An Apple A Day Keeps The Stock Market Bears Away

Stock-Markets / Stock Markets 2010 Jul 21, 2010 - 09:55 AM GMTBy: PaddyPowerTrader

U.S. stocks rose for a second day, erasing earlier losses as speculation the Federal Reserve will take steps to spur lending and an increase in building permits sent homebuilders and commodity producers higher and in doing so brushed off a nasty housing starts number and underwhelming numbers from Goldman Sachs. Yes on another day at the funfair the rollercoaster that is the Dow these days finished up 0.7% Tuesday after dipping as much as 1.4% earlier. Tech talisman Apple, Yahoo and AIDS drug maker Gilead Sciences (who missed EPS estimates and reduced guidance) were among companies that posted quarterly results after the official close of U.S. exchanges today.

U.S. stocks rose for a second day, erasing earlier losses as speculation the Federal Reserve will take steps to spur lending and an increase in building permits sent homebuilders and commodity producers higher and in doing so brushed off a nasty housing starts number and underwhelming numbers from Goldman Sachs. Yes on another day at the funfair the rollercoaster that is the Dow these days finished up 0.7% Tuesday after dipping as much as 1.4% earlier. Tech talisman Apple, Yahoo and AIDS drug maker Gilead Sciences (who missed EPS estimates and reduced guidance) were among companies that posted quarterly results after the official close of U.S. exchanges today.

The maker of the iPhone had already risen 2.6% during regular trading. After hours, it said earnings per share in Q3 continue to bear fruit and were $3.51, beating the $3.11 average analyst estimate. The company said it expects fourth quarter per share profit to be about $3.44, below the $3.83 predicted by analysts. Apple has beaten expectations in each report since 2003. The shares advanced 4.1% in extended trading. So good news for ARM the UK designer of semiconductors used in the IPhone and Infineon who make chips for Apple. But Yahoo sank 4.5% in trading after the close as the owner of the second most used search engine in the U.S. reported Q2 sales excluding revenue passed on to partner sites of $1.13 bn. The average estimate of analysts surveyed by Bloomberg was $1.16 bn.

Turning to hump day and stocks catching the eye in Europe include GKN which is up 8% after saying its trading performance has “continued to improve strongly” during the second quarter of 2010 and that the company will report H1 2010 profits of at least £170m. Condom king SSL is ahem up 33% after Reckitt Benckiser agreed to buy the firm for £2.54bn. Chemicals company Johnson Matthey is better by 2.5% on news Chairman John Banhan said quarterly sales to July were up 32% and Q2 would be “significantly stronger”. Other notable movers in London were Galiform (who own Howden Joinery builders are up 4.5%) after news their H1 2010 profits had increased to £21.6m from £4.7m in the same period last year. But online grocer Ocado is getting hosed and is down 10% on its first day of trading after some serious skepticism over valuations led the company to reduce the price of its IPO. Over on the Dax, VW is advanced 2.5% on news that it will probably start building an engine plant in Mexico in September.

Stateside the Dow futures are pointing to a positive open after some decent numbers from a few household names. Coca Cola have beaten EPS Street EPS estimates by 3c after the World Cup advertising is said have spurred sales growth while investment bank Morgan Stanley came in with profits of $1.09 per share (versus the expected $0.57c) though revenues look a little light. That said its up 3% per market. Other companies reporting pre NY open include mining giant Freeport Mc Moran who beat estimates on EPS and revenues while Abbott labs was the opposite missing on both measures. Helicopter to elevator manufacturer United Technologies is another company beating expectations today both in terms of EPS and revenues. And finally Wells Fargo is up 4% pre open after again topping analysts expectations and boosting optimism for the remains of the earnings season. Ebay $0.38) , Starbucks ($0.29) and Qualcomm ($0.54) are all slated to report after the closing bell.

