Bernankes Unusually Uncertain Gloom Impacts Markets

Stock-Markets / Stock Markets 2010 Jul 22, 2010 - 09:41 AM GMTBy: PaddyPowerTrader

US Fed Chairman Bernanke’s semi annual testimony on the Hill proved to be the game changer for stocks yesterday. Just as they had bounced Tuesday on whispers that he may offer fresh new policy measures, accommodation to support the markets, re-stimulate the flagging economy so stocks sold off Wednesday when he failed to deliver such. His comments were basically a rehash of the FOMC minutes (i.e. a fairly dour assessment of the economy) with one added Greenspan like euphemism for our lexicon i.e. that the outlook for the economy is “unusually uncertain”.

US Fed Chairman Bernanke’s semi annual testimony on the Hill proved to be the game changer for stocks yesterday. Just as they had bounced Tuesday on whispers that he may offer fresh new policy measures, accommodation to support the markets, re-stimulate the flagging economy so stocks sold off Wednesday when he failed to deliver such. His comments were basically a rehash of the FOMC minutes (i.e. a fairly dour assessment of the economy) with one added Greenspan like euphemism for our lexicon i.e. that the outlook for the economy is “unusually uncertain”.

After three years of uncertainty, that’s quite a statement for the chairman of the FOMC to make. The 1.3% fall in the SP 500 comes despite that of the 30 SP 500 firms that reported yesterday 90% beat Street EPS forecast with two thirds also ahead of consensus on revenues. Earnings fatigue anyone?

Today European equities have bucked the trend of falling prices in both Asia and North America, marking gains in excess of 1.5% during the session. A series of European data releases has indicated that the regional economy has been resilient to the recent sovereign debt crisis with advanced manufacturing and service PMI data both stronger than expected. Euro area industrial orders also grew at a brisk pace.

Today’s Market Moving Stories

•The much anticipated European banking stress tests results release time may be brought forward European Union regulators are considering releasing the results of bank stress tests tomorrow at 07:00 BST rather than at 17:00 BST as originally planned, newswires report. This is to prevent the release of information when the US market is open while European markets are closed and unable to react to any information. However, there is no official confirmation of any change in plan yet. A confidential draft template from the Committee of European Banking Supervisors (CEBS) showed that, as part of the adverse scenario of ’sovereign shock’, banks are required to publish a list of each lender’s gross and net exposure to central and local governments in 30 countries in Europe, including Greece, Spain, Ireland, Italy and Portugal. They are also asked to provide details of whether they booked their sovereign debt holdings in the banking or trading book.

•BOE MPC member Spencer Dale tells The Independent: “The near term outlook for both growth and inflation has deteriorated over the past couple of months. Inflation has come out a little higher than expected, and the news on VAT in the June Budget means that the time it will take inflation to get back to target will be pushed out, and I expect it will be above target until the end of next year.” He added “there are some signs that growth may be softening, again partly reflecting the June Budget … [and] there’s also the greater question of how things develop as countries around the world accelerate their fiscal consolidation plans.” The economy, said Mr Dale, would not return to normal “for an awfully long time”.

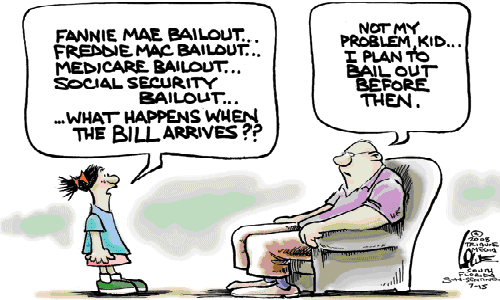

•The US housing market is about to hit a double dip decline. This is important news because of the impact of the US housing market on the US economy, and the impact of the US economy on the global economy. The best source of information on the US housing market comments on the latest survey by the Wall Street Journal, according to which inventories have gone up in 28 large metropolitan areas, and that newly signed contracts have plunged. Calculated Risk says the general problem is excess supply at current prices. Market clearing will only occur if prices fall again. The blog also makes the point that Obama’s housing tax credit was an unmitigated failure because it only benefited those buyers who would have bought anyway. The outcome of this constellation is now another period of falling house prices. And we all know what that means for the stability of the financial system, and the economy at large. And is China’s property market may be about to crash A very interesting article produces a proper metric for China’s land price by sampling 300 land auction prices. A paper by Jing Wu, Joseph Gyourko, and Yongheng Deng finds that since 2003, China’s property price rose by 800%, with half the increase coming in the last couple of years. Hamilton’s article also notes that the Shanghai stock market has fallen by a lot more than European stock markets this year down 20% as opposed to down 10% in Europe. This shows that the bubble is already deflating.

