Charting the Stock Market is Similar to Tracking a Squirrel Crossing a Busy Street

Stock-Markets / Stock Markets 2010 Jul 25, 2010 - 12:34 PM GMTBy: Guy_Lerner

Glenn Holderreed of Quacera Capital Management and the QPM Radar sent me an email the other day describing the market:

Glenn Holderreed of Quacera Capital Management and the QPM Radar sent me an email the other day describing the market:

"Charting this market is similar to tracking the moves of a squirrel crossing a busy street. Quickly moving to the middle, no better turn back, no, no, I can make it across, oh no I better go back, shucks I can make it across. Sometimes they make it, but many get flattened. I think there are a few flattened in this market."

For the better part of 8 weeks, prices on the S&P500 have gyrated above and below our key pivots causing two failed signals. This past week has yielded a third buy signal as prices are back above the key pivot of 107.58 on the S&P Depository Receipts (symbol: SPY). This area was resistance, but old resistance now becomes new support. These whipsaws certainly have had this squirrel chasing nuts and like many in this market, I have been driven nuts.

For the record, the PowerShares QQQ Trust (symbol:QQQQ) is above its key pivot at 45.01, and this is only the second signal in 8 weeks. The prior signal was a failure. 45.01 is now support.

With regards to investor sentiment, the "dumb money" remains bearish (i.e., bull signal) and the "smart money" and company insiders never really got super bullish with the current down draft and they continue their indifference to the market. I would interpret this set of circumstances as the following: 1) prices are above key pivot points and this is bullish; 2) investors remain bearish on the market and this should provide buying support if prices drop below current levels; 3) the market should continue to grind higher as the "smart money" continues its indifference.

The last 8 weeks and probably for several months prior, market participants have considered the possibility of a world economic slowdown and a double dip recession here in the USA. These concerns (rightly or wrongly) have subsided over the past two weeks as earnings and economic data out of Europe have buoyed investor optimism once again. The past 8 weeks of up and down price action has clearly reflected the concerns of investors. Failed signals are the kind of technical signs that I would expect prior to a bear market, and they should be respected. On the other hand, closes above key resistance levels can lead to powerful market moves. Being whipsawed in and out of the market (as we have experienced over the past 8 weeks) is not pleasant as you are zigging when you should be zagging. Whipsaws are a reality of trading.

I suspect for the immediate future we will end up somewhere between these two extremes. The markets won't be a pure bummer, but I don't see a real barn burner either. Unfortunately, despite the possibility of future whipsaws, I still see the need to honor my signals.

The "Dumb Money" indicator (see figure 1) looks for extremes in the data from 4 different groups of investors who historically have been wrong on the market: 1) Investor Intelligence; 2) Market Vane; 3) American Association of Individual Investors; and 4) the put call ratio. The "Dumb Money" indicator is now bearish for four weeks in a row.

Figure 1. "Dumb Money"/ weekly

The "Smart Money" indicator is shown in figure 2. The "smart money indicator is a composite of the following data: 1) public to specialist short ratio; 2) specialist short to total short ratio; 3) SP100 option traders. The "Smart Money" indicator is neutral.

Figure 2. "Smart Money"/weekly

Figure 3 is a weekly chart of the S&P500 with the InsiderScore "entire market” value in the lower panel. From the InsiderScore weekly report: "buyers stay stagnant".

Figure 3. InsiderScore "Entire Market" Value/ weekly

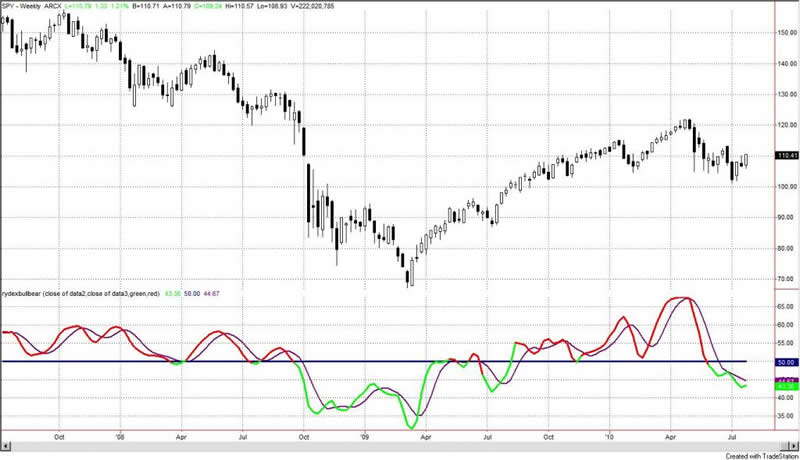

Figure 4 is a weekly chart of the S&P500. The indicator in the lower panel measures all the assets in the Rydex bullish oriented equity funds divided by the sum of assets in the bullish oriented equity funds plus the assets in the bearish oriented equity funds. When the indicator is green, the value is low and there is fear in the market; this is where market bottoms are forged. When the indicator is red, there is complacency in the market. There are too many bulls and this is when market advances stall.

Currently, the value of the indicator is 43.36%. Values less than 50% are associated with market bottoms. This is the lowest value since July, 2009.

Figure 4. Rydex Total Bull v. Total Bear/ weekly

Improve your market timing withPremium Content from TheTechnicalTake. For a nominal yearly fee, you will get a unique data set that will show you which way investors (i.e., bull market geniuses) are leaning.

To subscribe to Premium Content click here: Subscribe

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2010 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.