Last Stocks Bull Standing 2011

Stock-Markets / Cycles Analysis Jul 17, 2010 - 02:09 AM GMTBy: Clif_Droke

One of the most important contributions made in the science of market analysis is the series of equity market rhythms known as the Kress Cycles. The one who discovered these cycles, Samuel J. “Bud” Kress, has done for cycle theory what virtually no one else been able to accomplish, namely discovering a series of inter-related “hard” cycles that are all harmonically related and which provide an accurate context from which to view the past, present and future financial and economic climate.

One of the most important contributions made in the science of market analysis is the series of equity market rhythms known as the Kress Cycles. The one who discovered these cycles, Samuel J. “Bud” Kress, has done for cycle theory what virtually no one else been able to accomplish, namely discovering a series of inter-related “hard” cycles that are all harmonically related and which provide an accurate context from which to view the past, present and future financial and economic climate.

Kress accurately predicted the top of the secular bull market in 2000 with his cycles as well as the credit crisis of 2007-2008. He also called the bottom in March 2009 and, more recently, forecast an interim top for April 2010. For the last 10 years, Bud has published a series of interim reports – roughly once per year – called “Special Editions” (available through his SineScope advisory service, 15 Phoenix Ave., Morristown, NJ 07960). Previous Special Editions have provided important context for the bear market of 2000-2002, the recovery bull market of 2003-2007 and the most recent credit crisis and bear market. His Special Edition VII published in 2008 entitled, “Final Opportunity 2009,” projected that the following year 2009 would be the last year to begin a long term liquidation of conventional equities for those who failed to do so at the all-time double high in 2007. Special Edition VIII of 2009 was titled, “Remaining Five Years: 2010-2014” and discussed the potential for a bear market in 2010, a mini cyclical recovery bull market in 2011, and a once-in-a-century three year period of historic change, turmoil and dislocations to begin in 2012 and persist until 2014.

His latest Special Edition (the ninth one) has just been released and is entitled, “Last Bull Standing 2011.” It may well go down as being the most important one yet, for if Mr. Kress is correct in his prognosis, we will soon enter the final phase of the financial market recovery as the last of the key yearly cycles peaks next year.

Kress predicts that 2011 will culminate the dominance of the U.S. financial and economic system and begin a depression, the magnitude of which will be matched only by the one of 1930-1933. As such, the time between now and late 2011 will represent perhaps the last opportunity for investors to build (or rebuild) balance sheets and portfolios before the final crashing phase of Kress’s namesake 120-year cycle.

In his latest report, Kress reminds us that sound market analysis is more critical today than has typically been the case. As Kress points out, “Due to the inherent buy mind set bias, a dearth of sell recommendations exist. The critical time began at the turn of the [21st] century, and has become even more so in the most recent years.” He further asserts that “Identifying the time cycles determining the market’s directional behavior is the most basic, objective and unbiased means of predictive value to mitigate risk and enhance return thereby avoiding the debilitating pitfalls of conventional wisdom.” While Special Edition IX contains much of the information provided in the previous two, it also provides an insightful overview of the most influential yearly cycles and their inter-related positions and contains a series of graphic exhibits depicting the cycles’ positions to each other, making it easy to see how the cycles will influence the coming years.

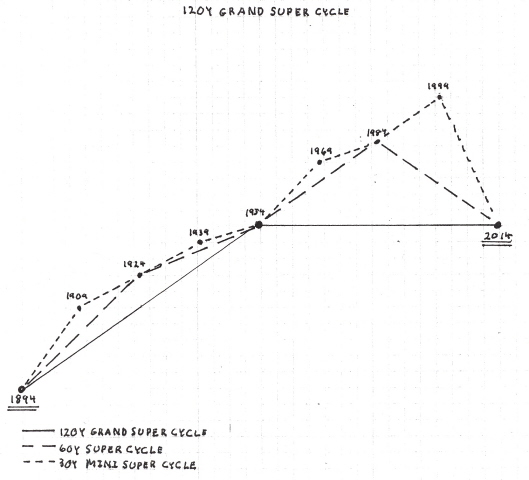

Kress begins his discussion with the famous 120-year cycle, the first of which began in the mid 1770s when America gained its independence from England after prolonged, depressed economic conditions and the Revolutionary War. The second 120-year cycle began in the mid 1890s after the country’s first major depression and the commencement of the Spanish American War. “This heralded the transition of the U.S.A. from an agricultural based economy to a manufacturing based economy,” writes Kress, “and is referred to as the Industrial Revolution.” Kress emphasizes the importance of the 120-year cycle in facilitating revolutions, whether they be of the military or cultural variety. As such, the 120-year Kress Cycle has also become known as the Revolutionary Cycle. It’s next bottom is scheduled for 2014.

In the latest Special Edition, Kress predicts the coming 120-year cycle bottom could bring with it America’s third “great” depression, a World War III equivalent and a third (social?) revolution. The emphasis is laid on the number three, for as Kress points out, when it comes to the cycles – as well as life in generally – events typically come in threes.