Today’s Market Moving Stories

•European regulators plan to detail three scenarios when they publish the results of their stress tests on the region’s banks this week, according to a document by the Committee of European Banking Supervisors. Banks will publish their estimated Tier 1 capital ratios under a benchmark for 2011, an adverse scenario and a third test that includes “sovereign shock,” according to a template prepared by CEBS for the banks and obtained by Bloomberg News. In the last scenario, banks will publish their estimated losses on sovereign debt they hold in their trading book as well as “additional impairment losses on the banking book” that they may suffer after a sovereign debt crisis, according to the document that was dated July 15. Under accounting rules, banks have to adjust the value of sovereign bonds held in the trading book according to changes in market prices, said Konrad Becker, a financial analyst at Merck Finck and Co. in Munich. For government debt held in the banking book, lenders must write down their value only if there is serious doubt about a state’s ability to repay its debt in full or make interest payments, he said. The sovereign-shock scenario doesn’t assume a European nation will default, said a person with knowledge of the matter, who spoke on the condition of anonymity because the information is private. Instead, it will assume that rising government-bond yields will push up borrowing costs, spurring defaults in the private sector that would lead to losses in lenders’ banking books, said the person.

•July’s Bank of England MPC minutes suggest that a near term interest rate hike still looks unlikely. As expected, Andrew Sentence remained on his own in voting for a rate hike, leaving the vote at 7-1. What’s more, there were some dovish comments from other members, who noted that the prospects for GDP had deteriorated a little. Admittedly, they continued to flag the risk of a rise in inflation expectations, especially given that inflation during the rest of 2010 was likely to be higher than May’s Inflation Report projection. What’s more, July’s meeting was always likely to be something of a holding operation ahead of next month’s Inflation Report, when the MPC will revisit its forecasts. In particular, the minutes said that it was too early fully to assess the impact of the Budget on inflation. Nonetheless, most members still seem to think that spare capacity will pull inflation down over the medium term, and note that the Committee considered the arguments both for tightening and loosening policy perhaps the clearest steer so far that more QE could yet be on the agenda. Indeed, if the recovery is as weak as we expect, more asset purchases are likely.

•Its time for the Fed’s semi annual monetary policy report at the US Senate today, and House of Representatives tomorrow. There has been talk that Bernanke could cut interest rate it pays on reserves to 0% (from 0.25%). I’d be very careful with this ’story’ as no one seems to know where it originated. Bloomberg quoted a guy saying the suggestion came “from somewhere”. That’s as specific as I have seen, and I have looked. Nothing in FT, nothing in WSJ. It sounds very unlikely. The Fed lobbied hard to get the authority to pay interest on reserves and has only had the right to do this since 2008. So it would be surprising if they stopped paying interest so soon after authority was granted. Also the Fed’s alleged motivation in doing this is to encourage commercial banks to lend out their excess reserves to the real economy, or so the story goes. I think the words of BofA CFO on Friday are worth remembering here: “we are in the business of loaning money to people, but people have to want to take out loans”. Still, these are exceptional times, so anything is possible. It would be dollar negative if it happened – being able to pay interest on reserves is an important part of the Fed’s exit strategy. The interest paid on reserves tends to serve as a floor on market interest rates, and having that floor there will help the Fed “walk” market interest rates higher when the time comes. If they take the floor away, would be an important signal that the policy rate is not going anywhere for a very long time. Fed would effectively be dismantling a key part of their exit apparatus. Financial Pressures Could Become Contagious.

•The U.S. financial regulation bill may halt the already diminished market for asset backed securities by increasing liability risk for credit raters, a securitization industry group and bank analysts said. The legislation, set for signature by President Barack Obama, eliminates credit-rating companies’ shield from lawsuits when underwriters include their assessments in documents used to sell debt. Moody’s Investors Service and Fitch Ratings have already told Wall Street that because of an increased risk of being sued, they will no longer let underwriters use ratings in bond-registration statements. The change, if combined with an existing Securities and Exchange Commission rule that restricts sales of asset-backed debt without ratings in offering documents, will put a “flash freeze” on the market, said Tom Deutsch, executive director of the American Securitization Forum. His concerns are shared by analysts at RBS.

British Banks Face £390bn Funding Gap.

