Silver Approaching Major Bear Market Breakdown, Gold Would Target $970

Commodities / Gold and Silver 2010 Jul 19, 2010 - 07:45 AM GMTBy: Ronald_Rosen

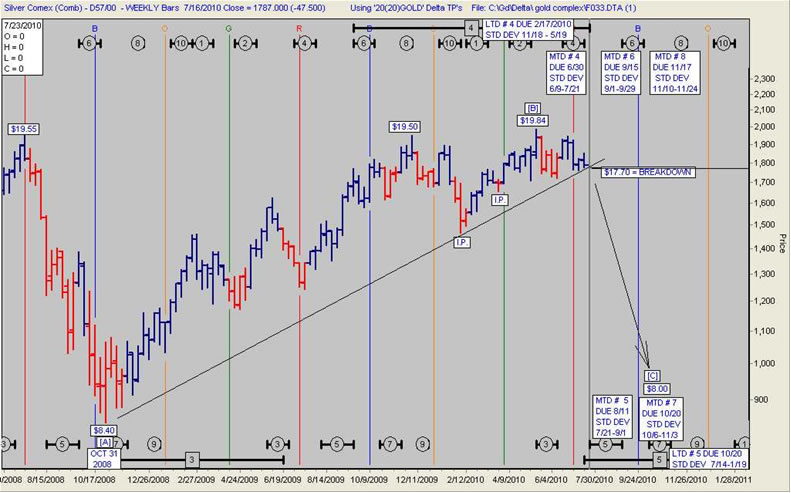

Silver Bullion Is Approaching A Breakdown. A Close Below $17.70 Will Break The 21 Month Uptrend. A [C] Leg Close Below The $8.40 Low Of The [A] Leg Will Complete A Flat Type Correction.

Silver Bullion Is Approaching A Breakdown. A Close Below $17.70 Will Break The 21 Month Uptrend. A [C] Leg Close Below The $8.40 Low Of The [A] Leg Will Complete A Flat Type Correction.

SILVER WEEKLY LOGARITHMIC

I will admit that sometimes my sense of humor is a bit macabre.

Download

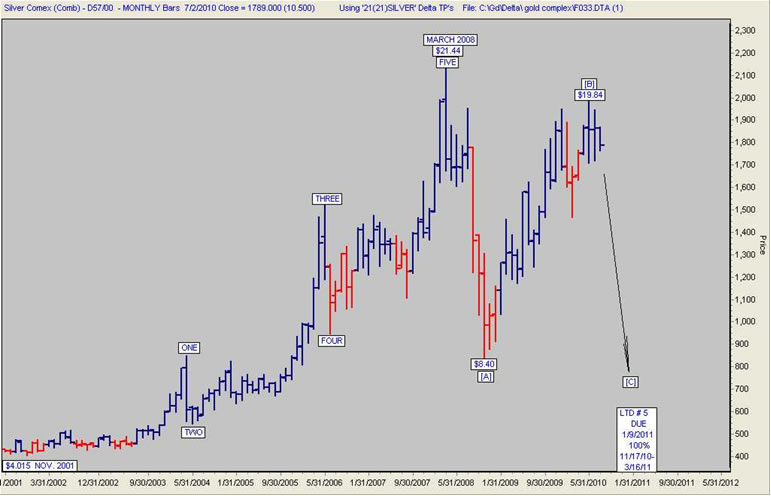

COMPLETE 8 WAVE CYCLE

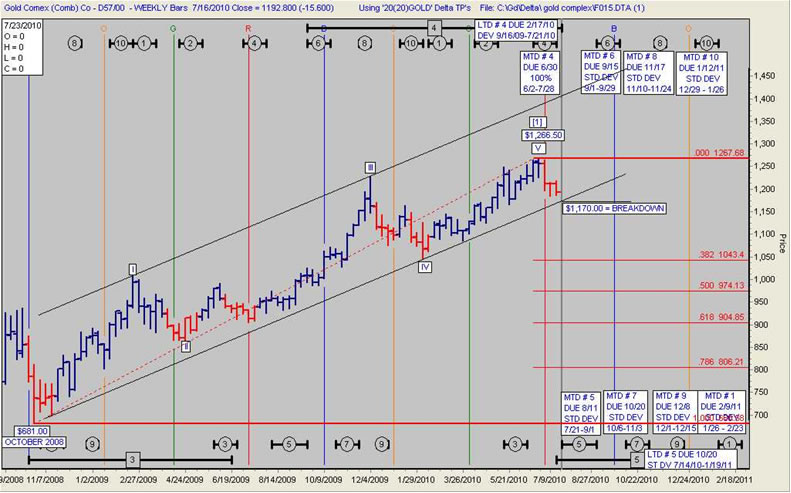

GOLD BULLION IS APPROACHING A BREAKDOWN.

A CLOSE BELOW $1,170.00 WILL BREAK THE 21 MONTH UPTREND.

A DECLINE TO THE $970.00 LEVEL SHOULD BE A MINIMUM EXPECTATION.

GOLD WEEKLY

Welles Wilder’s Delta Turning points for gold, gold shares, silver, silver shares, stock indexes, and crude oil are available to subscribers.

Subscription cost is $30.00 per month.

THE ROSEN MARKET TIMING LETTER

www.wilder-concepts.com/rosenletter.aspx

Gold coins and bars should be considered an insurance policy. I do not believe that they should be sold regardless of a decline in their price. The percentage increase in the precious metal shares is a multiple of the rise in the price of gold. The percentage decrease in the precious metal shares is a multiple of the decline in the price of gold. The shares are obviously more volatile than the metal. There is more hope for riches placed in the shares than there is in the metal. That hope gets dashed easily on the way down. Speculators in gold and silver have their hopes for riches dashed on the way down but gold has a hard core of holders that refuse to have their holdings dislodged by fluctuations. Holding the metal gold as insurance is the way to proceed until the financial and economic mess that we are living with is resolved or at least mitigated.

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.