Agnico-Eagle Mines Limited: Record Quarterly Revenue

Companies / Gold & Silver Stocks Jul 29, 2010 - 03:33 AM GMTBy: Bob_Kirtley

The general consensus for the quarterly income for Agnico-Eagle Mines Limited (AEM) was in the order of $0.40 per share, however, news just out has the figure higher at $0.64 per share for the second quarter, compared with a penny per share for the same period last year. The effect of their new mines construction programme going into production is starting to produce the results that we have been waiting for.

Sean Boyd, Vice-Chairman and Chief Executive Officer, who will be appearing on BNN tomorrow and always worth listening to had this to say:

“Our record quarterly financial results were driven by record gold production as all six of our mines operated throughout the quarter for the first time. Four of the mines are now operating at steady state with the other two in the late stages of optimization. Further increases in gold production and lower cash operating costs are expected in the second half of 2010 as we continue to optimize all our mines and focus on driving down the unit costs at our Kittila and Meadowbank mines,”

Agnico-Eagle also expects that its full year total cash cost per ounce is likely to be in the range of $425 to $450 which is no mean achievement, along with quarterly gold production of 257,728 ounces and revenue of $353.9 million resulting in net earnings of $100.4 million. Going forward the company anticipates that gold production will be in line with previous guidance of between 1.0 and 1.1 million ounces. Agnico’s current Cash and cash equivalents stands at $152.8 million as of 30 June 2010, largely due to the increase in gold production.

This stock forms part of our core portfolio so its fingers crossed as we struggle through the summer doldrums.

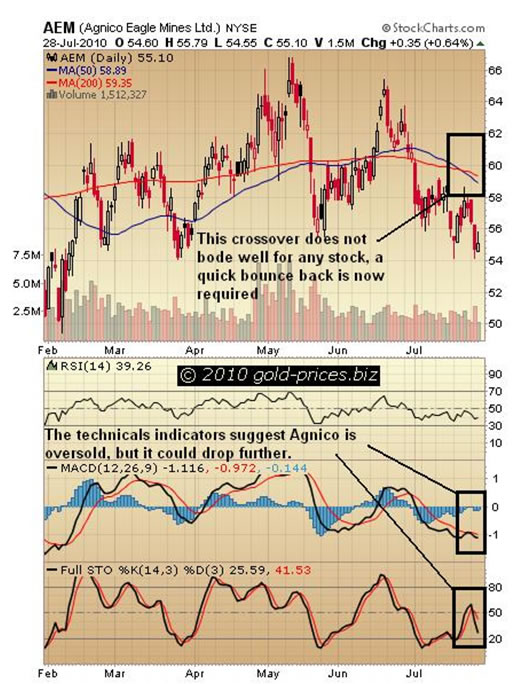

Turning to the above chart we can see that the 50dma has crossed over the 200dma in a downward motion which does not bode well for any stock, hopefully, now that Agnico is the the ‘optimization’ phase of production we will see a quick bounce back. The technical indicators suggest Agnico is oversold somewhat at the moment however the stock price could still fall a little further before we get to Labour Day which this year is on the 6th September 2010. Should there be a spike down then that would be the time that we will look to add a few more shares to out portfolio.

Agnico-Eagle Mines Limited trades on the NYSE under the ticker symbol of AEM and on the Toronto Stock Exchange under the symbol of AEM.TO.

Agnico-Eagle has a market capitalization of $8.64 billion, a 52 week trading range of $49.64 - $74.00, a rather high P/E ratio of 162.49 on volume of 1-2 million shares traded per day.

Stay on your toes and have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

The latest trade from our options team was slightly more sophisticated in that we shorted a PUT as follows:

Recently our premium options trading service OPTIONTRADER has been putting in a great performance, the last 16 trades with an average gain of 42.73% per trade, in an average of just under 38 days per trade. Click here to sign up or find out more.

Silver-prices.net have been rather fortunate to close both the $15.00 and the$16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.