Are We Out of the Recession Yet?

Economics / Recession 2008 - 2010 Jul 31, 2010 - 04:58 PM GMTBy: John_Mauldin

Are We There Yet?

Are We There Yet?

Driving with No Spare

A Muddle Through Economy

Absent a Policy Mistake

"... [this economic condition] has been brought about by policies which the majority of economists recommended and even urged governments to pursue. We have indeed at the moment little cause for pride: as a profession we have made a mess of things."

- Friedrich August von Hayek, Nobel Speech 2010 1974

Those of us who have taken young children on long road trips to somewhere they wanted to go are familiar with the plaintive question "Are We There Yet?" As a nation and indeed the developed world, it is not unreasonable to be asking "Are We There Yet?" about the road to recovery. The NBER, those self-appointed economists who are the official keepers of the score sheet of recessions and recoveries, have yet to tell us we are out of recession. Yet the economy is growing. Kind of. Today we look at the most recent data on second-quarter US GDP (which came out this morning), and even though it is backward-looking data, we'll see what we can discern that might help us chart the direction of the future. And then, if there is time, I'll highlight what is a very serious and growing problem for our state and local governments. There is a lot to cover and so, with no "but firsts," let's dive in.

Are We There Yet?

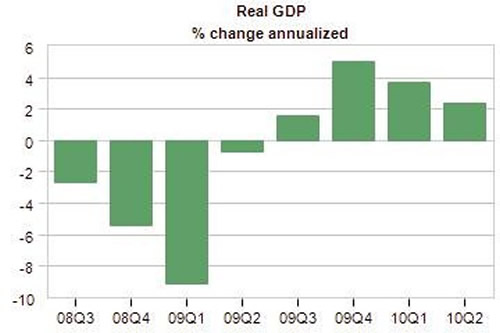

The economy of the US grew at a weaker than expected 2.4% in the second quarter, but the first quarter was revised back up to 3.7% on the strength of stronger-than-projected inventory rebuilding. But the recession years were revised downward rather significantly for this late in the cycle. We find now that the recession was worse than we thought, taking the economy down a total of 4.1% during the recession. As of today, we are not quite back to where we started, still down 1%. That means it is quite possible that we could finish the year and still not be "there yet." (To see a 1% rise in GDP we would need to see a 2% annualized rise for the rest of the year. We'll look at that possibility in a few paragraphs.)

Let's look at a few charts courtesy of the Dismal Scientist, at www.economy.com. First, recent GDP numbers:

If this were an average recovery, the economy would be growing at a 6% rate at this point, which pretty much says it all about our current 2.4% number. Further, 2.5 years after the beginning of a recession, we are typically already 8% higher than the prior high. This is a very tepid recovery, indeed.

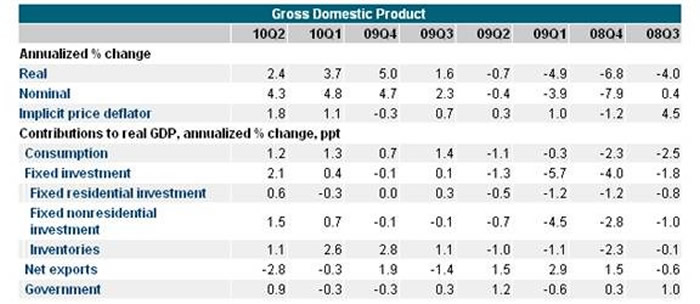

Now, let's look at the actual numbers.

There is a category called "Final Real Sales" you can create by subtracting the inventories number from the real GDP number. That reveals that final real sales grew by 1.3% last quarter. This is against what is normally a 4% number this far into a recovery. Is it any wonder that small businesses are asking "When will we get there?"

Next, look at the contribution from fixed residential investment. It has been negative or flat for six of the previous seven quarters. This time it added 0.6% to last quarter's GDP. But the housing market is lousy. What gives?

It seems that the housing tax credits induced home builders to increase construction by an annualized 28% last quarter. That was in spite of there being 18.9 million homes vacant in the US (an all-time high), and the number of foreclosures rising by as much as 100% in some cities. (Hat tip: David Rosenberg)

"Lenders are accelerating foreclosures as borrowers fall behind in mortgage payments after the worst housing crash since the Great Depression. A record 269,962 US homes were seized in the second quarter, according to RealtyTrac Inc. Foreclosures probably will top 1 million this year, the Irvine, California-based data company said in a July 15 report." (Daily Reckoning)

Ownership rates are falling and heading back to more traditional levels. Mortgage delinquencies are rising as the unemployment level stays persistently high. It is my guess that residential real estate will not contribute much if anything to GDP this quarter.

