The Global Food Crisis, Drought, Fire and Grain in Russia

Commodities / Food Crisis Aug 10, 2010 - 06:40 AM GMTBy: STRATFOR

Three interlocking crises are striking Russia simultaneously: the highest recorded temperatures Russia has seen in 130 years of recordkeeping; the most widespread drought in more than three decades; and massive wildfires that have stretched across seven regions, including Moscow.

Three interlocking crises are striking Russia simultaneously: the highest recorded temperatures Russia has seen in 130 years of recordkeeping; the most widespread drought in more than three decades; and massive wildfires that have stretched across seven regions, including Moscow.

The crises threaten the wheat harvest in Russia, which is one of the world’s largest wheat exporters. Russia is no stranger to having drought affect its wheat crop, a commodity of critical importance to Moscow’s domestic tranquility and foreign policy. Despite the severity of the heat, drought, and wildfires, Moscow’s wheat output will cover Russia’s domestic needs. Russia will also use the situation to merge its neighbors into a grain cartel.

A History of Drought and Wildfire

Flooding peat bogs appears to be bringing the fires under control. Smoke from the fires has kept Moscow nearly shut down for a week. The larger concern is the effect of the fires — and the continued heat and drought, which has created a state of emergency across 27 regions — on Russia’s ordinarily massive grain harvest and exports.

Russia is one of the largest grain producers and exporters in the world, normally producing around 100 million tons of wheat a year, or 10 percent of total global output. It exports 20 percent of this total to markets in Europe, the Middle East and North Africa.

Cyclical droughts (and wildfires) mean Russian grain production levels fluctuate between 75 and 100 million tons from year to year. The extent of the drought and wildfires this year has prompted Russian officials to revise the country’s 2010 estimated grain production to 65 million tons, though Russia holds 24 million tons of wheat in storage — meaning it has enough to comfortably cover domestic demand (which is 75 million tons) even if the drought gets worse.

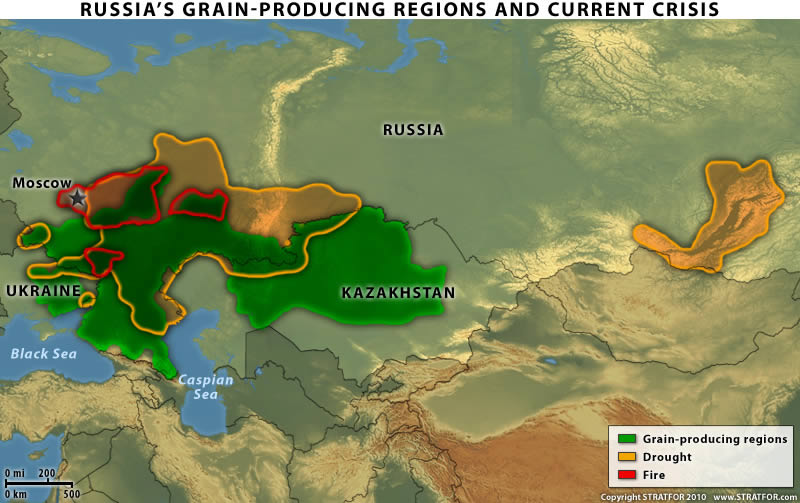

The larger challenge Moscow has faced in years of drought and wildfire has been transporting grain across Russia’s immense territory. Russia’s grain belt lies in the southern European part of the country from the Black Sea across the Northern Caucasus to Western Kazakhstan, capped on the north by the Moscow region. This is Russia’s most fertile region, which is supported by the Volga River.

Though drought and wildfires have struck Russia over the past three years, they have not affected its main grain-producing region. Instead, they struck regions in the Ural area that provide grain for Siberia. Those fires tested Russia’s transit infrastructure, one of its fundamental challenges. Russia has no real transportation network uniting its European heartland and its Far East save one railroad, the Trans-Siberian. While its grain belt does have some of the best transportation infrastructure in the country, it is designed for sending grain to the Black Sea or Europe — not to Siberia. The Kremlin began planning for disruptions of grain shipments to Siberia during the droughts and fires of 2007-2009. During that period, Moscow established massive grain storage units in the Urals and in producing regions of Kazakhstan along the Russian border.

This year’s drought and fires do not primarily affect Russia’s transportation network, but rather the grain-producing regions in the European part of Russia that make up the bulk of Russia’s grain exports. These regions lie on the westward distribution network, with the port of Novorossiysk on the Black Sea handling more than 50 percent of Russian exports.

Russia has focused largely on being a major grain exporter, raking in more than $4 billion a year for the past three years off the trade. This year, the Kremlin announced Aug. 5 that it would temporarily ban grain exports from Aug. 15 to Dec 31. Two reasons prompted the move. The first is the desire to prevent domestic grain prices from skyrocketing due to feared shortages. Russia’s grain market is remarkably volatile. Grain prices inside Russia already have risen nearly 10 percent. (Globally, wheat futures on the Chicago Board of Trade have risen nearly 20 percent in the past month, the largest jump since the early 1970s.)

The second reason is that the Kremlin wants to ensure that its supplies and production will hold up should the winter wheat harvest decline as well. Winter wheat, planted beginning at the end of August, typically fully replenishes Russian grain supplies. Further unseasonable heat, drought or fires could damage the winter wheat harvest, meaning the Kremlin will want to curtail exports to ensure its storage silos remain full.