Next in the order of Kress Cycles is the 60-year cycle, which is a constituent of the 120-year cycle. As Kress observes, “It equates to the average duration of the underlying economic super cycle. Since it is variable in duration, it is more appropriately referred to as the K Wave.” He goes on to point out that it comprises the gamut of economic activity from boom to bust as indicated by the stages of credit utilization – re-inflation, inflation, hyper inflation, disinflation, deflation, depression, and then the cycle begins anew. The second 60-year cycle in 1954 began the post-WWII economic expansion, peaking in 1984 and beginning the transition of the United States from a manufacturing to a service based economy. The current 60-year cycle also bottoms in 2014 along with the 120-year cycle.

Kress also discusses the 30-year and 40-year cycles in the latest Special Edition. His discussion of the significant 12-year cycle, the most recent one of which began in late 2002, is especially important. He notes that the tenth and final 12-year cycle which began in 2002 and peaked in 2008 with the “credit crash” began economic decline and deflation. The latest 12-year cycle bottoms in 2014 to form the bottom of the 120-year cycle.

Kress completes his overview of the key yearly cycles with a treatment of the 6-year and 4-year cycles, which form the smallest components of the 120-year Grand Super Cycle. The secondary component of the 12-year cycle is the 6-year cycle, which last bottomed in late 2002 and is scheduled to peak in the latter part of 2011. Meanwhile the third and final 4-year cycle bottoms later this year, and as Kress states, its advance will form the peak of the second and final 6-year cycle later next year. “This,” writes Kress, “should be the final, albeit mini, bull market of the post-WWII expansion and the beginning of two to three years of once-in-a-century potential turmoil, transition and change in the U.S.A.” As he also concludes, “The declining effect of the 120-year Grand Super cycle is evident and disarming.”

Elsewhere in the latest Special Edition, Kress includes an incisive discussion of the deflationary trend which began in 2008 and which he predicts will accelerate after 2011 in the final years of the 120-year cycle. “Deflation,” he says, “is effectively liquidation. Economic determination, being what it is, declining change becomes pervasively evident as the ‘system’ purges the excess accumulated since the post-WWII economic expansion with the beginning of the second 60-year economic super cycle of the 120-year Grand Super Cycle; the fourth (complete) since the beginning of the U.S.A. as we know it today.”

The inflationary phase of the 120-year cycle was accompanied by a characteristic Lebensweisheit, or philosophy, and was represented by essentially an expansionist mindset. But as Kress presciently observes, the current deflationary trend has its own unique philosophical outlook, namely one of contraction. “The declining economic condition,” writes Kress, “is euphemistically referred to as the ‘new normal’ and the mind set has changed to ‘going green’ which implies reverting back to nature; basics. The transition and purging is eliminating CO2 from carbon based fuels to solar, wind and grain based fuels. Debt is being liquidated to repair corporate and individual balance sheets; individuals are eliminating body fat by reducing food intake and emphasizing natural foods. A litany of purging, contractions, liquidation, etc. is evident in life around us when one steps back and views life today objectively and uncompromised.”

This leads Kress to ask, “Where will the U.S.A. as we know it today and our life styles be in 2014 with revolutionary change?” As Kress points out, the potential historic change could very well confirm the validity of the adage that “everything comes in threes.” The potential for a once-in-a-century revolutionary transition begins with the peak of the final year 6-year cycle in 2012 to being three years of potential turmoil, culminating with the 120-year cycle bottom in 2014. “Three institutions govern our lifestyle – economic, political, and social,” he writes. “The first 120-year revolution was political; the second was economic; so the third should most likely be social.” He predicts the coming third great revolution will witness the establishment of a fully socialist government in the U.S.

The final part of the latest Special Edition contains an overview of how an investor should position his portfolio with a view to the upcoming 120-year cycle bottom. Kress covers commodities, ETFs, options and equities, the weighting of each position being determined by the individual investor’s risk/return position and personal preference.

He lays special emphasis on gold, observing that it tends to benefit from the two economic extremes of hyperinflation and hyperdeflation. For the 14-year period of hyperinflation from 1967 to 1981, gold increased approximately 23 times in terms of price. After its correction following the 1980 price peak, it bottomed in early 2000 – 14 years prior to the 120-year cycle low scheduled for 2014 – and also at the beginning of economic contraction and deflation. “If gold increased at the same level in the current fourteen years as it did in the previous fourteen years,” he says, “gold has the potential upwards of $6,000 an ounce.” Kress advises that gold shouldn’t be traded but should be administered with the same mindset as with conventional equities during the previous half century, namely “hold for the long term and buy on corrections.”

Kress aptly concludes his latest Special Edition with these words, “Never before in a lifetime has a change in traditional mindset and approach preempted all historic priorities if continuing investment success is to be achieved.”

Cycles

Over the years I’ve been asked by many readers what I consider to be the best books on stock market cycles that I can recommend. While there are many excellent works out there on the subject of technical and fundamental analysis, chart reading, etc., precious few have addressed the subject of market cycles. Of the relatively few books on cycles that are available, most don’t even merit mentioning. I’ve read only one book in the genre that I can recommend – The K Wave by David Knox Barker – but even that one doesn’t deal directly with stock market cycles but instead with the economic long wave. I’m pleased to announce, however, that after nearly 10 years of research and one year of writing, I’ve completed a book on the subject that I believe will meet the critical demands of most cycle students. It’s entitled, The Stock Market Cycles, and is available for sale at:

http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.