Intermarket Reactions to Fed: It All Starts With the US Interest Rate Cut

Currencies / US Dollar Sep 18, 2007 - 05:47 PM GMTBy: Donald_W_Dony

A lowering of the Fed Fund rate creates many short and long-term effects within the different markets. Though the easing is designed to stabilize the economy, in light of the sub-prime credit crunch, and prevent the U.S.A. from drifting into a recession, there is also a chain reaction that develops due to this decrease.

A lowering of the Fed Fund rate creates many short and long-term effects within the different markets. Though the easing is designed to stabilize the economy, in light of the sub-prime credit crunch, and prevent the U.S.A. from drifting into a recession, there is also a chain reaction that develops due to this decrease.

The strength of a currency in the world markets is largely dependent on the fundamental health of the country and the interest rate being offered. The more fiscally secure the country, generally the lower the rate. The opposite is also true. Financially weak countries require a higher rate of return to remain competitive against other currencies.

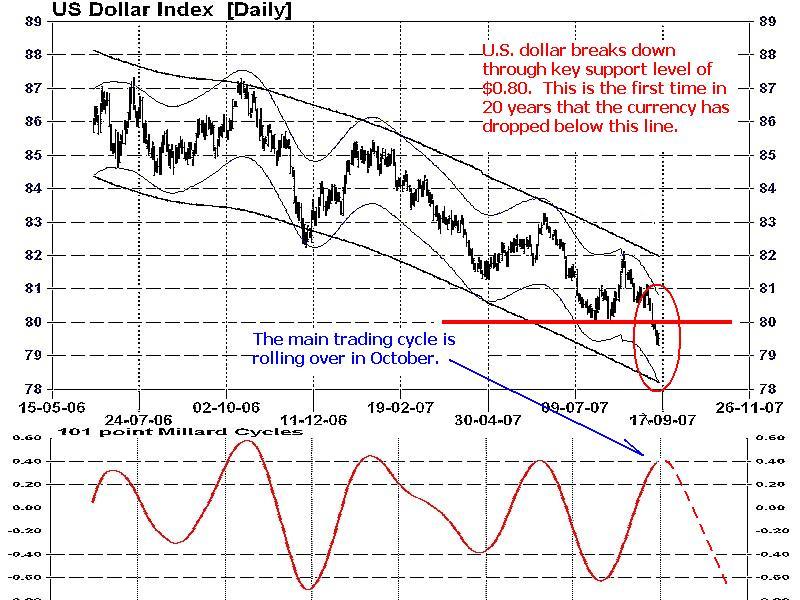

In the case of the U.S.A, with its ballooning deficits, a reduction in the Fed fund rate now makes the USD (Chart 1) even less attractive compared to other major world currencies and accelerates downward pressure. In mid-September, the dollar broke through $0.80 for the first time. This crossing of the major long-term support level was a clear signal that the market anticipated a drop in the Fed rate and that the draining attraction for the dollar was gaining momentum.

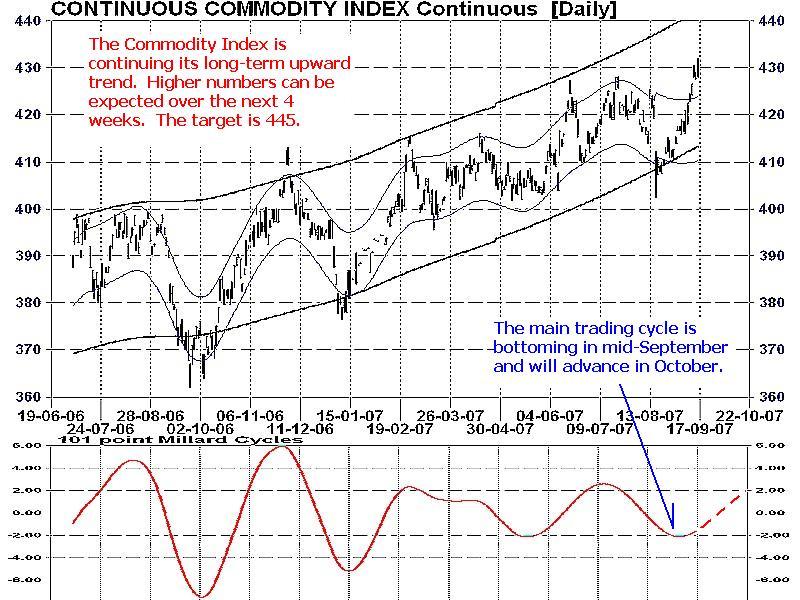

Continued failing in the dollar has the opposite reaction to commodities. A lower USD helps drive up the cost of raw material prices which produces long-term inflationary pressure (see Chart 2). Gold is the most sensitive to this pressure and generally the first to react. This precious metal, after months of consolidation, has finally broken out and is now expected to reach $745 by year-end.

