Stocks Bull Markets Generate Economic Growth

Stock-Markets / Financial Markets 2010 Jul 25, 2010 - 11:57 AM GMTBy: Nadeem_Walayat

The UK economy is booming! 1.1% growth for Q2 2010 annualises to 4.4%. The academic economists that populate the mainstream press were caught off guard again! with growth expectations ranging from 0.3% to 0.5%. As is usually the case the excuses button was pressed to try and mask the fact that they to all intents and purposes remain clueless on the direction of UK Economy with much press chatter focused on an non existant double dip recession.

The UK economy is booming! 1.1% growth for Q2 2010 annualises to 4.4%. The academic economists that populate the mainstream press were caught off guard again! with growth expectations ranging from 0.3% to 0.5%. As is usually the case the excuses button was pressed to try and mask the fact that they to all intents and purposes remain clueless on the direction of UK Economy with much press chatter focused on an non existant double dip recession.

Actual growth for the first half of 2010 now totals 1.5% which is is line with my expectations for strong growth during 2010 that targets UK GDP +2.8% as per the GDP forecast of december 2009 (UK Economy GDP Growth Forecast 2010 and 2011, The Stealth Election Boom ). This compares against forecasts of the OECD, IMF, E.U., and CBI that had penciled in UK growth of just 1% for the whole of 2010.

As is usually the case, the press and academic economists remain permanently fixated on looking through the rear view mirror, writing reams and reams to explain what has already happened. Whilst their response to one of the greatest drivers for economic growth is to state that that the stock market is detached from reality. Yes I said DRIVER, not LEAD INDICATOR which is the consensus view that the stock market rises to discount future economic growth, which is not quite accurate, a rising stock market acts as a strong positive feed back loop that GENERATES economic growth, that GENERATES RISING Corporate Earnings.

This is why the vast majority of analysts that are fixated on valuations and corporate earnings conclude that stocks cannot rise because they are over valued by as much as 40%. When the reality is that the stock market TREND MANIFESTS the reality, as I pointed out in Mid March 2009 (Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470) whilst many prominent analysts were stating that stocks could not rise due to the fact that corporate earnings were expected to collapse.

The bottom line - The stock market as a whole does not FOLLOW or LEAD, it GENERATES economic activity. The same can be applied to other major asset classes such as the housing market. But there the mistake that analysts make is that they fail to recognise that asset classes cycle. I.e. For a number of years housing can be the economic growth generator, at other times it can be stocks. If you get both strongly trending well above inflation then you get a boom. Similarly if both are falling then the markets are going to GENERATE a recession.

The dark pools of capital understand this, the Fed understands this, now you have also joined that exclusive club. One could generate a formula based on the real terms change in total valuations of all publically held assets i.e. housing, stocks, savings and bonds to determine the net impact on the economy to create a future trend path for the economy.

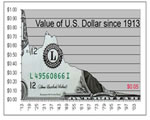

Inflation Mega-trend - The stock market tail along with other asset classes wags the economic dog by means of the derivatives market that has increased by $150 trillion DURING the credit crisis which is why deflationists are wrong, as by focusing on contracting bank lending or the Fed's balance sheet they are merely looking at the ripples on the surface of an inflationary ocean. As the banks start to lend again there will be an accelerating flood of money that no central bank will be able to prevent the inflationary consequences of.

Stock Market Trend - The Dow fell to a low of 10,007, and put in the anticipated higher low in preparation for a break above resistance at 10,407 as indicated last weekend (Stocks Stealth Bull Market Correction Generating China Buying Opportunity? ), that occurred this week with the Dow closing at 10,425. The Dow continues to target a trend to 10,700 as per the last in depth analysis (16 May 2010 - Stocks Bull Market Hits Eurozone Debt Crisis Brick Wall, Forecast Into July 2010) as illustrated below, with the actual trend having shifted a few weeks to the right due to putting in a later low.

Perma bears have now gone silent after having been busted once more, a couple of months ago Nouriel Roubini was forecasting that the Dow would fall by 20% over the next few months (23 May 2010 - Nouriel Roubini Stock Market 20% Drop Forecast, Time to Buy?), instead the Dow is still trading higher than where it was when he made the forecast, which matches every stock forecast made by Roubini that has turned out to be wrong for the duration of this stocks bull market, with other prominent media star analysts not far behind.

An in depth update is now pending that will seek to map out a trend for the next few months that I aim to complete sometime during the next 2 weeks.

The trend pattern remains for a corrective trading range in preparation for a blast off towards a 2010 target of 12,000 to 12,500 as illustrated by the below graph from the Inflation Mega-Trend Ebook (FREE DOWNLOAD). The current action signals a market that is preparing to test the bull market high.

