Stock Market, Look For A Retest Of The Highs

Stock-Markets / Stock Markets 2010 Aug 02, 2010 - 12:13 AM GMTBy: David_Grandey

In our mid-day update to our subscribers on Friday we said : “Part of me would feel safer seeing a retest of recent highs for a mini double top (little red line at 1120 or even the 1131 level before a drop as that would mark a double top at a retest of 1120 and/or a 5th and final wave higher.”

In our mid-day update to our subscribers on Friday we said : “Part of me would feel safer seeing a retest of recent highs for a mini double top (little red line at 1120 or even the 1131 level before a drop as that would mark a double top at a retest of 1120 and/or a 5th and final wave higher.”

So that’s what we want to be on the look out for next week. It’s our what to watch for on the long side and where our long side watch list is going to be the focus early next week.

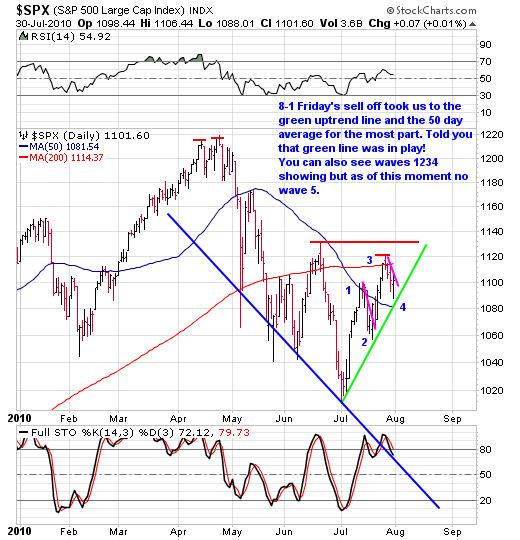

When one looks at the market from the July lows we can clearly see waves 1234 with 5 yet to rear its head. What we want you to key in on are the little pink lines, those are Pullback Off Highs (POH) patterns. They also show up as waves 2 and 4 – where we are now.

This tells us we are not done to the upside yet. Of course this assumes we are going to put in a 5th wave mind you or even a “Back To The Scene Of The Crime” retest of 1120 or 1131. Odds favor that though because of Friday’s action at the green uptrend line held and we got an upside reaction off of it. Besides see any topping pattern we can work with right now? We see no double top or back to the scene of the crime retest of 1120 or 1131.

In the what to watch out for department next week:

We’ve talked about the 1131 level numerous time over the last week or two as well as the 1120 level too. They are our what to watch out for levels as that is where we’d expect to see some stalling as they are resistance levels or retest levels. A retest of those red lines with failure? Then we salivate and get real serious on the short side. Same goes for a break of the green uptrend line off the July lows.

In Summary:

We go into the beginning of the month with four waves up ABCD with E yet to rear its head.

So that means to expect more in-flight turbulence on the short side. We’re ok with that but we’ll also want to enter new positions on the long side via names featured in the long side watch list this weekend.

Also understand that we are in the late innings of this upswing with 4 out of 5 showing. Which means a final push for the 5th wave which probably won’t last long. But we’ll want to capitalize on it via some short term long side trades.

Remember it’s what comes after a 5 waves up sequence. Here’s a hint — Wave 3 wonder to behold to the downside. We’ll cross that bridge when we get there though and save that for another conversation.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.