Fooled by Economic Stimulus, U.S. Economy Structural Problems Still Intact

Economics / US Economy Aug 09, 2010 - 03:58 AM GMTBy: Mike_Shedlock

Bill Watkins, a California Lutheran University professor, provides a nice summary on New Geography of the failure of various stimulus efforts to do anything meaningful in the wake of a collapse by Lehman, a collapse he says is a "regime shift".

Bill Watkins, a California Lutheran University professor, provides a nice summary on New Geography of the failure of various stimulus efforts to do anything meaningful in the wake of a collapse by Lehman, a collapse he says is a "regime shift".

Please consider Flexible Forecasting: Looking for the Next Economic Model by Bill Watkins.

The world changed in September 2008. We call it a regime shift. It's a move from one (good) equilibrium to another (bad) equilibrium. Statistical models that worked well in the old regime don’t work in the new regime. We hustled to adjust our models, but admitted that with limited experience in the new regime, we were less confident in our forecasts.

Some economists didn’t recognize the regime shift. They went about their business using the same old models in a new world. Comments about the length of a typical recession or about how sharp declines are followed by rapid recoveries were clear signals that the speaker didn’t understand the situation.

Some economists were fooled by the stimulus. The rules of accounting cause government spending to be reflected as an increase in economic activity. Stimulus plans such as Cash for Clunkers and tax credits for home purchases moved the timing of transactions, artificially reinforcing the direct spending impacts. Similarly, bailouts and foreclosure prevention programs postponed the recognition of losses.

Many interpreted the resulting increase in last winter’s reported activity as permanent, but that could not be. We were not building anything or laying the groundwork for sustained prosperity. Instead, we were just continuing the previous decade’s consumption binge. The banks had failed, but the government had stepped in. It became the mother of all banks, borrowing from future citizens and other countries to fuel today’s consumption.

Today, enough time has passed that even the most slowly adapting forecasters are forced to confront the post-2008 data and the government’s failed economic efforts. As forecasters confront these facts, their forecasts are becoming increasingly gloomy. Now, forecasts of protracted malaise or even a double-dip recession are increasingly common. Why?

Because we borrowed to extend a consumption binge, and we compounded that error with omissions and perverse policy.

The stimulus’s omissions are glaring. We didn’t significantly invest in infrastructure that would improve our future growth. We failed to address the weaknesses in our education sector that fuel increasing inequality, sentence many to a life of hopelessness, and permanently constrain our economic growth. We did nothing to encourage small business’s growth; in an example of perverse policy, we are actually creating a new regulatory regime that favors large companies.

Then there were the actions that will probably restrain future economic growth. The minimum wage was raised. We had health care reform, but we didn’t address the real problem: the fact that the health care consumer pays an insignificant portion of the bill at the time of consumption. We had financial reform that failed to address the fundamental problems of too-big-to-fail, and we protected risky activities, increasing the regulatory burden and crippling the ability of small banks. We halted much of our offshore drilling.

Looking forward, there is little reason for optimism. We’re considering huge increases in our energy costs through greenhouse gas regulation. We have a massive tax increase scheduled at the end of the year.

While a double-dip recession is not the most likely outcome, we can’t reject the possibility. More likely, we face a long slow struggle to overcome ourselves and restore real prosperity. The forecasters’ consensus appears to be moving toward accepting that reality.Massive Policy Errors

Bill Watkins discusses many of the things I have been talking about on this blog for years. Nonetheless, I thank him for a nice summary of why stimulus failed and also for recognizing that stimulus measures would fail in advance. Policy errors certainly have been rampant and very few economists saw them.

Watkins thinks economists now understand the "regime shift". More than likely, most of them don't. Instead, economists have a tendency to project current economic status forward, without understanding why. Because things have slowed down, economists became a more realistic. I doubt their understanding is much better.

If there is another round of stimulus accompanied by another uptick in the economy (the former is likely coming but probably not the latter), I have no doubt economists would think we are off to the races again and this was just another "soft patch".

