Illinois Higher Debt Default Risk than Iceland

Economics / Global Debt Crisis Jul 15, 2010 - 06:25 AM GMTBy: Dian_L_Chu

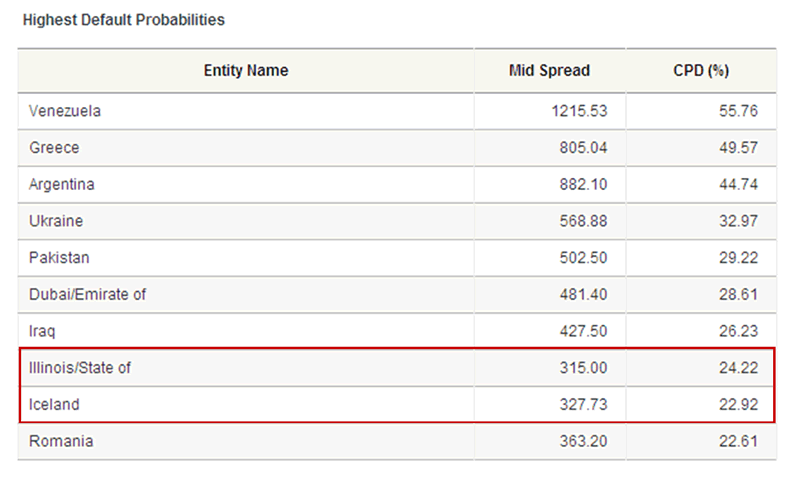

Illinois made headlines a few weeks ago when it overtook California as the worst credit risk among American states. Now, the fifth most populous state in the U.S. has officially overtaken Iceland in the default risk category as well. (See screenshot below from CMA site today)

Illinois made headlines a few weeks ago when it overtook California as the worst credit risk among American states. Now, the fifth most populous state in the U.S. has officially overtaken Iceland in the default risk category as well. (See screenshot below from CMA site today)

So, for Illinois to jump ahead of the Arctic country, in terms of default risk, is no small feat, to say the least.

Just how big a trouble is Illinois in? The State is looking at a two-year budget deficit going into FY2011 of at least $12.8 billion, according to a report issued by the Civic Federation's Institute for Illinois Fiscal Sustainability in January of this year,

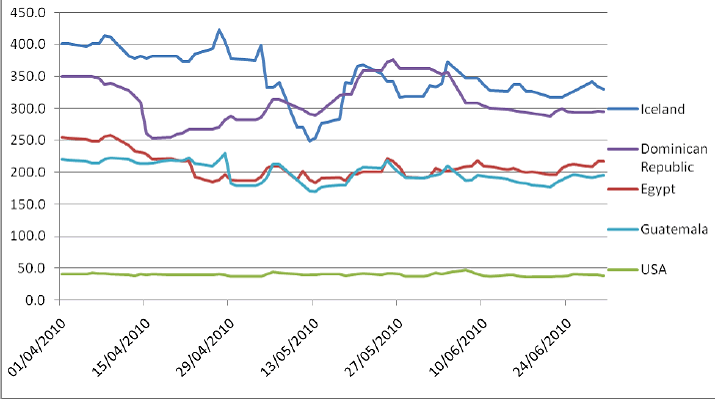

Its poor financial discipline and the lack of will to deal with budget issues prompted both Fitch and Moody's to downgrade the State's debt rating by one notch sending its credit default swap (CDS) to a record high.

After selling another $900 million in taxable Build America Bonds this week, Chicago Tribune estimated Illinois could incur extra interest costs of about $9 million a year--$225 million over the life of the bonds--due to the wide credit spread. The State has already issued about $7.8 billion in debt in 2010, and got $4.7 billion in unpaid bills in the fiscal year ended June 30.

And this is just the tip of the iceberg as the cash-strapped State said it would issue yet more debt. Even more alarming is that Illinois is not along, quite a few states like California, New Jersey, and New York, just to name a few, are also among the deeply indebted, and high credit risk in the U.S.

For 2009 to 2012, U.S. states would have nearly $300bn in budget deficits, according to figures from the National Association of State Budget Officers (Nasbo). Meanwhile, the Center on Budget and Policy Priorities projected that states’ cumulative budget shortfall will probably reach $140bn in the coming year, the biggest yet.

So, when the urgency of European debt crisis subsides, and the bond market shifts its focus away from Europe and onto the United States, America could have its own--Greece, or even PIIGS--of some sort, as early as next year.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.