Why Upbeat Corporate Earnings Reports Mean Caution For Stock Market Investors

Companies / Corporate Earnings Jul 19, 2010 - 05:27 AM GMTBy: Money_Morning

Jon D. Markman writes: While earnings reports continue to pour out each day, investors should be careful before being excitedly swayed by strong financials - there is much more of the big picture to consider.

Jon D. Markman writes: While earnings reports continue to pour out each day, investors should be careful before being excitedly swayed by strong financials - there is much more of the big picture to consider.

Stocks failed to get traction in the middle of last week after Alcoa (NYSE: AA) and Intel (Nasdaq: INTC) earnings reports underwhelmed investors, and Friday they spun off the road. The culprit: Fears that recent earnings gains represented a peak, and that weak readings on the economy were more representative of current conditions.

Retail sales disappointed and the Federal Reserve cut its 2010 growth forecast. Even word that Singapore grew at a record pace of 19.3% in the second quarter couldn't lift the air of despondency on Wall Street.

The big-cap and small-cap indexes alike flipped over into the red after running headlong into their 50- and 200-day averages and Fibonacci retracement zones. The Standard & Poor's 500 Index has now formed a new head-and-shoulders (H&S) top again not more than two weeks after a previous one was invalidated.

Head-and-shoulders tops are rally killers, and are much more than just a pattern of squiggles described by technical analysts who try to anthropomorphize price charts.

H&S tops trace out the psychological reaction of the herd of investors to waves of stimuli from unevenly distributed news events. They form when there is enthusiasm on the left shoulder, followed by sadness to set a left neckline, followed by a reborn euphoria to create the head, then renewed sadness that creates a new lower point for the neckline, then a new euphoria that doesn't surpass the most recent one to create the right shoulder, and then ultimately a final bout of sadness that creates the final stroke of the pattern back down to a lower neckline. All the while in this stretch of stock distribution, daily volume needs to be declining.

In my experience, the best place to short a market or index is when it appears ready to set a right shoulder on declining volume. Once other people see the same pattern, they will jump in and do the work for you. And that is what happened Thursday and Friday.

Many technical traders get offsides when they wait for a head-and-shoulders pattern to complete, and then try to short a decline under the neckline. That's what we call "shorting into the hole," and it is hazardous. Anyone can see that, and as the old saying goes, whatever everyone knows isn't worth knowing.

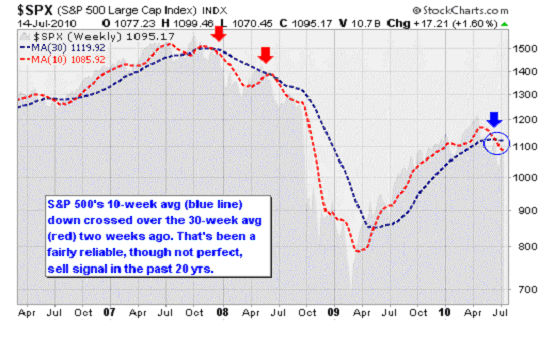

My point is that when a right shoulder is forming at a logical location -- in this case, resistance from the 50-day average, and a 50% Fibonacci retracement of the April-June slump -- then it is time to be aware that bears could emerge with firepower here to defend their downtrend. As you can see in the chart above, we are still in bears' territory after all, with the 10-week average under the 30-week average.

It's up to bulls now to prove that they have the ammo -- earnings surprises, new government programs, a shiny, positive new data point -- to get prices rolling higher again. The bottom line is: Be on your toes. Don't get lulled into thinking that seemingly upbeat earnings reports from Alcoa and Intel miraculously jolted the market back into a bull cycle. Those were backward looking reports, and investors don't believe they provide a good glimpse of a future most likely characterized by shrinking sales, shrinking margins and lower earnings.

Risk on the Barbie

Risk assets in general had a tough week as traders flocked to safe havens. Commodities moved lower, the Chicago Board Options Exchange Volatility Index (VIX) climbed, crude oil dropped, foreign stocks lost ground, and the euro fell. The dollar climbed from its lowest level since mid-May. The VIX rose after bouncing on its 200-day moving average, which is another big red flag for the broad market. And Treasury bonds posted their best gain since last Tuesday, not long after they looked like goners.

