Investment Grading Equity Analysts: Failed & Over Bullish for 25 Years

InvestorEducation / Learning to Invest Jul 20, 2010 - 11:17 AM GMTBy: Dian_L_Chu

Investment analysts' upgrades/downgrades have historically served as benchmarks for the markets, and could mean life or death to stock prices. However, the story of a 15% price swing in ATP Oil and Gas's (ATPG) stocks due to a $450-million math error by a JP Morgan (JPM) analyst probably has prompted some to question the value and validity of analysts' forecasts.

McKinsey Quarterly published a study in April to answer just that. Here is what McKinsey has to say after comparing analysts' earnings forecasts vs. the actual for the past 25 years:

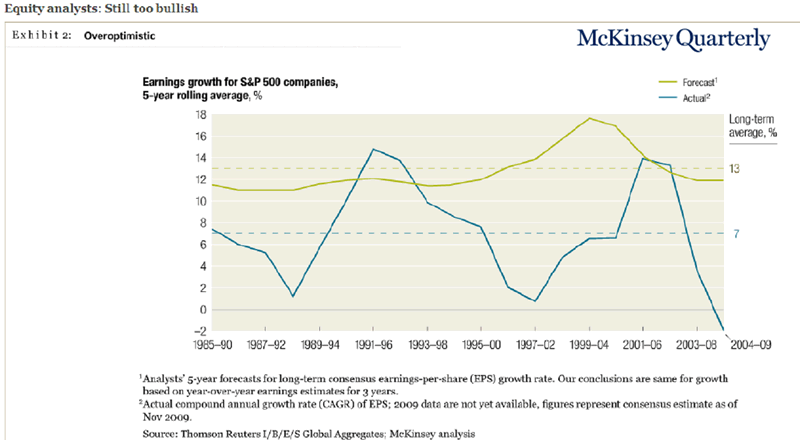

"Analysts, we found, were typically overoptimistic, slow to revise their forecasts to reflect new economic conditions, and prone to making increasingly inaccurate forecasts when economic growth declined."Moreover, McKinsey also finds that on average, analysts’ forecasts for earnings have been almost 100% too high in the past 25 years. (See graph)

McKinsey concludes that "Long-term earnings growth for the market as a whole is unlikely to differ significantly from growth in GDP, " and that the current infation and GDP expectations would be consistent with nominal earnings growth of 5 to 7%. However, "if economic growth slows significantly or if inflation and interest rates rise, returns from stocks could trend lower."

While fundamentals undeniably play a significant part in market movements, McKinsy's view seems to reflect a belief in the efficient market hypothesis. The article also sort of skimmed over how emotion and irrationality could overtake the markets more often than not.

The efficient market hypothesis holds that financial markets are "informationally efficient"; and thus existing share prices will always reflect all relevant information. However, in reality, markets are susceptible to "emotional bias" such as overconfidence and overreaction, as well as "informational bias" (i.e., misinformation, and not all relevant info is available to all markets.)

In other words, emotional and informational bias would constantly flow through in such a way that the markets most likely will never achieve the "informationally efficient" state.

Analysts, economists and rating agencies are human, just like the rest of the markets, which means individual emotional and informational bias most likely will be consistently reflected in their analysis, along with occasional plain human errors.

Although some say the markets don't take analysts as seriously as they used to, the case of ATPG and JPM should indicate otherwise. The bottom line is that investors should do own due diligence to formulate the best possible informed decision, instead of relying and reacting solely on analysts' reports.

(Note: pdf of the full McKinsy article is available here at Washburn University site.)

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.