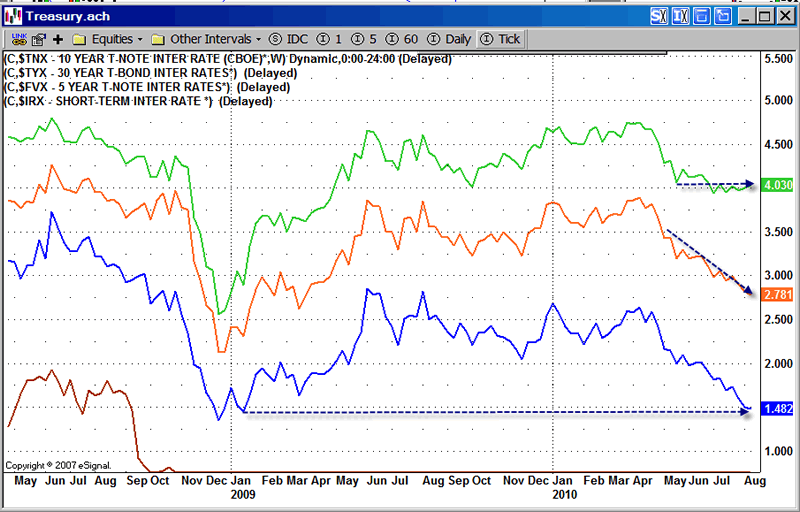

Yield Curve May 2008 Through August 10, 2010

A couple things stand out on the above chart.

1. The 5-year treasury yield is approaching all-time record lows and is now back to where it was in January of 2009.

2. The spread between 10-year treasuries and the 30-year long bond continues to widen

I suspect a major player continues to put on a long-10 short-30 trade. I can easily be wrong on that. The question is "where does the spread go from here?"

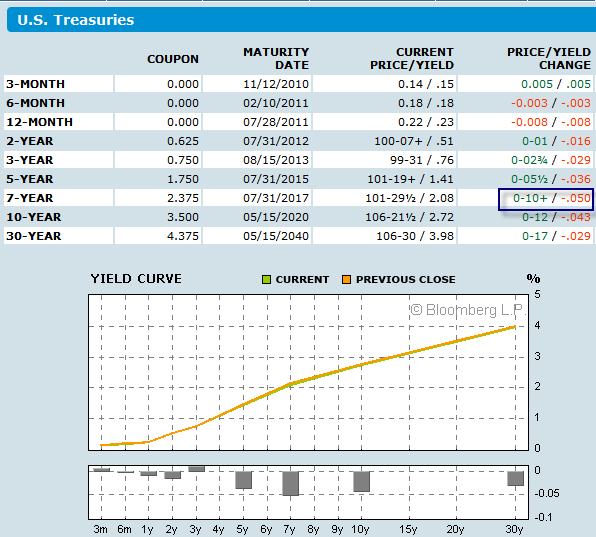

Yield Curve as of 2010-08-11

Today, one day after the FOMC announcement, the yield curve looks likes this.

Once again the 7-year treasury is in the sweet spot.

Yield on the 5-yer treasury is headed for an all-time record low, and the 10-year note yield is looking increasingly likely as well. So much for the idea that the bull market in treasuries is over.

Hypothetical Conversation

Here is a hypothetical conversation between Ben Bernanke and Jamie Dimon, CEO of JPMorgan, that explains the action in the middle of the yield curve recently.

Hello Jamie, this is your buddy Ben, Ben Bernanke. Here's the deal. We are going to announce a brand new policy called "Quantitative Nothingness".

We intend to keep the Fed's balance sheet intact, exactly where it is today. However, we are going to do that in an interesting way. I can't tell you exactly what we are going to say but ... here's a helpful hint: "Invest in the middle of the yield curve."With that hypothetical conversation out of the way, I do need to point out I am not a fan of conspiracy theories. I also want to point out once again that the Fed the most influence in the direction of the trend, and that the middle of the yield curve was begging to be flattened given the weak economy. Besides, hints like that simply don't happen, do they? So whocouldanode?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.