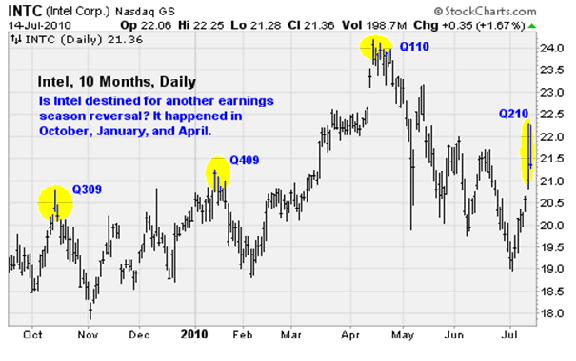

The situation still has the potential to darken in short order. Just look at the way earnings sweethearts Alcoa and Intel have been left at the altar by investors over the last two days. Intel was up as much as 7% in overnight trading after reporting earnings, but finished that day with a gain of just 1.8% and closed Friday with a 2.3% loss. Alcoa slumped 4% Friday and fell every session after its earnings report temporarily wowed the crowd.

The price action in the two stocks looks very similar to what happened during Q3 2009 earnings season last October, not to mention Q4 2009 and Q1 2010. Both companies reported solid results. Both were initially pushed higher. But both eventually formed big fat reversal patterns and plunged in all three cases. Maybe one day the gap buyers will learn.

The bottom line on this subject is not to get overly excited about earnings. They are highly manipulated numbers, and are virtually always accompanied by positive comments from the salesmen stationed in the chief executive's suite. Traders who really know what's going on lay in wait for these moments, and in the past at least have pounced.

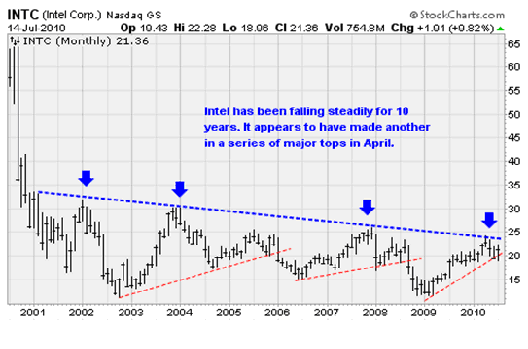

Intel and Alcoa are at least neutral in my model if not outright short-sells. They had their chance, and they blew it. The risk trades are cooked.

Strong Earnings Not Here To Stay

Earnings growth forecasts will have to fall heading into 2011 and beyond as the economy downshifts from its torrid recovery pace to its slower secular growth rate. Worst-case, earnings will have to discount a recession in Europe and the softening could spread like a virus to infect other parts of the globe. Analysts at UBS (NYSE: UBS) just cut their 2011 S&P 500 earnings per share forecast to $91, which is 6% below the consensus estimate.

The analysts asked themselves: Where are analysts most wrong? The two sectors the UBS team believes are most vulnerable to earnings downgrades are energy and materials due to their exposure to Europe. Both were by far the weakest sectors during the 1998 "Asian contagion" financial crisis.

Consumer discretionary -- retailers and their suppliers -- are also vulnerable. Stocks in the sector benefited earlier this year from a decline in the fear that U.S. families would save more and spend less under pressure from stagnant wages. Yet there's been help from an unexpected quarter: Lower interest rates have reduced families' loan servicing costs -- a deleveraging without the pain.

Still, if job growth remains as anemic as it was the past two months, UBS analysts believe that retailers' estimates will need to be cut.

And finally, the financials are expected to suffer near term due to the weak performance of the stock market in the second quarter. This reduces commission revenues, merger deal activity, and asset management fees. Plus the government is increasing the cost of regulatory compliance.

Recession Connection

Now let's take a quick look at a Goldman Sachs (NYSE: GS) prop-desk analysis of the probability of another recession. This is not the official GS analysis, but rather the view of traders who do their own research rather than just accepting what the brokerages' economics team hands out.

Most recession probability models use the shape of the yield curve -- a line that represents short-term, medium-term, and long-term interest rates on U.S. Treasury bonds -- as a major input. And most of the time, it's a valuable indicator. When rates are higher in the future than they are today, it's considered to point to higher growth for the economy down the road.

