Stocks Stealth Bull Market Correction Generating China Buying Opportunity?

Stock-Markets /

Financial Markets 2010

Jul 18, 2010 - 11:18 AM GMT

By: Nadeem_Walayat

China - You will no doubt have heard much about the start of the great chinese stocks bear market as the Shanghai SSEC index has fallen below 2,500 to currently stand at 2,424. In my opinion the whole trend off of the high is a correction and therefore represents a opportunity to buy at bargain prices.

China - You will no doubt have heard much about the start of the great chinese stocks bear market as the Shanghai SSEC index has fallen below 2,500 to currently stand at 2,424. In my opinion the whole trend off of the high is a correction and therefore represents a opportunity to buy at bargain prices.

Although whilst perma bears focus on the SSEC index, actual investor experience is better illustrated by the key China ETF FXI which shows a consolidating corrective trend rather than what one would term as a bear market.

China's wages are rising fast which means rising inflation which will be exported abroad to the west, a year from now deflationists will be using this as an excuse for still being wrong as inflation persists. Those looking for china's economy to go bust, will probably be waiting for several more decades as higher wages means more domestic consumption as the chinese consumer continues to play catch up to western consumers.

Bottom Line - China's stock market is not peering over the edge of the abyss as many commentators are suggesting, in fact i consider it at one of those March 2009-esk moments. China's Economy will more than double over the next decade which will send the SSEC several multiples higher. Watch as a year from now with SSEC trading at new bull market highs the bears will again emerge to call for another top, conveniently forgetting what was stated right at the very bottom!

More on the emerging market mega-trends for China, India and Brazil in the Inflation Mega-Trend Ebook (FREE DOWNLOAD).

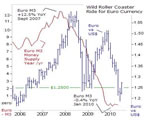

Dow - An early week high of 10,407 failed to break above resistance, the subsequent down trend accelerated into Fridays close of 10,097 which is inline with last weekends analysis (11 Jul 2010 - Stock Market and Gold Summer Correction, Remember White Swans Out Number Black Swans ) that concluded towards the Dow targeting a low in the region of 9,800 to 10,000 (target low price 9875).

This weeks technical picture remains of bearish lower highs and lows which demands a pattern breaking higher low at approx 9,900 to act as a spring board for a break above resistance which now stands at 10,407. The bigger picture remains of a stock market trading within a corrective range.

The stocks bull market remains firmly in stealth mode, the perma flash crashers will emerge once again to warn of an imminent crash as a consequence of the stocks death cross just as the market turns higher.

Gold - Gold's drift lower to end the week at $1188 is Inline with last weekends quick analysis for a continuing correction that targets $1140 from $1220, which I expected to be followed by a trend to target of at least $1333 by late 2010.

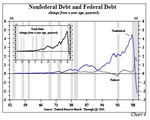

U.S. Inflation - Deflationists have been ignoring CPI Inflation for most of of 2010 as being at 2% meant reality did not match the "theory". The latest data shows that U.S. CPI has dipped for 3 consecutive months triggering deflationists focus back on to U.S. CPI with cry's of DEFLATION !, Though still ignoring the fact that year on year US inflation is still at 1.1%. The trend is inline with expectations for U.S. CPI to target a rate of 1% by end of 2010 (16 Jun 2010 - The Inflation Mega-Trend Continues With UK CPI 3.4%, RPI 5.1% ).

Are Deflationists Delusional?

This has never been more evident in the manifestation of now pricing everything in terms of the Gold price so as to illustrate that everything has deflated in terms of purchasing power in Gold. Really, this is so foolish that it is unbelievable in that it IGNORES the fact that the rise in the price of gold IS a manifestation of INFLATION as DEFLATION would have resulted in a FALLING GOLD PRICE, big name deflationists have been telling you for much of the past decade that Gold CANNOT RISE because of DEFLATION, now after it has more than doubled, it is perversely being used to illustrate that DEFLATION has taken place over the past decade.

BP - BP has finally plugged the gulf oil gusher and promised to make full recompense, but U.S. Politicians are hell bent on nailing the lid on BP's coffin as the crisis extends in all directions into the political arena far removed from the Gulf with U.S. politicians now demanding British / Scottish Governments to answer what role BP played in the release of Lockerbie bombing suspect Al Megrahi last year. As ever once you start pulling hard on a thread then the whole tapestry starts to unravel towards unforeseen consequences such as the people of Britain wondering what the hell is the UK doing still fighting, dieing and losing in Afghanistan some 8 years on ?