•France and Germany reach agreement on economic coordination one that stands no chance in hell of adoption In an effort to demonstrate the virility of the Franco-German relationship, the two countries agreed on a list of policy co-ordination proposals that stand no chance of adoption, as Wolfgang Schauble took part in a French cabinet meeting, during which Sarkozy called for a complete harmonisation of tax systems. On the substantive issue of policy co-ordination, the two sides agreed that they want to co-ordinate more and better, according to Le Monde they also want deficit sinners to be punished through a withdrawal of voting rights in the Council, and the imposition of a fine for member states with excessive deficits, and the imposition of an interest bearing deposit for member states that fail to bring their fiscal deficits in order. In other words, France and Germany to continue to the same dysfunction regime, except that they strengthen those parts that prove the most dysfunctional.

•Euro area manufacturing PMI came in stronger than expected at 56.5. Industrial orders rise 3.8% m/m. While UK retail sales were stronger than expected, rising 1% m/m excluding autos and fuel.

Irish Banks Rumoured to Pass Tests

Bloomberg are reporting that both Bank of Ireland, Allied Irish are to Pass EU’s Stress Tests. “Bank of Ireland Plc and Allied Irish Banks Plc, the country’s two biggest banks, are both set to pass the European Union’s stress tests on the region’s lenders, according to a person with direct knowledge of the matter. Bank of Ireland’s €2.9 bn ($3.7 bn) fundraising last month gave the lender enough capital to meet the threshold set by EU regulators, said the person, who declined to be identified because the talks are private. Allied Irish, the second biggest lender by market value, passed because regulators included in their calculations the €7.4 bn the bank plans to raise by the end of the year, said another person who declined to be identified.

The Committee of European Banking Supervisors, which is coordinating the tests, may yet alter its calculations for Dublin based Allied Irish, one of the people said. The lender is selling overseas assets, including its stakes in Poland’s Bank Zachodni WBK SA and MT Bank Corp. of the U.S., to raise the capital it needs. Chairman Dan O’Connor told the company’s annual general meeting in May the bank may sell new stock to bolster capital. The Irish government has pledged to underwrite the fundraising.

The two Irish lenders are among 91 European banks undergoing stress tests to show whether they can withstand a shrinking economy and drop in the value of government bonds. Ireland’s financial regulator told the two banks to raise a combined €10 bn by the end of December, following the stress test of domestic lenders in March. Jill Forde, a spokeswoman Ireland’s financial regulator, Allied Irish spokesman Alan Kelly and Bank of Ireland spokeswoman Anne Mathews all declined to comment. Under the tests, banks will be required to have a Tier 1 capital ratio of at least 6 percent in 2011. Firms that fail to meet the standard will be required to raise additional capital, people briefed on the talks said this week”

MT Bank, in which AIB has a 22.5% stake has reported a Q2 profit which has quadrupled, due to fewer bad loans and less acquisition spending. MT reported income of $1.46 a share ahead of expectations of $1.25. The stock however was 1.8% weaker due mainly to the general pronounced weakness in financials post Bernanke’s comments. At current share price, an MT sale would generate circa €1.1-1.2bn of capital for AIB.

Company / Equity News

•In UK equity news Pearson has agreed to by SEB’s Brazilian School learning system business for BP326m as a part of a strategic partnership, under which its will also provide technology and materials to SEB’s teaching institutions. The acquisition will take place in two stages, and is expected to complete by the end of the year. The acquired business is expected to generate sales of about GBP60m in 2010, and has achieved 20% organic sales growth. This deal is consistent with Pearson’s strategy to grow in selected fast-growing markets, and the recent GBP1.2bn IDC sale helped provide the funds to support this strategy.

