The Debt Supercycle Path to Profligacy and End Game

Economics / Global Debt Crisis Jul 18, 2010 - 03:43 AM GMTBy: John_Mauldin

The Debt Supercycle

The Debt Supercycle

Somewhere Over the Rainbow

The Path to Profligacy

Things That Cannot Be

I have been writing about The End Game for some time now. And writing a book of the same title. Consequently, I have been thinking a lot about how the credit crisis evolved into the sovereign debt crisis, and how it all ends. Today we explore a few musings I have had of late, while we look at some very interesting research. What will a world look like as a variety of nations have to deal with the end of their Debt Supercycle. We'll jump right in with no "but first's" this week.

Part of this week's writing is colored by my next conference. Next week I go to Vancouver to speak at the Agora Investment Symposium. I have a number of very good friends who will be there, both speaking and attending. This is generally a "hard money," gold-bug-type crowd (and a very large conference). Some (but not all) of the speakers believe that all fiat currencies, including the US dollar, will default in one way or another, either outright or through inflation, as mounting debts and out-of-control entitlement obligations force large-scale monetization, leading to high inflation if not hyperinflation.

There are a couple of panels and debates that I presume I will be involved in, and I have been meditating on how the panels will go. Bill Bonner, founder of Agora and a book-writing machine, has a steel-trap mind with an ability to turn a phrase that is way beyond that of your humble analyst. The preponderance of the panel members will likely be in the soft-depression camp, and most of us will card-carrying members of the Often Wrong but Seldom in Doubt school of economics and investing (the Latin for which, I am told, is "Saepe mendosus, nunquam dubius.") And yet, I am not quite there with most of that thinking, so the debates will be lively.

Understand, I started in the newsletter business back in 1981 or so, working with Dr. Gary North (also known as "Scary Gary"). Gary is an Austrian, and although I took a lot of economics courses at Rice, I had never read anything even remotely close to the Austrian school. I caught up rather quickly, and in the mid-1980s even wrote my own gold-stock newsletter (although I must admit I know next to nothing of the current gold-stock world). I was mostly limited to books, newsletters, and journals for reading material.

Then came the mid '90s and the internet, and the world opened up. I became incurably addicted to information and read widely and deeply. At some point the small lens of Austrian thought became difficult to continue to peer through, as I looked for perspectives on the larger world. I now worship at a number of economic altars, in the ongoing effort to understand what is happening in the real world, not just in the world of theory or the world of what we would like to be. So, with that background, let's look at The End Game.

The Debt Supercycle

When I mention The End Game, you'll immediately want to know what is ending. What I think is ending for a significant number of countries in the "developed" world is the Debt Supercycle. The concept of the Debt Supercycle was originally developed by the Bank Credit Analyst. It was Hamilton Bolton, the BCA founder, who used the word supercycle, and he was referring generally to a lot of things, including money velocity, bank liquidity, and interest rates. Tony Boeckh changed the concept to the more simple "Debt Supercycle" back in the early 1970s, as he believed the problem was spiraling private-sector debt. The current editor of the BCA (and Maine fishing buddy) Martin Barnes has greatly expanded on the concept.

Essentially, the Debt Supercycle is the decades-long growth of debt from small and easily-dealt-with levels, to a point where bond markets rebel and the debt has to be restructured or reduced or a program of austerity must be undertaken to bring the debt back to manageable proportions.

As Bank Credit Analyst wrote back in 2007:

"The history of the U.S. is characterized by a long-run increase in indebtedness, punctuated by occasional financial crises and subsequent policy reflation. The subprime blow-up is the latest installment in this ongoing Debt Supercycle story. During each crisis, there are always fears that conventional reflation will no longer work, implying the economy and markets face a catastrophic debt unwinding. Such fears have always proved unfounded, and the current episode is no exception.

"A combination of Fed rate cuts, fiscal easing (aimed at relieving subprime distress), and a lower dollar will eventually trigger another upleg in the Debt Supercycle, and a new round of leverage and financial excesses. The objects of speculation are likely to be global, particularly emerging markets and resource related assets. The Supercycle will end if foreign investors ever turn their back on U.S. assets, triggering capital flight out of the dollar and robbing U.S. authorities of any room for maneuver. This will not happen any time soon."

I was talking with Martin a few months ago, and about the topic turned to the ending of the Debt Supercycle. Martin said we are nowhere near the end, as the government is stepping in where private debtors are cutting back. We have just shifted the focus of where the debt is coming from. And he is right, in that the Debt Supercycle in the US, Great Britain, Japan and other developed countries (yes, even Greece!) is still very much in play as governments explode their balance sheets. Total debt continues to grow.