Russia’s conservatism when it comes to ensuring supplies and price stability arises from the reality that adequate grain supplies long have been equated with social stability in Russia. Unlike other commodities, food shortages trigger social and political instability with shocking rapidity in all countries. As do some other countries, Russia relies on grain more than any other foodstuff; other food categories like meat, dairy and vegetables are too perishable for most of Russia to rely on.

Russia’s concentration on food volatility has a long history. Lenin called grain Russia’s “currency of currencies,” and seizing grain stockpiles was one of the Red Army’s first moves during the Russian Revolution. In this tradition, the Kremlin will husband its grain before exporting it for monetary gain. And this falls in line with Russia’s overall economic strategy of using its resources as a tool in domestic and foreign policy.

Exports and Foreign Policy

Russia is a massive producer and exporter of myriad commodities besides grain. It is the largest natural gas producer in the world and one of the largest oil and timber producers. The Russian government and domestic economy are based on the production and export of all these commodities, making Kremlin control — either direct or indirect — of all of these sectors essential to national security.

Domestically, Russians enjoy access to the necessities of life. Kremlin ownership over the majority of the country’s economy and resources gives the government leverage in controlling the country on every level — socially, politically, economically and financially. Thus, a grain crisis is more than just about feeding the people; it strikes at part of Russia’s overall domestic economic security.

Russia’s use of its resources as a tool is also a major part of Kremlin foreign policy. Its massive natural resource wealth and subsequent relative self-sufficiency allows it to project power effectively into the countries around it. Energy has been the main tool in this tactic. Moscow very publicly has used energy supplies as a political weapon, either by raising prices or by cutting supplies. It is also willing to use non-energy trade policy to effect foreign policy ends, and grain exports fall very easily into Moscow’s box of economic tools.

Russia is using the current grain crisis as a foreign policy tool even beyond its own exports, prices and supplies. It has asked both Kazakhstan and Belarus to also temporarily suspend their grain exports. Belarus is a minor grain exporter, with nearly all of its exports going to Russia. But Kazakhstan is one of the top five wheat exporters in the world, traditionally producing 21 million tons of wheat and exporting more than 50 percent of that. The same drought that has struck Russia also has hit Kazakhstan; production there is expected to be slashed by a third, or 7 million tons.

Kazakhstan traditionally exports to southern Siberia, Turkey, Iran and its fellow Central Asian states, Kyrgyzstan, Tajikistan, Uzbekistan and Turkmenistan. For the first time, Kazakhstan had planned to send grain exports to Asia. It had contracted to send approximately 3 million tons of grain east, with 2 million of those supplies heading to South Korea and the remainder to be split between China and Japan. The drought has forced Kazakhstan to reassess whether it can fulfill those contracts along with contracts for its immediate region.

Russia’s request that Belarus and Kazakhstan cease grain shipments does not seem primarily connected to Russia’s concern over supplies, but instead looks to be more political. The three countries formed a customs union in January, something that has caused much political and economic turmoil. Kazakhstan sought to lock in its president’s desire to remain beholden to Russia even after he steps down, while Belarus reluctantly joined as Russia already controlled more than half of the Belarusian economy.

For Moscow, however, the union was a key piece of its geopolitical resurgence. The Russian-Kazakh-Belarusian Customs Union was not set up like a Western free trade zone, where the goal is to encourage two-way trade by reducing trade barriers, but as a Russian plan to expand Moscow’s economic hold over Belarus and Kazakhstan. Thus far, the Customs Union has undermined Belarus and Kazakhstan’s industrial capacity, welding the two states further into the Russian economy.

Since the customs union has been in effect, Russia has quickly turned the club into a political tool, demanding that its fellow members sign onto politically motivated economic targeting of other states. In late July, Russia asked both Kazakhstan and Belarus to join a ban on wine and mineral water from Moldova and Georgia after continued spats with each of the pro-Western countries. Russia has added another level of demands in light of the grain shortages. As of this writing, neither Astana nor Minsk has accepted or declined the demands from Moscow, with grain exporting season just a month away.

Given current Russian production and storage supplies, Russia doesn’t actually need Belarus or Kazakhstan to curb their exports. Instead, it is seeking to use the drought and fires to create a regional grain cartel with its new customs union partners.

And this leads to the question of the other former Soviet grain heavyweight, Ukraine. Ukraine, which does not belong to the customs union, is the world’s third-largest wheat exporter. In 2009, Ukraine exported 21 million tons of its 46 million-ton production. Also hit by the drought, Ukraine revised its projected production and exports for 2010 down 20 percent, with exports down to 16 million tons. Some fear Ukraine will have to slash its export forecasts even further. Moscow will most likely want to control what its large grain-exporting neighbor does, should it be concerned with supplies or prices. Despite Russia’s recent actions with regard to Belarus and Kazakhstan, however, Ukraine has not publicly announced any bans on grain exports.

If Russia is going to exert its political power over the region via grain, it must have Ukraine on board. If Russia can control all of these states’ wheat exports, then Moscow will control 15 percent of global production and 16 percent of global exports. Kiev has recently turned its political orientation to lock step with Moscow, as seen in matters of politics, military and regional spats. But this most recent crisis hits at a major national economic piece for Ukraine. Whether Kiev bends its own national will to continue its further entwinement with Moscow remains to be seen.

By Lauren Goodrich

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2010 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.