British banks face a funding crunch next year as they attempt to refinance debt amounting to double the amount they raised on average during the years of the credit boom. Banks must raise about £390bn in new debt in 2011, or more than £30bn every month just to replace their existing funding as they are hit by a combination of maturing bonds and the closure of major Government guaranteed financing schemes. Nomura analysts in a presentation yesterday, pointed to last month’s Bank of England Financial Stability Report (FSR)as they warned of the funding crunch facing the UK’s major banks. While the banks of other major European countries, such as France, Germany and Italy, face their own funding issues next year, none has to refinance anything like the same amount as the UK banks, which must replace debt worth just over 200% of the average raised in the years 2005 to 2007.

Company / Equity News

•Mitsubishi UFJ Financial, the Japanese lender that bought UnionBanCal, said it may spend more than 500 bn yen ($5.7 bn) to acquire more U.S. banks as domestic loan demand falls. Japan’s largest bank by market value is examining about 7 lenders of similar size to UnionBanCal, said Tatsuo Tanaka, head of global banking. The Tokyo based bank aims to boost overseas profit by more than 40 percent to 1 trillion yen, he said. The bank, which invested $9 billion in Morgan Stanley in 2008, is looking abroad as the world’s second-largest economy slows and the nation’s population declines. Mitsubishi UFJ spent about $3.6 bn the same year to take full control of San Francisco-based UnionBanCal.

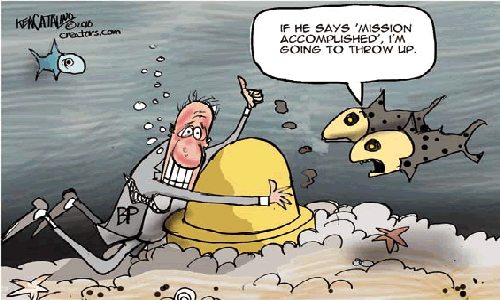

•As anticipated, BP has agreed to sell assets in North America and Egypt to Apache Corp. for $7 bn as part of its plan to raise cash to fund liabilities. The deals with Apache include BP’s Permian Basin holdings in Texas and southeast New Mexico as well as gas properties in western Canada, BP said today in a statement. BP also agreed to sell Western Desert business concessions and an East Badr El-din exploration concession in Egypt. The announcement comes after BP said it plans to sell some $10 billion of assets over 12 months to help pay for damages related to the Gulf of Mexico oil spill, caused by the explosion of its Macondo well on April 20. BP said it expects the deals to be closed in the third quarter.

•BHP Billiton., the world’s largest mining company, said fourth quarter iron ore production rose 16%, driven by expansions at its Australian mines and surging global steel demand. Output was 31.2 million metric tons in the three months ended June 30 compared with 27.1 million tons a year ago, the Melbourne-based company said today in a statement. That compares with a 32 million ton estimate by Credit Suisse Group AG. Australia, the world’s largest iron ore exporter, will boost sales 50% this fiscal year, according to government estimates, as BHP and Rio Tinto Group expand output. Production of iron ore and petroleum, BHP’s No.1 and No. 3 earners, notched up annual records.

•Roche Holdings top seller Avastin may shed $1bn in annual revenue if U.S. regulators follow a panel recommendation to revoke approval of the drug for use in breast cancer. Scientific advisers to the Food and Drug Administration voted 12-1 yesterday to rescind Avastin’s clearance in breast cancer after finding the drug paired with chemotherapies didn’t work better than other medicines alone. The agency usually follows panels’ advice, though it isn’t required to do so.

•Ad the U.K.’s biggest drug maker agreed to pay more than $1 billion to resolve more than 800 cases alleging its Paxil antidepressant caused birth defects, according to people familiar with the situation.

•The UKS’ Land Securities confirmed weekend press reports in its Q1 IMS (for the quarter ending 30th June) that it is to commit to start a 750,000 square foot development of a shopping centre at Trinity, Leeds. This is the first substantive shopping centre which has commenced construction post Lehman. Pre letting has reached 43%, with a further 4% in solicitors hands and 12% under negotiation. Group LTV rose to 46.1% from 43.5% as at March 2010, but will fall back to 43.7% upon receipt of the initial £225m proceeds from the forward sale of Park House in Mayfair, London. Interestingly, the statement indicated that whilst investor demand was strong in some sub sectors, the Company had seen early signs of price resistance in others. In other words there is resistance to rental increases.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.