Housing Market Fire Sales - Fingers of Instability Series Part Six

Stock-Markets / Financial Crash Sep 17, 2007 - 06:22 PM GMTBy: Ty_Andros

In This Issue – 5 Fingers

In This Issue – 5 Fingers

- FIRE SALES!

- The Silence is Deafening, Getting Ready to Lie With Numbers, Again!

- Are the Stock Markets Just Off Their Highs or Just Off Their Lows?

- Pigs in the Investment Python

- Crude Realities

FIRE SALES!

Little reported in this week's news was the Fire Sale Hovnanian Homebuilders conducted over the weekend. Offering 30% discounts on their new homes as they headed for the sidelines before their peers do. It is an act of yelling “FIRE IN A THEATRE”. Please understand that prices are set at the margin, in other words, the value of your holdings are determined by the last price at which they were transacted. In this example with Hovnanian it works out this way: Homes were sold at 30% discount to reduce inventories and to satisfy creditors that were getting nervous and demanding payment.

But the result after the sales is that every homeowner in similar homes in the area just saw the value of their homes drop an equivalent amount. Imagine a homeowner who had 20% equity in his home before the Hovnanian clearance sale; he may be a prime-quality borrower and live in a personally-affordable home (had the income to support his purchase). Presto, he wakes up on Monday and his is now 10% underwater on his purchase, and since his and many other mortgages in his area have been SECURITIZED, those previously healthy AAA credits have been turned into trash with these sales.

This person's wealth just suffered a CRASH, no different than if the value of his or her stock investments declined in the same manner. Homeowners and homebuilders in general had been holding their prices up through value-added incentives, such as special countertops or flooring sales tactics, are now between the proverbial rock and a hard place. This will no longer work. That sound you hear is the sound of crashing home values around the country as homebuilder after homebuilder will follow Hovnanian out the exits.

Do you think any homebuyer within 10 miles of the Hovnanian fire sale will pay premium prices now? The answer is no. Every home in that area just suffered devastating losses of equity of up to 30%, as did the homeowners. If you are an investor or homeowner of homes in that area you just rolled snake eyes. If you think the other homebuilders did not notice this, think again. They will now all be heading for the exits before somebody else in the areas they are developing beat them to the exits. Look for this to happen frequently and at ever increasing rates. Now, sub-prime is moving up the ladder to McMansions, and the ability to finance Jumbo mortgages (Loans over the Fannie Mae and Freddie Mac limit of $417,000) are absolutely in freefall. Thousands of homes in the hottest markets in the United States face this reality, as do the securities into which the developers' loans were placed. Take a look at this example of a 1,300 square-foot home in Los Angeles' Hancock Park neighborhood and the way it's been flipped repeatedly since 1994, as reported originally by Business Week and reported by Dennis Gartman of www.thegartmenletter.com :

July 1994: a couple purchases the home for $230,000, borrowing $218,000 at 6.75% from Jon Douglas finance.

March 2003: They refinance. Borrowing $313,000 from Downey savings and Loan at an adjustable rate of 3.5%

July 2005: They sell to a flipper for $815,000. He borrows $570,000 from loan center of California at 6.75% and an additional $244,000 from the same lender (piggyback loan). He spends $115,000 on remodeling.

March 2006: The house is sold for $1.29 million. The Buyer borrows just over $1 million form First Franklin, now a unit of Merrill Lynch at 7.5% and an additional $259,000 from the same source. (Obviously Merrill used their securitization arm to package and sell the loans to gullible investors)

August 2006: On behalf of mortgage investors (holders of the CMO's). The house is foreclosed on. It is listed by RE/Max at $900,000. Broker Kenneth Davis says an offer has been accepted at “close to asking”. Thanks Dennis.

Think of it, a small home for a million dollars, up 400% in ten years, it has a long way to fall, even after this most recent pullback. Every mortgage and home within that area suffered a devastating 25% or more loss in value the second that sale closed. People holding CDO's, CLO's and CMO's with that mortgage paper in it suffered huge 25% losses on the underlying value of the securitized products they hold. Possibly bigger losses, as well as the value of the securities, have no way of price discovery. As each Hovnanian competitor steps into the same course of action, the securities that hold those mortgages are set to be massacred as well. This is going to domino across the asset-backed security marketplace as homebuilders race each other out of the burning theatre to which Hovnanian just lit the matches.