Somewhere Over the Rainbow

And yet, and yet... While the Debt Supercycle may not yet have ended, I think we can begin to see a clear case that, like the sandwich-board-wearing cartoon prophet warning, "The End is Nigh!" Greece is the harbinger of fundamental change. Spain and Portugal are pointing to the same outcome, as their cost of debt keeps rising. And Ireland? The Baltics?

There is a limit to how much debt you can pile on. But as the work of Reinhart and Rogoff points out (This Time Is Different), there is not a fixed limit or some certain percentage of GNP. Rather, the limit is all about confidence, a theme I have written on many times. Everything goes along well, and then "Boom!" it doesn't. That "Boom" has happened to Greece. Without massive assistance, Greek debt would be unmarketable. Default would be inevitable. (I still think it is!)

The limit is different for every nation. For Russia in the 1990s, it was a rather minor total debt-to-GDP ratio of around 12%. Japan will soon have a debt-to-GDP ratio of 230%! The difference? Local savers bought government debt in Japan and did not in Russia.

The end of the Debt Supercycle does not have to mean calamity for each country, depending on how far down the road they are. Yes, if you are Greece your choices are between very, very bad and disastrous. Japan is a bug in search of a windshield. Each country has its own dynamics.

Take the US. We are some ways off from the end. We have time to adjust. But let's be under no illusions, we cannot run deficits of 10% of GDP forever. At some point the Fed will either have to monetize the debt or the bond market will simply demand an ever-higher interest rate. Why can't we go the way of Japan? Because we do not have the level of savings they have traditionally had. But their savings levels are rapidly declining, which says that if they want to continue their deficit spending at 10% of GDP, they will have to go into the foreign markets to borrow money at a much higher cost, or their central bank will have to print money. Neither choice is good.

The Path to Profligacy

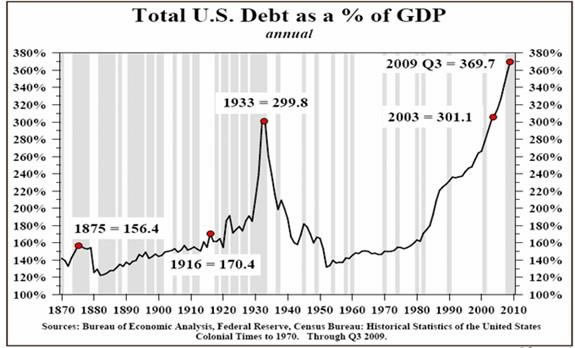

How did we get here? We simply kept borrowing ever greater amounts of money at an increasingly rapid pace. Look at the chart below. It is about six months old, but not much has changed.

In the beginning, each dollar of debt brought about a corresponding dollar of increase in GDP. But that early money was invested in houses and in the means of production, which helped grow the economy. As time went on, and especially after the '80s, more and more of the debt was used for consumption (of which much has come to be from foreign sources) and not for the increase of productive capacity. Toward the end, it took $3 of debt to create a $1 rise in GDP in the US. And now, each $1 rise in debt is government debt, which some research (not neo-Keynesian Paul Krugman's!) says has a slightly negative multiplier - it actually hurts GDP.

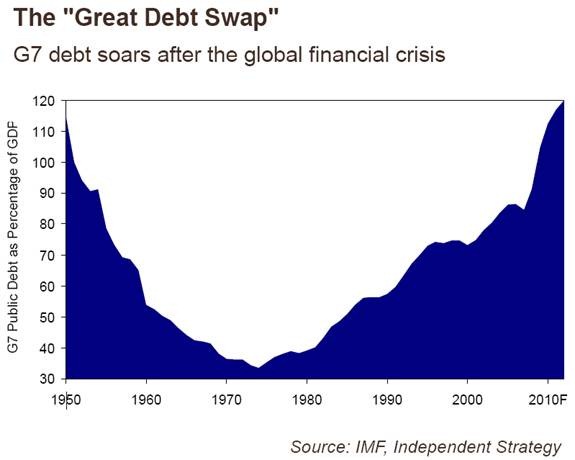

And it is not just the US. Take a look at the chart of G-7 debt (courtesy of GMO, more about which later). That is one ugly and unsustainable chart. In 1950 the G7 countries were recovering from very large war-time debts. Now we don't have that excuse. Nor do we have the option of doing what they did. They cut military spending, inflated a little in nominal terms, and grew their way out of the problem.

Things That Cannot Be

Talk about unsustainable. The next chart is one of something that cannot be. The US cannot borrow $15 trillion in the next ten years. It's just not there. Long before that, the bond market will simply rebel, rates will rise, and the aftermath will make the last crisis seem like a cakewalk.