Meanwhile where BP is concerned, the greater the anti-BP rhetoric, the greater the probability of a bid.

Your analyst preparing to complete several strands of in-depth analysis this coming week.

Comments and Source: http://www.marketoracle.co.uk/Article21199.html

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

| 1. BP Gulf Oil Gusher: Methane, Climate & Dead Zones |

By: DK_Matai

Gas and Methane Levels At Record

As much as one million times the normal level of methane is showing up near the Gulf of Mexico oil gusher, enough potentially to create dead zones in the water. "These are higher levels than we have ever seen at any other location in the ocean itself," according to sources cited by Reuters. The "flow team" of the US Geological Survey estimates that 2,900 cubic feet of natural gas, which primarily contains methane, is being released into the Gulf waters with every barrel of oil.

Read Article

| 2. Stock Market Head and Shoulders Pattern: A Time Symmetry Pattern? |

By: JD_Rosendahl

The stock market rebounded quite strongly all week and took the bearish tone off the market for now. Something I wrote about a few days ago was the theory of the Time Symmetry Head and Shoulders Pattern. See the daily chart of the DOW below.

Read Article

| 3. The Next Stop for the S&P 500 Stocks Index |

By: Jon D. Markman

Stocks zipped higher in the past week, capping the first four-day rally since early 2009. Get out the party hats and confetti, right? Bears tried to knock shares lower on Tuesday and early Thursday, but after they failed bids hit the tape in a big way and gave it lift.

Read Article

| 4. Recession, Deflation and Deficits Economic Outlook 2010 |

By: John_Mauldin

I look forward at the beginning of every quarter to receiving the Quarterly Outlook from Hoisington Investment Management. They have been prominent proponents of the view that deflation is the problem, stemming from a variety of factors, and write about their views in a very clear and concise manner. This quarter's letter is no exception, where they once again delve into the history books to bring up fresh and relevant lessons for today. This is a must read piece.

Read Article

| 5. UK Inflation Falls to CPI 3.2%, Precisely inline with 2010 Forecast |

By: Jim_Willie_CB

UK inflation for June 2010 registered a small drop from 3.4% to 3.2%, though remaining stubbornly above the Bank of England's upper limit of 3%, thus the BoE Governor, Mervyn King will write yet another letter to repeat that the high rate of inflation is just "temporary", though when does "temporary" high inflation stop being temporary? 6 months? a year? 2 years? as the country sleep walks into stagflation with all of the consequences for wage earners and savers.

Read Article

| 6. Silver’s Historical Correlation with Gold Suggests A Parabolic Top As High As $714 per Ounce! |

By: Lorimer_Wilson

Almost 70 respected economists, academics, gold analysts and market commentators (see list below) are of the firm opinion that gold is going to go to at least $2,500 if not as high as $10,000 per ounce (or more) before the parabolic top is reached. As such, just imagine what is in store for silver given its historical price relationship with gold. We’re looking at an extreme case scenario of a future parabolic top of perhaps as much as $714 per ounce for silver, the ‘poor man’s gold’. Let me explain.

Read Article

| 7. The Disappearing Intellectual in the Age of Economic Darwinism |

By: Henry A. Giroux

We live at a time that might be appropriately called the age of the disappearing intellectual, a disappearance that marks with disgrace a particularly dangerous period in American history. While there are plenty of talking heads spewing lies, insults and nonsense in the various media, it would be wrong to suggest that these right-wing populist are intellectuals

Read Article

| 8. Silver Heading for Price Crash to $9 |

By: Ronald_Rosen

To put it mildly, more than a telescope will be needed to find the silver lining on the silver charts posted in this update.

