Stock Market Profit Taking After Google Citi and BoA Disappoint

Stock-Markets / Stock Markets 2010 Jul 16, 2010 - 09:39 AM GMTBy: PaddyPowerTrader

US equity markets were saved from a beating following the release of better than expected earnings from JP Morgan, a USD 550mn agreement between Goldman Sachs and the SEC to settle a regulatory case, and news from BP that it has temporarily stemmed the flow of oil from the leak of its Gulf well. Agreement on the US financial reform bill, passed by the Senate yesterday and it is likely to be signed into law by US President Obama next week, which helped too.

US equity markets were saved from a beating following the release of better than expected earnings from JP Morgan, a USD 550mn agreement between Goldman Sachs and the SEC to settle a regulatory case, and news from BP that it has temporarily stemmed the flow of oil from the leak of its Gulf well. Agreement on the US financial reform bill, passed by the Senate yesterday and it is likely to be signed into law by US President Obama next week, which helped too.

Early, stocks had slumped 1.3% after they were again hit by growth worries. To recap, yesterday’s US data slate revealed a soft reading for PPI, whilst the July Empire manufacturing index dropped 14.5 points, a far bigger drop than forecast. The Philly Fed index also dropped further in July despite expectations of a small gain. In contrast, June industrial production edged higher, but manufacturing output actually fell while the level continuing claims remain worryingly elevated. Overnight Asia choose to focus on Google’s poor numbers with the Nikkei closing down 2.86%.

Markets are currently in a tug of war between great earnings results and solid guidance, however macro economic data recently remains subdued. At some stage we are either going to see companies tweaking earnings estimates slightly lower or we will see a rebound in economic data over the coming months.

But turning to today and stocks on the move Friday include BA, which is better by 2.5% on a broker upgrade from Soc Gen to a “buy” from a “hold”. And production testing gear firm Spectris has jumped 8%+ in London after a statement that they saw “signs of recovery” in most regions & markets. “Luxury” goods maker Burberry is better by 2.5% after announcing an agreement to acquire directly stores currently run for them in China by franchisees giving them more control. On the Continent German utilities RWE & E.ON are down 3% & 6% respectively on news of plan by the German government to impose a tax on nuclear power plants (see below). Elsewhere pharma giant Roche is off 3% after the release of studies which showed that their top selling drug Avastin didn’t show the same improvement in progression free survival in patients with advanced breast cancer as an earlier trail had.

And Elan is under pressure today (off 5%) after news that the company reached a settlement in principle with the US Department of Justice regarding the latter’s investigation into marketing practices for Zonegran (a product divested by Elan in 2004). The settlement is higher than the market had expected.

In pre market US we’ve had Q2 numbers from Bank of America and Citibank which both topped earnings expectations but disappointed on the revenues side and are trading off 4% & 2% respectively leading the more general market into the red.

Today’s Market Moving Stories

•The U.S. Senate passed the biggest overhaul of financial-industry regulation since the Great Depression, sending a bill inspired by the 2008 credit crisis to the White House for President Barack Obama’s signature. Senators voted 60-39 today in favour of the top-to-bottom rewrite of rules governing Wall Street firms, ending a year of partisan wrangling over protections for consumers and investors. The bill aims to prevent a repeat of an economic collapse that led to the failures of Lehman Brothers and Washington Mutual and a $700 billion bailout for companies including AIG and Citigroup. The measure’s passage came less than two hours before the U.S. Securities and Exchange Commission announced that Goldman Sachs ., which got $10 billion in bailout funds, will pay a record $550 million to settle claims it misled investors in collateralized debt obligations linked to subprime mortgages. In reality we will find out just how well the bank lobbyists have done their job to water down the original nobel but misplaced intentions of the administration as I’d say a bill that runs to 2,300 pages is the legal equivalent of a Swiss Cheese that any investment bank worth their bounus will run rings around.

•Goldman Sach’s civil court case with the SEC was settled yesterday. GS has been ordered to pay a charge of USD550m (broken down as USD300m to the State and USD250m to the investors wronged, including USD150m to IKB). There are no other securities that are being investigated and no kind of management overhaul will be ordered. This is most definitely victory for the giant vampire squid GS and the reaction to both the stock and CDS post the news reflected this. In reality it’s a slap on the wrist or the equivalent of getting community service for committing grand theft and shows just how toothless the SEC are. Longer term this is good for GS as it lifts the shadow over the company (although any permanent franchise damage remains to be seen). Furthermore, the settlement is supportive of other firms who could be under scrutiny as more similar mortgage deals are investigated by the SEC, that the GS case has set the ceiling for charges.