Gold - Gold had a stable week by closing a little higher on the week at 1,189. My expectations are for Gold to target 1,140 in advance of a break to new highs to target to $1333 later this year. However my last in depth gold analysis now dates back to November 2009, therefore now requires a major update.

European Bank Stress Tests

The E.U. published its fantasy land Bank stress tests on Friday, which are based on fantasy assumptions of VERY mild recessions of just -0.4% and no sovereign debt defaults despite the fact the recessions are usually 5 Times as severe as that which has been tested for and countries such as Greece are directly heading towards default within the next 2 years which effectively means that rather than 7 banks failing the stress test, a real stress test would have indicated at least 70 of the 91 banks would have failed the stress test.

The european politicians are desperate to persuade the markets that another banking crisis is not imminent, in the meantime they intend on immunising their banks against an inevitable sovereign debt default as now they know exactly what exposure the banks have to Greek, Spanish and Portuguese debt, so know how much potential losses would need to be covered by primarily German tax payers.

Comments and Source: http://www.marketoracle.co.uk/Article21385.html

Your not too stressed analyst.

By Nadeem Walayat

Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. China: The US Is "Insolvent and Faces Bankruptcy" |

By: Jesse

The common thought amongst even reasonably educated and economically literate Americans is that China is 'stuck with US Treasuries' and has no choice, so it must perform within the status quo and do as the US wishes, or face a ruinous decline in their reserve holdings of US Treasuries.

| 2. The Debt Supercycle Path to Profligacy and End Game |

By: John_Mauldin

I have been writing about The End Game for some time now. And writing a book of the same title. Consequently, I have been thinking a lot about how the credit crisis evolved into the sovereign debt crisis, and how it all ends. Today we explore a few musings I have had of late, while we look at some very interesting research. What will a world look like as a variety of nations have to deal with the end of their Debt Supercycle. We'll jump right in with no "but first's" this week.

| 3. 72 Analysts Believe Gold Will Go Parabolic To Between $2,500 and $15,000! |

By: Lorimer_Wilson

Believe it or not but I have identified 72 economists, academics, gold analysts and market commentators who have developed sound rationale as to why gold could quite possibly go to a parabolic top of at least $2,500 an ounce to even as much as an unimaginable $15,000 before the bubble finally pops!

| 4. U.S. Treasury Bond Fraud and Debt Monetization |

By: Jim_Willie_CB

A significant feature of fiat money systems is the privilege for the custodian to commit fraud, big fraud, gargantuan fraud, even counterfeit. Fannie Mae might function as the clearinghouse for numerous massive role programs with $trillion fraud behind each, hidden from view, especially since it was conveniently nationalized. Follow some other fraud schemes, right out in the open. Surely such recount only touches the surface, but these shenanigans are advanced forms of fraud. They are smoking guns of USTreasury fraud and counterfeit, with strong whiffs of monetization. Much more monetization is to come, fully endorsed and sanctioned. Other clever techniques are being used, given the Quantitative Easing has officially been halted.

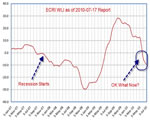

| 5. ECRI Paranoid About Calling a Double Dip Recession |

By: Mike_Shedlock

Inquiring minds have been watching the ECRI's weekly leading index plunge nonstop since October of 2009. Moreover the WLI has been in negative territory for 6 consecutive weeks

| 6. Welfare and Warfare, Paying the Price for the Baby Boomers Generation |

By: James_Quinn

Most people in America associate the Democratic Party with spending on welfare programs and the Republican Party with spending on warfare. Until reading Niall Ferguson’s brilliant The Ascent of Money, I never realized that welfare and warfare have gone hand in hand for over a century. The immortal German warmonger Otto von Bismarck was the first politician to introduce social insurance legislation in the 1880s. His reasoning was not strictly humanitarian. According to Bismarck, “A man who has a pension for his old age is much easier to deal with than a man without that prospect.” Bismarck was a shrewd politician who realized that when you provide people something for nothing, they will vote for you.

| 7. Stocks Stealth Bull Market Correction Generating China Buying Opportunity? |

By: Nadeem_Walayat

China - You will no doubt have heard much about the start of the great chinese stocks bear market as the Shanghai SSEC index has fallen below 2,500 to currently stand at 2,424. In my opinion the whole trend off of the high is a correction and therefore represents a opportunity to buy at bargain prices.

| 8. Consumer Confidence Collapsing, Economy Sinking Investor Profit Bonanzas |

By: Martin_D_Weiss

Rarely are the signs of an economic downturn as clear as they are today — collapsing consumer confidence, sinking retail sales, another round of housing market troubles, and much more.

And even more rarely do we see the stock market defy those signs like it did through Thursday of last week — finally succumbing, however, on Friday with the Dow’s 261-point decline.

| Subscription |

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2010 MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055. Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.