Stock Market Targeting Down Trend S&P 900 to 950

Stock-Markets / Stock Markets 2010 Aug 01, 2010 - 03:06 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

Very Long-term trend - Down! The very-long-term cycles are down and if they make their lows when expected, the bear market which started in October 2007 should continue until about 2014-2015.

SPX: Intermediate trend.The index made an intermediate top at 1220 and is now in an intermediate

downtrend which should come to an end in October 2010.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Overview:

The long-term perspective based on cycles: This is a Monthly Chart of the SPX which depicts the longterm cycles which have been, and will be, affecting the index from 1998 to the end of the secular bear market which started in October 2007.

After the protracted decline which started in 2002, the 12-yr cycle made its low and initiated an uptrend which topped in October 2007 when its half-span, the 6-yr cycle, turned down. The decline which followed was all the more vicious because the 7-yr cycle had also turned down. The 7-yr cycle -- which had last bottomed in September, 2001, a date which will be remembered for a very long time -- bottomed in November 2008, and the 6-yr cycle made its low in March 2009. The combined effect of these two cycles turning up are responsible for the uptrend which began on March 6, 2009, and which is likely to last for a few more months.

The mini bull market which started in March 2009 is being interrupted by the bottoming action of the 4-year cycle due to make its low in October. This is the reason a top was formed at 1220. The 2-yr cycle which bottomed in July initially helped with the market decline, but it is now counter-acting the downward pressure from the 4-yr cycle. This should end around 8/23 when the second phase of the correction from 1220 should begin and extend into the 4-year low in October.

The October low will be made in the face of the rising 2-yr, 6-yr and 7-yr cycles and, for this reason, it will bring less market weakness than some expect. After that low, it is unclear if the combined upward push from this group of cycles will develop enough strength to extend the uptrend which started in March 2009 beyond 1220. They will be going up against the final down-trending phase of the 120-yr cycle and all its subdivisions -- including the 40-yr, the 30-yr, the 12-yr and the 6-yr cycles -- scheduled to make their lows in 2014. The market itself will tell us exactly when the top will be reached, but after it has been made, it is fair to say that the final decline into the 2014 low will be a bear fest which could rival what happened in the 1930's, with all its dire consequences. Fortunately traders and investors which are aware of this cycle map will be well prepared to deal with this trying time.

Analysis

Chart Pattern and Momentum

Now that we have an increased awareness of the long-term trend, let's focus on how it is evolving on a dayto- day basis. In order to do that, we'll need to look at the Daily Chart of the SPX.

The downtrend from 1220, which is the bottoming phase of the 4-yr cycle, has been interrupted by the 2-yr cycle which made its low on 7/01. The index is tracing out the corrective pattern outlined by the blue trend lines. If it is helpful, you can think of it as an Andrews pitchfork with the dashed line being its median. The weakness of the uptrend is exemplified by the fact that prices are having some difficulty getting above the median.

The rally from 7/01 has barely managed to get outside the red intermediate channel from 1220 as it reached the first (1122) of three potential targets given in an earlier article. The other two were 1144 and 1175. It is already obvious that 1175 will probably not be reached, and that even 1144 could be a strain. Since it is normal for a pull-back to occur after a target is attained, this is what we are undergoing now. The retracement from 1120.95 has found support on the 200-DMA, and on the green trend line drawn from the 7/01 low, but since the uptrend has taken on the form of a wedge, the index may move outside of the wedge before completing its near-term correction. Friday's market action makes this a possibility. The SPX tried to put an end to its declining pattern, but failed and fell back at the close, setting up the potential for some additional selling on Monday.

The entire corrective pattern bracketed by the blue trend lines will probably not be complete until the week starting on 8/23, in connection with a top-to-top 15-16 week cycle high.

The daily indicators appear to be supporting this time frame. Although overbought, they are not showing any negative divergence, and this means that there are probably higher prices ahead which may still have enough time to reach the 1144 projection.

Let's now move on to the Hourly Chart. The same blue channel line and median that was drawn on the daily chart is also shown here. The SPX has been trying to move through the median but without success, so far. Part of the reason is that 1099 and 1122 were both phase projections from the P&F base that was built in late June. When a projection is reached, a retracement occurs. This is why we pulled-back from the 1122 level. Another reason for this near-term down phase is that there is a 66-67-day cycle low which was due on Friday/Monday. I have just become aware of this cycle, and it should be helpful in assessing price movement in the future.

Friday, the index had a sharp sell-off in the first hour, found some buyers at its 1090 projection -- which happened to coincide with the 200-hr MA and the rising trend line -- and immediately had a sharp rebound. After a few hours of consolidation, it tried to extend the bounce to completely escape from its downtrend channel, but the attempted break-out could not muster enough support from the A/D, and it fell back at the close. Whether Monday will see additional corrective action, or the SPX will start up right away will depend on when the cycle makes its low.

The lower (A/D) oscillator was already showing strong positive divergence when the sell-off occurred in the first hour, and it continued upward during the rest of the day, but neither one of the two momentum indicators was able to make a decisive reversal. Monday should be a different story.

Cycles

A long-term cycle map was provided above.

Short-term, a 66-67-day cycle was due to bottom either Friday or Monday.

Projections

The SPX fell just a little short of the 1122 target and pulled back after reaching 1120.95. The small P&F distribution pattern which formed at this high gave a count to1090 which was reached on Friday, but there is also the potential for a lower one to 1075 which is still viable if the cycle has not yet made its low.

Breadth

The NYSE Summation index (courtesy of StockCharts.com) is in an uptrend which does not appear to be over. Even though the RSI has reached overbought status, it normally makes a larger top pattern than the current one before turning down.

Longer-term, the index is in a downtrend, and would have to rise to a new high to signal a new uptrend. This is not likely to happen and, instead, the index should make a series of lower lows before turning up.

Market Leaders and Sentiment

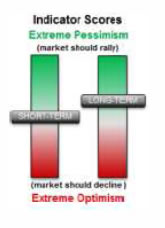

The SentimenTrader (courtesy of same) remains bullish. This supports the view that the uptrend which started on 7/01 has more to go before being exhausted.

Gold

Last week, GLD broke a short-term support level as well as a long-term trend line, and appears to have started an intermediate-term correction. After breaking the trend line, it had a typical back-test on Friday. If the break is genuine -- and the volume patterns seem to confirm that it is -- it should now continue its downtrend for some time to come.

The P&F chart has made a top which carries minimum downside implications of 1106, with an extension to 992-994 if the 102 support level does not hold.

Summary

The decline into the 4-yr cycle low, in October, started from 1219.54 on 4/26. It was interrupted by the bottoming of the 2-yr cycle, and this has caused a temporary upward corrective pattern which should be completed during the week starting on 8/23. After that, the downtrend should resume and find a low between 900-950. A more accurate projection will be given after the top of the correction is reached.

Announcement: Be sure to check-out my new website at www.marketurningpoints.com. It is 95% complete and only needs a few finishing touches.

If precision in market timing is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate the claims made by the following subscribers:

Thanks for all your help. You have done a superb job in what is obviously a difficult market to gauge. J.D.

Unbelievable call. U nailed it, and never backed off. C.S.

I hope you can teach me about the market and the cycles. I want to be like you and be the best at it. F.J.

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.