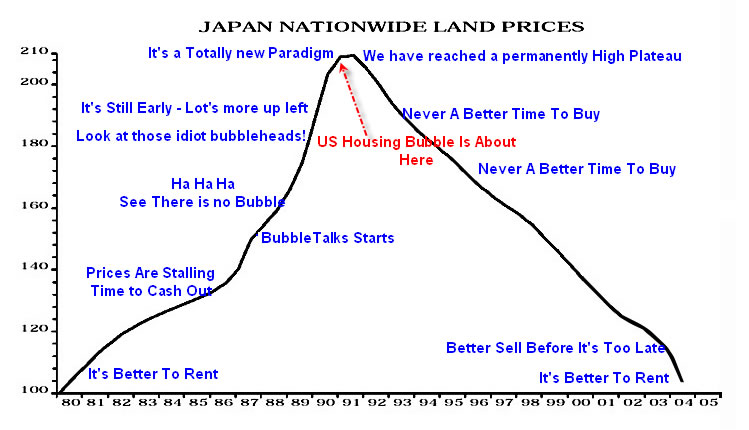

In contrast, I propose we are going to flirt in and out of recession for perhaps a decade, just as Japan did. Interestingly, every time the Japanese economy rebounded slightly, economists thought "thank God, deflation is over", only to see the Japanese economy relapse.

Problems Many, Solutions Nonexistent

- Tide of Debt: Consumers are swimming against a tide of debt with no way to pay it back.

- Demographics: Boomers are heading into retirement scared half to death because they did not save enough.

- Jobs: There is no source of jobs

- Wages: Global wage arbitrage

- Attitude Changes: a secular shift in the attitudes of consumers towards housing and risk taking is underway.

- The Fed is powerless to change attitudes.

Regime Shift? What? When?

Lehman filed bankruptcy in September of 2008.

For comparison purposes, I started posting on the phenomenon of people Walking Away from their houses in January of 2008. Here are some Links to Walking Away articles.

What is the real regime change: People willing to walk away from their homes for the first time in history, or the bankruptcy of a single company?

That people would voluntarily walk away from their homes is without a doubt a "game changer". It turned economic theory 180 degrees. Almost no one thought that would happen.

In contrast, nothing especially important changed in September of 2008. That Lehman would file bankruptcy is at best a symptom of attitudes that had long since changed.

It's a Totally New Paradigm

Secular attitude changes like "walking away" had their roots in the busting of the housing bubble.

Flashback Saturday, March 26, 2005: It's a Totally New Paradigm

Ron Shuffield, president of Esslinger-Wooten-Maxwell Realtors says that "South Florida is working off of a totally new economic model than any of us have ever experienced in the past." He predicts that a limited supply of land coupled with demand from baby boomers and foreigners will prolong the boom indefinitely.

"I just don't think we have what it takes to prick the bubble," said Diane C. Swonk, chief economist at Mesirow Financial in Chicago, who was an optimist during the 90's. "I don't think prices are going to fall, and I don't think they're even going to be flat."

"I look at this as a short-term investment," said Mr. Farquharson, 36, who works for a venture capital firm, "and plan to unload it as soon as things look dangerous."

Gregory J. Heym, the chief economist at Brown Harris Stevens, is not sold on the inevitability of a downturn. He bases his confidence in the market on things like continuing low mortgage rates, high Wall Street bonuses and the tax benefits of home ownership. "It is a new paradigm" he said.

Here are some links to the housing bubble chart updates, all made in real time.

One of my favorite updates of that chart regards the cover of Time Magazine going "gaga" over real estate one year after the bubble burst, but before anyone important even recognized that fact.

Inquiring minds may wish to consider US vs. Japan Land Prices Pictorial Update for a discussion of Time Magazine going "gaga". They even used the word "gaga" on the cover.

Regime Change Started in 2005

The regime change that Bill Watkins mentions, actually began in 2005 with the busting of the housing bubble. It took a couple more years before economists noticed because commercial real estate kept the game going for a while longer.

Commercial real estate follows residential housing with a lag, and from 2005-2007 stores like Home Depot, Lowes, Walmart, Pizza Hut, were still in rampant expansion. That expansion provided enough jobs to mask what consumers finally started figuring out: "home prices will not rise forever".

Nonetheless, Bill Watkins is actually ahead of the game in understanding there was a regime change. In 2008 Ben Bernanke was still in denial over the housing bubble and he had amazingly optimistic ideas where the unemployment rate was headed.

Even now, Bernanke displays little public awareness of what is going on. It would be interesting to hear what he says in private at the FOMC meetings in comparison to the soundbites the Fed delivers to the public. If FOMC soundbites represent what the man really thinks, Bernanke is nearly as clueless as ever, with little understanding of what went wrong or why, what the policy errors were, and what the Fed's role in this mess was.

Attitudes are the Game Changer

Watkins missed when the regime change occurred and possibly what the regime change even is (changing social attitudes on housing, consumption, risk taking, and debt, by consumers and banks alike).

The "attitude change" was the game-changer, NOT the event (the collapse of Lehman).

Nonetheless, Watkins is light-years ahead of most economists and economic cheerleaders in understanding that we did have had a massive regime change, that the regime change is lasting, and that stimulus efforts to date have done nothing to fix the structural problems at hand.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.