ECRI Paranoid About Calling a Double Dip Recession

Economics / Double Dip Recession Jul 20, 2010 - 04:27 AM GMTBy: Mike_Shedlock

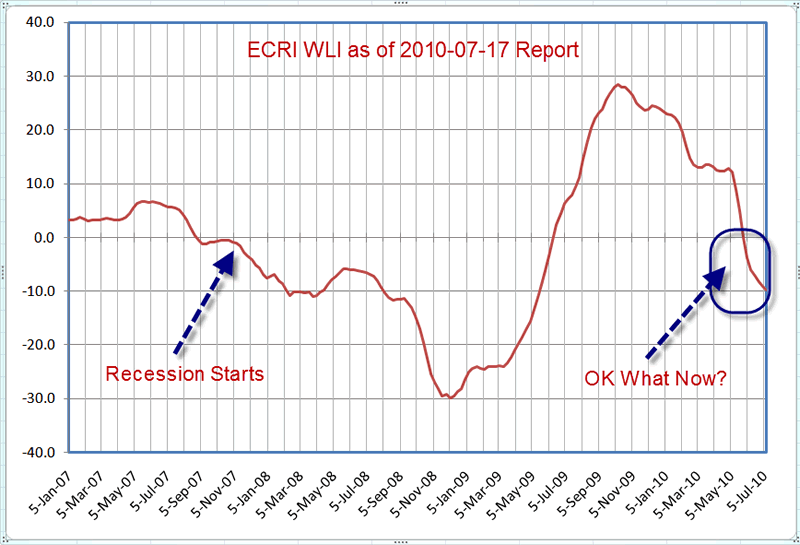

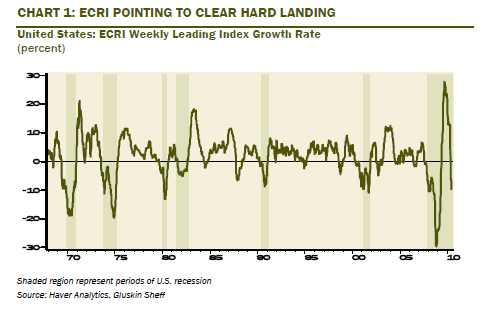

Inquiring minds have been watching the ECRI's weekly leading index plunge nonstop since October of 2009. Moreover the WLI has been in negative territory for 6 consecutive weeks.

Inquiring minds have been watching the ECRI's weekly leading index plunge nonstop since October of 2009. Moreover the WLI has been in negative territory for 6 consecutive weeks.

Is that a recession call by the ECRI?

Absolutely not, at least as of June 14, according to Lakshman Achuthan managing director of ECRI who blasted the Wall Street Journal for misleading reporting.

The Business Insider discusses the situation in Why Last Week's Collapsing ECRI Leading Indicator WASN'T A Recession Signal.

Following the Business Insider link back one step takes us to Jeff Miller's "A Dash of Insight" Weighing the Week Ahead: Negativity Prevails where I see that I was cited along with the Wall Street Journal, Zero Hedge, the Pragmatic Capitalist, and the Financial Times for incorrect intrepretation of the WLI.

Miller quoting a comment in response to the Wall Street Journal article writes...

Meanwhile, in the comments there was a stern rebuke. Lakshman Achuthan wrote:

While we certainly appreciate the attention given to our Weekly Leading Index, I’d like to clarify a few points raised in the article. First, according to the Economist magazine, “the ECRI” has not ever given false alarms on a recession forecast. http://www.businesscycle.com/about/testimonials/

The purported false alarms from “the ECRI” mentioned in this article come from a mistaken and simplistic view that negative growth in ECRI’s Weekly Leading Index (WLI) is tantamount to a recession forecast. In fact, since 1983, cyclical downturns have taken WLI growth under the zero line a dozen times, but recessions have followed on only three of those occasions – times when ECRI actually made a recession forecast.

Since ECRI itself has never used WLI growth going negative as a recession signal, it is important that such “false alarms” are attributed not to ECRI or even to the WLI, but to what is a mistaken interpretation of the WLI.

