China Shanghai Ready For It's Stocks Bear Market Birthday

Stock-Markets / Chinese Stock Market Jul 15, 2010 - 04:34 AM GMTBy: Adam_Brochert

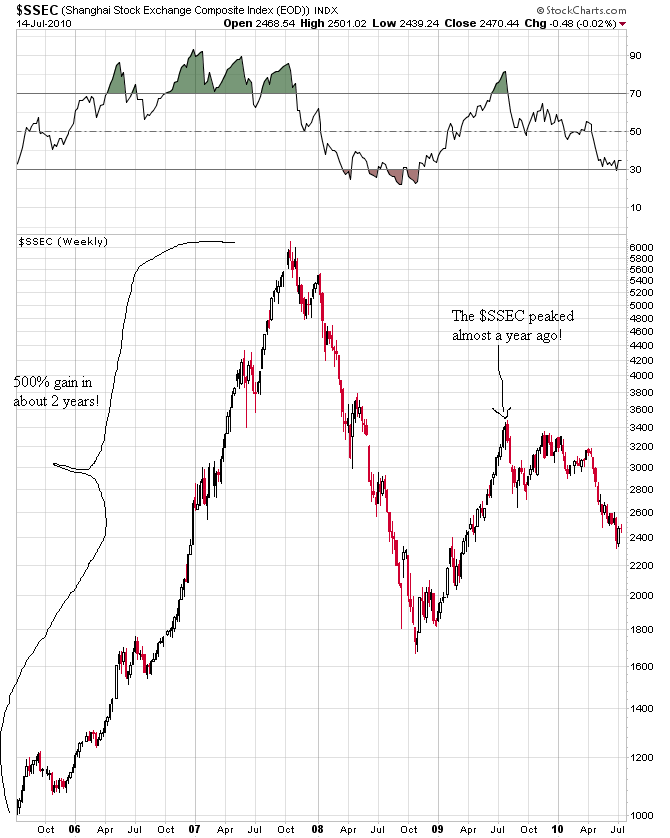

China is 2-3 weeks away from being ONE FULL YEAR into it's most recent bear market leg. Amazingly, despite the old retrospectoscope pointing out that the Shanghai Stock Exchange Composite Index ($SSEC) peaked on August 4th of 2009, people are still looking to the "miracle growth story" of China to lead the world out of its slump. This goes to show how long the average investor can be deceived into thinking a burst bubble can re-inflate. It is the same scenario as people wanting to believe the housing market was coming back last year. Or this year. Or next year. Ain't gonna happen, folks, so move along.

China is 2-3 weeks away from being ONE FULL YEAR into it's most recent bear market leg. Amazingly, despite the old retrospectoscope pointing out that the Shanghai Stock Exchange Composite Index ($SSEC) peaked on August 4th of 2009, people are still looking to the "miracle growth story" of China to lead the world out of its slump. This goes to show how long the average investor can be deceived into thinking a burst bubble can re-inflate. It is the same scenario as people wanting to believe the housing market was coming back last year. Or this year. Or next year. Ain't gonna happen, folks, so move along.

Now, I am not saying that China will not become the world's next superpower. To be honest, I don't know. It is certainly possible although by no means certain. Did knowing that the United States was destined to become the world's next superpower in 1930 help you make money by investing in the U.S. stock market over the next decade or two?

China is a burst bubble because it was one of the largest recipients of hot money flows during the final stages of a multi-decade reckless credit expansion. Here is a 5 year weekly log scale candlestick chart of the $SSEC through today's close with my thoughts:

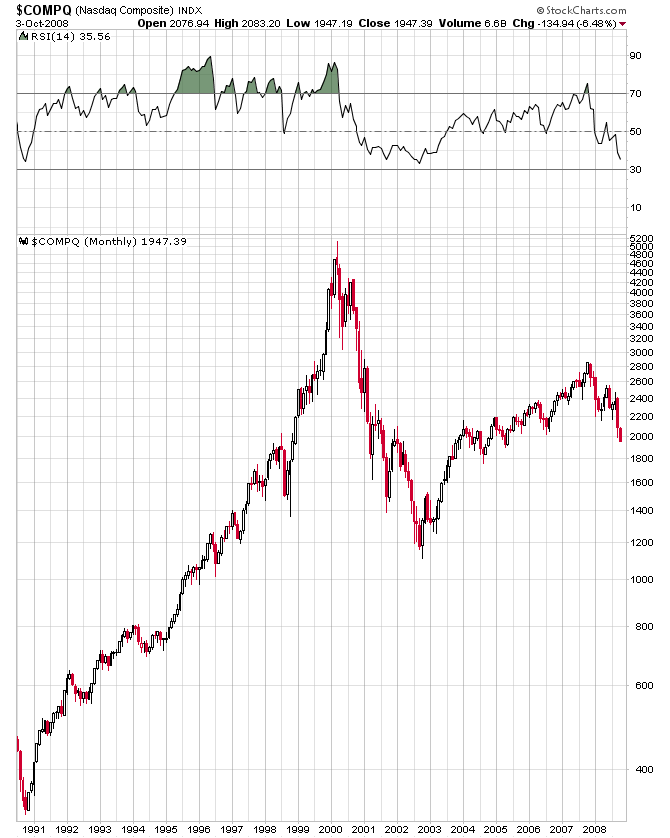

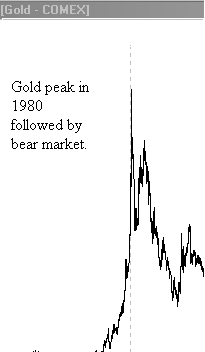

Investors need to recognize a replay of the same ol' chart to know what a hot money-fueled bubble and collapse look like. China's done for now. Put a fork in her and come back in a few years to see how things are going. Shanghai's current chart looks kind of like these charts:

If you don't know what came next on these historical charts, you've got some homework to do in my opinion. China is no miracle. It is a hot money bubble that is set to continue collapsing with the rest of the world as the secular credit contraction grinds onward relentlessly. A productive society that manufactures goods the rest of the world needs will fare better than a society drowning in debt, but how well did America's stock market do as the up and coming manufacturing powerhouse and major creditor nation during the last secular credit contraction in the 1930s?

How many investors have really let it sink in that China has been back in a bear market for almost a full year now? Is this telegraphing global economic strength and growth? Or is it the truth no one wants to hear so it is ignored? If the government publishes a GDP of +15%, Intel "blows away" earnings estimates and Bernanke says everything is going to be OK, what could possibly go wrong?

I'll stay on the short side here for a while and see how things play out. The Dow to Gold ratio will reach 2 before the global secular equity bear market is over and we may well go below 1 this cycle. The "powers that be" cannot stop this train wreck because they enabled and helped cause it. Yes, they can push too hard and destroy the currency, but anyone who doesn't recognize Gold as the ultimate form of cash by this point in the cycle may have gone too far down the paperbug vortex to be financially saved...

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2010 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.