The Silence is Deafening, Getting Ready to Lie With Numbers!

As regular readers know, I have been talking about the poor earnings reports expected out of the big money center and investment banks. It has been a humbling experience this week as they have not appeared, and now it is clear why. They can't! Little reported meetings between the ratings agencies, big banks and brokers and the financial authorities were taking place all last week. How can you value CDO, CMO, and CLO Securities when it is impossible to price them? As each example of what I outlined above takes place, it becomes more difficult to discover their price. And to report false information is a recipe for the trial bar to ATTACK on behalf of every investor who bought these poorly-thought-out products.

So the banks and brokers are going to the government for GUIDANCE in valuing them in a COMPLIANT manner to reduce the potential liability from misstating their results and financial condition. Here are some quotes (from Financial Times article) from US treasury secretary Hank Paulson from last week's meetings:

“The crisis of confidence in credit markets is likely to last longer than previous financial shocks of the past two decades,”

“the uncertainty in credit markets would last longer than the turmoil that followed the Asian crisis and the Russian default of the 1990s or the Latin American debt crisis of the 1980s.”

The comments came as it emerged that credit ratings agencies have been called to a special meeting in Washington by the umbrella body for the world's securities regulators to explain how they rate structured financial products based on mortgage assets.

“Secondly, it is the level of complexity,” he said, adding that he had met daily with bankers trying to value asset-backed commercial paper and other products.

“When they are confident they understand the products, confidence will return,” he said.

Wow, they don't even understand the value of their own holdings, how to value them, or when they will understand their values. And this is from the very bankers and brokers who “invented, packaged and sold” them to investors.

Last month investment banks and financial institutions issued just under $77 billion dollars worth of investment-grade securities to shore up their balance sheets in anticipation of the loss of value of the securities they currently hold (CDO's, CMO's, CLO,s and MBS's) or for which they provide backup lending facilities.

Merrill Lynch issued a warning Friday which basically went unreported except for the European Financial Press. The Bank of England stepped in and rescued UK mortgage lender “Northern Rock” after saying earlier in the week they would not do so. This is only the beginning as depositors have continued their run on the bank even after the bailout. Mervyn King didn't wish to see those lines of depositors lining up for withdrawals in the headlines, and I promise you, it made a lasting impression on bank customers throughout the UK and much of the world. Look for this to happen in the United States soon.

In order to get through the short term look for the “mark to the models” to return NOW as that is the only way to postpone the write downs of their “fast dwindling” reserves and announce huge and growing losses. If they “mark to the market” it is problematic, to say the least. The Federal Reserve is printing money at an unbelievable rate to underpin the markets; this is inflation in its purest form. They haven't a clue how to sort through the problems and if they have devised a plan for it they aren't telling! Markets dislike uncertainty, when they are uncertain they discount the worst possible scenario, does this give you an idea where the financial industry valuations may be headed?

Are the Stock Markets Just Off Their Highs or Just Off Their Lows?

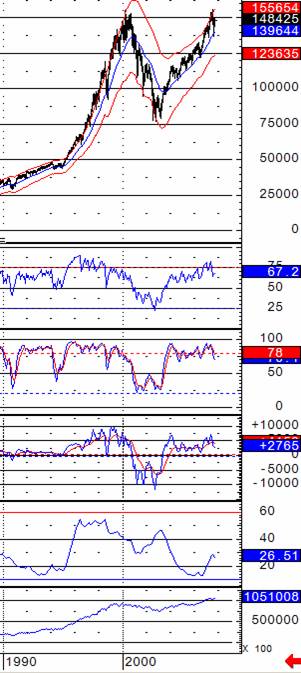

Many are saying the markets are just off their highs. I believe they are about to make new lows if measure in real money, ie. GOLD versus that thing they call the US dollar. Below are two pictures of the S&P 500 going back 10 years, the first in dollars and the second in gold.

In dollar terms things don't look too bad at this point. But in terms of the S&P priced in gold, the chart is rather grim, as the destruction of paper currency purchasing power is set to accelerate as we can see.