•Imperial in their Q3 trading statement Imperial indicated that financial performance remains in line with expectations despite volumes being weaker than expected.

•The FT is reporting that Santander will attempt to float 20 of its UK business which may raise £3bn in the autumn in order to fund its acquisition of the RBS branches it is on the verge of sealing. Price tag for the branches are said to be £1-1.5bn. This is not the first time this idea has been floated, but the concern naturally is can an IPO be done in such volatile markets and can Santander raise the amount it wants. Possibly questionable and as such, according to the FT, would rely on existing group level reserves which could well top 10bn by end 2011 when the acquisition completes.

•Tate released a solid Q1 trading statement this morning, which reflects the reorganisation of the business. Good news came from volume growth in sucralose and corn sweeteners (HFCS in Mexico), partly offset by margin weakness in the Industrial starch business in both the Americas and Europe. Guidance was limited to expectations of “progress” in the current financial year.

•Mitchels Butlers, the UK pub group posted an interim management statement this morning. Like for like sales in the first 42 weeks of the financial year increased by 1.6% with total sales up 2.1%. Like for like sales rose by 1.2% in the group’s most recent nine weeks. The month of the World Cup had a negative impact on food sales reducing overall like for like sales by approximately 2.0%, indicating an estimated underlying growth rate of 3.2% in the nine week period.

•Stora Enso, the global paper, packaging and wood products company and peer of Smurfit Kappa reported a strong set of Q2 results this morning. Operating for the period came in at €213m, considerably ahead of consensus estimates of €160m. This represents an operating margin of 8% and an increase of €148m year on year. These results provide a positive read through for Smurfit Kappa who will report Q2 results on the 11th August.

•A closer look at the reportedly solid earnings from Switzerland’s largest bank Credit Suisse for 2Q10, beating expectations with net income of CHF1.6bn, shows us that the Swiss lender was helped by tax credits of CHF522m and fair value gains of CHF855m, tainting the picture quite significantly. However, when it comes to solvency, with a Tier 1 ratio of 16.3%, the Swiss bank continues to be one of the best capitalized institutions in Europe and, while not subject to the stress tests, the bank did state that if they apply the stress test scenario to their capital position, they would still have a Tier 1 ratio of 12.5%, which would give them a top notch pass in the tests.

•More good results from the tech space as Qualcomm, the biggest maker of chips that run mobile phones, they rose in extended trading last night after the company said it expects higher profit and selling prices for devices based on its technology.

•Microsoft may raise its quarterly dividend for the first time since 2008 as its cash hoard swells, data compiled by Bloomberg suggests. This quarter, Microsoft may boost the dividend to 15 cents a share from 13 cents, giving the company an indicated dividend yield of 2.31 percent, according to the data. That increase would cost the software maker about $700 million a year. Microsoft, which will probably post its biggest sales gain in two years when it reports fourth quarter earnings today, had $39.7 billion in cash and short-term investments as of March 31. The company is looking for ways to reward shareholders after a 21 percent slide in the stock price last quarter, compared with the 12 percent drop in the Standard Poor’s 500 Index.

•In a clear example of how BIG oil works when they feel threatened four of the world’s largest oil companies are creating a strike force to stanch oil spills in the deep waters of the Gulf of Mexico in a billion dollar bid to regain the confidence of the White House after BP ’s disaster. Exxon Mobil, Chevron , Royal Dutch Shell and ConocoPhillips said that they are forming a joint venture to design, build and operate a rapid response system to capture and contain up to 100,000 barrels of oil a day flowing 10,000 feet below the surface of the sea. BP’s Deepwater Horizon well had been leaking up to 60,000 barrels per day 5,000 feet below the surface. The new system, consisting of several oil-collection ships and an array of subsurface containment equipment, resembles the one developed by BP during three months of trial and error after its leased rig exploded April 20, unleashing the worst offshore oil spill in U.S. history.

•India’s government may offer to buy BP’s stake in a natural gas field in Vietnam, as the U.K. energy company sells $10 billion of assets to pay for the Gulf of Mexico oil spill.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.