Read Article

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2010 MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055. Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

Russ Abbott

18 Jul 10, 18:16

|

China wages

I always enjoy your writings, and I apologize for writing only when I have a concern. But here it is. You said "China's wages are rising fast which means rising inflation which will be exported abroad to the west." What do you mean by that? Are you saying that we will be paying higher prices for things manufactured in China? If that's so and if western workers have no extra money because our economy is still depressed, higher prices for Chinese goods are more likely to lower the western standard of living rather than produce inflation. This will reduce demand, etc., which may still lead to overall deflation in the west. -- Russ Abbott ______________________________________

|

Nadeem_Walayat

18 Jul 10, 18:19

|

China inflation

For over a decade China has been exporting deflation abroad, i.e. ever cheaper goods. Now its exporting inflation. YES, this means living standards will fall in real terms. NO this does not mean Deflation it means the purchasing power of currency will fall i.e. INFLATION

|

Russ Abbott

19 Jul 10, 07:35

|

re: china

Well, China's exporting of deflation didn't produce deflation in the west. So China's exporting of inflation may not produce inflation in the west. It's probably much more a matter of (a) the state of the economy and (b) how central banks respond. If China doubled the prices it charged for everything tomorrow, I doubt that the result would be inflation. There are just too many people out of work. -- Russ Abbott

|

Nadeem_Walayat

19 Jul 10, 07:38

|

Re: China

China exporting deflation resulted in low inflation in the west as the price of goods fell. China exporting inflation will therefore mean higher above trend inflation going forward. If china doubled everything tommorrow then you would have very high if not hyper inflation, i.e. the price would have gone up. There are also too many people out of work in Zimbabwe with most of the population unable to buy the goods in the shops, that's NOT resulting in deflation by hyper inflation.

|

Yat-wing Chang

20 Jul 10, 06:48

|

Generating China Buying Opportunity?

Hi, Nadeem, great blog. I am trading in Hong Kong, I 100% agree with you that this is a very good chance to buy chinese stocks, in fact best time in 10 years in terms of stocks valuation, a lot of the stocks bottomed 2 months ago, all the ETFs have not followed the SSEC index lower since it dropped below 2600. Anthony Bolton came out of retirement and moved to Hong Kong in April and started the China Special Situations Fund, he held a conference last week and said that he sees value everywhere, he also predicted that a bull market for the next few years, Soros set up an office in Hong Kong and sent 2 of his top tarders last year and has been buying since, most of us are not talking about bear market over here, cos we know it is not, the chinese GDP slowed down a bit last quarter as a result of the government's tightening policies, when China released the GDP data last week, Chinese Prime Minister Wen Jia Bao said that the economy is going just the way they want it to be, they don't want the economy to be too heated, but some thought that the chinese economy will keep slowing down and go bust or something due to the global economy, how wrong can they be?

|

Jim McGruvie

20 Jul 10, 18:09

|

Inflation is yesterday’s problem

Inflation is yesterday’s problem and investors buying index-linked gilts today will lose money tomorrow, according to the only man I can remember who consistently predicted the credit crisis many years ago. David Kauders’s views are all the more suprising because he was extolling the advantages of gilts – that is, bonds or IOUs issued by the British Government – more than a decade ago, when most other independent financial advisers favoured shares and share-based funds. Back then the bond specialist at Kauders Portfolio Management argued that decades of credit expansion had created a bubble in asset prices which must prove ultimately unsustainable, causing stock market valuations to crash. He even stuck to his guns in the pages of The Daily Telegraph after share prices began rising strongly in 2003 and has continued to urge caution about equity valuations since then. Now he is warning savers worried about the effects of inflation that index-linked gilts are not a suitable substitute for National Savings & Investments’ index-linked certificates. NS&I stopped issuing linkers yesterday after 1.5m investors poured £24bn into them, following recent sharp increases in inflation. But Mr Kauders said: “Index-linked gilts are bad value because, if the Retail Prices Index (RPI) of inflation moves downwards, the redemption value of these gilts will also fall – unlike NS&I index-linked certificates where you are guaranteed to get your capital back. “In any case, inflation is yesterday’s problem. What is coming next is long-running deflation, a long-term trend for prices and interest rates to fall – as they have done for more than 20 years in Japan. “The recent increase in RPI has been caused by governments’ attempts to bail out the banks but these figures, like those for economic growth, are misleading and there will be nothing the authorities can do to prevent deflation over the long term.” The RPI, which includes housing costs and council tax, is currently running at five per cent, while the Consumer Price Index (CPI), which excludes these costs, is running at 3.2 per cent. Some experts reckon this has reduced the real value or purchasing power of cash individual savings accounts (ISAs) by a total of £1.6bn since the start of this year. A basic-rate taxpayer will need to find interest rates of four per cent and above to beat CPI, or 6.25 per cent to beat RPI. People who pay 40 per cent tax would need to find savings or investments paying 5.33 per cent to keep up with CPI, or 8.33 per cent for RPI. Earlier this month, after the Government announced it was switching most pensions’ indexation from RPI to CPI, I asked in this space: “How long will it be before the Government decides it also prefers to use the lower measure of inflation as the benchmark for National Savings & Investments‘ index-linked certificates? Or index-linked gilt-edged stock? Both are currently linked to RPI but, when politicians start helping themselves to savers’ private property, it often proves habit-forming.” Now it has found a different and more drastic way to cut the cost of NS&I index-linked certificates – and the Debt Management Office says it is looking at issuing gilts issued to CPI. Last year – and again in January, 2010 – I reported that the Bank of England had switched 70 per cent of its staff pension fund into index-linked gilts and commented that this was as close as you can get to officially-sanctioned insider-trading. The annual rate of change in RPI has doubled since January and I tipped NS&I index-linked certificates again in this space in May. Even if Mr Kauders is wrong about a double-dip recession, he is not the only bond expert to be wary of linkers today. Peter Day of Killik stockbrokers said: “They are bad value in the short-term, although the fact that gains are free from capital gains tax (CGT) may make them more attractive to higher rate taxpayers over the long term. “But prices have run up so far that short-term index-linked gilts currently offer negative real yields. For example, Index-linked 2.5 per cent 2011 are currently trading at £308.83 per £100 of nominal stock. “The RPI since they were issued would add £292 to their redemption value if there is no further increase before they are redeemed next year. So you would need to see RPI rise to 5.7 per cent over the next 13 months to get your money back if you buy today and I would not regard them as attractive.” While nobody can be sure what will happen with inflation, it is clear that index-linked gilts do not provide the risk-free, tax-free return that NS&I index linked gilts offered – until last week.