For most countries with debt problems, The End Game is a binary-path-dependent future. Countries can elect to get their fiscal houses in order over time, getting the fiscal deficits below the growth of nominal GDP. That is not without consequence, as it will mean slower growth in the short term (less than one year), but cutting deficits year after year, even gradually, will mean a very slow-growth, Muddle Through economy for a sustained period.

Some say the coming election is the most important we have had for a long time. I disagree. It is one thing for the Tea Party movement and independents to elect a Republican Congress. If I am right and the economy is still slow and unemployment lingers around 8% by 2012, it is likely we will see a Republican president at that point. So some will say 2012 will be the important election.

However, I think the really important election will be in 2014. Let's make the (clearly) optimistic assumption that Republicans get religion and really go to work on the deficits. The economy will not be booming in 2014, as a result of the tightening and move to austerity, whether through cuts or tax increases or both. Cutting more than $1 trillion annually out of spending over 7-8 years is not easy or without pain.

Will voters in 2014 decide there is too much pain? Will they stay the course for fiscal control or will they scream for more stimulus? Will they take the long view and let politicians make hard choices or will they send the message that short-term choices are what they want? Will they give lip service to going on a diet and exercising and then stay on the couch and eat chips and watch TV? Or will they really get fiscal religion and get with the program?

It's all well and good to say that you want fiscal rectitude. It's another thing when it is hitting budgets near and dear to you. And to get back to a remotely sustainable deficit is going to take pain in every corner. It is going to hit near you, gentle reader. Some will get hit harder than others.

And this is the case in every country running large and out-of-control deficits. It is not just a US problem. The Irish are in what can only be called a depression, along with the Baltic states and Hungary. Greece will soon be there, once they have to meet market rates for their debt, or force their labor markets to endure a very serious deflation to make themselves more competitive.

So, can we know how The End Game will turn out? The short answer is no. Each country will have to make its own political choices. Could we see hyperinflation in the US on Britain or Japan? It is possible, with bad policy decisions. I doubt it that it gets to that. But could we see inflation? The answer is yes.

That has been the traditional method of default for many countries over the years. Instead of outright default, they simply inflate away debt. And the logic is compelling. If you have 5% inflation along with 3% real growth, you get a nominal growth rate of 8%. That means in nine years the economy is twice the size in dollar terms, but only about 35% bigger in inflation-adjusted terms. If somewhere along the way you can get your deficits down to "just" 3%, then you can reduce your debt-to-GDP ratio by 5% a year. In less than ten years, you cut your debt-to-GDP ratio in half. Sounds good, right?

Of course, you have destroyed the purchasing power of your currency, given a real hit to the incomes of the middle class, defrauded those who bought your debt, and in all likelihood you did not hold inflation to just 5%. Think the '70s.

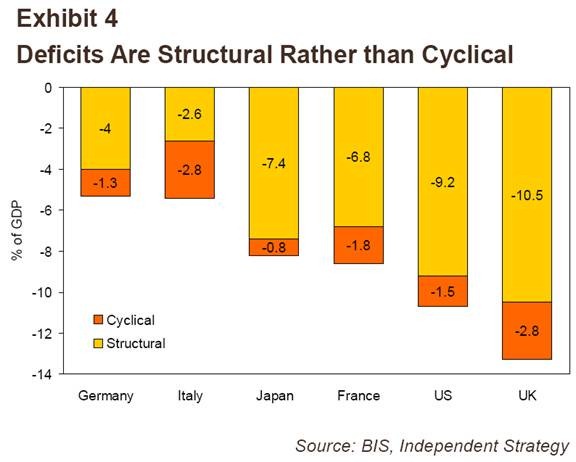

And getting the deficit down to 3% is no easy proposition for many countries. Look at the chart below, again from GMO in a paper by Edward Chancellor on sovereign debt. I highly commend it to you. It is all over the net, but the easiest place I found to read it is at http://www.zerohedge.com/article/must-read-reflections-gmos-edward-chancellor.

We can think of fiscal debt in two ways, structural and cyclical. Structural debt is that caused by government spending programs. Cyclical debt occurs during recessions as revenue drops. One assumes that at some point things get back to normal and revenues begin to rise and the cyclical part of the deficit goes away. But that still leaves the structural debt. That can only be dealt with by cutting spending, raising taxes, or holding spending flat while growing your way out of the problem - or some combination of all three.