In fact, at the very least, ECRI itself would need to see a “pronounced, pervasive and persistent” decline in the level of the WLI (not merely negative readings in its growth rate) following a “pronounced, pervasive and persistent” decline in ECRI’s U.S. Long Leading Index (not discussed in the article), before it makes a recession call.Just The Facts Maam, Not The Spin

If the ECRI does not want people assuming the WLI can be used as a recession forecast, then perhaps they ought not present it that way.

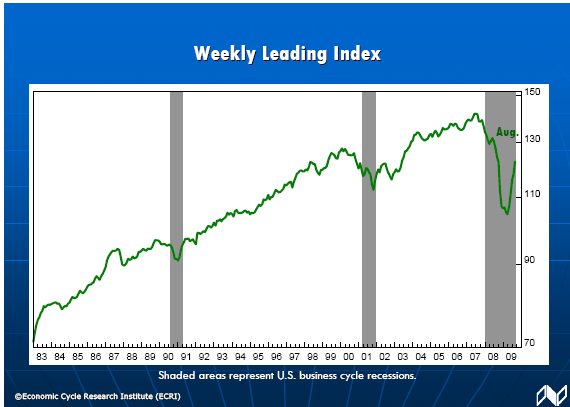

Please consider some charts and text from the ECRI publication The Great Recession and Recovery

ECRI Weekly Leading Index

"This is an index that’s been around for over a quarter of a century, and over that time (shown here) it has correctly predicted every recession and recovery in real-time."

I need to repeat that, over this entire time period, I was present to see each of the correct recession and recoveries calls in real-time, without false signals in between.Supposedly the WLI in "real-time" has correctly predicted every recession without a single false signal.

That is quite an amazing claim. It is also false, for multiple reasons!

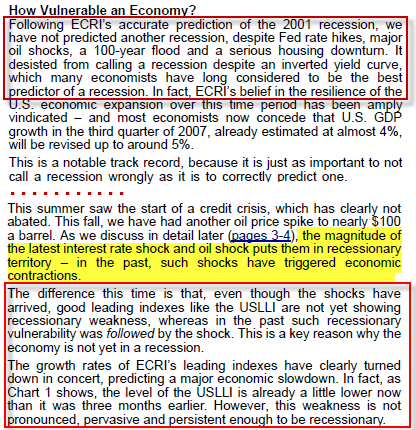

Flashback November 2007 ECRI Vol. XII, No. 11: Weakness In Leading Indicators Not Yet Recessionary

Please consider the following image snip. Highlighting is mine.

In November of 2007 the ECRI was bragging it did not forecast a recession "despite an inverted yield curve, which many economists have long considered to be the best predictor of a recession"

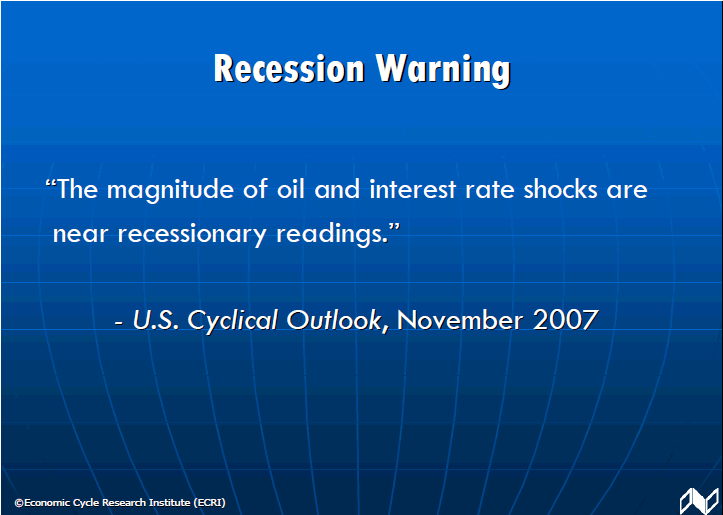

In contrast note the spin from The Great Recession and Recovery.

Accompanying that slide the ECRI said "And we issued a clear Recession Warning noting that: “The magnitude of oil and interest rate shocks are near recessionary readings.” A month later, as we now know, the recession began.

Compare that slide, with the above image snip, noting the yellow highlighting.

The ECRI was clearly bragging not only about besting the yield curve, but also said "The Difference this time is that, even though the shocks have arrived, good leading indexes like USLLI are not showing recessionary weakness. ... as Chart 1 shows, the level of the USLLI is already a little lower now than it was three months earlier. However, this weakness is not pronounced, pervasive and persistent enough to be recessionary"

It's Different This Time!