But right now, with short-term interest rates locked near zero, the yield curve has lost some of its value. This is because long-term rates will always be higher than 0% -- thus, the yield curve will always point to growth.

With this in mind, our GS prop-desk analysts left out the yield curve variable in their latest recession probability calculations. The outcome: Their model still only forecast an 8.6% probability that the economy will tip back into recession six months from now.

Recent economic data points suggest the economy's growth rate is slowing, though. The ISM Manufacturing and Non-Manufacturing Indices have pulled back. The economy lost jobs in June. The U.S. government's fiscal posture is transitioning from an economic stimulant to a depressant as spending is cut and taxes raised. And all those temporary Census workers are out of work.

As the next part of their analysis, the GS analysts decided to see how the economy would look if they used a different measure of employment than the typical payroll growth figure. Instead, they fed the worsening employment-to-population ratio into their recession model.

The result this time was more serious: A 25% probability that the economy will tip back into recession six months from now. For now, stocks seem to be headed higher. But the risk to the economy from joblessness is something we need to be mindful of in the weeks to come.

Week in Review

Monday: Aluminum giant Alcoa (NYSE: AA) kicked off the Q2 earnings season by reporting an earnings beat. Income beat estimates by a penny a share. Revenue increased 22% over last year.

Tuesday: The U.S. international trade balance unexpectedly worsened in May, but the underlying details showed industrial exports increased nicely -- a sign that the U.S. manufacturing sector is finding eager buyers for its products overseas. Intel (Nasdaq: INTC) reported very solid Q2 earnings of 51 cents per share against the 43 cents analysts were expecting. The company also provided favorable guidance.

Wednesday: Retail sales dropped more than expected in June, falling 0.5% month-over-month versus the consensus estimate of a 0.2% decline. Weak auto sales were a major factor. Hotel operator Marriott International (NYSE: MAR) reported better-than-expected earnings.

Thursday: The Empire State Manufacturing Survey came in well under expectations at 5.1 versus 18 and the prior period result of 19.6. Growth in new orders is tanking, falling to 10 from 17.5 -- a worrisome sign that the rebound in the manufacturing sector could be slowing. The good news was that initial weekly jobless claims dropped out of the range that has prevailed since October. But analysts at Deutsche Bank AG (NYSE: DB) note that the improvement could be due to seasonal factors and not indicative of labor market strength.

Google (Nasdaq: GOOG) was the first major corporation to miss earnings expectations while JPMorgan Chase (NYSE: JPM) beat its estimates thanks to a reduction in loan loss provisions.

Friday: The University of Michigan's Consumer Sentiment Index dropped to 66.5 -- down from 76 the previous month and well under the consensus estimate of 75. Bank of America (NYSE: BAC), Citigroup (NYSE: C), and General Electric (NYSE: GE) all reported better-than-expected earnings. Revenues contracted for all three companies on a year-over-year basis, however.

The Week Ahead

Monday: Delta Air Lines (NYSE: DAL) and IBM (NYSE: IBM) report earnings.

Tuesday: An update on housing starts will be reported. A number of heavy hitters report earnings including Goldman Sachs (NYSE: GS), PepsiCo (NYSE: PEP), Apple (Nasdaq: AAPL), and Yahoo! (Nasdaq: YHOO).

Wednesday: Coca-Cola (NYSE: KO), Morgan Stanley (NYSE: MS), Wells Fargo (NYSE: WFC), and Starbucks (Nasdaq: SBUX) report results.

Thursday: A busy day. Reports on initial weekly jobless claims, existing homes sales, and the Leading Economic Index will be released. 3M (NYSE: MMM), Caterpillar (NYSE: CAT), United Parcel Service (NYSE: UPS), Xerox (NYSE: XRX), Amazon.com (Nasdaq: AMZN), and Microsoft (Nasdaq: MSFT) are among the companies due to report earnings.

Friday: McDonald's (NYSE: MCD) and Verizon Communications (NYSE: VZ) will report earnings.

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source : http://moneymorning.com/2010/07/19/earnings-reports/

Money Morning/The Money Map Report

©2010 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.