•The WSJ reports that Citigroup for the first time has publicly detailed one way it dressed up its balance sheet and incorrectly hid risk from the public. In a filing disclosed on Thursday, Citigroup explained how it made an accounting mistake that hid billions of dollars in debt from investors. Citi said it misclassified certain short-term trades as “sales,” when they should have been classified as borrowings because the bank had demanded additional collateral from trading partners when it wasn’t supposed to. Citi acknowledged in May that it had misclassified as much as $9.2 billion of short-term repurchase agreements, or “repos” at times over the past three years, but it had provided few details. The disclosures again spotlight Wall Street “window dressing,” which occurs when banks temporarily shed debt just before reporting their finances to the public at the end of quarterly periods. The practice indicates that banks are carrying more risk most of the time than the public can easily see.

The Comeback Kid

The Euro has staged a remarkable comeback over the last month, recovering from below 1.20 to the dollar to nearly 1.30 and catching the market completely wrong footed and short. What has been driving it? Will it strengthen further, consolidate, or reverse trend? And should its appreciation be welcomed? There are several factors at work. The first is a paradoxical situation where, while the recovery is clearly more robust in the US than in the eurozone, the Fed sounds more dovish and seems to be toying with the idea of a renewed wave of quantitative easing, whereas the ECB sounds cautiously more optimistic and short term market rates have tentatively begun to edge up. Moreover, investors are gradually gaining a measure of confidence from the policy actions of individual eurozone governments: nothing earth-shattering so far, but enough to raise hopes that policymakers have perhaps accepted the need to launch long overdue fiscal and structural reforms. Spain is probably the best example. Most encouragingly, it seems that Asian investors, having done their homework over the last nine months, now feel more comfortable in assessing and taking on individual sovereign credit risk within the eurozone: demand at recent Spanish auctions is a case in point, and if this trend is sustained it would mean that risks of a systemic regional debt crisis have substantially diminished. The make-or-break challenge ahead is the release of the stress tests, which begins in a week’s time. We should not get our hopes too high, as the very fact that we will initially get only the aggregate results for individual countries rather than individual banks tells us the first best is already off the table. Hopefully, however, the exercise will be handled professionally enough to avoid a major accident, in which case EUR/USD will remain stable in the coming months, to the satisfaction of both parties involved.

Company / Equity News

•JP Morgan Chase’s earnings numbers don’t reflect a rebound in the bank’s fortunes, says Dick Bove, banking analyst at Rochdale Securities. JP Morgan’s revenue was $25.6 bn in the second quarter. “On the whole this number is not a good number, it’s here because they’ve taken money out of reserves and put it into earnings,” Bove, who has a “buy” rating on the bank, told CNBC. “The one metric that is very good is that their non-performing assets are down.” JPMorgan’s earnings rose to $1.09 a share, from 28 cents. However, revenue declined 8 % to $25.6 bn, in the second quarter, from $27.7 bn in the quarter a year ago.

•Google’s second quarter earnings missed analysts’ target as higher expenses and the fallout from the European debt crisis dragged down the Internet search leader. The letdown announced Thursday stemmed from Google’s expanding payroll and a run-up in the U.S. dollar that has been driven by fears that the euro will crumble if governments in Greece, Spain, Portugal and Italy default on their perilously high debts. The worries hurt Google because about one third of the company’s revenue comes from Europe, and customer payments made with the euro translated into fewer dollars than a year ago. Even so, the currency squeeze wasn’t as severe as some analysts anticipated. Google shares fell nearly 4%, in extended trading Thursday after the release of results. Although Google remains the Internet’s most profitable company, investors have been fretting about signs of decelerating growth amid stiffer competition from Apple , Facebook and Microsoft . On top of those challenges, a showdown over online censorship in China that has muddied Google’s future prospects in the world’s most populous country.

