Stocks Stealth Bull Market Correction Generating China Buying Opportunity?

News_Letter / Financial Markets 2010 Jul 25, 2010 - 11:53 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

July 18th, 2010 Issue #42 Vol. 4

Stocks Stealth Bull Market Correction Generating China Buying Opportunity?Inflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader China - You will no doubt have heard much about the start of the great chinese stocks bear market as the Shanghai SSEC index has fallen below 2,500 to currently stand at 2,424. In my opinion the whole trend off of the high is a correction and therefore represents a opportunity to buy at bargain prices. Although whilst perma bears focus on the SSEC index, actual investor experience is better illustrated by the key China ETF FXI which shows a consolidating corrective trend rather than what one would term as a bear market.

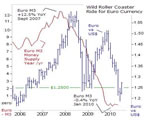

China's wages are rising fast which means rising inflation which will be exported abroad to the west, a year from now deflationists will be using this as an excuse for still being wrong as inflation persists. Those looking for china's economy to go bust, will probably be waiting for several more decades as higher wages means more domestic consumption as the chinese consumer continues to play catch up to western consumers. Bottom Line - China's stock market is not peering over the edge of the abyss as many commentators are suggesting, in fact i consider it at one of those March 2009-esk moments. China's Economy will more than double over the next decade which will send the SSEC several multiples higher. Watch as a year from now with SSEC trading at new bull market highs the bears will again emerge to call for another top, conveniently forgetting what was stated right at the very bottom! More on the emerging market mega-trends for China, India and Brazil in the Inflation Mega-Trend Ebook (FREE DOWNLOAD). Dow - An early week high of 10,407 failed to break above resistance, the subsequent down trend accelerated into Fridays close of 10,097 which is inline with last weekends analysis (11 Jul 2010 - Stock Market and Gold Summer Correction, Remember White Swans Out Number Black Swans ) that concluded towards the Dow targeting a low in the region of 9,800 to 10,000 (target low price 9875). This weeks technical picture remains of bearish lower highs and lows which demands a pattern breaking higher high at approx 9,900 to act as a spring board for a break above resistance which now stands at 10,407. The bigger picture remains of a stock market trading within a corrective range. The stocks bull market remains firmly in stealth mode, the perma flash crashers will emerge once again to warn of an imminent crash as a consequence of the stocks death cross just as the market turns higher. Gold - Gold's drift lower to end the week at $1188 is Inline with last weekends quick analysis for a continuing correction that targets $1140 from $1220, which I expected to be followed by a trend to target of at least $1333 by late 2010. U.S. Inflation - Deflationists have been ignoring CPI Inflation for most of of 2010 as being at 2% meant reality did not match the "theory". The latest data shows that U.S. CPI has dipped for 3 consecutive months triggering deflationists focus back on to U.S. CPI with cry's of DEFLATION !, Though still ignoring the fact that year on year US inflation is still at 1.1%. The trend is inline with expectations for U.S. CPI to target a rate of 1% by end of 2010 (16 Jun 2010 - The Inflation Mega-Trend Continues With UK CPI 3.4%, RPI 5.1% ). Are Deflationists Delusional? This is never been more evident in the manifestation of now pricing everything in terms of the Gold price so as to illustrate that everything has deflated in terms of purchasing power in Gold. Really, this is so foolish that it is unbelievable in that it IGNORES the fact that the rise in the price of gold IS a manifestation of INFLATION as DEFLATION would have resulted in a FALLING GOLD PRICE, big name deflationists have been telling you for much of the past decade that Gold CANNOT RISE because of DEFLATION, now after it has more than doubled, it is perversely being used to illustrate that DEFLATION has taken place over the past decade. BP - BP has finally plugged the gulf oil gusher and promised to make full recompense, but U.S. Politicians are hell bent on nailing the lid on BP's coffin as the crisis extends in all directions into the political arena far removed from the Gulf with U.S. politicians now demanding British / Scottish Governments to answer what role BP played in the release of Lockerbie bombing suspect Al Megrahi last year. As ever once you start pulling hard on a thread then the whole tapestry starts to unravel towards unforeseen consequences such as the people of Britain wondering what the hell is the UK doing still fighting, dieing and losing in Afghanistan some 8 years on ? Meanwhile where BP is concerned, the greater the anti-BP rhetoric, the greater the probability of a bid. Comments and Source: http://www.marketoracle.co.uk/Article21199.html Your analyst preparing to complete several strands of in-depth analysis this coming week. By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: DK_Matai Gas and Methane Levels At Record As much as one million times the normal level of methane is showing up near the Gulf of Mexico oil gusher, enough potentially to create dead zones in the water. "These are higher levels than we have ever seen at any other location in the ocean itself," according to sources cited by Reuters. The "flow team" of the US Geological Survey estimates that 2,900 cubic feet of natural gas, which primarily contains methane, is being released into the Gulf waters with every barrel of oil.

By: JD_Rosendahl The stock market rebounded quite strongly all week and took the bearish tone off the market for now. Something I wrote about a few days ago was the theory of the Time Symmetry Head and Shoulders Pattern. See the daily chart of the DOW below.

By: Jon D. Markman Stocks zipped higher in the past week, capping the first four-day rally since early 2009. Get out the party hats and confetti, right? Bears tried to knock shares lower on Tuesday and early Thursday, but after they failed bids hit the tape in a big way and gave it lift.

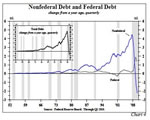

By: John_Mauldin I look forward at the beginning of every quarter to receiving the Quarterly Outlook from Hoisington Investment Management. They have been prominent proponents of the view that deflation is the problem, stemming from a variety of factors, and write about their views in a very clear and concise manner. This quarter's letter is no exception, where they once again delve into the history books to bring up fresh and relevant lessons for today. This is a must read piece.

By: Jim_Willie_CB UK inflation for June 2010 registered a small drop from 3.4% to 3.2%, though remaining stubbornly above the Bank of England's upper limit of 3%, thus the BoE Governor, Mervyn King will write yet another letter to repeat that the high rate of inflation is just "temporary", though when does "temporary" high inflation stop being temporary? 6 months? a year? 2 years? as the country sleep walks into stagflation with all of the consequences for wage earners and savers.

By: Lorimer_Wilson Almost 70 respected economists, academics, gold analysts and market commentators (see list below) are of the firm opinion that gold is going to go to at least $2,500 if not as high as $10,000 per ounce (or more) before the parabolic top is reached. As such, just imagine what is in store for silver given its historical price relationship with gold. We’re looking at an extreme case scenario of a future parabolic top of perhaps as much as $714 per ounce for silver, the ‘poor man’s gold’. Let me explain.

By: Henry A. Giroux We live at a time that might be appropriately called the age of the disappearing intellectual, a disappearance that marks with disgrace a particularly dangerous period in American history. While there are plenty of talking heads spewing lies, insults and nonsense in the various media, it would be wrong to suggest that these right-wing populist are intellectuals

By: Ronald_Rosen To put it mildly, more than a telescope will be needed to find the silver lining on the silver charts posted in this update.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.