US Corporate Earnings Season Gets Into Full Swing

Stock-Markets / Stock Markets 2010 Jul 19, 2010 - 09:39 AM GMTBy: PaddyPowerTrader

Ending a yoyo week U.S. stocks fell Friday, ending the Dow’s longest winning streak in two months, following worse than estimated revenues at Bank of America , Citigroup and General Electric. Lack of loan growth is the a canary for broader weakness in the US economy. BofA CFO “we are in the business of loaning money to people, but people have to want to take out loans”. Economic data wise, a big dip in consumer confidence that sank to the lowest level in a year and the ECRI leading indicator pointing to a recession in the next 3 months added to the gloom.

Ending a yoyo week U.S. stocks fell Friday, ending the Dow’s longest winning streak in two months, following worse than estimated revenues at Bank of America , Citigroup and General Electric. Lack of loan growth is the a canary for broader weakness in the US economy. BofA CFO “we are in the business of loaning money to people, but people have to want to take out loans”. Economic data wise, a big dip in consumer confidence that sank to the lowest level in a year and the ECRI leading indicator pointing to a recession in the next 3 months added to the gloom.

But turning to today and stocks on the move include International Power which is ahead by 9.3% after GDF Suez, operator of Europe’s largest natural gas network, said it’s in preliminary talks to combine some of its assets with International Power, creating an enlarged London traded company majority owned by GDF. (see below for more).

Tomkins, whose manufacturing business ranges from car parts to bath tubs has soared 32% after Onex Corp., Canada’s biggest publicly traded buyout firm, and the Canada Pension Plan Investment Board signalled they may bid about £2.9 billion for the British company.

Rio Tinto is better by 2.4% today after the world’s third biggest mining company said initial output at its A$1.86 bn Argyle diamond mine underground expansion will start within two years as global demand recovers.

Fellow Mining giant BHP Billiton is up 1.2% as copper, nickel, tin and zinc climbed in London trading.

German steelmaker ThyssenKrupp climbed 2% Monday after it was raised to “outperform” from “underperform” at Cheuvreux, which said it sees “substantial hidden value in the company’s industrial businesses” and expects “a market rerating of the stock.”

Electrolux, the world’s second biggest appliance maker, slid 7.8% this morning after saying demand weakened “substantially” in southern Europe. And Philips Electronics the world’s biggest lighting company, dropped 3% after forecasting sales growth will slow.

US earnings highlights this Monday include Texas Instruments ($0.62), IBM ($2.58) and Halliburton ($0.37c). The only economic data due is the NAHB housing market index at 15.00 (expected to come in at 16).

Today’s Market Moving Stories

•Board members at four of the continent’s biggest banks in the UK, France and Germany said they have grave reservations about the way in which the exercise had been conducted and were worried the markets would misinterpret the outcome. Quotes banker: “the market will compare our stressed capital ratio with others that have been calculated in an entirely different but untransparent way”.

Some groups also complain about the lack of common procedures across the regions’ regulators. While most national regulators appear to have gathered banks’ data and then stress tested it, in other countries, notably Germany, it is the banks themselves that have been asked by regulators to stress test their own balance sheets. “It leads to stupid comparisons.” Some regulators admit in private that the process has been chaotic and could backfire.

•IMF walks away from Hungary (only temporarily, for now) The IMF is unwilling to release any more cash to Hungary under its 2008 agreement, until Hungary agrees to take additional measures to improve fiscal position. Its probably just a negotiating tactic, and it will all blow over in a few months, but likely to hurt global risk appetite in Europe. Its not just on fears of a Hungarian default (no immediate risk of this), but also a reminder that the IMF could one day abandon Greece if progress is not satisfactory. The new government already ruffled feathers some weeks ago saying a default is not out of the question. Austrian and Greek banks have considerable exposure to Hungary, and HUF selling today on the back of this is not going to make life any easier for the legions of Hungarian mortgage holders who own unhedged Swiss Franc (CHF) denominated mortgages.

•Under the bailout plan, the IMF has agreed to provide €10bn to help recapitalise Greek banks. However, it says this cash will only be disbursed in two installements, €5bn at a time, and not until Sept and Dec. This means if the stress tests show Greek banks are under capitalised, the IMF won’t be in a position to help until Sept. That’s a long, long, euro negative wait. Also, the new CEO Regling of the European Financial Stability Fund said last week it would take 3 to 4 weeks to mobilise cash if a member state requests it, so don’t expect any help from that quarter either.

•U.K. house prices fell mid-July as the number of new sellers outnumbered potential buyers, adding weight to forecasts that after gaining in the first half of 2010 house prices will end the year little changed from January, a survey by Rightmove showed Monday.

•According to a survey made by Allensbach Archiv, 75% of Germans are concerned about the current state of affairs in Germany, up from 55% last year. Just 22% of those surveyed expect positive economic developments in the coming six months, while 38% expect an economic setback. In terms of “general optimism regarding the future”, just 37% maintained positive views (down from 50% reported in April). The results are noteworthy, given Germany’s relatively robust economic performance in times of crisis. In fact, the results are worse than those in the middle of the economic crisis.