What about inventories? That has been a strength the last few years, adding a lot to our national growth. But inventory-to-sales ratios are at an 8-month high, which suggests that businesses may back off from increasing inventories at the recent pace.

Government spending? The bulk of the stimulus programs are going away in the latter half of the year, especially those that benefited state and local governments. Governments are slated to cut back spending or raise taxes by almost 1% of GDP. As many as 500,000 government employees may lose their jobs.

On a positive note, fixed nonresidential investments were the best they have been in several years. Let's hope that businesses keep it up!

A Muddle Through Economy

All that being said, if we take away housing and project slower inventory growth and less government spending, we could see the GDP number for this quarter fall to the 1% range and stay there for the rest of the year. Even the normally bullish Economy.com suggests that growth will be "sluggish" in the last half of the year. All in all, the very definition of a Muddle Through Economy.

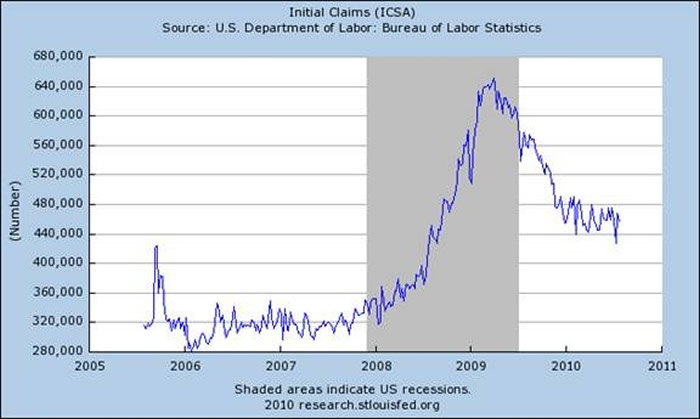

Until we start to see a real rise in employment, it is hard to get too enthusiastic. Everyone seems to be happy that initial claims have come down from their highs. But they have gone sideways for almost a year. Let's look at two charts. First, the last five years of initial claims.

Then a chart (courtesy of Bill King) which shows that continuing claims are at levels typically associated with recessions. This is not the stuff that "V"-shaped recoveries are made of.

Driving with No Spare

I was on CNBC and Fox this last Thursday to talk about deflation. On CNBC I was side by side with my good friend Paul McCulley. It is no secret that Paul is a rather liberal Democrat. He is all for increasing taxes on the rich. This spring he told me at my conference that tax increases on the rich do not have the same multiplier as those for everyone else, and so therefore taking the Bush tax cuts away will not threaten the economy. I, of course, think it will.

I called Paul up to chat before we went on together. I was quite surprised to learn that he now thinks the Bush tax cuts should be extended for maybe another two years.

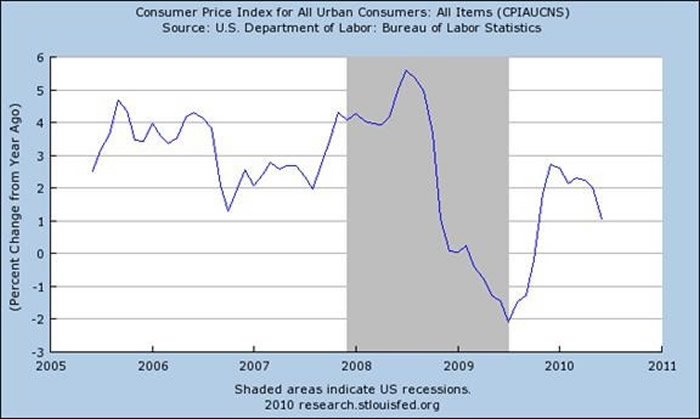

Why? We are both concerned about an unwelcome bout of deflation stemming from lack of final demand (as opposed to falling prices from increased productivity). Look at the graph below. Notice that prior to the beginning of the last recession inflation was running at a 4% clip and actually rose to above 5% before falling to a minus 2% and then rising to almost 3%. Since the beginning of the year, as the economy has softened, inflation has been steadily falling and is now at 1%. If the economy continues to falter, one would suspect that inflation could fall even lower.

