The Inflation and Deflation Debate Deconstructed

Economics / Economic Theory Aug 06, 2010 - 09:25 AM GMTBy: Jesse

'What most people call reason is really rationalization. Given a new set of data, most people will search through it only for those examples that support their existing beliefs. Their beliefs are really opinions, a tenuous collection of myths, anecdotes, slogans, and prejudices based largely on justifying personal fear and greed. This is what makes modern propaganda so powerful; people do not bother to think critically and objectively and act for the greatest good. And in their ignorance they can find the will to do increasingly monstrous things, and rationalize them.' Jesse

'What most people call reason is really rationalization. Given a new set of data, most people will search through it only for those examples that support their existing beliefs. Their beliefs are really opinions, a tenuous collection of myths, anecdotes, slogans, and prejudices based largely on justifying personal fear and greed. This is what makes modern propaganda so powerful; people do not bother to think critically and objectively and act for the greatest good. And in their ignorance they can find the will to do increasingly monstrous things, and rationalize them.' Jesse

In a purely fiat regime, the question of a general (monetary) deflation and inflation is a policy decision. Anyone who does not understand this does not understand the modern mechanism of money creation. As the pundit said, "The mind rebels..."

But rather than engage in the usual facile intramurals about the topic, let's consider something more important. How does one 'play this' which is really what all these discussions are about: self interest.

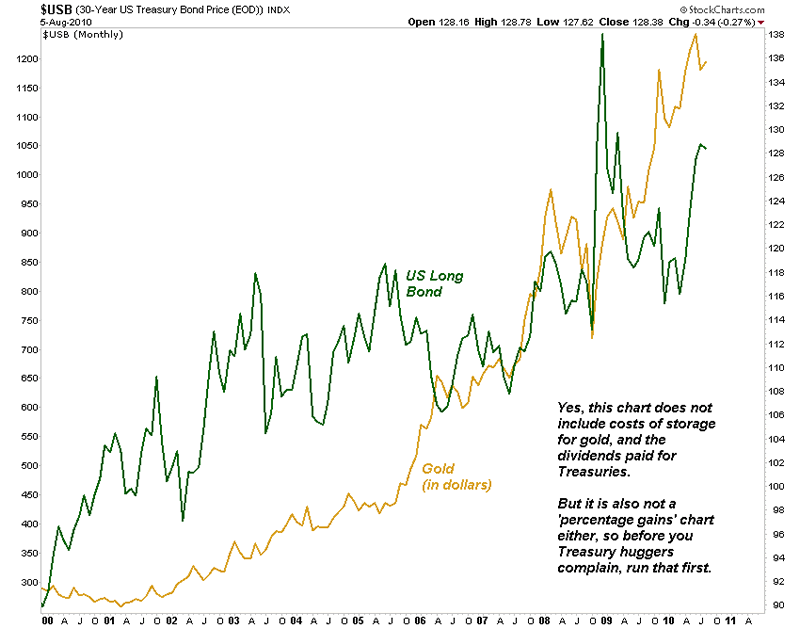

The champion of deflation is the Treasury Bond (and the Dollar), and of the inflationists, Gold.

There are extremes on both sides, and probably more sense in the middle, since life rarely sustains the extreme unless there are people messing about with it. The only naturally efficient markets are in ... nature, and that only as measured over the long term.

Anyone who doesn't think Treasuries have been in a long bull market are blind fools.

But the same is true of gold.

I will leave the dollar aside for now to simplify the discussion, but it hardly lends itself to the deflationary theory.

People who have taken positions and held them in both Treasuries and Gold over the past ten years have made money, a very nice return. When one has a theory that consistently and reasonably encompasses that, you might have something worthwhile.

The deflationists will say that gold is a bubble fueled by mistaken speculators, and the inflationists will say that the Treasuries are being supported and manipulated by the Fed. Neither is able to look out from their deep wells of subjectivity.

You may wish to consider that the great part of this discussion, inflation versus deflation, is a diversion. But that is a discussion for another time.

The question for all failing theories is, as always, what next. What is the alternate count.

Oh boy oh boy, [our desired outcome] is finally coming and when it gets here its going to be good. We are finally turning [Japanese / Weimar].

Things are in bull markets, or bear markets, until they are not. The undeniable trend break is the best indication of change in momentum.

But things in the world of complexity are rarely as simple or straightforward as the average mind will allow, or can accept.

Anyone who thinks the Fed is impotent has not been paying attention to the last one hundred years. The Fed is not impotent, merely constrained. Their constraint is the policy arm of the government, the dollar, and the bond, in the absence of some external standards including external force.

Until one understands that, nothing can or will make sense. That is why the current discussion is so nasty and propaganda-like. It is not about what will happen, but rather about a public policy decision, about what people want to happen.

Consider that these debates are merely diversions, to distract people away from the most significant factors in their troubles, which are exploitation and fraud. Paid professionals who were arguing the virtue of credit expansion as the bubbles blossomed are now arguing just as strenuously for austerity now that the bubbles are collapsing, their master having taken their spoils. They will say for pay, without regard for the solutions that are in the best interest of the country. Few are thinking of their country anymore, as the individual is conditioned to think of themselves as globalized abstractions.

And as always, be careful what you wish for, because you may get it. In this current climate, this class warfare, the American nation is a house divided. And you know what happens to those.

And the winners may inherit the wreckage, a pyrrhic victory, but they can console themselves that they have won the irrelevant debate.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2010 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.