S&P 500 Denominated in Dollars : S&P 500 Denominated in Gold

These are monthly charts so their implication on the future direction is strong! It should be clear to anyone that this bull market is alive and well, in terms of Fiat currencies, and about to resume its bear trend when viewed in GOLD! Everyone looks at the possibility of testing the August lows in the stock market, the more important low we are about to penetrate is the market measured in REAL MONEY, ie GOLD! It's now clear why we see huge upward pattern breaks in gold and crude oil. As money printing accelerates to address the problems in the credit market collapse, expect the S&P in gold to break lower. If the S&P breaks lower in terms of dollars, look for the S&P in gold chart to impulse out of its low and head lower. GOT GOLD ANYONE?

Pigs in the Investment Python

The banks are attempting to do an imitation of Atlas and trying to lift the distressed lending onto their shoulders. Conduits, SIV's, mortgages, private equity, asset-backed securities (CLO's, CMO's, CDO's) are all falling back onto their balance sheets and SUCKING the life out of their reserves. As outlined in previous editions, the offloading of previously committed lending obligations of over 350 billion dollars worth of private equity deals has begun, and the blood has only begun to spill.

The marketplace is putting this back on their plates as there is no place to sell it, and the treasury and the Federal Reserve are encouraging them to take it down and feed it into the discount window. The discount window had its largest inflow since September 2001. But the uncertainty that is sub prime valuations in the securitized products is now broadening, as we see in the previous fingers of instability.

Wall Street tried last week to unload the Allison Transmission loans, part of a $4.2 billion dollar buy out that was postponed in July. They sold only 1 billion at 96 cents on the dollar. They tried to take the KKR buyout of First Data to the market this last week and failed to garner enough interest to take down 5 billion of the 25 billion dollar loan commitment they made. Collectively, they hold over 350 billion dollars of private equity commitments and can't even move small drops of them into the market place.

At 96 cents on the dollar the losses are 16 Billion, at 90 cents 40 billion at 85 cents 60 billion. As the securitized paper market woes widen, so will these losses as the buyers will not take a chance on extending their losses. How can they rate the NEW paper with Moody's and S&P already on the hook for their past misdeeds in rating previous offerings? And obviously 96 cents will not get it done, so it is time to mark them down and try to sell them again. More and more of these poor lending decisions are coming back to haunt the banks and brokers that committed to them with plans to sell the trashy commitments they made to the securitized markets (this is no different than selling sub prime trash they knew was in previous offerings). The $77 billion they raised last month to bolster their balance sheets can vaporize in a few days time. Money can't be created fast enough for these impossible-to-price-and-place securities and obligations. Gold is set to go a lot higher as the money to “paper over the problems” is created with the click of a mouse or a flick of the button on a printing press.

Crude Realities

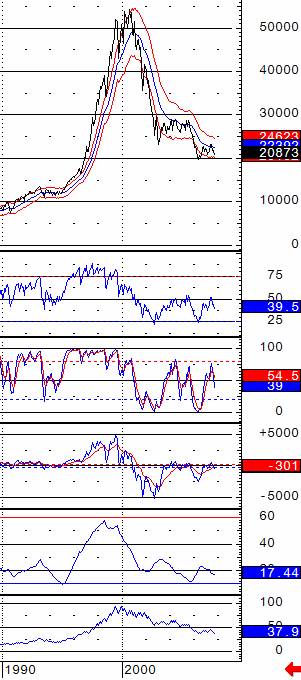

Crude Oil is breaking out higher as we speak; just like the gold chart I illustrated last week this other critical component is breaking out higher as well. We covered crude oil projections to 98 dollars in late July when the monthly chart finished its bottom pattern and issued its projections. It pulled back over the 6 weeks since that time and now has issued a second short-term objective of $88.00 dollars a barrel. It has now been in expanding backwardization that whole period and has broken out to the upside as this WEEKLY chart illustrates:

Crude Oil is breaking out higher as we speak; just like the gold chart I illustrated last week this other critical component is breaking out higher as well. We covered crude oil projections to 98 dollars in late July when the monthly chart finished its bottom pattern and issued its projections. It pulled back over the 6 weeks since that time and now has issued a second short-term objective of $88.00 dollars a barrel. It has now been in expanding backwardization that whole period and has broken out to the upside as this WEEKLY chart illustrates:

As you can plainly see, crude backed, filled and tested the bull trend line since the original new high was made. This is a weekly chart so this action is significant and it is issuing new buy signals as you read this -- there is not one internal that is not confirming the new highs and buy signals (they are top to bottom, RSI, slow stochastic's, MACD, ADX and on balance volume). The new price highs in July were confirmed by all the oscillators at that time, signaling robust, new price highs are to be expected. You can expect gasoline to make robust new highs as well, and its weeklies are on buy signals as well. There is only 19 days of inventory in storage, the lowest in decades. As robust demand, short supplies and rampant money creation set the stage for a powerful new move higher in the energy sector.