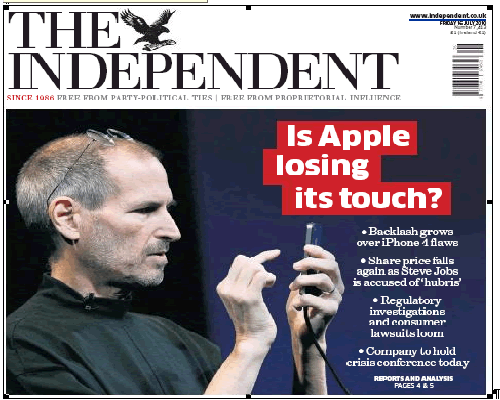

•Apple’s, looking to avoid a recall of the iPhone 4, may give away rubber cases or offer an in store fix to address a design flaw in the newest version of its top selling product, according to analysts. The company, which is holding a news conference at 1 p.m New York time today, doesn’t plan to announce a recall, a person familiar with the matter said yesterday. CEO Steve Jobs may instead offer the giveaways or refunds to dissatisfied customers, some analysts said.

•Advanced Micro Devices., Intel ’s main competitor in computer processors, posted sales that beat analysts’ estimates as more personal computer makers build products based on AMD chips. Revenue rose 40% to $1.65 bn, AMD said today in a statement. That compares with the $1.55 bn average of estimates compiled by Bloomberg. Profit, minus certain items, was 11 cents a share. Analysts projected 6 cents. AMD rose 1.5% in late trading. The stock has dropped 23 percent this year.

•BP may saddle potential buyers of its assets with lawsuits as it tries to raise money to pay claims that could reach $100 billion from the Gulf of Mexico oil spill, lawyers and analysts said. Apache Corp. may agree to pay $10 billion to $11 billion in cash next week for some of BP’s Alaskan assets, according to people familiar with the deal. Exxon Mobil , Royal Dutch Shell and Tullow Oil have also said they may be interested in buying some of BP’s properties. Laws prohibiting fraudulent transfers could allow victims to sue a buyer to recover money deemed essential to pay claims, and successor liability could leave a purchaser with BP’s obligations, if BP files for bankruptcy. A proposed change to federal bankruptcy laws could force a buyer to wait for BP to get approval from victims for the sale, or persuade a judge it will have enough assets to pay claims in full.

•French retail giant Carrefour Thursday reported a 6.3% rise in second quarter sales boosted by the weakening euro and strong sales in emerging countries, but said the overall economic environment would remain tough. The retailer also signed a partnership with Chinese hypermarket retailer Baolongcang in a move to expand its presence in that fast-growing market. The world’s second-largest retailer after U.S.-based Wal-Mart Inc. posted sales for the three months ended June 31 of €24.92 bn, compared with EUR23.96 billion a year earlier, in line with analysts’ expectations of €24.94 bn.

•Boeing raised its long term forecast for commercial aircraft demand yesterday, on the back of steady air traffic growth in Asia and the expansion of low cost carriers in Europe. The company expects aircraft demand to reach 30,900 jets through to 2029 (up 6.5% from its previous forecast in June 2009 of 29,000). This compares to a forecast from Airbus in September 2009 of 25,000 aircraft, although this did precede the strong rebound in air traffic seen since the start of this year. Boeing is predicting an average annual growth in passengers of 5.3% over the next two decades, which compares to a rate of c.5% over the last thirty years. This improved forecast will be welcome news for the sector and comes ahead of the Farnborough Air Show next week, when Boeing is set to unveil its 787-8 Dreamliner in its first public appearance.

•Germany’s government plans to impose heavy taxation on the country’s nuclear energy industry, Süddeutsche Zeitung reports. In addition to plans to impose a tax on nuclear fuel elements which is expected to yield €2.3bn (and was taking into account of the €80bn consolidation package for 2011 to 2014), the government plans now to impose another tax, related to any extension of the operating license of nuclear power plans, “in the same amount”. The additional tax revenues (which would, as things stand, could amount to between €4 and €5bn p.a., or around 0.2pp of GDP) shall be used for budget consolidation.

•Separately yesterday it was reported that the German government will impose an air travel tax to raise €1bn a year, according to a draft law seen by Reuters. Under the plan, airlines will be taxed according to the distance their passengers travel, starting January 1st, 2011. For shorter trips within the European Union and a number of other countries less then 2,500 kilometres away, the tax is set at €13. For longer trips it will be at €26. Although this is clearly a negative for Ryanair as Germany is now one of its largest markets, but it had been expected by analysts.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.