Baby Boomer Dynamics, Housing, Jobs Creation, and the Falling Participation Rate

Economics / US Economy Aug 04, 2010 - 04:57 AM GMTBy: Mike_Shedlock

Job estimates are often difficult to predict because month-to-month variances can swing wildly. However, census firing is about to take back another chunk of census hiring and I expect another bad looking jobs report this month.

Job estimates are often difficult to predict because month-to-month variances can swing wildly. However, census firing is about to take back another chunk of census hiring and I expect another bad looking jobs report this month.

Interestingly, Geithner is making excuses in advance.

Please consider Geithner Says Unemployment May Advance Again Before Declining

Treasury Secretary Timothy F. Geithner said U.S. unemployment may rise again before it falls and the economy isn’t recovering rapidly enough.

“It’s possible you’re going to have a couple months where it goes up,” he said on ABC’s “Good Morning America” program. “People start to come back into the labor force, and that can cause the measured unemployment rate to go up temporarily.”

The U.S. economy grew at a slower-than-expected 2.4 percent pace in the second quarter as consumer spending slowed, according to Commerce Department data. Companies probably added about 90,000 jobs in July, according to the median estimate in a Bloomberg News survey before the Labor Department’s Aug. 6 employment report. The jobless rate is forecast to rise to 9.6 percent from 9.5 percent.Geithner's Disingenuous Statements

When Geithner says "“People start to come back into the labor force, and that can cause the measured unemployment rate to go up temporarily” he is talking about the Participation Rate (the percentage of the working-age population who are currently employed or are actively seeking work).

The theory Geithner is using is that in a recovery, people who were not in the work force start looking for jobs. Those actively looking for jobs are considered unemployed.

The reality is that were it not for a huge decline in the participation rate (deep into an alleged "recovery"), the unemployment rate would far higher.

Indeed, the unemployment rate dropped in 2010 only because people gave up looking for jobs as unemployment benefits expired.

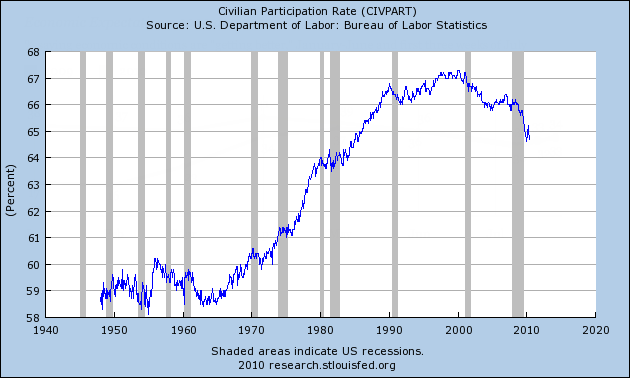

Civilian Participation Rate

Perhaps people start looking for jobs, but there certainly is no sign of it. If it happens this month, in the face of census firings, the unemployment rate could potentially soar.

Demographics

Bear in mind that it takes between 100,000 and 125,000 jobs a month to keep up with demographics (birth rate plus immigration).

2010 Job Gains As Initially Reported

June -125,000

May +431,000

April +290,000

March +136,000

February -36,000

January -44,000

The net of that is +652,000 jobs in six months, approximately enough to keep the unemployment rate flat for the year. Instead, the unemployment rate dropped along with the participation rate.

Had the participation rate risen (more people looking for jobs than giving up), the unemployment rate would be closer to 10.5%.

Baby Boomer Retirement

The massive increase in the participation rate between 1960 an 2000 is a result of single wage-earner households going to dual wage-earner households (both husbands and wives working), a decrease in average family size, and other boomer related dynamics.

Now, as boomers head for retirement we can and should expect the participation rate to decline. However, I took that into consideration with my estimate that it takes 100,000 to 125,000 jobs a month to keep up with birth rate and demographics. In 2000, the number was close to 150,000 a month.

Bernanke's estimate is 100,000 jobs a month. However, I think he is slightly low-balling for obvious reasons. Regardless, we are both in the same ballpark.

Clinton vs. Bush vs. Obama

Clinton not only had far more favorable demographics to work with than either Bush or Obama, he also happened to be president during the midst of a genuine productivity boom, falling commodity prices, and an internet revolution that created millions of jobs.

In terms of job creation, Clinton was lucky. That combination will not be seen again for decades and he did not have to do anything to get it.

However, one must play the hand one has been dealt, and to show I am not taking partisan sides, Bush and Obama have both blown it with misguided policies and stupid wars.

Housing Boom and Housing Bust

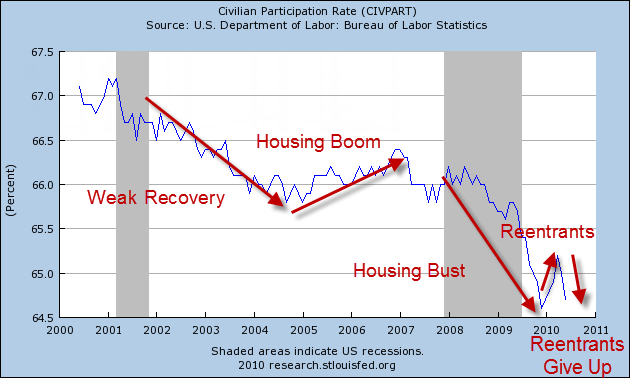

Let's zero in on the participation rate since 2000 to see what trends suggest.

The above chart shows the effect of the Greenspan induced housing bubble.

Even though housing peaked in 2005, commercial real estate temporarily picked up where residential housing left off. That combination kept employment high with countless Home Depots, Lowes, Pizza Huts, etc, adding jobs for two years even as housing went into a tailspin.

This all ended in late 2007 with a thunderous crash of housing, commercial real estate, commodities, and the stock market.

In late 2009, the participation rate rose as people who thought there might be jobs, started looking for them. It was a mirage. As people exhausted their unemployment benefits, they gave up and instead started collecting social security.

Note that as soon as someone stops looking for a job (even if they want one), they are not considered to be unemployed, nor are they a part of the labor force, thus the participation rate drops.

Dynamics at Play

To accurately predict trends in unemployment, one not only needs to estimate the number of jobs the economy will create (or lose), one has to get boomer dynamics and the participation rate as well.

Ironically, one can be wrong on both estimates and still come out OK if the forces balance out.

Best of this Recovery is Over

If the participation rate jumps now, so will the unemployment rate. If jobs decline and the participation rate jumps, the unemployment rate will soar.

To make substantial progress on the unemployment rate, it will take continuously rising jobs (substantially above 100,000 a month), and a falling participation rate.

Not to blow out any recovery candles, but that combination is highly unlikely.

Looking ahead, the jobs picture appears bleak. The best of this recovery is over: Corporate Hiring is No Longer Improving and Americans are Less Optimistic.

Geithner is making excuses in advance, hoping for a miracle that is unlikely to come.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.