Why Are Economic Debates in Academia So Bitter? Answer Because the Stakes Are So Low

Stock-Markets / Stock Market Valuations Jul 18, 2010 - 09:36 AM GMTBy: Charles_Maley

John Hussman of the Hussman Funds has a Ph.D. in economics from Stanford. He used to be a professor of economics and international finance at the University of Michigan. Now, he’s a highly successful money manager. John tells a story about how Paul Krugman once gave a talk at Stanford about a model of economic development which caused him to leave academia and become a money manager.

John Hussman of the Hussman Funds has a Ph.D. in economics from Stanford. He used to be a professor of economics and international finance at the University of Michigan. Now, he’s a highly successful money manager. John tells a story about how Paul Krugman once gave a talk at Stanford about a model of economic development which caused him to leave academia and become a money manager.

“Paul drew a diagram on the board,” John said, “and as he described it, he drew a few little arrows indicating migration of businesses from one area to another. A respected economic theorist at Stanford, Mordecai Kurz (who never drew an arrow without a differential equation), immediately jumped up and shouted “You haven’t described the dynamics!!” to which Paul responded that he was indicating a general movement of economic activity toward one place to improve efficiency. Dr. Kurz pounded the table and screamed “Then erase the arrows!! ERASE THE ARROWS!!” and then stormed out of the room and slammed the door behind him. I think that was probably the exact moment that I decided to go into finance.”

In a recent interview John reiterates on how an academic look at the markets can be misleading and potentially very dangerous for the simple reason that “it doesn’t work that way in the real world.” No amount of talk, no amount of writing things on a blackboard or quoting theories from textbooks or lectures is going to be a match for reality. We are being sold one of those textbook looks at the stock market right now (The new normal) when in fact, reality looks quite different. Here are a few important observations from his most recent letter.

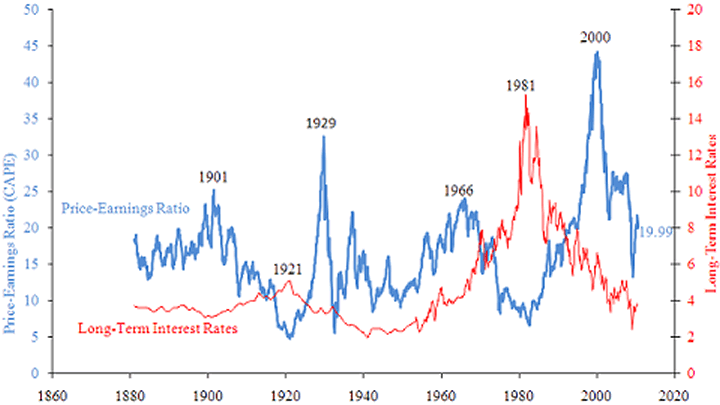

“On a valuation basis, the S&P 500 remains about 40% above historical norms on the basis of normalized earnings. The disparity between our valuation assessment and the putative undervaluation being touted by Wall Street analysts is so great that a few remarks are in order. First, virtually every assessment that “stocks are cheap” here is based on the ratio of the S&P 500 to year-ahead operating earnings estimates, and often comes with a comparison of the resulting “earnings yield” with the depressed 10-year Treasury yield. What’s fascinating about this is that this is the same basis on which analysts deemed stocks to be about 40% undervalued just prior to the 2007 top, following which the market plunged by more than half. There’s a great deal of analysis regarding forward operating earnings that I published in 2007, but probably the most comprehensive piece was Long Term Evidence on the Fed Model and Forward Operating P/E Ratios from August 20, 2007.”

“To properly understand the price-to-forward operating earnings ratio, you have to recognize that operating earnings exclude a whole host of charges – what some observers correctly call “recurring non-recurring” charges. These include large and often quite regular losses that the companies deem, often on the thinnest basis, to be detached from their core business – even if the losses are directly related to their core business. Items like enormous asset write offs come to mind. Moreover, the “forward” means that these are year-ahead analyst estimates, which are typically substantially higher than trailing 12-month reported earnings.”

“Think of it this way. Suppose your poodle is 40% overweight. Someone sells you a scale where every pound shown on the dial represents 1.4 pounds of actual weight. Guess what? Your poodle will step on that scale, and the dial will pleasantly report that your dog is at its ideal weight. That may be comforting if you don’t like to face reality, but the truth is, you’ve still got one sick puppy.”

When you hear analysts say that the historical average P/E ratio is about 15, you have to recognize that this is the normal P/E based on trailing 12-month earnings after subtracting all write offs and other charges. Forward operating earnings are invariably much higher, and it turns out that the comparable historical norm, as I discuss in that 2007 piece, is only about 12. If you exclude the late 1990’s bubble valuations, you get a historical norm closer to 11.5. The 1982 and 1974 market lows occurred at about 6 times estimated forward operating earnings.”

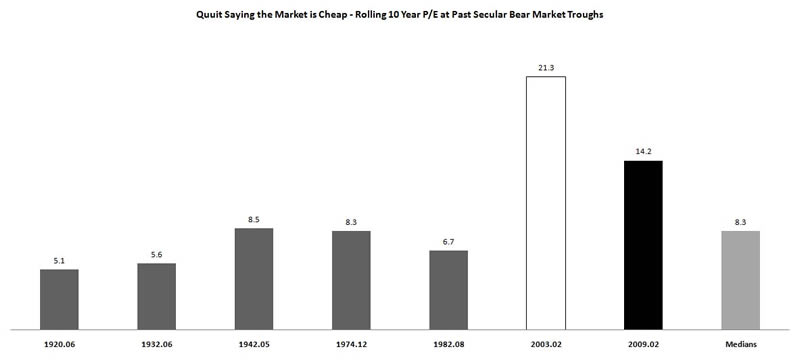

Now in addition to the Hussman “real world” historical norm PE of around 12, let’s look at bear market low PE ratios. The last five major bear markets going back to 1920 reveals the average PE at the bottom was 6.84, a far cry from the 19.9 x earnings today and the norm of 11.5-12.

Perhaps the February bottom at 14 x earnings was an interim low and not the final bear market low. Bear markets last a long time and have many temporary bottoms, but only one final bottom. Even if we give the benefit of the doubt that earnings will rise from the current $51 to $75 but that the multiple trades at the average of the major bear market bottoms of the past (6.84) the S&P would be valued at around 500. This would be down over 50% from current levels.

Another way to look at it would be to ask what earnings are needed to validate the current 1100 S&P at various PE ratios.

We would need earnings to grow to $78 to substantiate a valuation of 1100 at the February low of 14 x earnings. Earnings close to $92 would be needed to validate the 1100 S&P level at 12 times earnings (the historical PE ratio) and a whopping $160 (a threefold expansion) to substantiate a valuation of 1100 at 6.84 x earnings (the average of the 5 major bear markets).

Considering the shape of the economy these are some very tall orders to fill.

Enjoy this article? Like to receive more like it each day? Simply click here and enter your email address in the box below to join them. Email addresses are only used for mailing articles, and you may unsubscribe any time by clicking the link provided in the footer of each email.

Charles Maley www.viewpointsofacommoditytrader.com Charles has been in the financial arena since 1980. Charles is a Partner of Angus Jackson Partners, Inc. where he is currently building a track record trading the concepts that has taken thirty years to learn. He uses multiple trading systems to trade over 65 markets with multiple risk management strategies. More importantly he manages the programs in the “Real World”, adjusting for the surprises of inevitable change and random events. Charles keeps a Blog on the concepts, observations, and intuitions that can help all traders become better traders.

© 2010 Copyright Charles Maley - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.