Gold And Silver Stocks Are About To Crash!

Commodities / Gold & Silver Stocks Aug 03, 2010 - 08:42 AM GMTBy: Ronald_Rosen

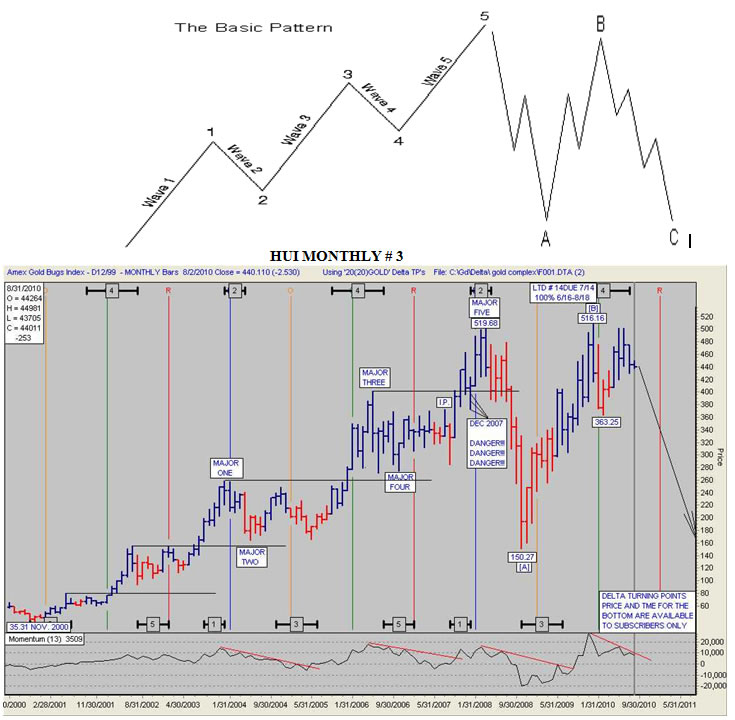

There is one chart in the precious metals complex that has been true, honest, and faithful right from the beginning of its bull market. You will see a white square on this chart that says DEC 2007 DANGER!!! This was a magnificent and totally up front and obvious clue that the tide was about to turn bearish for the HUI. Between November 2000 and December 2007 the HUI did not at any time retreat below a previous monthly high.

There is one chart in the precious metals complex that has been true, honest, and faithful right from the beginning of its bull market. You will see a white square on this chart that says DEC 2007 DANGER!!! This was a magnificent and totally up front and obvious clue that the tide was about to turn bearish for the HUI. Between November 2000 and December 2007 the HUI did not at any time retreat below a previous monthly high.

Horizontal lines have been drawn to show you this continuously bullish pattern. For the first time in seven years the HUI closed below a previous monthly peak in December 2007. I wrote about this in several REPORTS and told subscribers to sell. The HUI continued moving up for three months and then began a Flat Correction. The HUI has not exceeded the March 2008 high of 519.68 for the last 29 months.

HUI MONTHLY # 1

When a trading pattern that has been in effect for seven years suddenly changes, it is a loud and clear message that the tide is turning. The HUI, in a most honorable stance, is once again telling us that the final [C] leg down of its [A], [B], [C] correction is about to get underway. Since November 2000 the HUI has completed a nearly perfect five wave move. It warned us that the tide was going to change and it is now telling us that it will decline to slightly below the 150.27 low of the [A] leg low. It has not wavered in its integrity. I expect it to continue in this honorable manner. The HUI will greet us with open arms at the bottom and we can get aboard at that time. The Delta Turning points will tell us when the bottom is due to arrive.

“In a regular flat correction, wave B terminates about at the level of the beginning of wave A, and wave C terminates a slight bit past the end of wave A.” E. W. P.

The Delta Turning points for the precious metals complex and a number of other important market items are available by subscription to:

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.