The Moody’s Blues for Ireland

Moody’s downgraded Ireland’s government bond rating from Aa1 to Aa2 with a stable outlook this morning. Three key reasons were provided:

1) a loss of financial strength as evidenced by a substantial increase in the Debt to GDP ratio and a simultaneous increase in debt financing costs. The agency expect the Debt to GDP ratio to stabilise at 95%-100% over the next 2-3 years;

2) weakened growth prospects due to the severe downturn in the financial services and real estate sectors and an ongoing contraction in private sector credit; and

3) the crystallisation of contingent liabilities due to the recapitalisation of the Banking Sector (€25bn or 15.3% of 2009 GDP). The stable outlook reflects Moody’s view that upside and downside risks are “evenly balanced”. Given Moody’s recent actions on Spain, Portugal and Greece, this move is hardly surprising but it comes at a somewhat unfortunate time for the NTMA who will conduct their regular dual bond auction tomorrow. However the 1 notch downgrade and stable outlook should be seen as a relatively positive result, Ireland now has the same Moody’s issuer rating as Italy yet trades 141bps wider in 10 year.

Dietmar Hornung, lead analyst for Ireland at Moody’s Investor Service, said Ireland has “turned the corner” and that the agency has a “constructive” view on the country. Moody’s doesn’t expect any further rating change in the “foreseeable future” after downgrading its rating on Irish government bonds, Hornung said in a telephone interview. Today’s cut reflected a “gradual significant deterioration” in the Irish government’s financial strength, he said.

Company / Equity News

•Spain’s largest bank, Banco Santander has submitted a bid for AIB’s 70.5% stake in Bank of Zachodni, according to reports from Polish media. The other two bidders for the stake include PKO Bank Polski and BNP Paribas.

•Tomkins announced this morning that they had received a proposal from Onex Corporation (PE group) and the Canada Pension Plan at 325p, a 40% premium to Friday’s close. No formal offer has yet been made but Tomkins have made their books available for due diligence, which is now at an advanced stage, indicating that a bid is likely. At the same time Tomkins provided a trading update indicating that the positive momentum continued in H1, but was likely to slow with the wider economy in H2. Some signs of this have already been seen in July trading. The 420p bid values Tomkins £2.8Bn, including debt and the pension deficit the EV is £3.2Bn.

•Daimler issued a profits update on Friday which guided towards Q2 EBIT of € 2.1bn, a substantial increase on market expectations. Daimler also said that they would increase their EBIT guidance for FY10 when they release their results on 27 July. The outperformance is driven by the Mercedes car division in the US and China, better mix, positive foreign exchange rate impacts and an improved performance by the Trucks division.

•Fiat has agreed with eight banks to refinance €4 billion in loans, a measure that paves the way for the company’s planned split into separate automobile and heavy-equipment companies, Il Sole 24 Ore reports, without citing sources. The fund will partly roll over expiring debt but €2.4 billion of the fresh cash is structured as a bridge loan to be substituted by an eventual bond sold by Fiat Industrial, the paper said. Analysts expect Fiat Industrial, comprising CNH Global and truck maker Iveco, to have a higher rating than Fiat’s low-margin and cash-intensive car business.

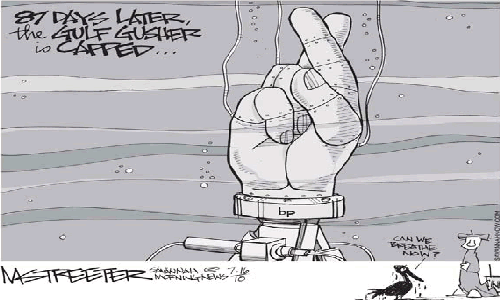

•U.S. government officials ordered BP Plc to submit plans for reopening its sealed Gulf of Mexico well and resuming efforts to capture oil after tests found a suspected leak seeping from the seabed. In a letter addressed to Bob Dudley, BP managing director, National Incident Commander Thad Allen said tests had detected a “seep a distance from the well and undetermined anomalies at the well head.” The letter was posted on the website of the joint information centre for the spill. No decision was announced as to whether BP will be ordered to open the valves sealing the well, which would allow oil to resume flowing.

•GDF Suez operator of Europe’s largest natural-gas network, is planning a 6.4 billion-pound ($9.8 billion)cash offer for International Power Plc, the Mail on Sunday said, citing unidentified people familiar with the matter. GDF, said to be in talks with the U.K. power company about a bid around 420 pence a share, has met advisers, including Goldman Sachs ., and has the support of the French government, which owns 35 percent of GDF, the newspaper said. Previous talks between the two companies broke down in January, the newspaper said. Paul-Alexis Bouquet, a spokesman for GDF Suez, declined to comment when contacted today by telephone.

•Dutch electronics giant Philips said it posted a better than expected net profit in the second quarter, boosted by cost cutting and improved organic growth particularly from the lighting and consumer lifestyle businesses in emerging markets, but said sales growth for the remainder of the year will slow. However, the company said it’s confident it will exceed its earnings before Ebita. We are particularly pleased to have reached an adjusted profitability level of 10% in the quarter.” Net profit came in at €262 million, up from €45 million a year earlier. Analysts had expected a net profit of €239.8 million. The company said the double digit sales growth, reported in the first half of 2010, will for the remainder of the year moderate towards mid single digit level, which reflects the continued but slow recovery in the U.S. and Europe, seasonal blips in the Television business following the soccer World Cup, and the improved sales performance reported in 2009.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.