Gold Traded Options at $2,000/oz Surge By More Than 1,000% in 10 Weeks

Commodities / Gold and Silver 2010 Jul 14, 2010 - 07:09 AM GMTBy: GoldCore

Gold rose 1.26% yesterday after the Portuguese debt downgrade; silver rose 2%. Gold has gradually edged up in Asian and early European trade. It may challenge resistance at yesterday's high of $1,217.90/oz but if it falls below the recent trading range of $1,210/oz to $1,215/oz it could quickly fall to short term support of $1,195/oz and $1,190/oz.

Gold rose 1.26% yesterday after the Portuguese debt downgrade; silver rose 2%. Gold has gradually edged up in Asian and early European trade. It may challenge resistance at yesterday's high of $1,217.90/oz but if it falls below the recent trading range of $1,210/oz to $1,215/oz it could quickly fall to short term support of $1,195/oz and $1,190/oz.

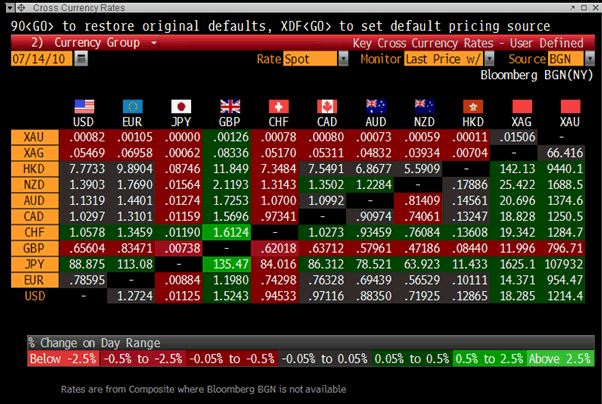

Gold is currently trading at $1,213/oz and in euro, GBP, CHF, and JPY terms, at €955/oz, £795/oz, CHF 1,284/oz, JPY 107,498/oz respectively.

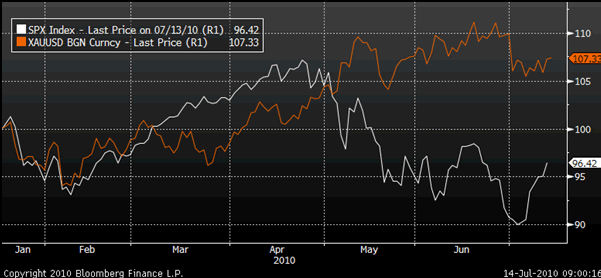

Gold and the S&P 500 - Year To Date (YTD) - Daily

Most equity indices have now risen six days in a row and Asian markets were up overnight on the positive Intel earnings and outlook. Whether these gains are sustainable remains to be seen and as ever there is a risk that this is a "dead cat bounce".

Physical demand remains steady and robust as seen in elevated premiums for bullion coins and bars, particularly in Asian markets. It continues to be difficult to secure British sovereigns and other European gold coins in volume. The sales of the US Mint's one-ounce gold Eagle coins tripled in May from the prior month. The recent liquidation of gold ETF holdings has abated with inflows being seen. This may indicate that the worst of the recent sell off is over in the gold market.

Data from the gold options market shows that smart money believes that gold will go higher in the coming months and that the recent fall in prices may be another correction and consolidation prior to another move up in prices. Open interest in options which allow holders to buy gold at $2,000 an ounce by December 2011 has surged a massive 11-fold on the Comex since May 11. Open interest to buy at $1,500/oz by the end of the year has fallen by 33 percent which suggests that gold market participants remain unsure of gold's short and medium term prospects but confident of higher prices in the long term.

Cross Currency Rates at 1000 GMT - Gold and GBP Higher and JPY and CHF Lower

Oil prices continue to trade in a range between $55 and $90 a barrel. Whether oil breaks out to the upside or the downside will be a critical signal with regard to whether inflation or deflation will be the primary challenge to financial markets in the coming months.

WTI Crude - 3 Year (Daily)

Silver

Silver is currently trading at $18.25/oz, €14.35/oz and £11.97/oz.

Platinum Group Metals

Platinum is trading at $1,535/oz and palladium is currently trading at $466/oz. Rhodium is at $2,425/oz.

News

(Reuters) - US crude edged higher to trade near two-week highs above $77 on Wednesday, as stock markets rallied on the back of upbeat quarterly U.S. corporate results that also signalled increasing fuel demand. US crude for delivery in August CLc1 advanced 8 cents to $77.23 a barrel at 0100 GMT after touching $77.37 on Tuesday, the highest price this month, but still about $10 lower than a 19-month peak above $87 reached in early May. Global daily oil demand will increase by 1.35 million barrels next year to 87.84 million barrels per day, the International Energy Agency said on Tuesday in its monthly Oil Market Report, compared with demand growth of 1.77 million bpd expected this year. The 2010 forecast was revised higher by 80,000 bpd.

(Daily Telegraph) - The June inflation figures made for sobering reading. Retail price inflation fell to 5pc, down from 5.1pc in May, but economists had expected to see it fall to 4.9pc. The rise in core inflation, from 2.9pc to 3.1pc, was of even more concern. Apart from lone hawk Andrew Sentance, the Monetary Policy Committee (MPC (A050540.KQ - news) ) is gambling on the stuttering economic recovery stifling inflationary pressures but the markets seem far from convinced. The pound rose a cent yesterday as traders concluded that interest rates could rise sooner rather than later, if inflationary pressures persist. According to one leading retailer, there could be a lot worse to come. The MPC, he argues, is being naive by assuming that the inflationary effects of the VAT rise will not be felt until the rate rises to 20pc in January. Many retailers no doubt eager to boast in January that they have frozen "VAT" will quietly start raising prices in September, he predicts. Add the weak pound to the mix (retailers typically buy from Far East suppliers in dollars) and he expects to see high street prices rise by 5pc.

(Bloomberg) -- Silver held in ETF Securities Ltd.'s European and Australian exchange-traded products rose 1.4 percent to a record 28.517 million ounces yesterday, according to the company's website.

(Bloomberg) -- Platinum prices may face months of declines, possibly losing more than $200 an ounce with a "major reversal" under way, according to a technical analysis from Commerzbank AG that cited trading patterns. Platinum, used in auto catalysts, has fallen about 13 percent since touching a 21-month high of $1,756.25 an ounce on April 27. The metal traded today at $1,533 an ounce after rebounding 2 percent last week, the first weekly climb in three.

(Bloomberg) -- Palladium's surplus will shrink 62 percent this year on increased usage by carmakers, according to VM Group and ABN Amro Bank NV. The excess supply of platinum will increase, they said. Palladium demand will fall short of supply by 217,000 ounces this year, down from 578,000 ounces in 2009, the researcher and the bank said today in a report. Consumption by the car industry will advance 15 percent to 4.6 million ounces, they predicted.

(Xinhua) -- The gold price in Hong Kong went up 153 HK dollars to open at 11,185 HK dollars per tael on Thursday, according to the Chinese Gold and Silver Exchange Society. The price is equivalent to 1,205.25 dollars a troy ounce, up 16. 49 U.S. dollars at the exchange rate of one U.S. dollar against 7. 79 HK dollars.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.