If the economy were to tip into a recession with inflation so very low (or even near zero at the end of the year), the results could be very toxic. As Paul's colleague and my friend Mohamed El-Erian writes, we are driving our economic car without a spare tire. If we were to go into a deflationary recession, there is not much that government could do. Our deficits are already at dangerous levels, and a recession would mean that tax collections would fall further. The Fed has some policy room, but it is of a variety that has not been tried for a very long time. Frankly, we cannot be sure of the unintended consequences.

One of the guest hosts on Fox informed me that double-dip recessions are very rare things. And I agree. Absent a policy mistake it should not happen. But increasing taxes to the level that is now contemplated, along with spending cuts and tax increases at the state and local levels, is a very dangerous experiment with the economy being as soft as it is.

Absent a Policy Mistake

The key words are "absent a policy mistake." If the economy is growing at 3% and inflation is over 2%, if a majority thinks that taxes should be raised, then so be it. We would survive. But raising taxes in January is an experiment on our economic body without benefit of anesthesia.

Mark Haines (host at CNBC) rightly pointed out that there is a lot of sentiment for reducing the deficit, and was I against reducing the deficit? The answer is "no." But I want to do it with spending cuts and spending freezes until the economy is more vigorous and inflation is above target levels. And then let's see what Obama's tax commission comes up with in December.

This is a variant on Pascal's Wager. The losses are very large if we fall back into recession: Increased unemployment on top of already high levels. Reduced tax receipts. A very sick stock market. The world will suffer from our reduced demand. The cost to prevent that outcome? We forego a few hundred billion in the next year against the deficit.

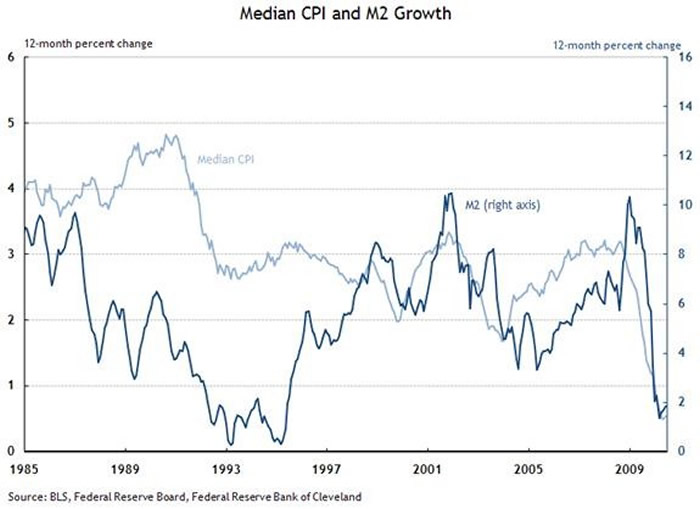

One last thought. The correlation between CPI and M2 has risen to -.85 in the last 15 or so years. M2 is continuing to fall, as is the velocity of money. Just one more reason to wait until there is clear evidence of a real recovery.

Ok, one more last thought. One of the guys on Fox (you can't see who, in a remote studio) said we shouldn't worry about inflation because corporate profits are doing well. Really? That seems to be the bull argument everywhere for everything. Look at the above chart. Corporate profits have been rising as inflation and M2 have been falling, as bank lending is imploding, as capacity utilization is at recession-era levels, unemployment is outrageously high, savings rates are back up to 6% (see below), and consumer spending is abnormally weak compared to what it should be after a recession.

When those corporate profits start turning into jobs, when we can see pricing power in the markets, then we can possibly say that there is a correlation between profits and inflation.

Maine and Turks, Etc.

I fly to Minneapolis on Sunday for a speech on Monday morning, then back to Dallas that afternoon. On Wednesday I fly with my youngest son, Trey (16), to New York. Larry Kudlow is planning on working me into the show on Wednesday, so watch or hit your record button. Then Trey and I are off to Maine for the annual Shadow Fed fishing trip hosted by David Kotok. This year Bloomberg will be covering it on Friday. Then it's back to NYC on Sunday for some meetings, on to Washington DC for a Tuesday consulting gig for the Defense Department, and then down to Miami and off for five days to the Turks and Caicos with Barry Habib and his family.

I am still working on the book, and we will have a full rough draft in the next few days. I am very happy with the way it is coming together.

Some of my readers know that every year for the last four years Trey has caught more fish than I have. That is a little frustrating. This year, one of my readers has sent me some special hi-tech lures. If they work, I will give you a link. Maybe Dad can finally come into camp without Trey bragging about how much better a fisherman he is (which is unfortunately true).

It is time to hit the send button. Have a great week.

Your hoping for lots of tight lines analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.