The more money they print the more Oil will just re-price in the lower purchasing power of the currency, whatever it may be. I saw a story on CNBS er CNBC on Friday where they trotted out a young oil analyst (he couldn't have been 30 years old) from the Bank of America who said crude oil was fundamentally overpriced. What a laugh it was as Sue Herrera told the audience don't worry we are here to tell you this is not a problem. This guy was an “amiable dunce” of the first order. I remember myself when I was 30 and I didn't have a clue, how he made it into the frontlines of CNBC (CNBC world is a much more honest organization, and not a wholly owned subsidiary of the New York establishment) is a testament to their complicity in trying to dupe you into what they wish you to think. Are you stupid? No I think not. But they are for trying to tell you these things! Do you think 100 dollar crude oil could be a problem? Of course it will be!

IN CONCLUSION:

Stock market rallies are the result of the money creation and it is going into the markets rather then into the credit problems. This rally has been done with very low volume. 100's of billions of dollars of new money can be expected to be created to address the emerging “financial system” problems. China is so ripe for a large pullback it is incredible. One poor lending decision after another is being revealed, and the securities they are packaged in are crumbling! What is unfolding in the housing markets is now becoming nothing less than a crash, ask the people that lived near Hovnanian's FIRE SALE. Globally, economies are on good footing, but financially the underpinnings are caving in like a house of cards as investors around the world in over-the-counter derivatives (CDOs, CMOs, MBS, CLOs,) have been fooled by the banks, investment houses and the ratings agencies. No one wants to pay the piper and the cover-up of their malfeasance continues.

There are no shortages of dollars, Yen, Swiss Francs, Yuan, Aussie dollars, etc. In fact, there are more of them served up on a daily basis in quantities that would boggle your mind. Assets will just re-price in the devalued scripts. There is a “shortage of confidence” in whom you can trust as losses have not been revealed and the bodies have not yet surfaced. So uncertainty rules the day, all solutions are inflationary in nature.

It's clear the financial authorities in Washington and New York want the story never to surface. They will sooner or later. The problem is not isolated to a small group of players, so its watch and wait. I don't understand why they don't want to fess up and get it behind them, unless the truth is too harsh to reveal. I don't believe this is the end of the world, only an opportunity if you have prepared yourself. Have you made money during this turmoil? If not, figure out why, research investments that did and diversify your portfolios. What is unfolding are nothing but opportunities for the prepared investor!

I apologize for getting carried away with my commentary last week, I did not mean to frighten you! And I stand corrected on my line about no responsible public servants as my readers peppered me with the name of that last American hero “Ron Paul”. Of course, I know him as I am a libertarian (as he is) and voted for Ross Perot when he spouted the truth, and got Bill Clinton. So let's not hold our breath as good policy is not a winning recipe for elections in the lands of the “something for nothing” personality. What a terrible state of affairs in the political arenas of the G7. This week promises to hold a lot of surprises as the investment banks start to report and the Federal Reserve meets on Tuesday. Will they come clean or try and postpone reckoning day? My guess now is the latter. We will be discussing this commentary and more on Commodity Classics videocast on www.commodityclassics.com and Market news 1 st , www.mn1.com on Wednesdays at 4 p.m. cst and on www.mn1.com on Fridays at 1:30 pm cst . Don't miss the exciting next edition of Tedbits and the “fingers of instability” series. If you enjoyed this commentary send it to a friend and subscribe its free at www.TraderView.com Thank you.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

Ty Andros LIVE on web TV. Don't miss Ty interviewed live by Michael Yorba from Commodity Classics. Catch Ty's interview every Wednesday at www.MN1.com or www.CommodityClassics.com at 4pm Central Standard Time .

By Ty Andros

TraderView

Copyright © 2007 Ty Andros

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.