After the fact, the ECRI took one statement out of context, a statement they went to great lengths to refute, then has the blatant gall to claim they issued a "recession warning".

By the way. The Bold Headline on the page with the yellow highlighting is "WEAKNESS IN LEADING INDEXES NOT YET RECESSIONARY"

ECRI's Predictive Capability

The facts show that the ECRI did not actually "predict" the recession until we were in it for several months. They get away with this nonsense because of an even longer delay by the NBER in setting the start of the recession.

Want proof?

Friday, January 25, 2008

ECRI Says There Is A Window of Opportunity for the US Economy

The U.S. economy is now in a clear window of vulnerability, given the plunge in ECRI’s Weekly Leading Index (WLI) since last spring. Yet there is a brief window of opportunity within that window of vulnerability to avert a recession. That is why ECRI has not yet forecast a recession.

Self-Fulfilling or Self-Negating?

If we have a recession this year, it will be the best advertised in history. Recently, several Wall Street houses joined the 70% of Americans who have been expecting a recession for the last few months. A number of other prominent economists boosted their estimates of the probability of a recession above 50%.

Yet such probability estimates imply that a recession is a matter of chance, whereas it is still a matter of choice. This is why, having correctly predicted the last two recessions in real time without crying wolf in between, we are not forecasting one yet.The facts show the ECRI thought a recession that had already started about two months earlier could have been prevented.

Recession of Choice

Friday, March 28, 2008

ECRI Calls it "A Recession of Choice"The U.S. economy is now on a recession track. Yet this is a recession that could have been averted. In January, given the plunge in the Weekly Leading Index, we declared that the economy had entered a clear window of vulnerability. Yet we emphasized the brief window of opportunity within that window of vulnerability for timely policy stimulus to head off a recession.

It is a somewhat different story with regard to GDP, because the cyclically volatile manufacturing sector still accounts for 36% of GDP. A mild downturn in that sector should limit the decline in GDP in this recession.

In fact, we may or may not see two straight down quarters of GDP in this recession. But, contrary to popular belief, as we have detailed* elsewhere, that is neither a necessary nor a sufficient condition for a recession.

Recession of Choice?

As noted above, on March 28, 2008, the ECRI states we are on a "recession track". At that time, the recession was already underway for a minimum of four months.

This statement is worth repeating: "In fact, we may or may not see two straight down quarters of GDP in this recession. But, contrary to popular belief, as we have detailed elsewhere, that is neither a necessary nor a sufficient condition for a recession."

The idea that this recession could have been prevented is far beyond silly. The excesses and reckless behaviors in residential real estate, commercial real estate, derivatives, credit lending, securitizations, credit cards, and debt at every level (not just in the United States but globally) were such that not only was a recession baked in the cake, but that a gargantuan consumer-led recession was 100% guaranteed.

There is absolutely nothing the Fed could have done to avoid this recession. To believe otherwise is foolish.

ECRI Paranoia

I believe it is a fair statement by Lakshman Achuthan that “the ECRI” has not ever given false alarms on a recession forecast.

Indeed, the ECRI seems so paranoid about making a mistake in calling recessions that it will not predict one until it is blatantly obvious by anyone with an ounce of common sense that we are already in one.

Now the ECRI is upset that people are using the WLI to predict recessions even though the ECRI posts their chart with the claim "This [the WLI] is an index that’s been around for over a quarter of a century, and over that time (shown here) it has correctly predicted every recession and recovery in real-time."

Amazingly the ECRI gets upset when people take them at their word, mistakenly thinking the WLI actually predicts something, perhaps because the ECRI posts a chart that says it does!

I suppose you can see how confusing this is when the WLI "has correctly predicted every recession and recovery in real time" yet Lakshman Achuthan also says ... In fact, at the very least, ECRI itself would need to see a “pronounced, pervasive and persistent” decline in the level of the WLI (not merely negative readings in its growth rate) following a “pronounced, pervasive and persistent” decline in ECRI’s U.S. Long Leading Index (not discussed in the article), before it makes a recession call.

That is a clear statement that the WLI cannot in and of itself predict anything unless it follows the ECRI’s U.S. Long Leading Index.

Got that? I hope so.

