Learning How to Profit From Theta When Trading SPX Options

Stock-Markets / Options & Warrants Aug 10, 2010 - 02:42 PM GMTBy: Chris_Vermeulen

J.W. Jones writes:

As discussed in the first article, “The Hidden Potential of Learning How to Trade SPX and Gold Options” I pointed out that there are several fundamental principles that must be mastered before profits can be attained when trading options. Novice traders typically skip the discussion about “The Greeks” and skim over volatility only to watch their precious trading capital disappear.

J.W. Jones writes:

As discussed in the first article, “The Hidden Potential of Learning How to Trade SPX and Gold Options” I pointed out that there are several fundamental principles that must be mastered before profits can be attained when trading options. Novice traders typically skip the discussion about “The Greeks” and skim over volatility only to watch their precious trading capital disappear.

As promised, this article and future articles are going to discuss the Greeks as they relate to options trading in a way that hopefully everyone reading this can understand. While there are more than ten Greek symbols that directly relate to option pricing, an option trader must be able to clearly articulate and understand 4 of the ancient Greek symbols and one English invention. (Vega is not a true Greek symbol-Look it up!)

The five core Greek symbols which are critical in order to understand are as follows, in no particular order: Delta, Theta, Vega, Gamma, & Rho. Most veteran option traders have a sound understanding of Delta, Theta, Vega, & Gamma. Rho is not nearly as well known, but anyone who has ever studied econometrics, option pricing models, or has studied applied finance know all too well the importance of Rho. For inquiring minds, Rho measures sensitivity to current interest rates.

Today’s article is going to focus on the Greek symbol Theta. By now many readers may wonder why I continually capitalize the Greek symbols, and the reason is because they are that critical. The technical definition of Theta derived directly from Wikipedia when applied to options is as follows:

THETA - Θ, measures the sensitivity of the value of the derivative to the passage of time: the "time decay."

Time decay (Theta decay) is of critical importance when an option trader is attempting to quantify and/or mitigate risk. There are two parts factored into the price of an option contract: extrinsic value (a major component of extrinsic value is Theta; the other is implied volatility) and intrinsic value which would be the amount of money a trader would gain if they exercised an option right away. A great many authors who opine about options get caught up using terminology like intrinsic and extrinsic value which only serves to confuse most novice option traders even more. I refuse to use those words in my writing as I find them to be cumbersome and option trading can be made much more difficult than it needs to be.

Theta and time decay are synonyms when discussing options. An easy way to remember their congruence is that the word time starts with a “T” as does Theta. If a trader owns calls or puts outside of any type of spread, they are totally exposed to time decay (Theta) and as an option contract gets closer to expiration, the time value of the contract diminishes. This accompanied with failure to account for implied volatility (to be discussed in the future) are the fundamental reasons why so many people lose money when trading options.

Just as theta can be an option trader’s worst enemy, it can also be used as a profit engine. If an option trader sells an option contract to open the position, that option trader is using theta as a method to profit or as a way to reduce the cost of a spread. While this article will not spend a ton of time discussing various option spread techniques, in the future we will discuss them in detail. At this point, we are only attempting to understand that Theta represents the time decay priced into an option.

It is also critical to understand that Theta (time decay) is not linear in the time course of the life of an option and accelerates rapidly the final two weeks before an option expires. The rapid time decay the final two weeks before expiration presents a multitude of ways to drive profitability, but it also can represent unparalleled risk. While this article is just an introduction to Theta, the next article later this week will continue the time decay discussion.

Since we are discussing Theta, I thought it would make sense to discuss a trade I took last week which utilized Theta as the profit engine. Recently a variety of underlying indices, stocks, and ETF’s have options that expire weekly. Weekly expiration expedites Theta and gives option traders additional vehicles to produce profits.

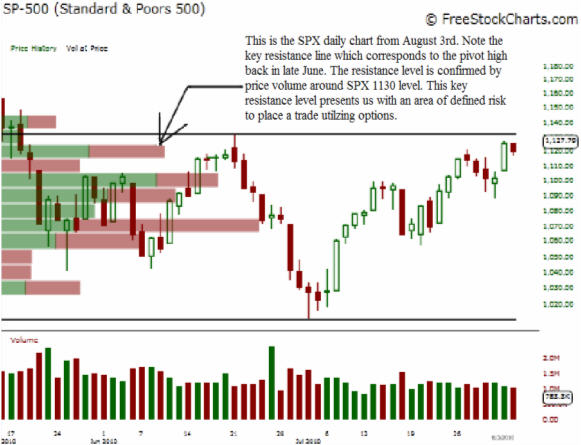

While most equity or futures traders might shy away from a chart like this, an option trader has the unique ability to place a high probability trade. I believed that the market would stall around the SPX 1130 area so I looked for a trade which would utilize the SPX weekly options. The SPX weeklies expire based on the Friday SPX open. With the SPX trading around 1124, I put on a call credit spread which used time decay as the primary profit engine.

The setup I used involved selling an 1150 SPX call and buying an 1175 SPX call, which is also known as a vertical credit spread. I received $100 (1.00) for the 1150 SPX call and purchased the 1175 call for $20 (0.20). The $80 dollar profit represents the maximum gain per contract sold. As an example, if I placed this trade utilizing five contracts per side I would have a maximum gain of $400 dollars. The probability of success at the time when I placed this trade was around 78% based on a log normal distribution of the price of the underlying.

Immediately after placing the trade I utilized a contingent stop order that would close my trade entirely if the SPX reached the 1135.17 area. Essentially, my maximum loss not including commissions was limited to around $60 dollars per contract with a maximum gain of around $80 per contract assuming we did not get a big gap open.

Essentially, if the SPX stayed below 1135.17 for two days and opened on Friday below the 1150 level my trade would reach maximum profitability. This is a trade I actually placed on Tuesday afternoon, however I exited the position before the close on Thursday due to the impending jobs report which was set to come out Friday morning. I was able to collect over 60% of the premium sold per contract ($80) which came to about $45-50 per side. At $1,000 dollars risked based on my stop level, the trade would have produced a net gain of around $750 dollars in less than 3 days.

Hopefully this basic example illustrates the potential profits options can produce if they are traded appropriately with risk clearly defined while having hard stops in place. This trade produced a nice profit, however it was susceptible to a gap open, thus I maintained a relatively small position to mitigate my overall risk profile. As always, a trader must see potential risks from all angles and utilize proper money management principles when determining how much capital to risk. In closing, I will leave you with the insightful muse of famed trader Jesse Livermore, “A loss never troubles me after I take it.”

If you would like to continue learning about the hidden potential options trading can provide please join my FREE Newsletter: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.