Solving the Great Disconnect Between Stock Market and Economic Reality

Stock-Markets / Stock Markets 2010 Jul 31, 2010 - 03:26 PM GMTBy: Mike_Larson

We have a “Great Disconnect” on our hands.

We have a “Great Disconnect” on our hands.

On Monday, the Federal Reserve Bank of Dallas released its latest manufacturing survey. This wasn’t old, stale data; the survey was conducted in mid-July. And the results were awful, with the headline index plunging to -21 from -4 a month earlier. That was the worst showing in a year.

Yet the Dow Jones Industrial Average jumped 101 points. That happened in large part because FedEx boosted its 2010 earnings target.

Or how about what happened a few days earlier? The ECRI released its latest weekly leading index, and the results were dismal once again …

The index slumped to -10.5 percent, the worst reading going all the way back to May 2009. Every single time this indicator has slipped into double-digit negative territory, a recession has followed. Every single time.

Yet that Friday, the Dow ramped 102 points. A few reasons? Honeywell and Verizon topped earnings targets, while companies such as Ford talked about a brighter 2011.

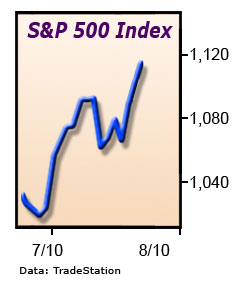

|

The disconnect showed up yet again on Tuesday when the Richmond Fed released its regional business activity index for July …

The index slumped for the third month in a row, with new orders plunging and capacity utilization slumping big-time. Consumer confidence also tanked, with the Conference Board’s index slipping to 50.4 from 54.3. That’s the worst reading since February.

The market response? A collective shrug. The Dow finished slightly higher, while the S&P 500 lost all of a point.

You can get the bullish spin on the disconnect from CNBC. Pundits claim investors are ignoring the bad economic news because things are about to turn, and because company comments should outweigh macroeconomic data.

My take is entirely different — and if I’m right about what’s really going on, it has serious implications for your investing strategy!

Companies Can’t — or Don’t Want to — See the Train Bearing Down on Them!

If you were to climb into a time machine and go back to late 1999 and early 2000, you’d hear corporate executives waxing extremely bullish about their prospects. The heads of Cisco, Intel, Amazon.com, and many others saw nothing but rainbows and blue skies ahead. This continued even as leading economic indicators began to slump.

Sure enough, the economy eventually fell apart. And all those bullish pronouncements proved not to be worth a warm cup of spit!

Or how about Enron and WorldCom?

|

Those stocks initially soared when their executives said business was booming. But reality came crashing down eventually. Once again, investors who listened to the chatter coming out of corporate boardrooms got their heads handed to them.

What about a more recent example — say, in home building, or mortgage lending? You should go back and listen to the conference calls, or read the transcripts from 2005 or 2006. These guys were falling all over themselves talking about the new paradigm in housing … the surging sales … the soaring prices.

They continued to spout happy talk even as the underlying, empirical economic data and leading indicators began to roll over. Result: Yet another pasting for anyone who listened to the supposedly clued-in execs.

It’s hard not to conclude that corporate America is full of liars, cheats, and charlatans. And in SOME instances, that’s exactly the case. But more is going on here …

For starters, corporate execs extrapolate too much from current trends. If sales are improving or even booming, say, because of the biggest government bailouts and stimulus packages in the history of the world, they tend to view the trend as sustainable. That forms the basis of their forward projections, including the ones given on earnings conference calls.

But that tendency is precisely the most dangerous at turning points in the underlying economy!

Investors who believe optimistic CEOs — even as the economy is entering a recession — will invariably get killed. Those forward projections will end up being sharply revised, and the companies’ shares will tank.

Here’s something else to consider: CEOs depend on positive market perceptions of their prospects. That’s because most of these guys have thousands and thousands of company shares in their portfolios.

If a corporate CEO came on the phone during a conference call and said: “You know what guys? Business stinks, and it’s getting worse. Better sell your stock … fast!” what do you think would happen?

The stock would tank, and his or her personal wealth would evaporate. So of course most CEOs are going to talk a big game.

|

In the current economic environment, something else is going on too. The U.S. economy is stuck in the mire. But overseas economies … particularly in Asia … are still doing well.

So multinational companies that have exposure to those healthier regions are temporarily able to offset their lousy U.S. operations with foreign strength. That was definitely the case with FedEx, to cite just one example.

Your Job and Mine: Cut Through the B.S.!

As investors, we have a very important job. We have to cut through the B.S. coming from corporate America and make judgments about what’s REALLY going on — then act on those judgments before the guys in the corner offices around this country tell us: “You know what, you were right.”

When I survey the economic landscape, I see:

- Consumer confidence falling to multi-month lows,

- Regional manufacturing indices falling off a cliff,

- Banks lending less money, and mortgage and consumer credit plunging, and

- Durable goods orders falling, and job creation completely MIA.

And against that, I hear plenty of optimistic comments from corporate execs who stand to benefit by talking up their prospects.

It should be pretty clear by now where I’m casting my lot … and where I think you should too!

Until next time,

Mike

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.