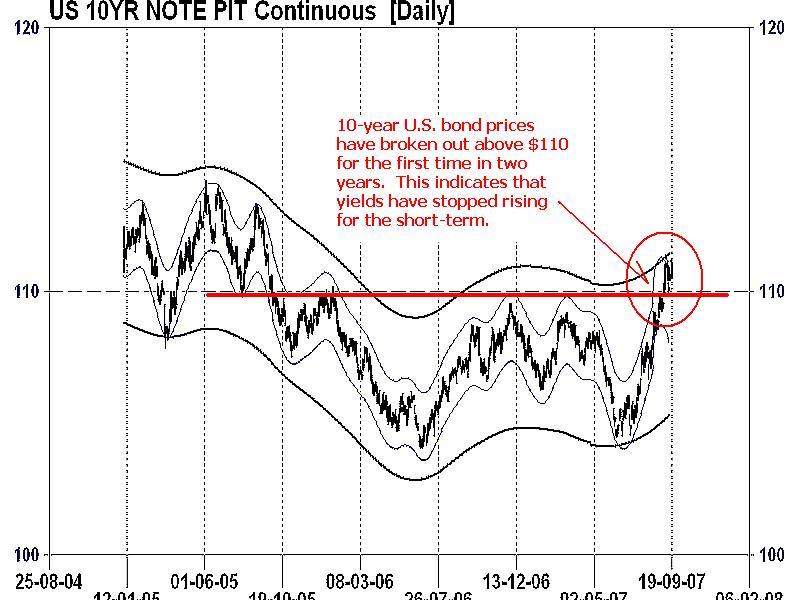

Though longer-term, the fall of the USD increases inflation and will drive bond yields higher; in the short-term the opposite has occurred. The easing of the Fed rate has boosted 10-year US Treasury notes (Chart 3) above $110 for the first time in two years and is expected to continue advancing to resistance of $114 by December. However as commodities lead 10-year bond yields in the long-term, the fund rate cut of 50 basis points will help escalate the advance of most commodities and ultimately pull yields up and drag bond prices lower.

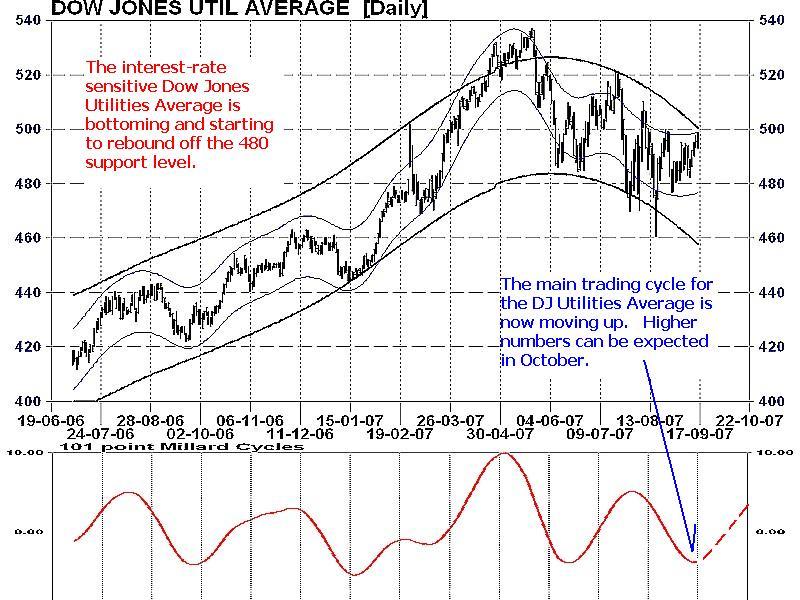

Utilities, the most interest rate sensitive equities group, have also received a thrust upwards due to the rate drop. The Dow Jones Utilities Average (Chart 4) traded over the 500 resistance level after declining from the July 2007 peak. This rise is expected to continue into October (see lower portion of Chart 4). The DJ Utilities Average also plays and important role as a leading indicator on the Dow Jones Industrial Average. Strength in the utilities sector often filters through to the DOW.

My conclusions: With the Fed dropping the fund rate by 50 basis points on Tuesday in an attempt to stabilizes the U.S. economy, many other intermarket reactions, both short and long, has been set in motion. The main effect for most investors is the new-found weakness in the U.S. dollar below $0.80 will help perpetuate the secular bull market in commodities and continue to keep inflationary pressures simmering in the background. This would suggest that portfolios should remain over-weighted in natural resources.

Additional research is available in the upcoming October newsletter.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.