Banking Industry Crisis, INSIDE JOB The Movie

Politics / Credit Crisis 2008 Jul 15, 2010 - 04:41 AM GMTBy: Bob_Kirtley

Having a day out in the big city of Auckland with an old Buddie who is an accountant, we decided to paint the town red and so we went to the Auckland Film Festival to catch a couple of movies one of which is entitled ‘Inside Job‘

Its an all star cast which includes, Presidents Clinton, Bush and Obama along with the usual suspects Bernanke and Geithner, some eminent Professors of Colombia and Harvard University who did not cover themselves in glory and the rating agencies who failed miserably in their assessments of the banking industry.

A synopsis of the this film is as follows:

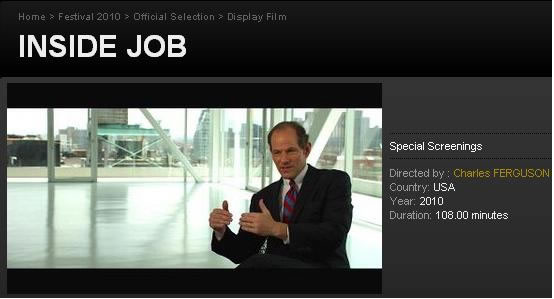

From Academy Award® nominated filmmaker, Charles Ferguson, comes INSIDE JOB, the first film to expose the shocking truth behind the economic crisis of 2008. The global financial meltdown, at a cost of over $20 trillion, resulted in millions of people losing their homes and jobs. Through extensive research and interviews with major financial insiders, politicians and journalists, INSIDE JOB traces the rise of a rogue industry and unveils the corrosive relationships which have corrupted politics, regulation and academia. Narrated by Academy Award® winner Matt Damon, INSIDE JOB was made on location in the United States, Iceland, England, France, Singapore, and China.

This is a quote from the writer and director of the film, Charles Ferguson of The Wall Street Journal:

“Deregulation, which began in the 1980s ….. has without any exaggeration, given rise to a criminal industry.”

If you enjoyed the Sopranos then you will enjoy this film, the sad thing though is that the wrong doers are still in power and the main stream media still hangs on every word they utter. The pre-election promises of President Obama to bring change to the banking sector fizzled into oblivion as he has re-appointed pretty much the same team that he once so ardently criticized.

One of the reasons for the bank bail outs during the financial crises was that they were too big to fail and the solution has been to create even bigger banks than we had before the crisis, so we appear to have learned nothing.

The ratings agencies had a AAA status for the Icelandic banks that were a model of perfection for the rest to look up to, just days before they went bankrupt. When questioned as to why they had got it so badly wrong they said in their defence that the ratings were ‘only opinions’

We should note here that the Chinese have down graded the US sovereign debt:

Dubbed as the world’s first “non-Western” sovereign credit rating agency, in its debut international report, Dagone (means Big Justice in Chinese) down shifted the US to AA with a negative outlook, while UK and France were given AA-; Belgium, Spain, Italy with A-. Zerohedge.

The times are certainly changing.

The film also shows a Harvard university professor who produced a report supporting the stability of the three banks in Iceland singing their praises and he also got it badly wrong. However he omitted the fact that he was paid handsomely by the bank for its compilation and when questioned about his integrity got a tad uncomfortable. Any aspirations a parent might have about sending ones children to such learning institutions might want to see this film and re-think their strategy in respect to further education, in our humble opinion.

And finally a quote from Rob Nelson, Variety:

“Inside Job is the definitive screen investigation of the global economic crisis, proving hard evidence of flagrant amorality – and of a new non fiction master at work…. It points an incriminating finger at not only the financial services executives who got filthy rich on working peoples pain (and who remain in power) but also government officials and business school toppers irrefutably revealed to be in Wall Streets pockets… Ferguson aims to arm audiences with information and infuriate them into action.”

If you can get to see this film its well worth it in our view, it’ll make you laugh and cry!

Have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

The latest trade from our options team was slightly more sophisticated in that we shorted a PUT as follows:

On Friday 7th May our premium options trading service OPTIONTRADER opened a speculative short term trade on GLD Puts, signalling to short sell the $105 May-10 Puts series at $0.09.

On Tuesday the 11th May we bought back the puts for just $0.05, making a 44.44% profit in just 4 days.

Recently our premium options trading service OPTIONTRADER has been putting in a great performance, the last 16 trades with an average gain of 42.73% per trade, in an average of just under 38 days per trade. Click here to sign up or find out more.

Silver-prices.net have been rather fortunate to close both the $15.00 and the$16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Dick Brandlon

10 Dec 10, 14:45 |

Greed

The problem cited in the film used to be called "greed." Now, contrary to what it was before, it's called "business." |