|

Nadeem_Walayat

21 Jul 10, 00:02

|

Inflation Mega-Trend

We are barely at the beginning of the inflation mega-trend that will probably run for decades. Kauders is explaining why inflation is high after the fact, after RPI has risen to 5%, it's easy to look in the rear view mirror and explain why, but the fact of the matter is that RPI IS at 5%. Temporary ? I would not be surprised if we see RPI at above 7% during 2011. RPIX exludes housing AND that is ALSO at 5% I tipped Index linked certs in November 2009 and virtually every month since. WHy 2011 Gilts, why not longer date 2030 to 2040.

|

Dave Roberts

26 Jul 10, 10:02

|

"Are Deflationists Delusional?"

Nadeem, Thank you for providing us with your colourful articles. I find them both interesting & informative. I work in the currency markets however and I find your point about Gold somewhat misleading Your most recent article states: "Are Deflationists Delusional?" This has never been more evident in the manifestation of now pricing everything in terms of the Gold price so as to illustrate that everything has deflated in terms of purchasing power in Gold. Really, this is so foolish that it is unbelievable in that it IGNORES the fact that the rise in the price of gold IS a manifestation of INFLATION as DEFLATION would have resulted in a FALLING GOLD PRICE, big name deflationists have been telling you for much of the past decade that Gold CANNOT RISE because of DEFLATION, now after it has more than doubled, it is perversely being used to illustrate that DEFLATION has taken place over the past decade. Firstly language such as "this is so foolish that it is unbelievable" is rather sensationalist and does not really add to the credence of your argument. More importantly on the subject of Gold, your comments are true to an extent however Gold can also be viewed as a currency in its own right. Sovereign wealth funds & Central Banks frequently engage in the purchase and sale of gold to manage currency reserve risk. The crucial point exempt from your argument is simply one of sovereign default. If cracks in the Eurozone exacerbate, these massive funds will seek safety out of EUR into the JPY (unusually given the incredible level of debt and negative population growth rate) CHF and SGD (more understandably) and of course USD (until the US hit the QE buttons again). The salient point I am making is that just because the gold price is rising bears no judgement on those that support the deflationist argument. I err toward the deflation scenario in the short/medium term and the hyperinflation argument in the longer term as US lead QE resurfaces. For me a crucial indicator is 10y US bond yields which are sub 3%. To my mind the bond markets are not usually as delusional as equity markets as their fundamental outlook surrounds the availability and assessment of credit, something the equity markets should take more notice of in ernest! Just one last point - I have never quite understood why Robert Prechter features prominently on your website and he is the biggest deflationist of all. Would you regard his analysis as delusional? I look forward to your next article With regards Dave