Synopsis

So ... Please don't think the WLI predicts anything unless and until and after the fact Lakshman Achuthan and the ECRI says it does, in yet another publication hyping its stand-alone "real-time" predictive capability.

Meanwhile, I note the WLI has fallen to -9.8. Don't worry. It's not predicting anything, until after-the-fact it does. Then again others disagree.

Double-Dip Odds 2 out of 3

Dave Rosenberg had his sights on the ECRI in his July 19th 2010 Breakfast With Dave Commentary (red highlighting is mine).

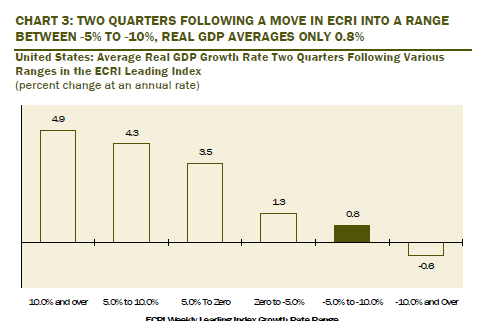

The growth rate on the ECRI leading index did it again! It sank further into negative terrain, now at -9.8% during the week ending July 9, down from -9.1% the prior week. This was the tenth deterioration in a row and the growth index is now negative for six straight weeks. We have never failed to have a recession with the ECRI at current levels but there is also inherent volatility in the index that requires acknowledgment. Our reckoning is that in the past few weeks, the index has gone from pricing in even-odds of a double-dip to two-in-three odds. It may take a while, but Mr. Market will figure it out before long.

A Look at Both Sides

I want to be as fair as I possibly can to the ECRI so I will present both sides of the coin as best as I can.

Side 1

Side 2

- The ECRI grossly took statements out of context regarding its recession "Warning Call" in November 2007. There was no recession warning. In fact, the ECRI explicitly bragged that it gave no such warning in contrast to the inverted yield curve (which ironically had it correct).

- The ECRI did not predict the 2007 recession until we were already in recession for 3-4 months.

- The ECRI is blatantly hypocritical when it says the WLI "has correctly predicted every recession and recovery in real-time" while chastising the Wall Street Journal that the WLI needs to follow a "pronounced, pervasive and persistent decline in ECRI’s U.S. Long Leading Index (not discussed in the article), before it makes a recession call."

- On January 25, 2008 the ECRI said "This is why, having correctly predicted the last two recessions in real time without crying wolf in between, we are not forecasting one yet." The recession had already started. The ECRI clearly blew the recession call. Nothing they do or say can paper over this fact.

- Not only did the WLI blow the recession call, but the ECRI's U.S. Long Leading Index (USLLI) blew the call as well. So much for supposedly "leading" indicators.

- Investors could have used the ECRI's genuine "recession track" warning in March 28, 2008 and have exited the market at that time. Loss would have only been 14-15% from the peak, in retrospect, a nice exit.

- The ECRI gave a nice entry in Spring of 2009.

- Even though the ECRI has clearly blown a recession call, they can still claim they have not called for a recession that did not happen.

Then again, one could also have looked at the inverted yield curve and loaded up on long bonds or 10-year treasuries and possibly done much better. I freely admit hindsight is 20-20 and many thought long dated treasuries would implode.

Tools in the Bag

Once again, attempting to be as fair as possible, the WLI could be a very useful indicator when other data confirms.

For example, in late 2007 one could have looked at the inverted yield curve in conjunction with a negative WLI and decided it was not very smart to be invested in the market. Theoretically, the two tools together could have given a very timely exit signal.

Unfortunately, a negative yield curve is not going to happen again for a long time given the low end of the curve is at zero. So don't go looking for that combination now.

Although we do not have an inverted yield curve, we do have massive amounts of data including a yield curve that has flattened 100 basis points in short order, something one would never see in a recovery.

Once again, using all the tools in the toolbox and with numerous confirming data, it should be easy to see this economy is in trouble. However, as in 2007 the ECRI refuses to see it.

Why?

I am sticking with my thesis the ECRI is so paranoid about making a mistake in calling recessions that it will not predict one until it is blatantly obvious by anyone with an ounce of common sense that we are already in one.

That's fine by me, but not if it wants to make preposterous claims such as the WLI "has correctly predicted every recession and recovery in real-time"By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.