I find it interesting that Italy has a far less problematic fiscal situation than many of its neighbors. And while politicians in the US always say they will cut out wasteful spending, there just isn't all that much here, percentage-wise. Italy has a lot of places to cut. As an example, there are 629,000 official cars, some of them high-priced Maseratis, that ferry government officials around. That is ten times more than in other European countries and, on a percentage-of-GDP basis, 50 times more than in the US. They could cut out half of them and save about $15 billion, by my back-of-the-napkin calculation, which is more than 0.6% of total GDP. Reduce the number to the European average and you could cut half the structural debt. (I assume about $50,000 per year for maintenance, depreciation, and drivers.) Oh, that we in the US had such easy pickings. (http://www.economist.com/node/16102798?story_id=16102798)

The Province of Uncertainty

Edward Chancellor closes his paper so eloquently. Let me quote:

"As a result of the financial crisis, the world's leading sovereign credit markets have left the world of risk, where probabilities of gains and losses can be measured, and entered the darker province of uncertainty. The future performance of sovereign credits depends on future events and decisions that are unknowable.

"Will the global economic recovery be sustained? Or will economic growth and tax revenues remain weak for a prolonged period? Will policymakers in leading countries find the political strength to restore their government finances to order? Or will, as some fear, the attempt to cut deficits actually increase them (by hurting the economy and reducing tax revenues)?

"Will central banks engage in further bouts of quantitative easing until they reach the point of no return? Or will they err on the side of caution and tighten too early? Will the current deflationary policies within the Eurozone persist? Or will the ECB turn toward the monetization of excessive debt levels? Will interest rates on long-term government debt remain low? Or will bond vigilantes take fright and demand higher rates as compensation for all this uncertainty and risk?

"These are interesting but intractable questions. Nobody knows their answers. Current yields on government bonds in most advanced economies (PIGS excepted) are at very low levels. Under only one condition - that the world follows Japan's experience of prolonged deflation - do they offer any chance of a reasonable return. But this is not the only possible future. For other outcomes, long-dated government bonds offer a limited upside with a potentially uncapped downside. As investors, such asymmetric pay-off profiles don't appeal to us. Caveat (sovereign) creditor!"

As noted above, The End Game is path-dependent for each country. By that I mean that the end result will stem directly from the course they choose. It is not clear what those choices will be.

For instance, I have often noted that the euro is not a currency so much as an experiment. But it is also not an economic currency, but rather a political currency. Whether the euro lasts in its present form is a political decision to be made by numerous national actors. It is too soon to tell.

All of the developed countries that are in trouble have hard decisions to make. To pretend that we know exactly what that involves requires a fair degree of hubris. But we can see the various paths. In most cases, the number of paths is quite limited, because bad choices were made that have brought us to our current set of choices. As we attempt to sort out those paths, we will find there are signposts along the way telling us which path we are taking. As investors, we can then position ourselves accordingly.

And even for countries that, relatively speaking, have kept their act together, we are talking about a large part of world GDP at risk. It is an interesting world in which we live.

Vancouver, Maine, and Europe

As noted above, next week I am in Vancouver. I will be doing a seminar for my Canadian partner John Nicola on Tuesday evening. Drop me a note if you want an invite, assuming there is room. Then on to the conference, where there are so many friends and compatriots - I am really looking forward to it. Back home for two weeks and then off to New York for a day for some media, then to Maine for the annual fishing trip with David Kotok and friends. Looks like CNBC will not cover it this year after all.

I will be going to Europe in the middle of September. For sure London, Amsterdam, and Malta. Maybe a few other cities. I will spend a weekend at the vacation home of European partner Niels Jensen in Mallorca (along with South American partner Enrique Fynne). More on that as the schedule settles.

Thinking of Europe has me once again thumbing through my latest copy of International Living. I often wonder (fantasize?) about the places they describe and wonder what it would be like to have a less hectic life. Maybe someday, but for now I take it in bits and pieces as I travel. You can get your own inexpensive copy of International Living and find out about what locales are inviting or just dream along with me.

This weekend is going to be a busy working weekend. My co-author for the book, Jonathan Tepper of Variant Perception, is in from London; and we will spend the next three days editing, writing, critiquing, and thinking about the book. The goal is to have a rough first draft by the end of July and then final edits by the end of August, and then get it to the publisher and out the door as soon as possible after that. Frankly, writing a book is a lot harder than writing this e-letter. I know it is mostly mental, but a book seems so much more, well, serious. It takes 3-4 times as long to write the same amount of copy. But I think this book is going to be well worth the time.

It is time to hit the send button. It is late and I have to get up (relatively) early. Jonathon is young (at least to me!) and seems to need no sleep, so I have to try and keep up with him. We'll see how that goes.

Have a great week! Even if we are thinking about The End Game, that doesn't mean we can't have fun in the summer!

Your ready to get this book out analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.