|

Nadeem_Walayat

26 Jul 10, 12:57

|

gold, deflation, bonds

> Just one last point - I have never quite understood why Robert Prechter features prominently on your website and he is the biggest deflationist of all. Would you regard his analysis as delusional? You may say so but I could not possibly comment :) Gold a currency ? Gold is a concentrated store of value, an asset, not currency. Gold HAS to be exchanged for a CURRENCY to enable purchases / investments to be made. Central banks hold gold priced in a currency, i.e. dollars. Gold is priced in currencies and is rising in currency because of inflation as mainfestation of the increasing supply of currency. Bond markets are sub 3% because real interest rates are negative i.e. wealth is being stolen by governments to finance deficits and debt. Look at the UK RPI, is 5%, UK bonds are 3.5%. Thats minus 1.5%. Yes the banks are reluctant to lend, but as they do start increase lending it will fast accelerate into a flood and bonds will fall sharply (LONG End) Best NW

|

Shelby Moore

27 Jul 10, 00:41

|

+Inflation != +gold

Dave Roberts wrote: "This has never been more evident in the manifestation of now pricing everything in terms of the Gold price so as to illustrate that everything has deflated in terms of purchasing power in Gold. Really, this is so foolish that it is unbelievable in that it IGNORES the fact that the rise in the price of gold IS a manifestation of INFLATION as DEFLATION would have resulted in a FALLING GOLD PRICE, big name deflationists have been telling you for much of the past decade that Gold CANNOT RISE because of DEFLATION, now after it has more than doubled, it is perversely being used to illustrate that DEFLATION has taken place over the past decade." How many times are we going to have to write that gold price does not rise or fall with respect to inflation or deflation, but rather it rises during negative REAL interest rates. Do you some historical research and you will learn this fact.

|

Nadeem_Walayat

27 Jul 10, 01:01

|

Negative interest rates

Negative real interest rates is a manifestation of the inflation mega-trend, theft of wealth from savers hence forcing them to spend / invest in assets such as gold, anything other than to hold onto cash. So yes, negative real interest rates is one of the primary drivers for the gold trend.

|

Shelby Moore

27 Jul 10, 01:52

|

Inverted semantics

With all due respect, the theft from savers is only possible because the interest rates are lower than actual inflation. If interest rates were higher than inflation, then inflation would not be a problem for savers. So the driving factor is not inflation mega-trend, but rather the manipulation of interest rates lower than reality, with $trillions in derivative swaps. Actually inflation is a ponzi scheme, so it becomes necessary to lie about interest rates at some point in order to keep the ponzi scheme from popping. This is why hyper-inflation is guaranteed at the end, because ponzi schemes can be unwound, only reset.

|

27 Jul 10, 09:27

|

Negative interest rates

Thats what I am saying, negative interest rates is theft from savers because of the inflation mega-trend. Inflation is being used to steal the wealth of savers. In the UK RPI is 5%, saving rates are generally less than 2%. If there were deflation then savers would be getting richer. (Offcourse thats if one trusts the official inflation statisics).

|

Intraday Trading

06 Sep 10, 06:51

|

Chinese Stocks: A Buying Opportunity?

Policy makers are likely to raise borrowing costs later than expected amid Europe’s sovereign-debt crisis and because inflation won’t “go out of whack,” said Gigi Chan, a fund manager at Threadneedle, which oversees about $97 billion. China’s economic planning agency yesterday predicted inflation of about 3 percent this month, a level economists say could lead to the first interest-rate increase since the financial crisis. “We’re not overly concerned about inflation picking up majorly and affecting what we see is reasonably robust growth in the economy,” Chan, the London-based manager of Threadneedle’s $100 million China Opportunities Fund, said in a telephone interview yesterday. “The market’s not looking expensive so we think it’s a good time to pick up some stocks that are looking good value and have got good prospects.” http://www.sharetipsexpert.com/Intraday Tips

|

China - You will no doubt have heard much about the start of the great chinese stocks bear market as the Shanghai SSEC index has fallen below 2,500 to currently stand at 2,424. In my opinion the whole trend off of the high is a correction and therefore represents a opportunity to buy at bargain prices.

China - You will no doubt have heard much about the start of the great chinese stocks bear market as the Shanghai SSEC index has fallen below 2,500 to currently stand at 2,424. In my opinion the whole trend off of the high is a correction and therefore represents a opportunity to buy at bargain prices.